By Max Williams, Co-Founder & COO, Runa Digital Assets

Cryptocurrency is often used to refer to all 10,000+ digital tokens issued on blockchain networks. While yes, the asset class originated from creating a digital, decentralized, and non-sovereign form of currency, it has evolved, with many now focused on distributed computing platforms, blockchain networks, and decentralized applications that have little to do with a currency. Calling every token a cryptocurrency is a misnomer. We support a rebrand of sorts to “digital assets” to prevent the common confusion that every token is a currency seeking to displace the dollar. In this report, we will clear up the confusion by providing a sector taxonomy, explaining the simplified business models of different types of crypto networks, and offering a glimpse into what the future might hold.

Not All Digital Assets Are Currencies

In 2021, we wrote about the birth of a new asset class - digital assets. Digital assets share similarities with other asset classes like currencies, commodities, and equities but are unique and distinct. Like any emerging concept, it requires a deep understanding of new principles, technologies, and terminology. Many have come to understand Bitcoin but remain confused about what the other assets do. “Are they competing with Bitcoin?”, “Why are they valuable”, “What is the token for?” are common questions we get. Like any asset class, there are similarities across the many underlying individual assets, but fundamentally, each of them is very different.

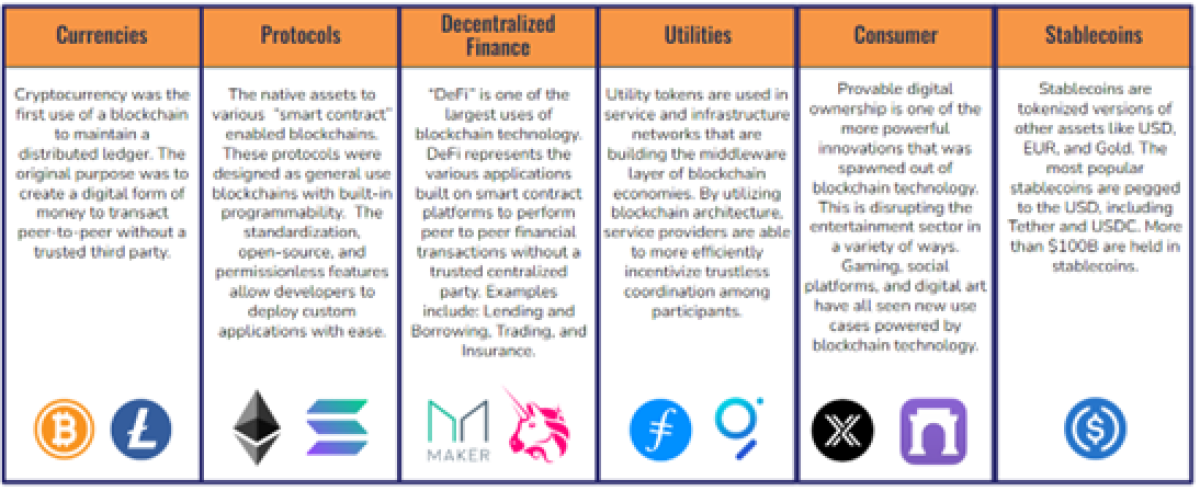

When we first began investing in digital assets, we found it helpful to develop a proprietary sector classification to organize the investable landscape. We came up with 5 primary sectors, plus stablecoins: Currencies, Protocols, Decentralized Finance, Utilities, Consumer, and finally Stablecoins.

The focus of this report is on the non-Currency assets, so we will ignore the Currencies and Stablecoin sector for now.

