Authored by Christie Townsend

It’s fall in the northern hemisphere, and around the world this means that school is back in session. There’s something about this time of year that invites reflection; maybe the contemplative mood is brought on by the transition of seasons as the air gets chillier in this neck of the woods, or maybe it stems from the desire to ‘finish strong’ as we enter the final quarter of 2024, but this year in particular, I have been thinking a lot about what makes an investor great over the long term.

The question of what makes a good investor has been posed countless times, yet it continues to spark discussion among seasoned professionals and aspiring investors, alike. Even investment greats like Howard Marks and Warren Buffet, among others, have weighed in. However, one concept that consistently rises to the forefront of the discussion is the importance of becoming a good student of investing, aka a student of the markets.

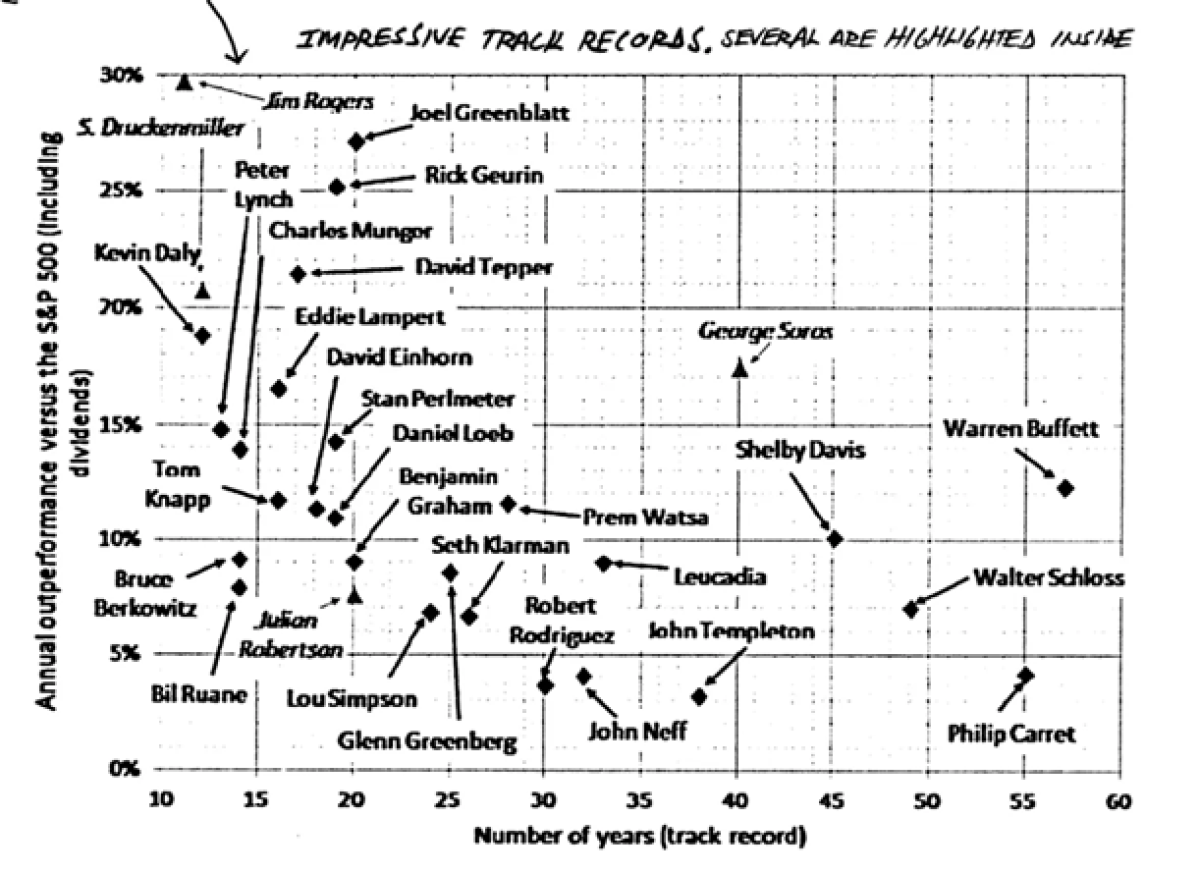

While this insight seems straightforward, it begs the question: What does it truly mean to be a good student?? Is it just getting good grades? While outcomes are important, marks are not the only determinate of “great”, and yet when it comes to evaluating investments in particular, we often judge practitioners based solely on their track record vs. an arbitrary equity benchmark (Figure 1).

