It’s everyone’s favorite time of year – forecasting season. Record low interest rates, record high inflation (in recent history), and unprecedented monetary and fiscal policy have made the job of the capital allocator very difficult. Oh, and the global pandemic has moved into its third calendar year in case you had forgotten.

This edition of Chronicles of an Allocator focuses on some of the most interesting forward-looking pieces we’ve seen to start off 2022, after the manic year that was 2021. Before we get started, I’m excited to hand the opening bid to Paisley Nardini, CFA, CAIA of Invesco to talk about how they’re looking at capital markets at the beginning of the year.

--

After COVID pushed the global economy to the brink, 2021 seemed rather uneventful – relatively speaking, of course. The year was characterized by a familiar rhetoric: divergent global equity returns (US continued to dominate), low bond yields (with talks of imminent rate hikes), continued COVID related health-stress, and all of us wondering when life will go back to “normal.”

There was one defining characteristic that left an impression on us, a new buzzword from which we could begin to assess the evolving landscape of our times: inflation. The unanswered question heading into 2022 and defining investor allocations is whether we can put a cap on rising prices or if Mr. Inflation will be “the one that got away.”

According to Invesco’s 2022 Asset Allocation outlook, the year ahead is shaping up to be characterized by not only inflationary pressures, but also by a deceleration of economic growth as fiscal and monetary policy is removed. Those double-digit returns we’ve been experiencing across assets classes may be a relic of the past. Invesco’s base case, supported by the Global Market Strategy team, is optimistic that the near-term, skyrocketing prices should peak mid-year, continuing to support inflation-hedging real assets (real estate/commodities) as well as higher growth assets such as equities.

But what if inflation persists?

Runaway inflation in a marketplace – which is still clinging for stability post COVID – could warrant more defensive portfolio positioning. Lower-volatility equities (developed over emerging markets) and naturally, inflation-hedging assets would be favored. Emerging markets are more likely to be negatively impacted by rising inflation as many countries are classified as net importers.

Also, although inflation tends to reward equities more than bonds, when examining S&P 500 returns by decade and adjusting for inflation, the results show the highest real returns occur when inflation is 2% to 3%. This means a persistent print of inflation in the mid-single digits could be worrisome for both stocks and bonds, especially if growth is slowing.

Keep an eye on monetary policy action

Another impact of persistent inflation could be increasing policy actions by central banks to help navigate market uncertainty. Central banks, exception being China, are pointing to less accommodative monetary policy in the quarters ahead as growth appears to have normalized and concerns for inflationary price pressures mount. If central banks pull out the rug too quickly, growth could evaporate, jeopardizing stability.

China is unique in that its policy makers cut rates twice in 2021 – a move which ultimately restored some stability in a region dragged down by increasingly slowing growth and systemic risk in the property market. This gives reason to consider China distinctly from your broader emerging market allocations – for bullish or bearish reasons.