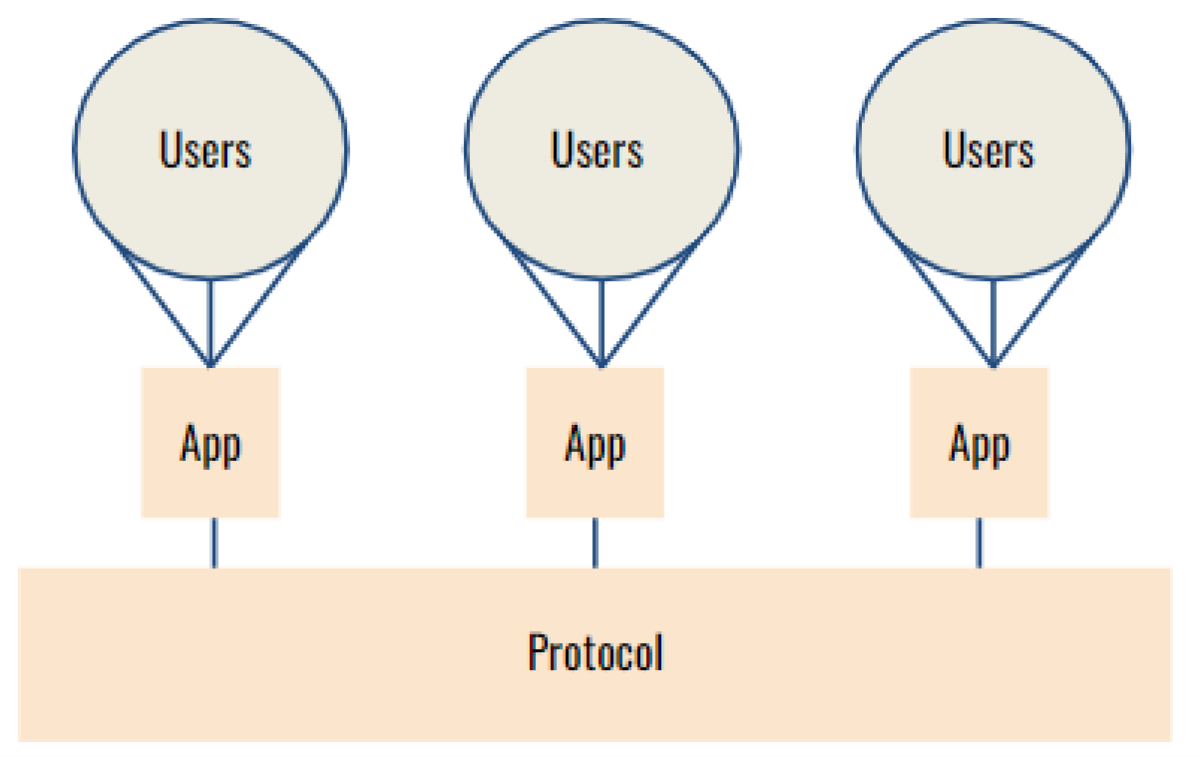

You can further organize the four remaining sectors into Protocols and Applications. Protocols are base layer networks that provide standardized and open-source software for users and developers to build on top of. Applications plug into these protocols by developing smart contracts and hosting them on the underlying protocol. For each transaction the application needs processed, it pays a fee to the protocol. Thousands of different applications exist, but generally fall into one of three categories: Decentralized Finance (DeFi), Utilities, or Consumer applications.

Users of the applications may or may not know what underlying protocol the application they are interfacing with is built upon, and some applications exist on many protocols. Key features of the protocol include security, decentralization, throughput, and cost. Application developers look to balance which features they need to support their use case and which protocols have an existing base of customers they can easily sell into. Hopefully, this all sounds straightforward and familiar, as this is how things typically work in existing non-crypto application development. Where things look a little different is how value is created for tokens.

