Welcome to the September edition of Chronicles of an Allocator.

Can your ideas change the world? What would Chester V, the main villain of Cloudy with a Chance of Meatballs 2, think of the current state of venture capital today? While we aren’t facing a disaster of “epic portions” and cheeseburgers haven’t fallen from the sky, GMO co-founder Jeremy Grantham has gone on record to say that climate change is one of the biggest crises of our time. Not only does this make for an engaging speech, but Grantham believes that venture capital investments are the solution. In fact, the majority of his $1 billion-plus Grantham Foundation for the Protection of the Environment in allocated to venture capital investments, in attempt to fund ideas that could quite literally save the world.

The future is private. When asked what advice he would give younger people interested in finance on an episode of Invest like the Best, Grantham urged young investors entering the business to pursue a career in venture capital, saying:

“[Venture capital] gives you the same opportunity to use your brains in your research, in your analysis. But it's more opportunity to use your imagination and to mix with people who are trying to change the world for the better. And it is useful. Private equity and regular investing is shuffling shares between one player and another, doesn't change anything. I sell a share, you buy it, who cares? Venture capital is, you're taking new money away from something else and you're putting it into a new idea. You're building a small plant maybe that would not have been built without your money.”

Of course, so much altruism all around does tend to bring out the cynicism (and hilarious side) of social media. Still, the role that new venture projects play on the battlefield of large societal issues (like climate change) could be huge. Combine innovation with a structure that, at least in theory, brings about a longer-term view, and we find several upstarts that could really disrupt the incumbents.