Where to allocate capital in 2022

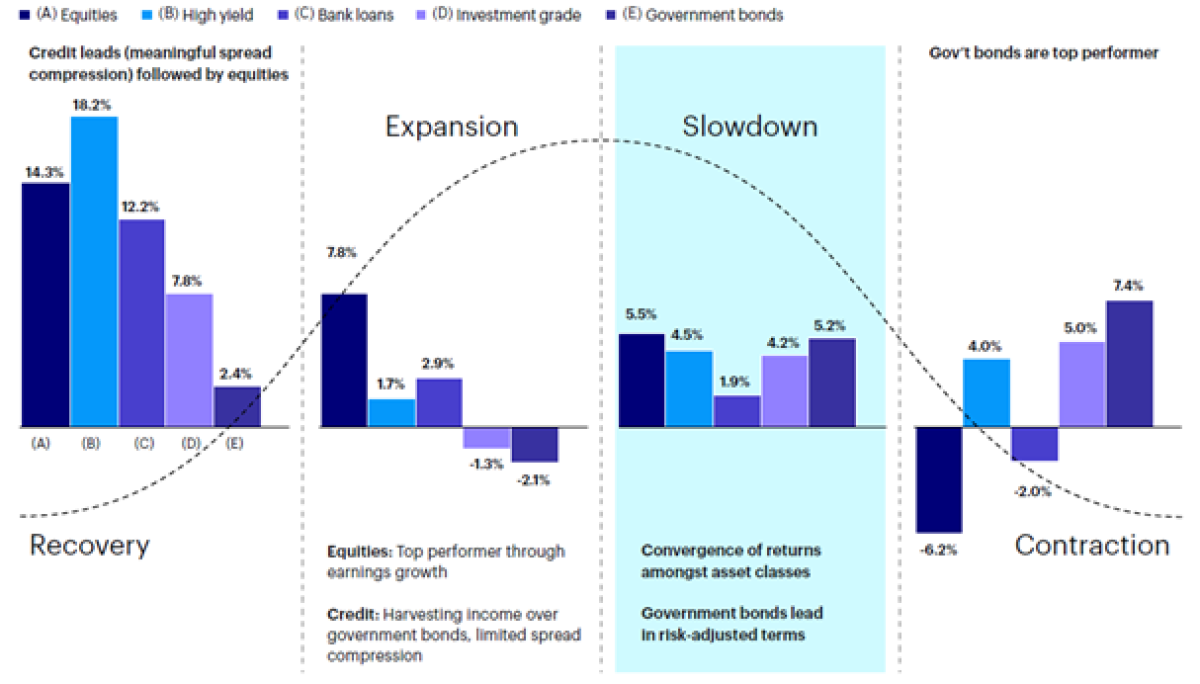

2022 could be a year of skating on thin ice. As the market transitions to a slower growth environment, fiscal and monetary policy support will need to be removed with utmost precision to avoid stoking investor fears. As such, a slightly more cautious positioning, with tilts to growth-oriented sectors and a less pronounced overweight to equities versus fixed income, may be warranted. Reducing the allocation to equities is supported by the historical phenomenon that as the mid-cycle nears, asset class returns tend to converge, which could warrant a greater need for diversification.

