By Dhruv Sharma, PhD, Executive Director, Multi-Asset Research at MSCI

Are client portfolios truly optimized if core components of the client’s wealth, such as a family business or significant real-estate holdings, are managed separately from the client’s more liquid investments? For many professional investors and advisors, this question strikes at the heart of a persistent challenge in modern portfolio construction. Wealthy individuals and families often possess substantial private assets, yet traditional asset-allocation frameworks frequently treat these as constraints or afterthoughts, rather than integral parts of a cohesive strategy. This disconnect can lead to suboptimal risk management, missed diversification opportunities, and a failure to fully leverage the unique characteristics of private markets.

We present here insights from recent research into total portfolio allocation (TPA) that is supportive of a paradigm shift, positing that private equity and private credit deserve a strategic, not merely an opportunistic, role within a unified framework. By leveraging factor-based analysis, we can build a more holistic understanding of how public and private assets interact, paving the way for portfolios that are potentially more resilient, customized, and better aligned with a client’s long-term wealth objectives.

Adding private assets: portfolio construction in modern wealth

The once-reliable 60/40 portfolio now faces headwinds as many anticipate an era of lower prospective returns for traditional assets and increased market volatility. This concern has spurred a widespread search for alternative sources of return, income, and diversification, leading many to explore outcome-oriented strategies that look beyond simple public-market beta. Private markets, with their potential for illiquidity premia, differentiated return streams, and access to unique growth opportunities, have garnered new attention.

Consistent economic transformations, from technological disruption to evolving global trade patterns, have created a wider dispersion in asset performance, demanding more sophisticated asset allocation tools. And wealthy clients themselves present unique complexities: multi-generational investment horizons, specific income needs and, often, deeply embedded and emotionally significant private holdings. Traditional optimization models, often designed for institutional investors with perpetual horizons and fully liquid portfolios, fall short in addressing these nuances. They may overlook the underlying economic exposures of core private assets or fail to adequately account for the uncertainty inherent in long-term capital-market assumptions, especially for less transparent private investments.

A unifying vision: key pillars for holistic allocation

Our research into TPA for modern wealth offers a framework to bridge this gap, advancing portfolio construction in three primary ways:

A unified factor-based view: The most significant hurdle in holistic allocation is often the "apples and oranges" problem of comparing public and private assets. Our framework uses a multi-asset-class factor model as a common analytical language.[1] Instead of categorizing by asset class, we break down investments, whether a public stock, private equity fund, or core real-estate holding, into their underlying drivers of risk and return, such as exposures to equity, interest rates, inflation, industry, and country factors. A factor-based approach, which analyzes how asset classes have historically interacted, can contribute to portfolio allocations that broaden diversification. When it comes to private assets, for which historical return-based correlations can be misleading due to smoothed valuations and infrequent pricing, the approach provides an economically intuitive and more robust understanding of their diversification potential.

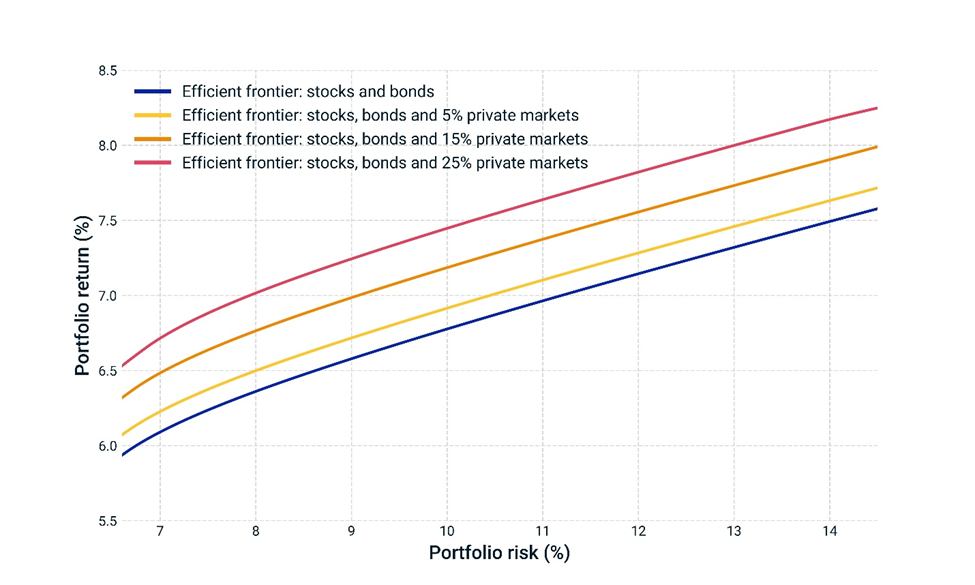

Adding private assets to a portfolio of public assets lifted the efficient frontier[2]

