Authored by Laura Merlini, CAIA, CIFD, Managing Director, EMEA

In January’s Chronicles of an Allocator, we explored Venezuela—richer in oil than Saudi Arabia, but with no real way to move it. This month, we ask: who has the capital, patience, and strategic ambition to unlock that buried wealth?

Look to the Gulf.

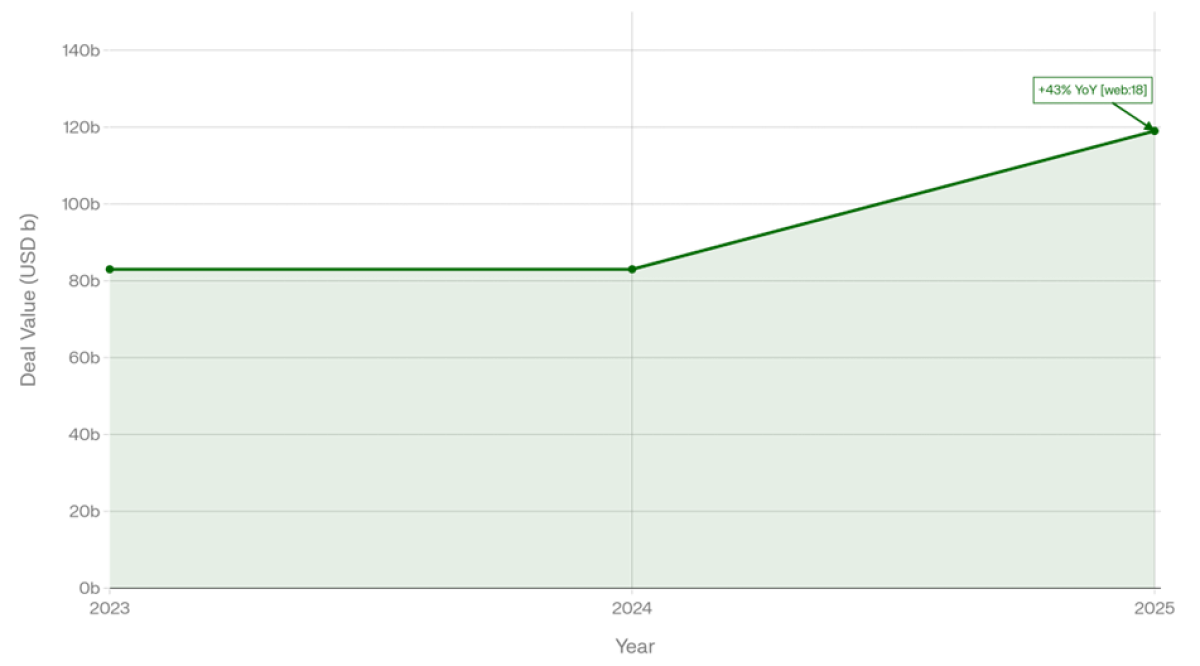

Middle Eastern sovereign wealth funds have quietly become the center of gravity in global state capital and 2026 is already showing that the real action is shifting from deal rooms to boardrooms. If you have been tracking deal flow, you already know the headline: Gulf funds deployed roughly $119 billion in 2025, up 40% from 2024, and now account for nearly 43% of all sovereign investor activity globally.

Gulf SWF Deal Activity Growth (2023-2025)

Strong acceleration in deployment volume after flat 2024

Source: https://salaamgateway.com/story/gulf-swfs-capture-43-of-global-deal-activity-in-2025