Global cycle: Historical excess returns across asset classes

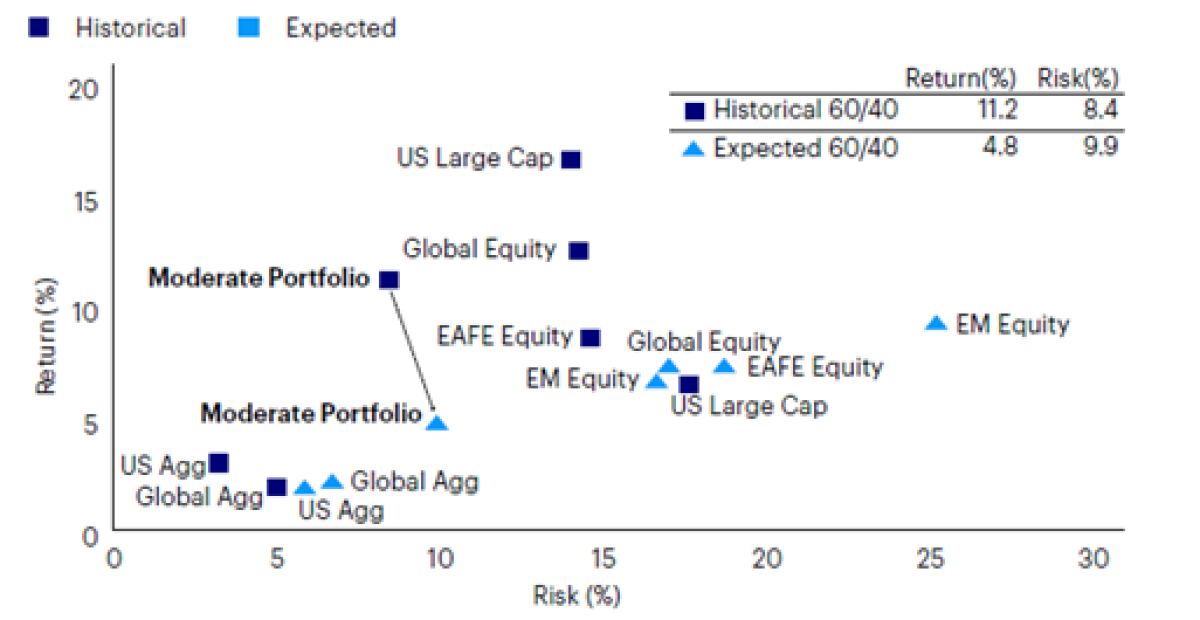

Realizing return/income targets could become more difficult

With today’s full valuations across asset classes and low starting yields in bonds, the same 60/40 portfolio which provided double digit returns over the last decade is expected to deliver annualized returns just shy of 5% over the coming decade. For many investors private market alternatives are becoming a growing piece of their strategic asset allocations, and a key component to meeting portfolio objectives.

Significant drop in expected return for traditional 60/40 portfolios amid increased risk (USD)

What alternatives are attractive in this market?

Real assets have risen as a key opportunity, as commodities, real estate, and infrastructure offer the benefits of growth and income in addition to inflation-hedging properties, diversifying a portfolio’s existing growth (equity) and income (bond) investments. Lastly, with investors cautious on adding duration in this low yield environment, private credit has become a newer entrant in many investors' strategic policy allocations as the asset class offers yields far greater than traditional bonds and minimal duration exposure to hedge against rising rates.

Whether you’re optimistic about the year ahead, or less constructive, there are plenty of opportunities in this evolving marketplace to seek growth, income, stability, or real return. Although much of this cycle’s double-digit returns may be behind us, this year may just offer the stability we’ve all been seeking – in our portfolios and beyond.

- Paisley Nardini, CFA, CAIA, Strategist at Invesco

Welcome to Chronicles of an Allocator. This month, we’ve curated some of our favorite asset allocation outlook pieces that will help inform you how to allocate capital for the long term.

Experienced pilots prepare for turbulence and 2022’s forecast comes with potential storm clouds, according to Cambridge Associates’ most recent outlook. From an asset allocator standpoint, perhaps that means seeing more flexibility in manager mandates, as hedge funds and venture capital funds cross over into private and public markets, respectively. Past performance is no indication of future results, but we really mean it this time! Endowments saw their best year in recent history but, with this backdrop, it’s probably time to temper expectations.

