Authored by Nick Pollard, Managing Director, APAC

Throughout history gold has always held a special place in human imagination and activity - as a symbol of divine favour and royal power, a practical store of wealth and money, and a compact metaphor for desire, security, and the risks of excess. From pirates to presidents, from temple altars to trading floors, gold has moved effortlessly between myth and money always promising value, prestige, and the temptation that turns fortunes into fables.

In Asia in particular gold has worn many faces: currency, dowry, temple offering, and lately a strategic reserve line in balance sheets. In 2025 it is doing more than shining— it’s glistening brilliantly - outperforming, drawing in central banks, institutions, and a growing retail base alike. This is not nostalgia; it’s a recalibration of risk, culture, and technology that gives gold new practical value for allocators from Singapore’s sovereign wealth managers to family offices in Hong Kong.

From Emperors to ETFs: Continuity and Change

Asia’s affinity for gold is ancient. Emperors and maharajas didn’t collect bullion because it glittered on their wrists; they held it because it represented fungible power, tradable across borders and political regimes. That cultural habit has persisted and adapted: physical jewellery and temple donations coexist with vault-stored bars, exchange-traded funds, and tokenized ownership. Today’s gold market in Asia is where centuries-old behaviour meets modern financial plumbing — and that fusion is shaping demand and allocation patterns.

2025 Performance

- Price action: October’s record spot peak above $4,300/oz reverberated throughout Asian markets, widening local premiums and ramping showroom activity in jewellery hubs from Mumbai to Bangkok.

- YTD returns: Double-digit gains translated into meaningful local-currency appreciation for holders in currencies with depreciating trajectories versus the dollar.

- Volatility and role: Gold served as a portfolio stabilizer for Asian institutional portfolios amid regional equities sell-offs and currency swings,

These outcomes were not uniform across Asia: local tax regimes, import duties, and distribution frictions produced variation in premiums and retail affordability, but the macro message was clear—gold mattered for both sovereigns and savers.

Central Banks and Official-Sector Dynamics in Asia

Asian central banks are an active structural buyer group in 2025. Motivations and behaviours differ across the region:

- China: Reserve diversification and geopolitical hedging remain priorities. While China’s official disclosures are measured, market participants factor in quiet accumulation and domestic policy coordination that supports gold as a non-fiat reserve asset.

- India: A rising middle power with a legacy of private gold ownership, India’s Reserve Bank has been more conservative on official accumulation but policy emphasis on stable external balances increases the appeal of gold for reserve and sovereign wealth strategies.

- Southeast Asian central banks: Smaller economies are increasingly using gold to hedge FX risk and complement foreign-exchange reserves as they manage tourism and trade cycle exposure.

- Taiwan and Singapore: Active purchases and visible entries onto reserve balance sheets reflect a strategy of diversification away from concentrated exposure to any single foreign currency.

Official buying creates a structural bid that Asian markets price in, particularly because regional regulators and sovereign managers are sensitive to cross-border capital flows and currency risk.

Retail Demand and Cultural Tailwinds by Country

- India: Wedding season and festivals like Diwali remain the backbone of physical demand. Even at elevated prices, cultural purchase patterns, family gifting, and the use of gold as collateral in informal credit networks sustain a baseline of demand. Rural and tier-2/3 markets maintain especially strong consumption patterns, making Indian retail demand uniquely sticky.

- China: Lunar New Year and wedding-related purchases are complemented by rising investment demand through ETFs and digital platforms. Urban consumers increasingly treat gold as a savings alternative to property or bank deposits in certain life-cycle stages.

- Southeast Asia: Countries such as Thailand, Malaysia, and Indonesia show a mix of jewellery-led retail and rising appetite for investment bars and coins as local wealth rises. Religious giving and traditional uses keep a physical floor to demand.

- Hong Kong and Singapore: These financial hubs act as conduit markets. Wealth flows, trading desks, and vaulting services here support regional price discovery and cross-border transactions, even as local retail is comparatively smaller.