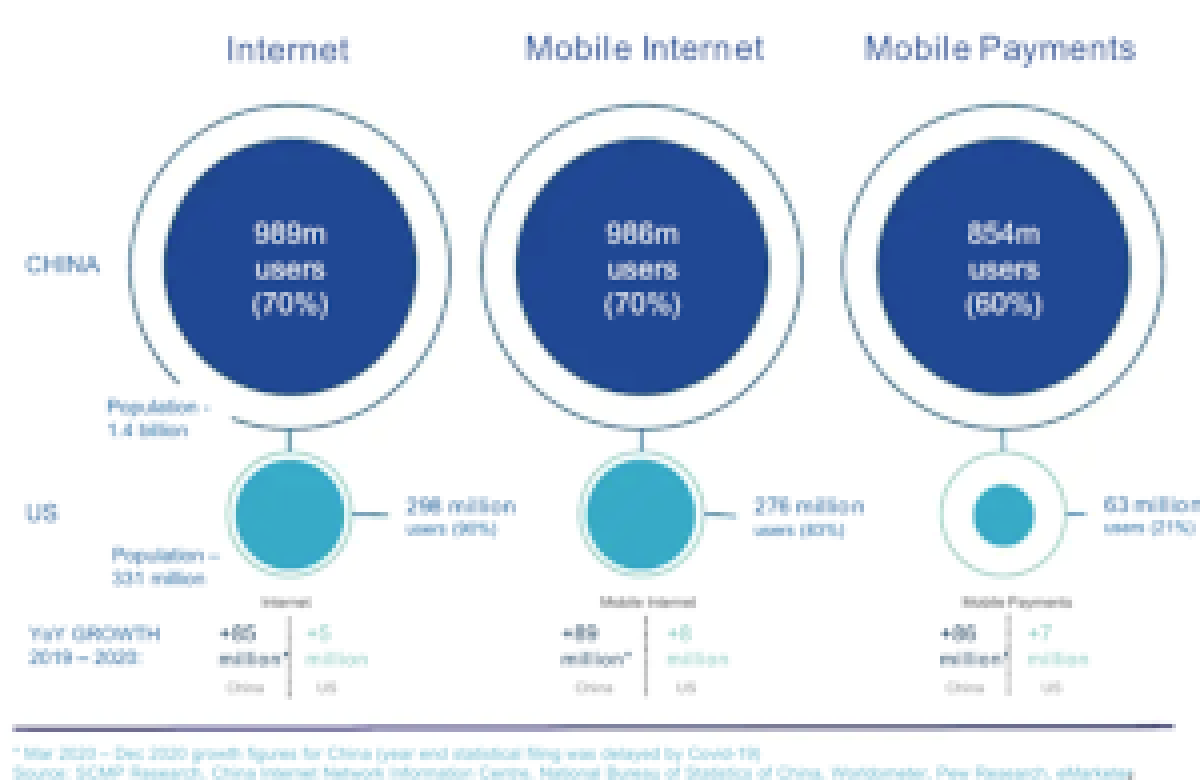

Investors seem to be listening. According to Preqin, global venture capital funds managed over $1.2 trillion as of 2020, increasing threefold from 2015 levels. Not all of the money is constrained to Silicon Valley, either. While growth remains strong in the U.S., the number of deals in Asia have quintupled in number and increased nearly tenfold in size.

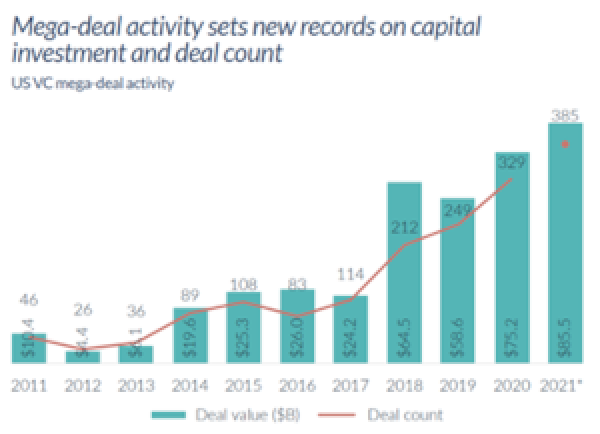

How big can your idea get? It seems that venture capital investors are not only funding big ideas, but also funding big deals. In their H1 2021 Venture Monitor Report, Pitchbook and NVCA found that we’ve already exceeded 2020’s deal count and capital raised in just the first half of the calendar year.