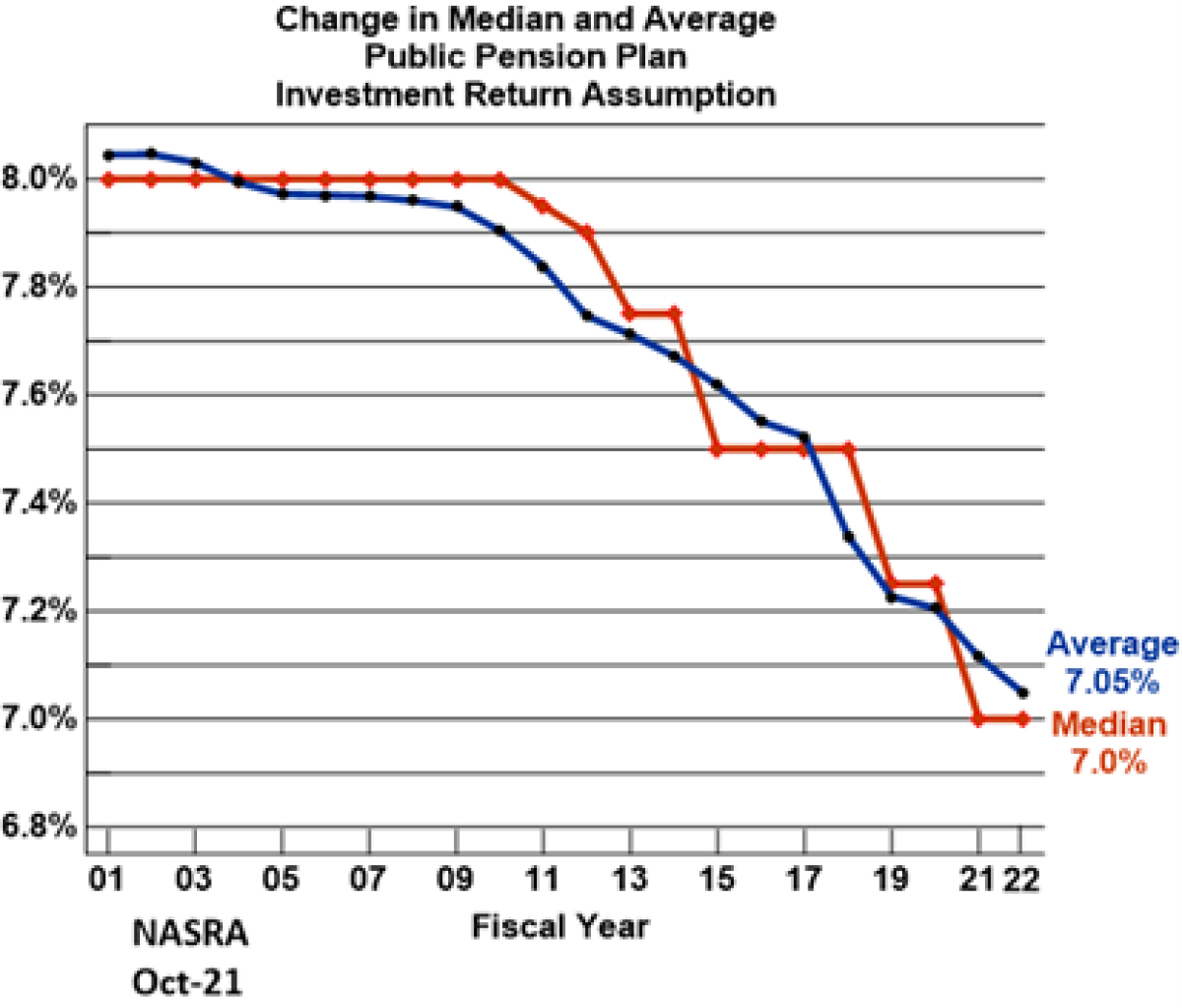

5% nominal returns over the next five years. That’s at least what BlackRock is saying to expect from a global 60/40 portfolio. That might be a slight challenge for U.S. pension plans that still have an average return assumption of 7%, according to NASRA.