Cultural demand restrains downside in prices: families keep, inherit, and pass on gold, creating persistent stock rather than velocity-driven selling.

Fintech, Tokenization, and Expanding Access Across Asia

Asia is at the forefront of democratizing gold ownership:

- Micro-ownership platforms in India and Southeast Asia allow users to accumulate fractional gold digitally with tiny daily or monthly purchases, translating cultural saving habits into digital flows.

- Tokenized gold pilots in Singapore and Hong Kong push regulatory innovation: custody frameworks, proof-of-reserve standards, and custodial auditing are becoming part of product launches targeted at cross-border investors.

- Mobile-first markets see higher adoption: users in urban China and India increasingly prefer app-based accumulation to physical buying, which shifts demand from local jewellers to regulated vault providers and ETFs.

This widening of access increases marginal demand elasticity and brings new cohorts—younger savers, urban professionals, and digital-first investors—into the market.

Market Structure and Trading in Asian Hours

Asian trading hours are growing in importance for price discovery and hedging:

- Increased volumes in Asian-session futures and spot trading reduce reliance on European and U.S. hours for liquidity. Regional exchanges and clearinghouses have introduced products tailored to local participants, including micro futures and weekday-settlement options.

- Vaulting and custody services in Hong Kong and Singapore enable quicker settlement for Asian traders and reduce cross-border frictions for physical delivery.

- Localized premiums: Import duties, VAT, and tax regimes create regional price differentials that active traders and arbitrage desks exploit, shaping flows between centers such as Mumbai, Dubai (as a re-export hub), Shanghai, and Singapore.

For allocators, the improved Asian market structure equates to better ability to hedge geopolitical events that primarily affect Asian assets and currencies.

ESG, Responsible Sourcing, and Provenance in Asia

Asian institutional investors—sovereign funds, family offices, and pension managers— are increasingly applying ESG screens to bullion:

- Demand for responsibly sourced gold is rising in major urban centers where consumers and trustees ask for mine-to-vault traceability.

- Southeast Asian jurisdictions are experimenting with certification schemes and better regulation of artisanal mining to reduce reputational risk and align with global responsible sourcing standards.

- Institutional buyers in Singapore and Hong Kong increasingly prefer audited allocated bars from refineries that comply with Responsible Gold Mining Principles and OECD due-diligence guidelines.

This shift affects which supply sources are accessible to institutional allocations and can create premium spreads for certified gold.

Practical Guidance for Asian Allocators

- Strategic sizing: Start with a modest strategic allocation—typically low-single-digit percentages—and adjust tactically for regional currency risk and festival-driven demand cycles.

- Vehicle mix: Use allocated physicals for reserve-like roles, regional ETFs for liquid exposure during market moves, and regulated tokenized offerings for small-scale, digital-native investors.

- Operational due diligence: Prioritize custodial jurisdiction (Hong Kong, Singapore), insurance, audit trails, and repatriation rules; account for import duties and GST in pricing decisions, especially in India and some Southeast Asian markets.

- Event-driven overlays: Use Asian-hour futures and options for hedging around major regional events—elections, trade negotiations, or geopolitical incidents— here local news drives immediate safe-haven flows.

Key Risks Specific to Asia

- Regulatory shocks: Sudden changes to import duties, GST/VAT treatment, or controls on capital flows can alter local premiums and physical market liquidity.

- Currency swings: Rapid depreciation in local currencies against the dollar can amplify local currency returns but also complicate hedging and target allocations.

- Social and political risks: Localized unrest or trade interruptions can interrupt physical supply chains and vault access in ways that matter for on-the-ground dealers and investors.

These regional risks require Asia-specific operational planning, not generic global playbooks.

Where Next?

In their latest research paper, “Buy Gold Mining Stocks” (2025), BCA Research believe gold is now in a structural bull market, and their optimistic forecast, with the right tailwinds, suggest gold could hit $5000 over the next 12 months.

