By William J. Kelly, CAIA, Founder & Managing Member, Educational Alpha LLC

While clever headlining (at least IMHO!) has been a hallmark of this newsletter, some matters are just too important to be subjected to whimsical double entendres.

For those who have chosen to get their daily dose of information about the BBB from the likes of Twitter/X or TruthSocial, you may be missing not only the finer points of the hefty (hence the “Big” qualifier) 1,038 pages, but also the backdrop of what this means to a certain sovereign’s current statement of income and balance sheet. I was a recent guest on Negocios TV to discuss this very topic, and more video-based learners can see it here, but I still encourage you to read on and make informed consent the ally of the unenlightened.

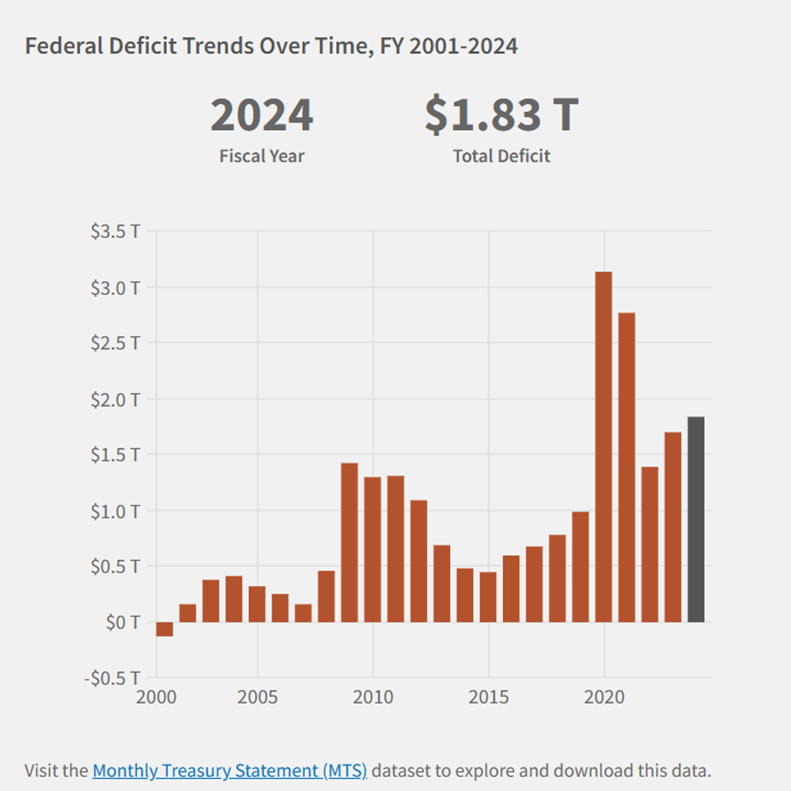

We should begin with the backdrop of some cold hard facts. In fiscal 2024 the U.S. rang up a deficit of $1.8 trillion, adding to our accumulated pile of national debt, which now stands at a more big-than-beautiful $36T. You can also be forgiven if you have forgotten what a surplus year felt like, as you would have to go back about 25 years to find the last time that has happened. In fact, it has become such a rare occurrence, we have only experienced a surplus four times in the last fifty years and remain on a course to never see one again.

The origin of the quote “a billion here, a billion there, pretty soon it adds up to real money” remains a little unclear, but if it was the NYT in 1938, or Republican Senator Everett Dirksen circa 1960, it was a long time ago and, in both instances, it was a reference to overspending at the Federal branch of government. What does matter is that the billions are now nominal and the trillions real, and we still have not addressed this even more well-fed elephant in the room.

If you are expecting solace or relief from the BBB, you will find it more likely to represent a destination to a future credit rating from Moody’s than it is an Ozempic bolus to the hind quarters of the portly pachyderm. In fact, the non-partisan (#LOL) Congressional Budget Office estimates that the BBB will add an incremental $2.4T to the already ballooning debt over the next ten years.

To perhaps frame this problem and to get the average American to open their kitchen window and scream “I’m as mad as hell and I’m not going to take it anymore” let us put it in the parlance of that average American. Assume that a family of four is doing relatively well and that the combined breadwinners bring home $500,000 a year. Unfortunately for them, but maybe not the credit card company who is underwriting this largess, they are living beyond their means and have spent $700,000 this past year. Extraordinary and unexpected expenses are part of life, so if this was an unusual year with monumental medical expenses for a loved one or a major home repair, there might not be a need to panic. However, in this fictional household, imagine that this overspending pattern has persisted for 25 years and the corresponding debt on their balance sheet is now $3.5 million, or a whopping seven times what this family earns. Debt service alone will eventually sink this domestic ship, and rather than another trip to Disney, they are far more likely to find themselves next on the docket of a local bankruptcy court.

The above example just needs another seven zeros. You now have the real picture, and the more you stare it, the more likely you should be to have that Howard Beale moment! No wonder the real economy, and the likes of real business people like Jamie Dimon, are worried about cracks in the bond market. BBB not only fails to address the issue, it is also potentially knee-capping foreign investment in the U.S. with a proposed revenge tax on the foreign investors who fund our massive pile of debt, with a cover charge in the range of 5-20%

You can be forgiven if you are not acquainted with this revenge tax, as you would have had to patiently read all the way to page 959 of the BBB to follow the Section 899 storyline. It remains unclear if there will be exemptions to those foreigners who fund our balance sheet or what might be the impact to non-U.S. investors in a drawdown fund structure. “2 and 20, plus 20 more” will not only become a tough marketing pitch, it will also certainly mean an even tighter bearhug on the onshore individual investor to plug what could be a big fundraising hole.

Beauty will always be in the eye of the beholder, but if you plan to kiss a frog named BBB, please do it with your eyes wide open.

Seek education, diversity of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

About the Contributor

William (Bill) J. Kelly, CAIA is the Founder and Managing Member of Educational Alpha, LLC where he writes, podcasts, and speaks on a variety of investment related topics, focused on investor education, transparency, and democratized access to differentiated risk premia. Previously he was CEO of CAIA Association since taking this leadership role in 2014 until his retirement in 2024. Prior to that, Bill was the CEO of Boston Partners, and CFO and COO of The Boston Company Asset Management, a predecessor institutional asset manager. In addition to his current role, Bill is also the Chairman and lead independent director for the Boston Partners Trust Company and serves as an independent director for the Artisan Partners Funds, where he is also Chair of Audit Committee and a designated Audit Committee Financial Expert. He is also currently an Advisory Board Member of the Certified Investment Fund Director Institute within the IOB (Dublin) which strives to bring the highest levels of professionalism and governance to independent fund directors around the world. Bill began his career as an accountant with PwC where he earned his CPA (inactive).

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/