Leveraging illiquidity strategically: Illiquidity is often viewed as a drawback of private assets. When managed within a client’s assessed tolerance, however, it can offer strategic benefits. The illiquidity premium can be a meaningful source of enhanced returns for investors who are able to commit capital for longer periods, typically greater than five years. Moreover, the lock-up nature of many private investments can instill investment discipline, helping to mitigate behavioral biases such as panic selling during market downturns. Our framework explicitly considers a client’s illiquidity tolerance when determining strategic allocations to private markets. This assessment is a crucial consideration in integrating private equity and private credit into portfolios of publicly traded assets.

Robust and practical optimization: Traditional mean-variance optimization can produce concentrated portfolios, especially when dealing with assets that have high expected returns, but also high uncertainty around those estimates, a common feature of private markets. Our TPA framework addresses this shortcoming by incorporating explicit penalties for portfolio concentration, encouraging broader diversification. It also accounts for the uncertainty inherent in capital-market assumptions via robust optimization. By applying greater scrutiny to allocations based on less reliable return predictions, a feature particularly relevant in private assets, the portfolios generated by applying the framework tend to be more robust and less sensitive to small changes in input assumptions. The resulting allocations are not only theoretically sound, but generally more practical, as they are aligned with real-world client preferences and constraints.

Turning insights into impact: actionable steps for allocators

Following a factor-based framework suggests tangible actions that CIOs and advisors can take to help them better reflect their client’s preferences in the portfolios they manage:

Rethinking core holdings: A client's family business or legacy real-estate holdings do not need to be a constraint. Factor analysis can highlight underlying economic exposures so that the wealth manager can build a diversified portfolio around it.

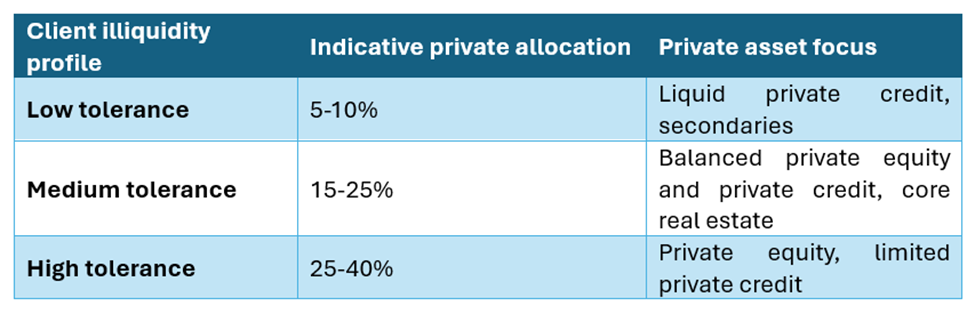

Systematic illiquidity budgeting: By assessing a client's capacity and willingness to tolerate illiquidity across different time horizons, the wealth manager can move beyond ad hoc private-market allocations. This ability allows for a more strategic determination of the appropriate position size and type of private-market exposure. For example, a higher illiquidity tolerance might allow for a larger allocation to private equity, whereas a moderate tolerance might favor more liquid forms of private credit or secondaries. A key practical application of this framework is systematically linking a client's illiquidity tolerance to their strategic private-asset exposure, as shown in the following table.

Linking a client’s illiquidity preference with the appropriate private asset focus[3]

Enhanced transparency into private assets: Because the framework helps wealth managers look under the hood of private equity funds’ underlying factor exposures, they can gain a clearer understanding of how that fund may impact an existing portfolio’s diversification. For example, does a private-credit strategy offer genuine diversification from public fixed income, or does it largely replicate existing credit and duration risks?