However, Erb and Harvey in “Understanding Gold (2025), warn of over-hype leading to reversion, and that historically multi-year returns often disappoint.

What is beyond dispute is that gold has your back in market meltdowns. In 11 major S&P 500 drawdowns since 1975 (everything from Black Monday to Liberation Day) gold rose in eight and fell less than stocks in the rest. During recessions it posted positive returns in three out of four.

And keep in mind….

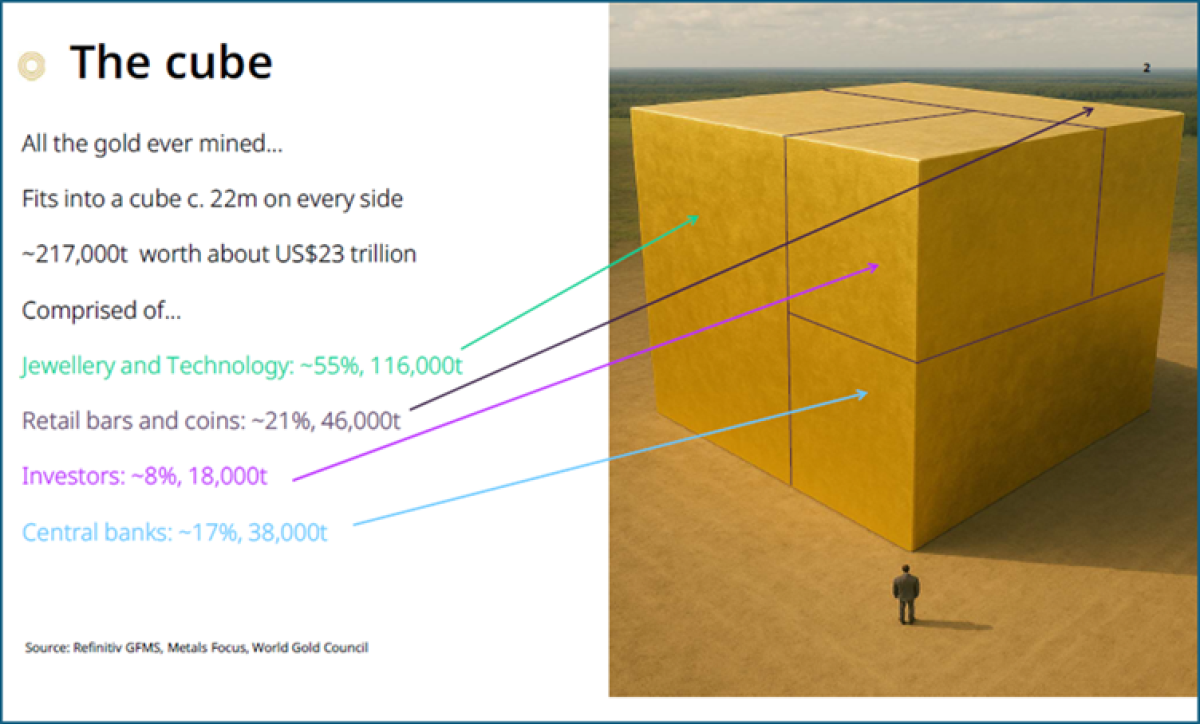

Its inherent scarcity–low natural abundance, slow annual production, and the gap between what’s physically out there and what economically mineable–will always help it defy logic when it comes to value.

Weight That Works

In Asia, gold is both legacy and leverage: a cultural asset that doubles as a modern financial instrument.

Gold still gleams. In 2025 it also works—in portfolios, in vaults, and in the digital rails connecting savers and sovereigns across Asia. That combination of heritage and utility is why, for many allocators, gold’s weight in the balance sheet is rising alongside its market price.

For financial allocators, the message is clear: gold isn’t just glittering—it’s working. And in a world where uncertainty is the only certainty, that’s worth its weight in… well, you know.