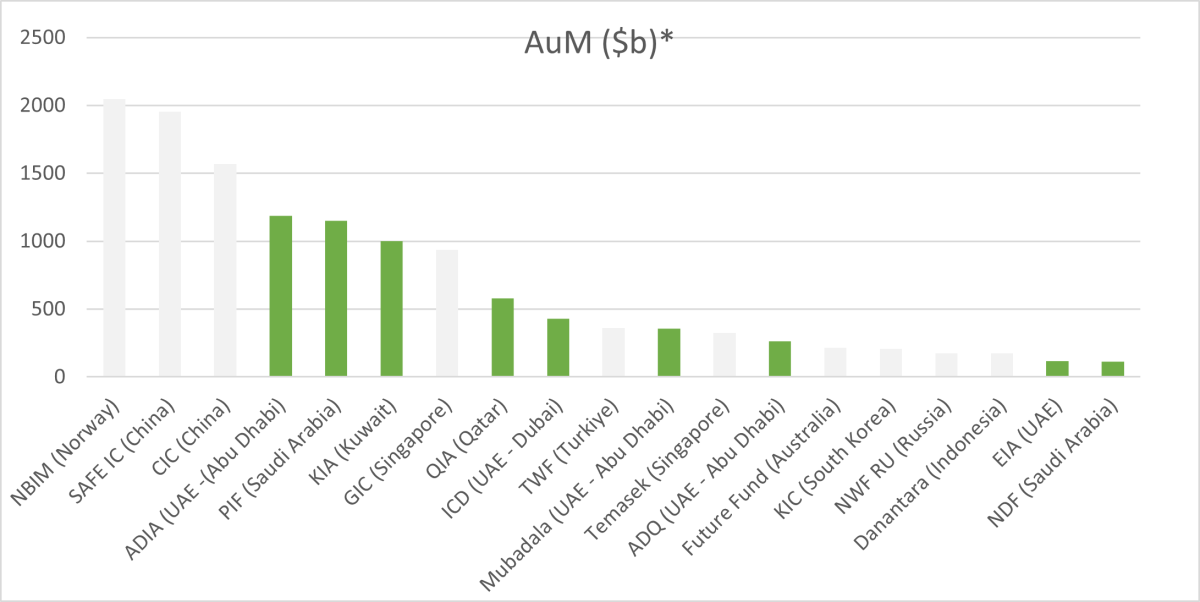

As shown in the table below, nine of the 20 largest sovereign funds are based in the Middle East. They are anchored by Saudi Arabia’s PIF, Abu Dhabi’s ADIA, and Kuwait’s KIA, each holding around a trillion dollars. Combined with Mubadala, QIA, ADQ, and the DIC, this group commands firepower comparable to a mid-sized G20 economy, but with investment horizons measured in decades rather than election cycles.

Top 20 SWFs by AUM

The Triple Mandate of SWFs

When you sit across the table from a Gulf SWF team seeking to raise capital or seal a partnership, you are negotiating with an institution carrying three overlapping mandates simultaneously.

First is economic diversification. These funds recycle hydrocarbon surpluses into tourism corridors, logistics hubs, manufacturing clusters, and advanced technology. Together, these investments form the operational backbone of Vision 2030 and similar national strategies. With this shift in perspective, a deal becomes infrastructure for national development.

Second is energy pragmatism. Even though it may appear contradictory, Gulf SWFs are simultaneously underwriting both energy transition and energy security. They hold stakes in LNG producers and renewable platforms, as well as in grids, storage, and other critical infrastructure. They are betting that the world will need a diverse energy mix for longer than pure climate models suggest, while positioning themselves to lead in whatever mix ultimately emerges.

Third is investment diplomacy. Acquiring board seats in technology companies, stakes in critical infrastructure, or holdings in sports franchises serves a clear geopolitical function. Even as current-account surpluses narrow, Gulf economies have accelerated foreign investment since 2023, using their sovereign vehicles to deepen ties and hedge against a fragmenting world.

For anyone raising capital in this ecosystem, understanding the triple mandate is essential. Gulf SWFs seek returns but also national development outcomes, energy-security positioning, and diplomatic optionality. The art lies in making those objectives converge.

Planning Beyond the Barrel

The backdrop to all of this is a simple but uncomfortable reality. The world is gradually and unevenly moving toward lower growth in oil demand. Gulf producers continue to benefit from low-cost barrels, but fiscal buffers cannot rely on the strategies of the 2010s forever.