How Digital Assets Create and Capture Value

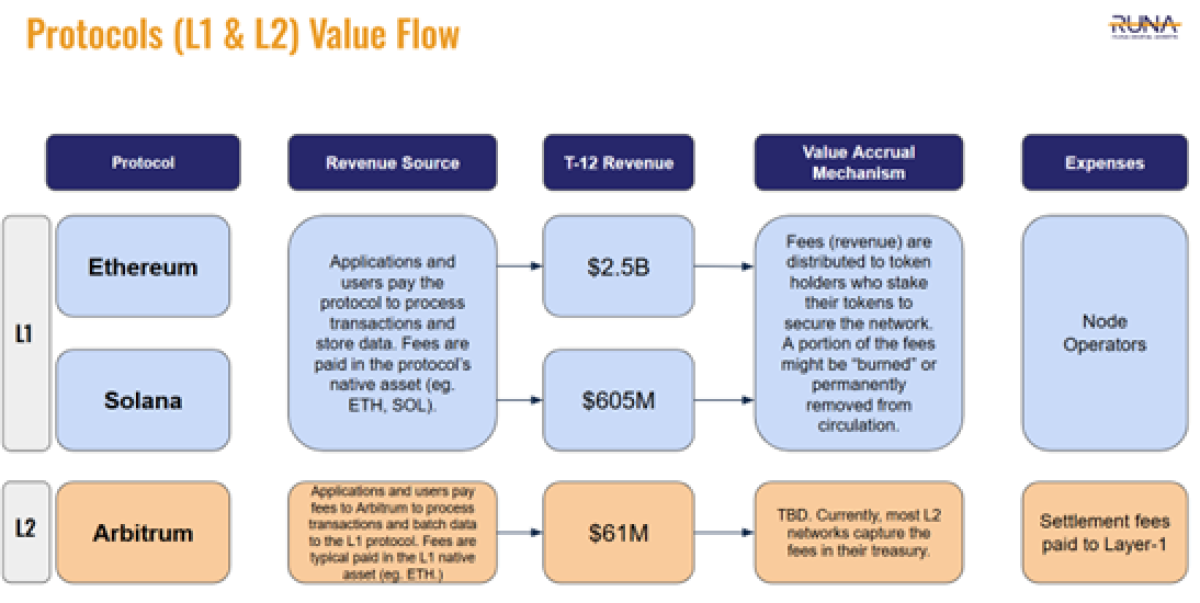

Since Protocols set the foundation for applications, we will start there. Two types of protocols exist today, Layer-1s (L1) and Layer-2s (L2). The difference between them being that Layer-2 protocols are resellers of blockspace on the Layer-1 blockchain. The L2 provides a subset of the services (execution) an L1 does, then aggregates and batches the activity to the L1 for final processing. By only providing a subset of the services, L2s offer cheaper transaction costs and higher throughput to applications and users but remain integrated with the L1 for better security and decentralization.

Revenue consists of all transaction fees, denominated in the L1 asset (e.g. ETH, SOL), generated by application activity on the protocol. To get to the revenue number stated in dollars, the value of the L1 token is converted at time of transaction to $USD.

For L1s, fees follow one of two paths from there:

Distributed to stakers: Tokenholders who lock their tokens in a contract, “Stake”, receive a certain portion of fees generated by the protocol. This is similar to dividends.

Burned: Some protocols elect to “burn,” or permanently remove from the total token supply, portions of the revenue. This is analogous to a share buyback.

For L2s, the mechanics are slightly different. Once a transaction is accepted, the L2 pays a settlement fee to the L1 protocol for final processing, thereby reducing their gross margin. Whatever is left after settlement costs is kept by the network treasury wallet. Tokenholders do not receive any portion of the fees, nor are any tokens burned. Keeping up with the analogies, this can be viewed as retained earnings by the network.