Figure 1: Impressive Investment Track Records: Annual Outperformance vs. S&P 500

Source: CLSA.

These comparison exercises are fun and sometimes informative, but too often focus on the outcomes of great (or just lucky!) investors, not on what characteristics are indicative of investor greatness.

In my quest to find a modern solution to this age-old question, I turned to perplexity.ai and asked a simple question: What makes a good student? The results were interesting. As skeptical as I am about AI tools, I must admit, the list I got back was insightful, so I used it to help me create a more robust checklist of what makes a good student of investing.

AI Informed List of Characteristics: “Good Student of Investing”

Education / Continuous Learning Focused

(Due) Diligence

Self-Discipline / Patience

Adaptability / Humility

Confidence / Risk Management

Integrity

This list captures the core competencies like education, integrity, and risk management required on your journey to mastering aspects of investing; however, it also misses the one crucial trait that is required for good students to become great investors: intellectual curiosity.

“If you don’t keep learning, other people will pass you by. Temperament alone won’t do it—you need a lot of curiosity for a long, long time.”

Charlie Munger, American businessman, investor, and philanthropist

The truth is, intellectual curiosity is a trait that is often taken for granted when we discuss our craft, even as the investors we admire largely attribute their success to it. It is the driving desire to learn about investing, portfolio construction, alternative investments, and other investment opportunities, along with the willingness to ask increasingly deeper questions. Intellectually curious investors take pleasure in understanding the minutiae of how markets work, learning why people behave in certain ways, evaluating the fundamental rationale behind decisions, and regularly challenging their underlying data and assumptions. Intellectual curiosity helps investors learn faster and develop new and creative solutions to recurrent investment puzzles.

Given its importance, there are a number of unique ways to foster and/or strengthen your intellectual curiosity muscle:

Enlist Your Network. Everyone knows the importance of connecting with investors you admire, but it’s equally valuable to engage with interesting and thoughtful leaders in adjacent and/or industries that are meaningful to your portfolio. Additionally, reaching out to those with diverse interests outside of yours can provide fresh perspectives and insights. But perhaps more importantly, find people who you respect but can disagree with you; it will help sharpen your investment ideas and theses. Engage operators to deepen your due diligence processes. Learn from the mistakes of others.

Revisit your beliefs regularly. Review your investment processes and procedures periodically in order to ensure they are adequate and appropriately tied into your program for achieving investment goals. Solicit feedback and dine à la carte from the best practices of others with similar goals.

Expansive Reading/Knowledge Intake. There really is no substitute for high quality educational sources, and while it’s important to read investment specific news, history, and research, reading and listening to podcasts outside of investments will often inform some of your best decisions. As such, a list of interesting research and resources has been included below to pique your curiosity!

“To be a great investor and to be successful in most things, intellectual curiosity helps a lot…always reading, even if it’s not directly relevant to the job today.”

David Rubenstein, American lawyer, businessman, and philanthropist

and co-founder and co-chairman of The Carlyle Group

Foundational Resources:

Learn Infinitely. Invest Wisely.

The CAIA Curriculum: Built By Investors, For Investors

Intermediate / Advanced Topics:

When You Should Invest More in Alternatives (Morningstar)

Cambridge Associates' Risk Allocation Framework

Pitchbook's 4Q 2024 Allocator Solutions

Secondaries Investing is an Underutilized Risk Mitigation Tool for Real Estate Investors

AI: Eye on the Market: AI, NVCA AI Resources