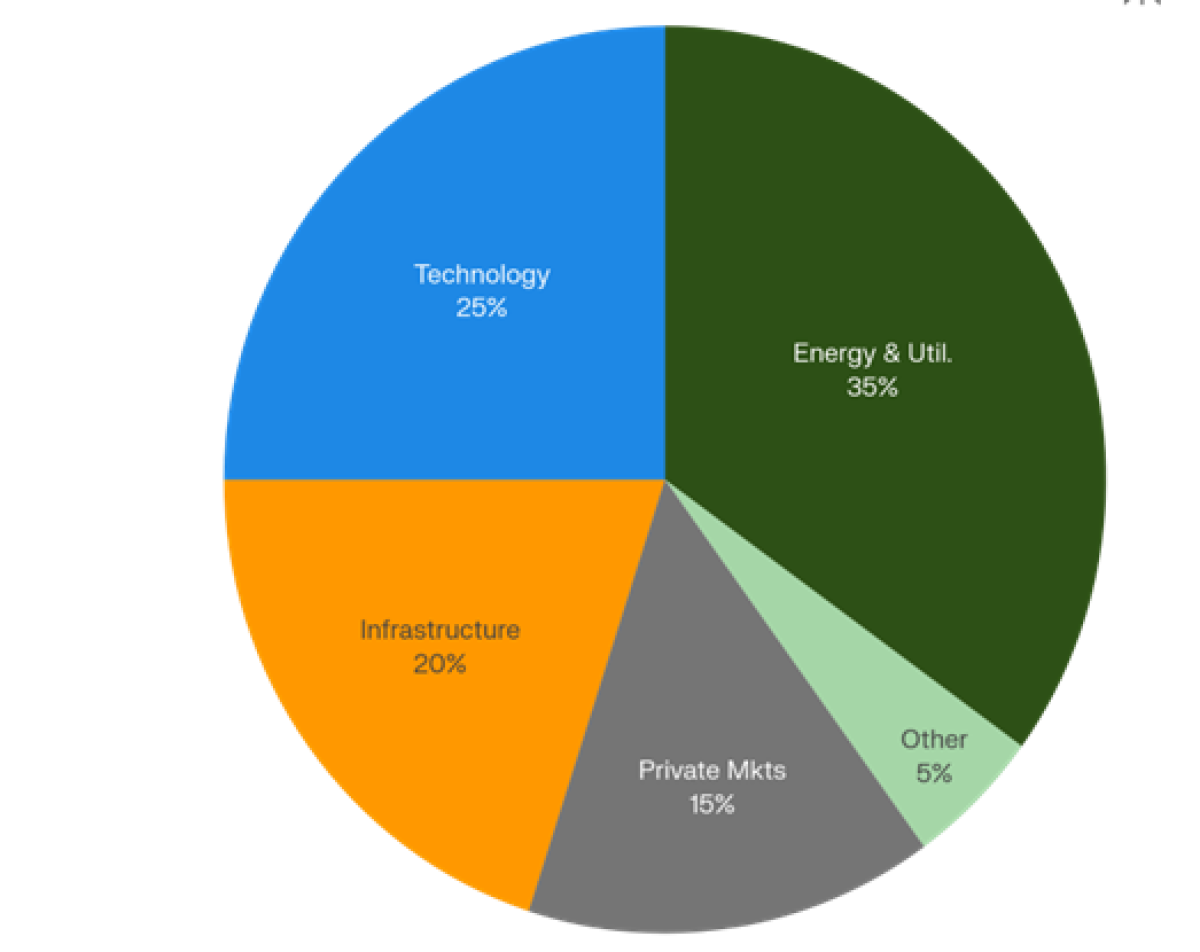

Gulf SWF Deal Activity by Sector (2025)

In this environment, sovereign wealth funds have become the central mechanism of national diversification rather than mere savings pools. This is evident in how budget surpluses are funneled into sovereign vehicles and then invested in tourism districts, logistics corridors, manufacturing clusters, and digital infrastructure, supporting both economic and political objectives. At the same time, many MENA strategies explicitly align domestic reform agendas with SWF-backed investments in renewables, clean technology, and low-carbon infrastructure. This approach helps hedge both fiscal risk and social stability as the oil era matures.