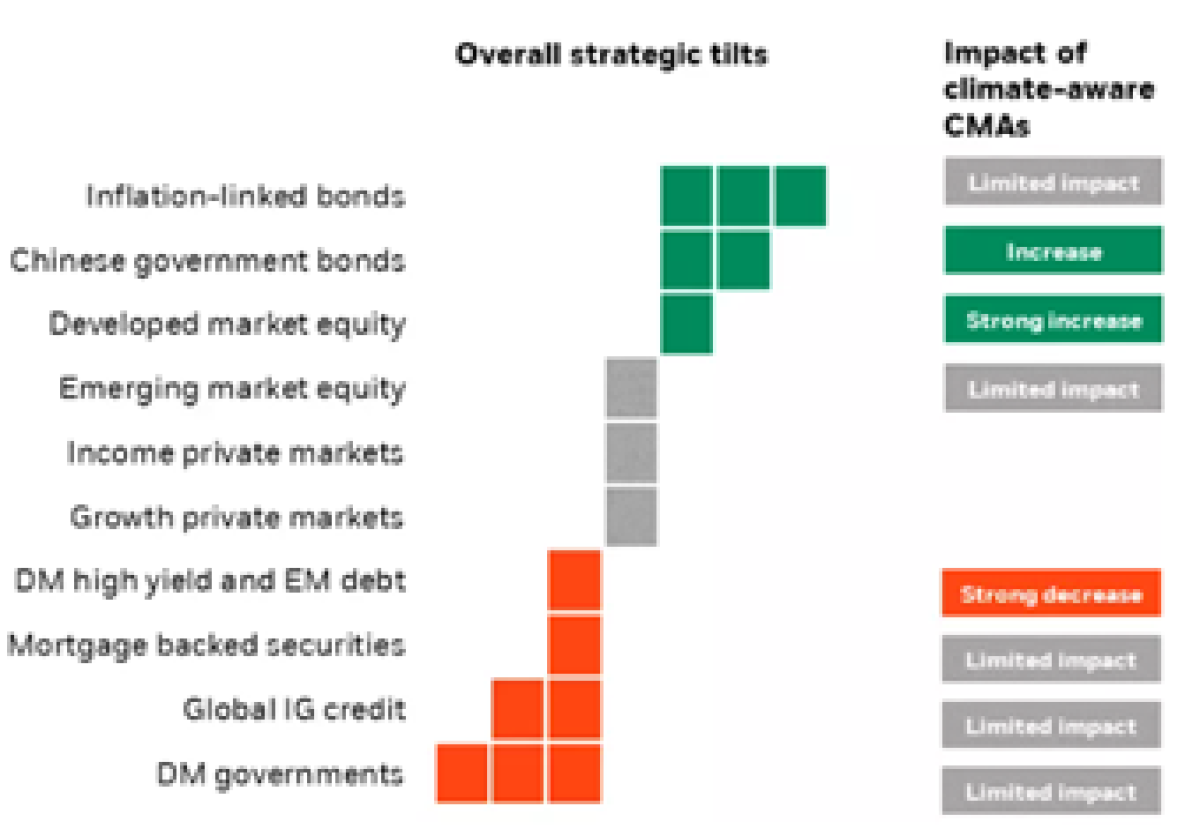

Those making asset allocation decisions will also have to factor in climate risks. Those looking to tilt away from negatively impacted assets might want to consider less sovereign debt and investment grade credit, and more inflation-linked bonds and developed market equity.