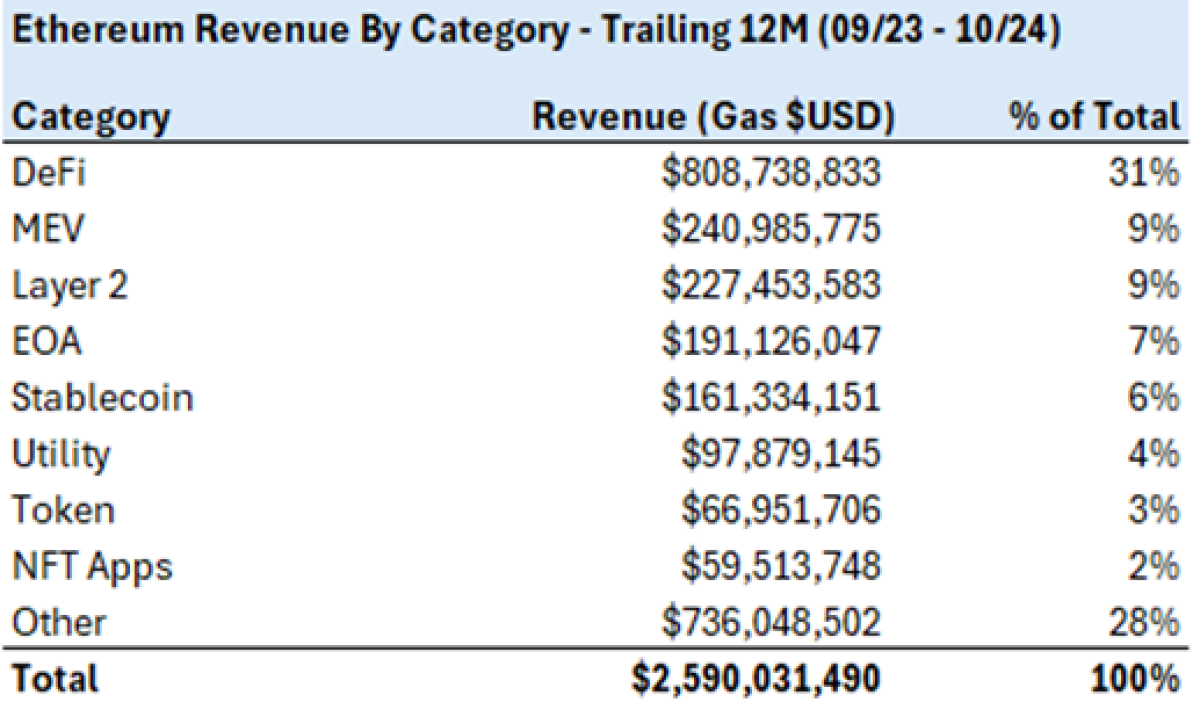

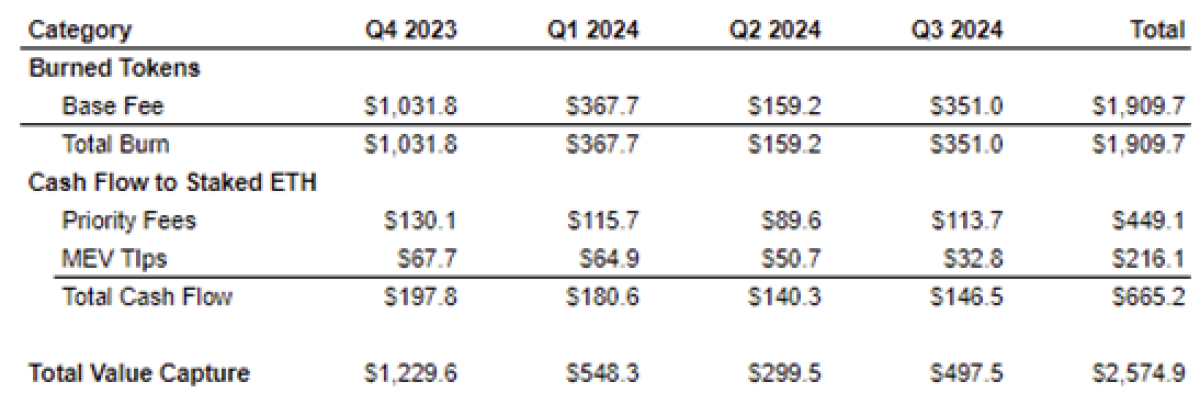

Ethereum’s $2.5B in revenue is likely staggering to those not paying attention to digital assets. Various different activities contribute to revenue, but DeFi and L2 settlement fees make up the bulk of it.

(Source: Runa Digital Assets, Artemis)

Within the revenue line item for Ethereum, a few factors drive the changes from one period to the next:

Base Fees: Each transaction must pay a base fee for execution. More complex transactions may incur a larger fee depending on the blockchain. E.g. Trading assets on DeFi is more computation intensive than sending a stablecoin to another wallet.

Priority Fees: When competition for blockspace is high, users can pay an additional fee to skip the line and have their transaction processed faster.