Building Internal Capability

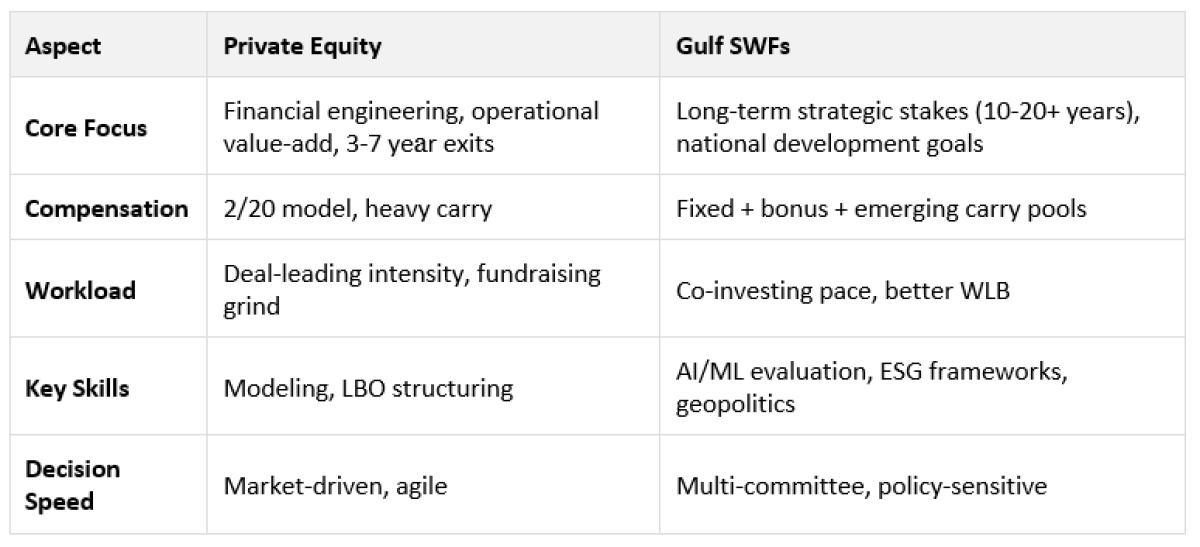

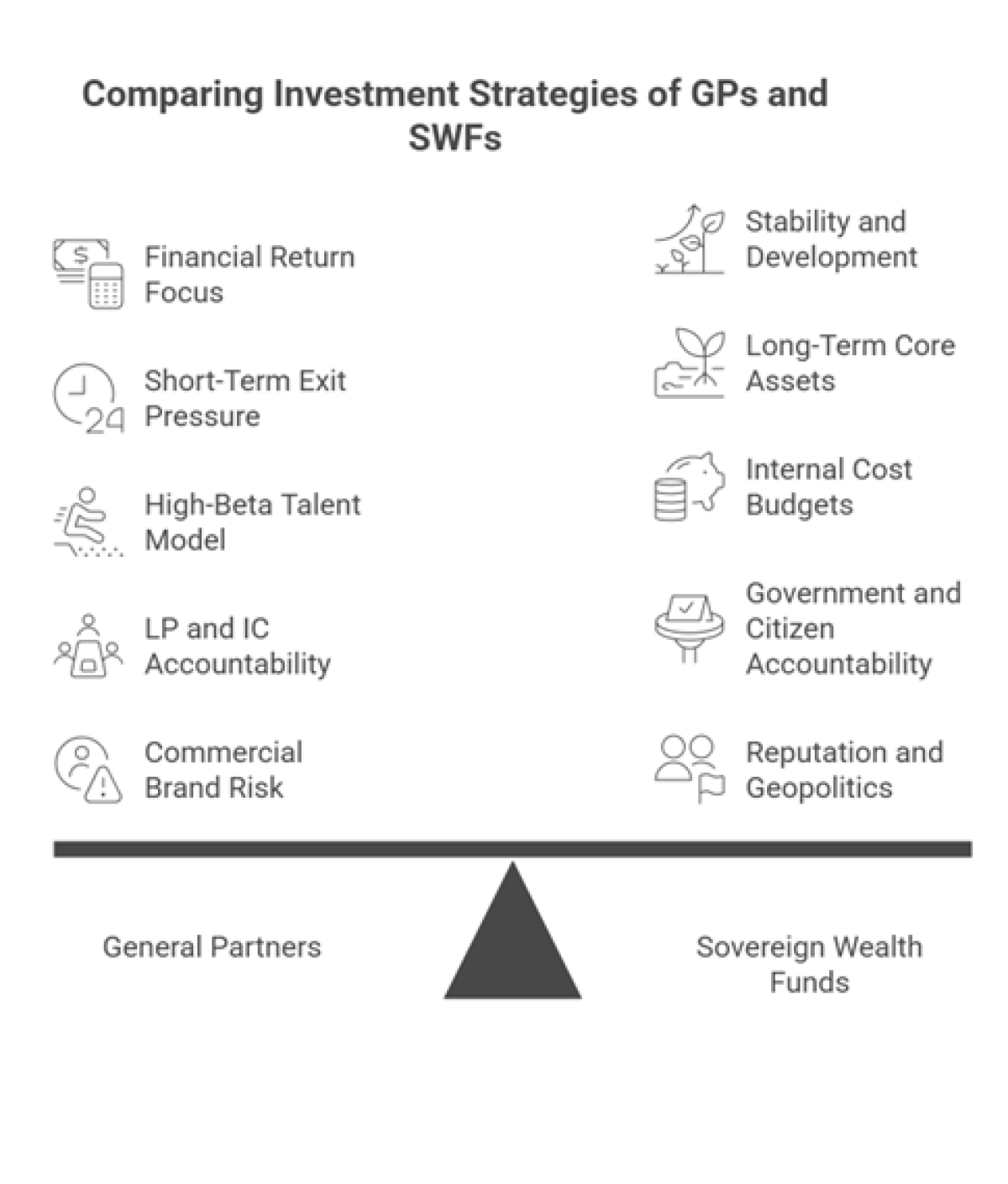

Five years ago, Gulf sovereign wealth funds relied on private equity firms and foreign advisers for complex deals. Today, they are building internal teams and compensating them with carry pools, providing private equity-style pay for sovereign fund work. ADIA and PIF are actively recruiting senior dealmakers from firms such as Goldman Sachs and Blackstone.