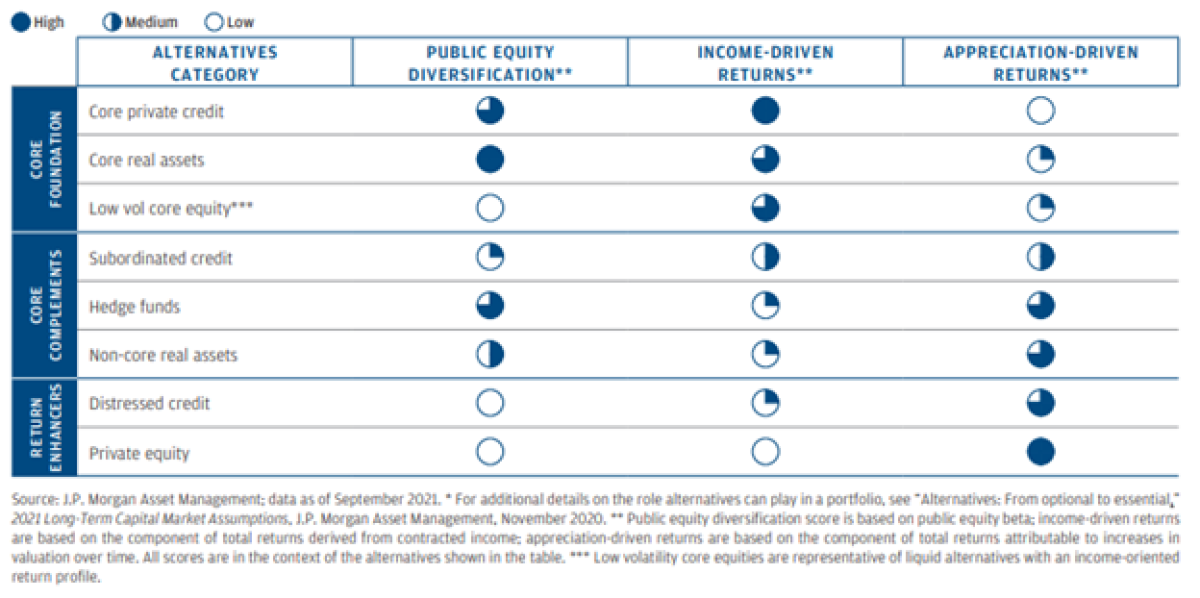

Okay, I’m finally listening. If you, at least conceptually, believe that better diversification needs to incorporate better alternatives , your next step is probably thinking about how. It’s a disservice to refer to alternative investments in one giant bucket: Pulkit Sharma, CFA, CAIA, Shay Chen, CFA, CAIA, and the JPMorgan Alternatives Group provide a better framework for implementation that aligns different strategies to goals such as diversification, income, and appreciation in JPMorgan’s 2022 Capital Market Assumptions.