MEV Opportunities: Maximum extractable value (MEV) is opportunistic arbitrage that arises from the exact order of transactions. DeFi activity is the largest contributor to MEV. MEV is captured by third parties, but they pay “tips” to stakers for processing transactions.

Following the two paths outlined above, we can put this into a model to understand how much is being burned per year and how much is being returned to tokenholders via staking distributions.

Ethereum Value Capture Model ($M)

(Source: Runa Digital Assets, Blockworks Research)

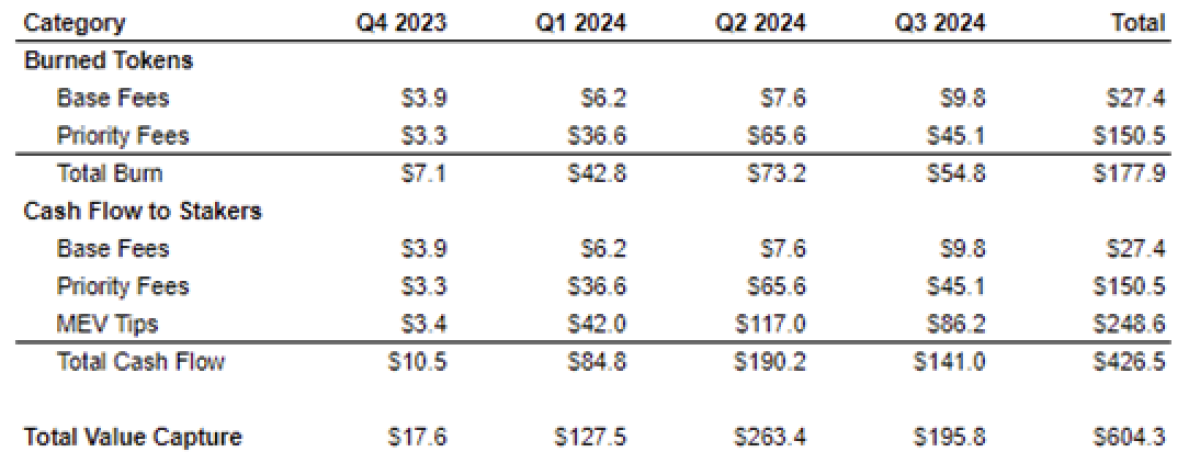

We can compare Ethereum’s financial activity to Solana by constructing a similar model. There are differences in how fees flow back to tokenholders on Solana. The same paths exist, burning tokens and distributions, but Solana has chosen to split the base fee and priority fees evenly (50% each) between burning tokens and distributing to staked tokenholders.

Solana Value Capture Model ($M)

(Source: Runa Digital Assets, Blockworks Research)

Protocols represent the largest sector by market capitalization after currencies due to the large TAM, compelling economics, and strong network effects shown by legacy platforms. They have also been able to show a scalable business model for open-source software, driven by demand for underlying blockspace, which creates value for the network token through mechanisms like burning and staking distributions.