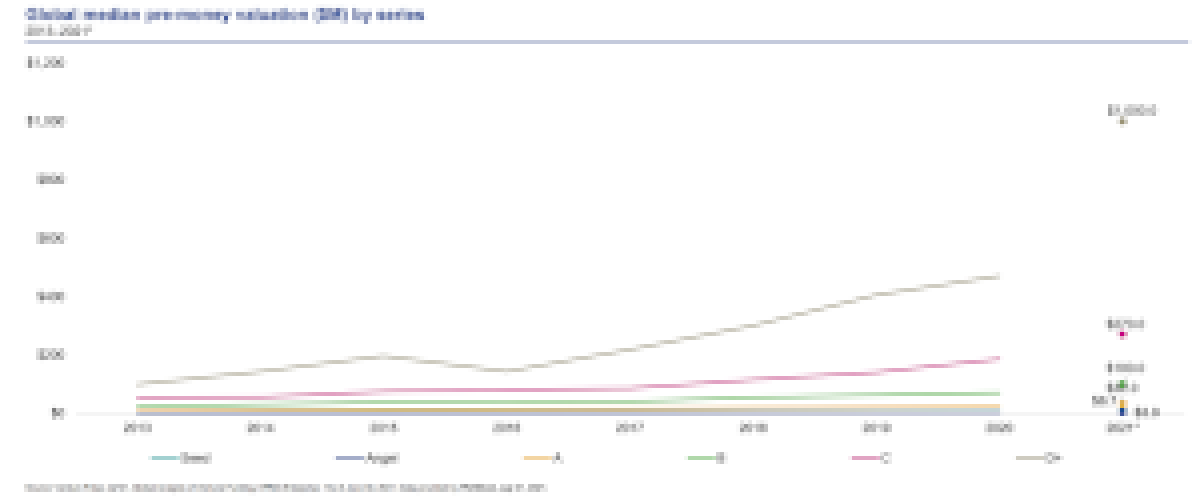

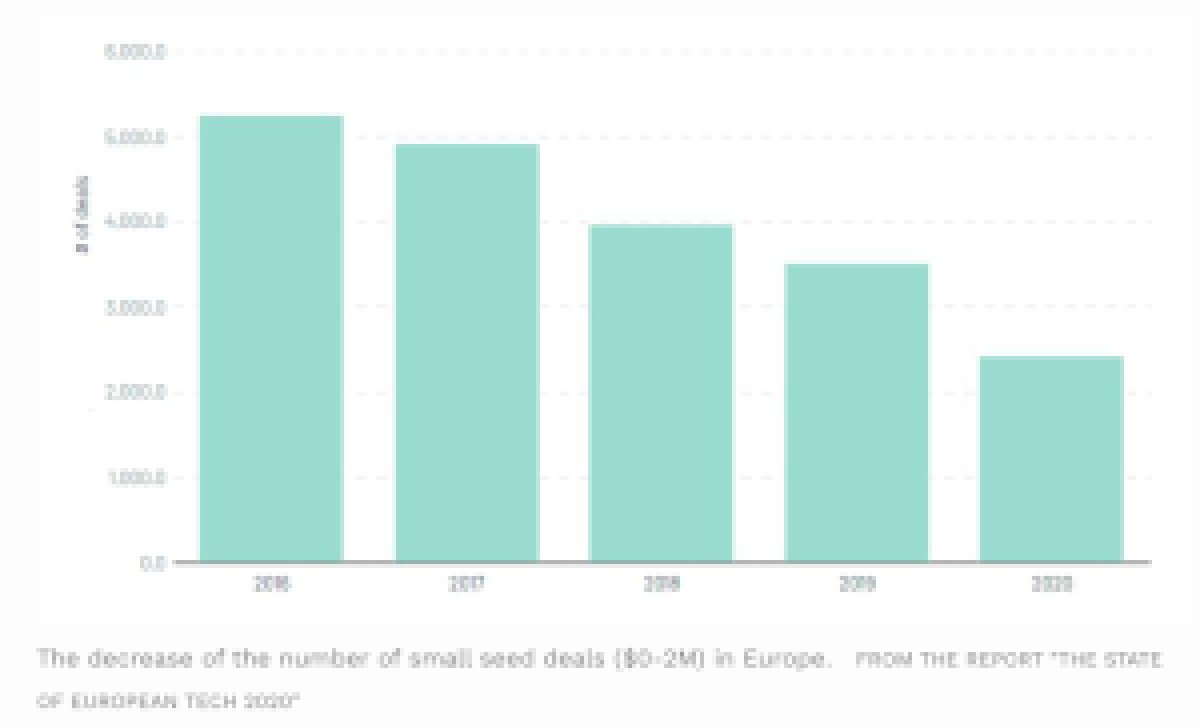

What’s more, according to their analysis, median and average deal sizes have shot up across all stages over the last decade. In earlier stage rounds especially, this may be driven by the fact that startups are more mature and developed when accessing institutional capital. Speaking of institutional capital, not all VC firms have the same success rate, or so said famed venture capitalist Andreesen Horowitz on a recent Bloomberg interview – VC hit rates are much better for top-tier (and often larger) venture firms, where the 10% success rate rule of thumb is more like 50%. A combination of increased availability of capital, investor interest in the asset class, and crossover investor participation (public equity asset managers are getting in on the action) are driving deals to new highs. I suppose you could say the pace at which fundraising has taken off is enough to make a grown man cry.

As you can probably guess, this month’s topic is Venture Capital. In this edition, we cover some of the recent trends mentioned above, with a closer look at how these trends are affecting VC ecosystems in Europe and Asia.

I would also be remiss if I didn’t highlight our upcoming series on the Fundamentals of Venture Capital, starting September 23. We’ll be covering the life cycle and performance of venture capital funds and presenting a framework for the investment process, from the development of portfolio objectives, through liquidity management and manager selection. Preqin will also join us to share recent data on industry AUM, dry powder, fundraising, deals, and investor appetite.

Enjoy,

Aaron Filbeck, CFA, CAIA, CIPM, FDP, Director, Global Content Development