The skill sets these teams bring are critical. They need people who can evaluate machine-learning models and semiconductor supply chains, understand ESG frameworks and geopolitical constraints, and translate AI due diligence into boardroom presentations for government stakeholders.

Source: https://www.vciinstitute.com/blog/where-pe-and-swfs-diverge-and-where-they-quietly-converge

The structural difference is clear. Private equity optimizes for financial returns behind closed doors, while SWF teams must justify decisions to multi-stakeholder approval chains and maintain relationships with global CEOs. This talent premium is where Gulf funds quietly outcompete Wall Street.

The Islamic Finance Layer

There is an important Islamic finance layer to this story that is easy to miss if you only follow the headline deals. Several Gulf SWFs, and many of the banks and asset managers they partner with, operate within (or alongside) Sharia-compliant frameworks, particularly in fixed income, infrastructure, and real estate. This shapes how capital is structured (sukuk and other asset-backed instruments instead of conventional bonds), how leverage is used, and which sectors are off-limits. In practice, it means a growing share of deployment into domestic infrastructure, green projects, and "real economy" assets is being packaged in ways that appeal both to global partners and to a deep regional investor base that prefers or requires Sharia compliance. Knowledge of the Islamic finance toolkit is increasingly critical to following Gulf sovereign capital in action.

The Architecture of Gulf Sovereign Capital

January 2026 offers a case study. Sovereign investors deployed $13.7 billion across 43 deals, which was slower than 2024–25. While headline watchers saw caution, the real story remained invisible to deal databases. In Abu Dhabi, authorities quietly rewired the sovereign ecosystem. A new L’IMAD fund was created with fresh leadership. ADQ’s chief moved to L’IMAD, and ADQ’s portfolio was transferred under the new structure. The result is a three-pole system. ADIA handles the global portfolio, Mubadala oversees industrial strategy, and L’IMAD focuses on domestic development. From the outside, deal flow paused. From the inside, decision-making chains simplified and mandates clarified. Once the dust settles, the system will be positioned to move quickly on large, strategic transactions. This represents a clear shift in the “architecture of power.”

Why This Matters

Gulf SWFs remain among the few actors capable of underwriting multi‑billion-dollar tickets in energy transition, infrastructure, and late-stage technology, even in a higher-rate environment. Co-investing with them provides patient capital, scale, and access to projects that may never reach public auction. It also involves mandates that combine financial returns with industrial and foreign policy objectives, along with governance structures that evolve in real time. For policymakers, the Abu Dhabi reset serves as a reminder that design choices are critical. Decisions about how many funds to have, how to allocate savings, development, and stabilization responsibilities, and where decision rights reside are front-page issues. As more countries consider launching new sovereign vehicles or reshaping existing ones, the Gulf experience offers a clear lesson. The architecture of state capital, including who holds the levers, how mandates interlock, and how transparent the system is, will be as important as the sheer volume of assets in determining how this capital shapes markets over the next decade.

Resources:

- Global SWF: 2026 Annual Report https://globalswf.com/reports

- MUFG Research: Middle East 2025 outlook - https://dev2.mufgresearch.com/macro/middle-east-2025-outlook-themes-shaping-the-outlook-in-2025/

- Kearny 100: The next frontier of SWFs: how SWFs can attract and retain the right capabilities https://www.kearney.com/service/transactions-transformations/article/the-next-frontier-of-swfs-how-swfs-can-attract-and-retain-the-right-capabilities

- Invesco: Global Sovereign Asset Management Study 2024 https://www.invesco.com/content/dam/invesco/igsams/en/docs/Invesco-global-sovereign-asset-management-study-2024.pdf

- EY: How MENA Sovereign Wealth Funds (SWFs) are using investment strategies to futureproof their economies https://www.ey.com/content/dam/ey-unified-site/ey-com/en-ae/insights/wealth-asset-management/documents/ey-mena-swf-report-2024-05-2025.pdf

- https://www.ainvest.com/news/middle-east-sovereign-wealth-funds-adopt-performance-based-pay-model-2508/

- https://economic-research.bnpparibas.com/html/en-US/Gulf-GCC-investing-heavily-abroad-despite-falling-current-account-surplus-1/28/2026,53182