Making the Climb

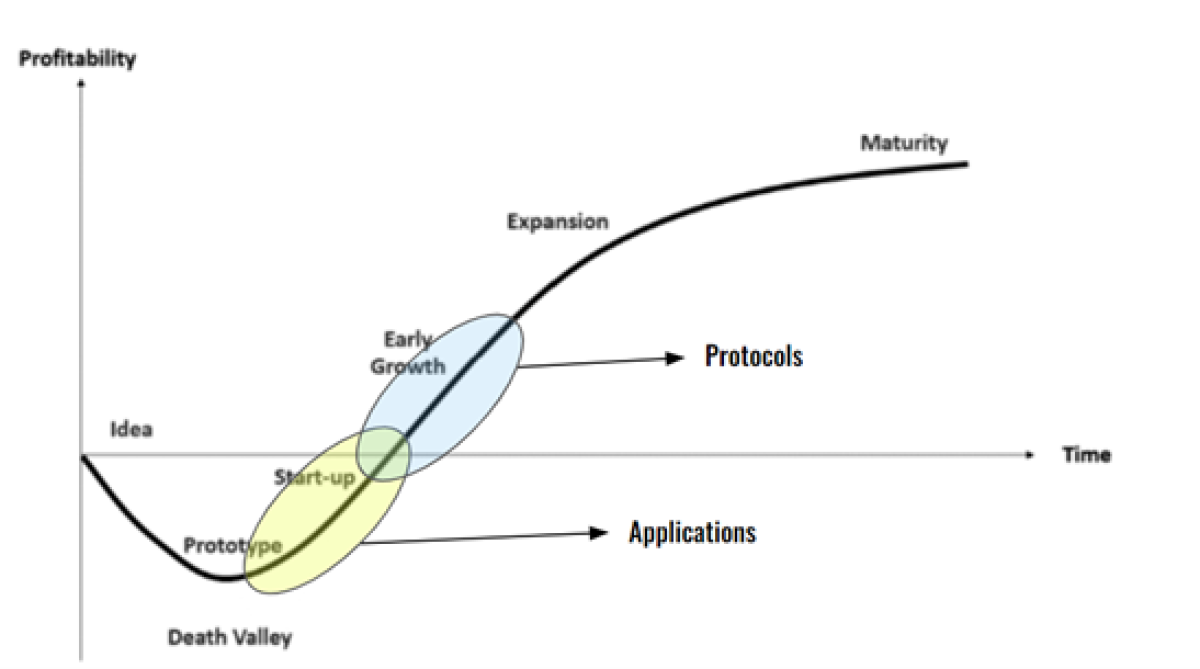

One of our core beliefs is that the Cambrian explosion of digital asset projects is healthy, but so are the massive die off events that occur alongside them. At both the protocol and application level, most projects will fail to ever cross the “Death Valley” (below).

In our view, Protocols and Applications are at different points of the “Start-Up J-Curve.” Protocols have made the climb from the valley of death and proven a viable business model exists with the right network design, throughput, and security. They provide a valuable service to application developers and capture some of that value for themselves and the tokenholders of the network. Protocols also appear to have reached a better position with global regulators on their status as a digital commodity. The SEC recently approved an Ethereum ETF, implicitly acknowledging ETH’s status as a non-security.

Applications currently sit below the protocols, still wading their way through a dark and turbulent valley to find not only product-market fit, but also a viable business model to generate value for themselves. Developers are experimenting with many different designs, and there is evidence of a few viable paths being established.

We believe this discovery process for applications might be accelerating due to a few recent developments:

Blockspace Singularity: In June, we wrote how the “Big Bang” moment for blockchains was here. The protocols and infrastructure had reached a sufficient level that allowed developers to no longer have to think about infrastructure and focus solely on their application.

Scale and Speed of Crypto Networks: Like Protocols, Applications benefit from the characteristics of public blockchains - open-source, freely accessible, global, and easily integrated with other applications. Once product-market fit is found, they often quickly demonstrate exponential growth with compelling economics.

Regulatory Reversal: Applications, especially the DeFi sector, have taken the brunt of the unclear regulatory environment in the US. Oftentimes, projects have chosen to geofence their applications from users in the US and refrained from monetizing certain business lines to avoid further scrutiny. Over the last six months, we have seen evidence of a shift in attitude towards digital assets from both political parties, previewing what might be a more friendly environment in the future. Not only might this allow for all projects to service users in the US, but projects may also be comfortable experimenting with different value capture mechanisms for tokenholders.

Don’t Tell Me, Show Me

Digital assets are moving to the “don’t tell me, show me” phase, and we believe there will be something to see for all types - Currencies, Protocols, and Applications. The success of the Bitcoin ETF speaks for itself, but we believe the economics of Protocols and Applications will soon catch the eye of investors.

About the Contributor

Max Williams is a Co-Founder and Portfolio Manager at Runa Digital Assets, an institutional investment firm specializing in digital assets. A digital asset investor since 2017, Max co-founded Runa Digital Assets in 2021. Previously, Max was a Managing Director at Nasdaq in the North American Markets division focused on listed options trading.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/