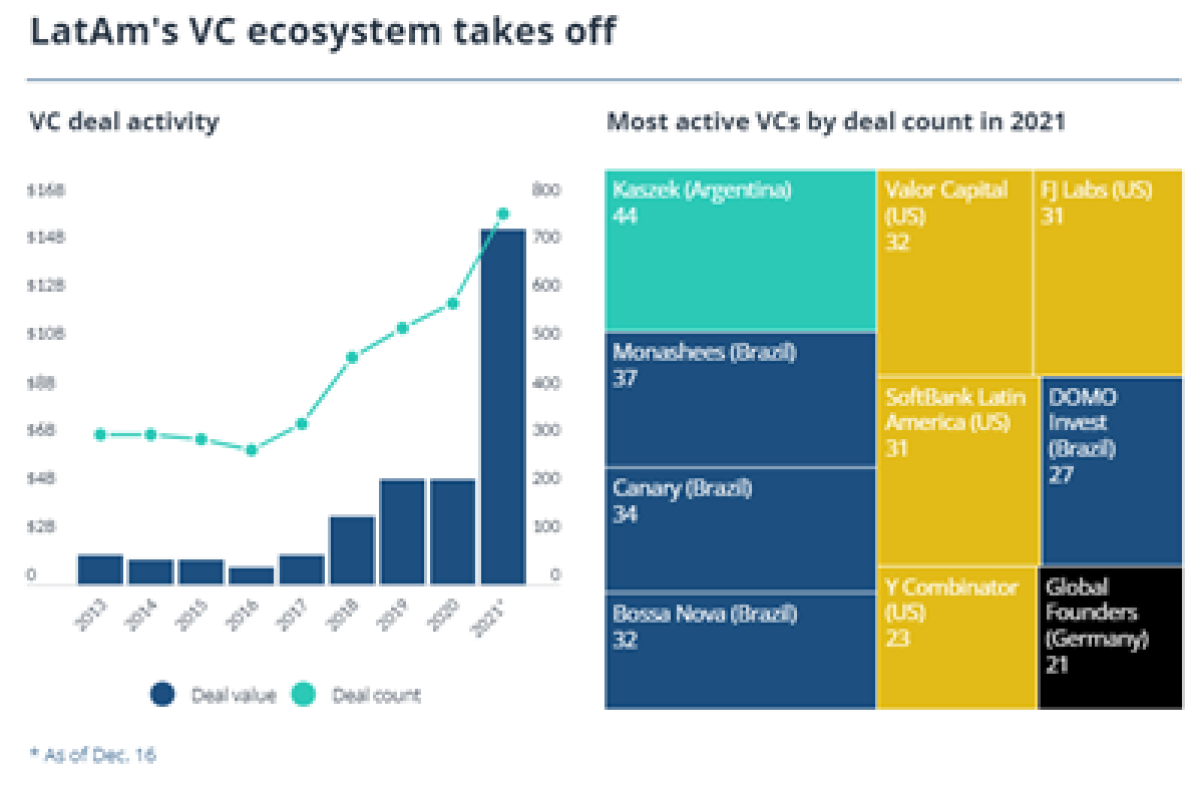

Venture Capital: Exploding in Latin America, Africa, and the Middle East. In 2021, venture-backed companies raised $14.8 billion across 772 deals in Latin America, more than the total capital invested in the region in the previous six years combined, according to Pitchbook.

Similarly, Africa has seen a venture capital boom, which is expected to be driven by continued investment in fintech, healthcare, software, digital assets, and e-commerce. Did you know that there are only 400 magnetic resonance imaging (MRI) machines available to provide services to 400 million people in West Africa? Did you also know that e-commerce has only penetrated 3% of the South African market?

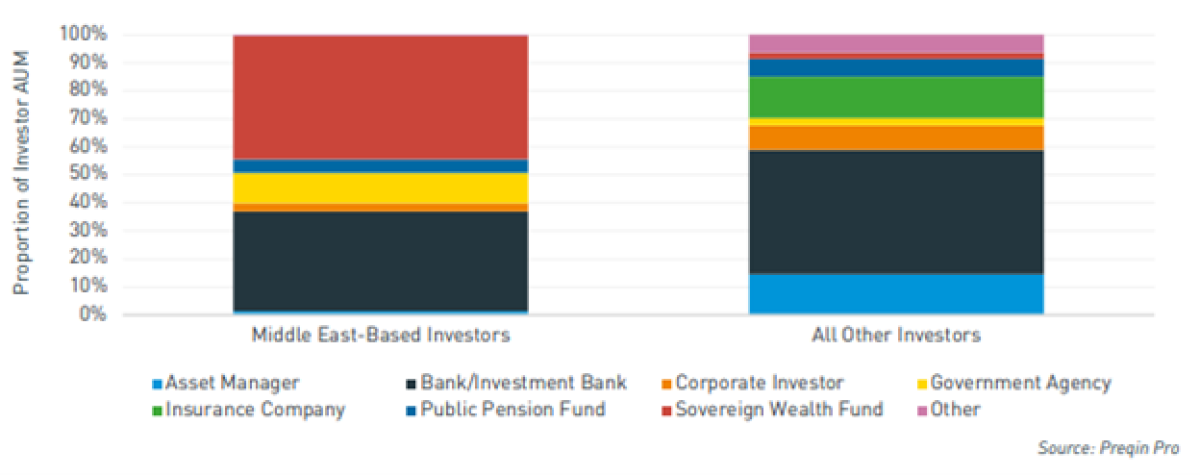

Private Capital Investor AUM by Type: Middle East-Based vs. All Other Investors

The Middle East has also seen tremendous growth in its VC market, laying foundations for strong private capital investment as economies in the region attempt to decarbonize and move away from oil and gas dependence. Sovereign wealth funds, which account for 44% of private capital AUM in the Middle East, are still seeking to use their portfolios to support local non-oil GDP and create millions of jobs for their citizens.

Cryptocurrencies: The more you learn, the more things you need to learn. If you want to see all things cryptocurrency for 2022, this behemoth of a paper might just be for you. Topics covering crypto policy, market infrastructure, people to watch, DeFi, NFTs, and DAOs will have you reading for a while.