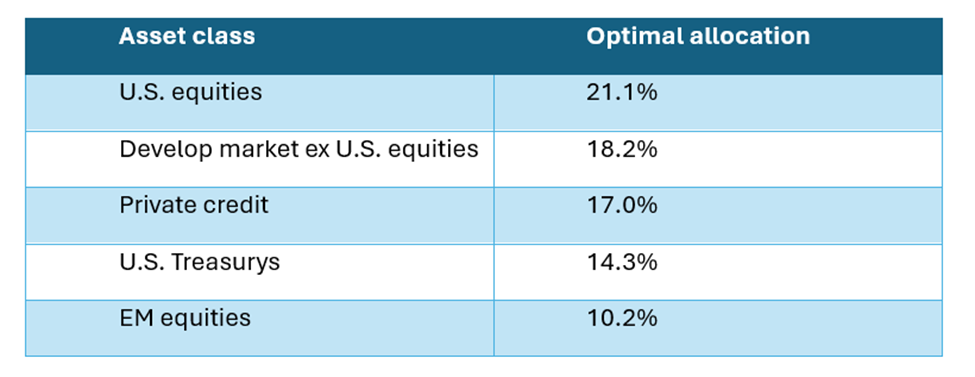

Customized solutions: The framework can also support a wealth manager’s ability to more closely tailor allocations to private assets to accommodate diverse client profiles. Consider, for instance, an established business owner who recently sold their primary business but retains significant holdings in private real estate, approximately 10% of their total wealth, which serves as a core holding. The client has a high comfort level with private investments due to their entrepreneurial background. Our TPA framework, recognizing the high illiquidity preference (20-25% private-market exposure in the diversifying portfolio as shown in the table above), leads to a balanced risk profile. The resulting allocation is equity heavy, with strategic allocations to private credit to capture its lower volatility and income-generation potential, and to private equity, which complements the core real-estate position. The integrated approach estimates an increase in the client’s expected portfolio return by approximately 0.5% compared to a baseline public-markets-only portfolio, while maintaining a similar target risk level. [4]

TPA framework allocation for high illiquidity preference

The path ahead: evolution and opportunities in total portfolio allocation

The thoughtful integration of private equity and private credit in a portfolio of public-market assets, when guided by an understanding of their fundamental risk drivers and a client’s specific circumstances, can be a reality in modern wealth management. A factor-based TPA framework, like the one we describe here, offers a practical blueprint for implementation to help wealth managers systematically analyze, integrate and optimize portfolios that include private assets.

Looking ahead, challenges and opportunities abound. The democratization of access to private markets continues, bringing new vehicles and investor types into the fold. This will heighten the need for robust analytical frameworks and improved data transparency. Navigating the evolving regulatory landscape, particularly concerning retail access, and addressing tax efficiency across complex public-private portfolios will also be key. Ultimately, success will depend on an evolving allocator mindset: one that prioritizes comprehensive, integrated solutions for achieving long-term financial well-being.

About the Contributor

Dhruv Sharma, PhD is Executive Director, Multi-Asset Class Investment Research at MSCI. He leads the development and application of risk models and scenario analysis for multi-asset portfolios, helping asset owners and wealth managers address complex investment challenges. His research focuses on portfolio construction, asset allocation, and macro-financial risk modeling. Dhruv holds a PhD and a Master’s degree in Theoretical Physics from École Normale Supérieure in Paris, as well as an Engineering degree from École Polytechnique.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/

[1] We used the MSCI Multi-Asset Class (MAC) Factor Model in our research.

[2] Thoughtful integration of strategic private assets, analyzed within a unified framework, can potentially offer improved risk-return tradeoffs compared to traditional portfolios limited to public markets. We used the MSCI USA, MSCI USA Small Cap, MSCI World ex USA, MSCI Emerging Markets, MSCI US Government Bond, MSCI USA REIT, MSCI USD Investment Grade Core Corporate Bond, USD High Yield Corporate Bond, MSCI US Private Equity Closed-End Fund and the MSCI US Private Credit Closed-End Fund Index in our asset universe.

[3]A client's capacity and willingness to accept illiquidity are crucial inputs for determining the appropriate strategic allocation to private markets. Higher tolerance generally supports a larger and potentially more growth-oriented private asset portfolio. These ranges and focus areas are for Illustrative purposes only.

[4] Using expected return assumptions from MSCI Macro-Finance Model, and covariances estimated from the MSCI Multi-Asset Class Factor Model.