By Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP

Managing Director, Global Content Strategy, CAIA Association

Like the Gallagher brothers, we’re preparing for the unknown (read: they’re back on tour, we’re in a trade war) and are moving on from the familiarities of the past (read: welcome back Oasis, goodbye globalization).

The Brains I Had Went to My Head

Why do we diversify? Ask ChatGPT and it'll rattle off a list: reducing risk, protecting against volatility, optimizing the risk-return tradeoff. However, to me, diversification comes down to one thing: the future is unknowable. Future returns are unknowable, risk is unknowable, and the relationships between assets (i.e., correlation) are also unknowable.

There’s a concept in time series modeling called “walk-forward analysis.” The idea is straight forward in concept but difficult in practical decision-making: you train your model using only data available up to a certain point in time, then test it on data that comes after, with no peeking ahead. You repeat this process over and over, simulating what it’s like to make decisions in real time, with only the information you actually had at that time. This removes something known as “look-ahead bias,” the idea that you unknowingly let future data influence your past decisions.

Part of the problem with research that ends with the punchline “if you had just put your money in x, you would have done better than y” is that none of those findings actually put the reader in the seat of the investor at that time with information available at that time. It’s easy to look at past performance with hindsight being 20/20, but it’s much harder to make a call. This is true for public vs. private markets, risk-on vs. risk-off assets, and diversification itself.

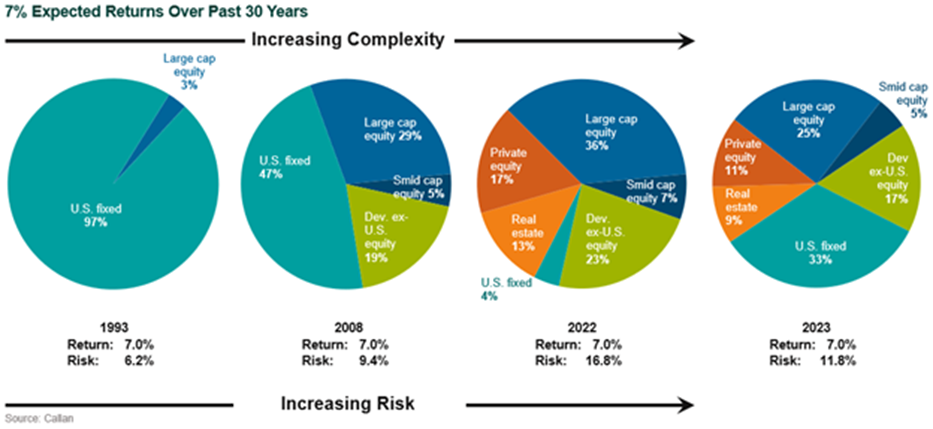

To illustrate this, I always love using some variation of the pie charts in Figure 1.

Figure 1: 7% Expected Returns Over Past 30 Years

Source: Callan

Hypothetically, let’s assume you’re aiming for a 7% return – what would you need in your portfolio to get there at different points in time?

In 1993, you could have hit that target with a very conservative portfolio of almost all U.S. fixed income.

By 2008, you needed to diversify way beyond this, adding global equities to the mix

Fast forward to 2022, your fixed income is almost non-existent, replaced by risk assets like private equity and real estate.

Then in 2023, after interest rates rose sharply in 2022, fixed income increased but the portfolio remained diversified.

The purpose of Figure 1 is not to prescribe what the optimal portfolio should look like moving forward. Instead, it shows that diversification is not static and reacts to market conditions. Again, the future is unknowable.

Please Don’t Put Your Life in the Hands of a Rock ‘n’ Roll Band

During COVID (the last time we were in the middle of a market meltdown and a global pandemic), I wrote an article about putting yourself in the shoes of an investor at the turn of each decade. This was through the lens of performance-chasing rather than forward-looking capital market expectations, but I think the concept still applies.

Selecting decade cutoffs is arbitrary, but they still tell an important story: the best and worst performers don’t remain fixed and often oscillate over time. The hardest part is identifying that rotation – you only see it in hindsight. Why does this matter? if you’re an investor in 1993 (again, Figure 1) and your forward-looking return expectations suggest loading up on U.S. Treasuries to achieve a 7% return, you have no idea that the back half of the decade will become incredibly painful. However, you’ll begin gaining new information in 1994, 1995, 1996, and so on, and your portfolio is likely to adjust to this new information (imagine sitting exclusively on U.S. Treasuries at the height of the tech bubble! You’re fired!)

Conversely, when 2000 arrives, you’re looking back on a decade that was dominated by risk assets like venture capital and (unprofitable) growth equities. Without a forward-looking view, it can be very tempting to chase returns, window-dress your portfolio, and load up on high-risk growth assets. However, you don’t know what the future holds, and you have no idea that risk assets would go on to have a muted (to negative!) decade in CAGR terms.

The point is, managing a diversified portfolio is tough because 1) you have no idea where things are going and 2) no matter what you do, you’re always going to invest in something that’s not working. Investing is a forward-looking exercise – it’s tough to ignore what’s already happened, but it’s a sunk cost.

Don’t You Know You Might Find a Better Place to Play?

I’m writing this piece on the back of Trump’s recent tariff announcements on self-proclaimed “Liberation Day.” To borrow from Lenin “there are decades where nothing happens; and there are weeks where decades happen.” This was one of those weeks (by the way, I love living through yet another unprecedented crisis). Of course, since the announcement, markets have moved dramatically, and prognosticators are predicting higher probabilities of a recession, along with increased expectations for inflation.

You’ll continue to see articles, posts, and tweets about staying the course and that, if you weren’t properly diversified before the drawdown, it’s too late. I would offer a slight nuance – what matters isn’t where your portfolio was, it’s what you’re going to do with the information you have now. For some, that might mean doing absolutely nothing. For others, it might be rebalancing or making a tactical shift. All of which should be done with a forward-looking view.

For anyone who wants to harp on about the past, tell them it’s too late as we’re walking on by.

About the Contributor

Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP is Managing Director, Global Content Strategy at CAIA Association. His industry experience lies in private wealth management, where he was responsible for asset allocation, portfolio construction, and manager research efforts for high-net-worth individuals. He earned a BS with distinction in finance and a master of finance from Pennsylvania State University.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/