Authored by Steven Novakovic, CAIA, CFA, Managing Director, Educational Programs

Much like the subject of TLC’s iconic song, retail investors are increasingly tempted by what lies beyond their familiar (investing) waters. And whether or not one agrees with the trend, these investors are continuing to gain access to the new frontier (or new to them, at least) of private markets. In the U.S., the Executive Branch, Congress, and regulators have all recently announced moves to support the democratization of alternative investments. As new rules are being written, new funds (including ETFs) with blended allocations to liquid and illiquid assets are launching regularly.

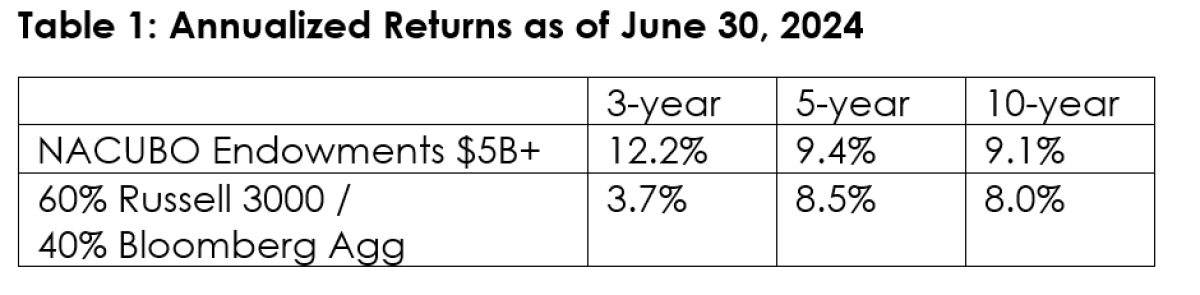

It's easy to see why the world of alternatives has garnered so much attention from retail investors. As shown in Table 1, institutions have enjoyed outsized returns from alternatives in the last decade, and these figures can be enticing. It’s not surprising that retail investors would see these returns and (mistakenly) view an allocation to alternatives as a cure-all for portfolio underperformance.

While these developments create great opportunities for the wealth industry and retail investors, democratization also introduces some potentially serious risks. Most notably, housing illiquid securities within vehicles that promise regular liquidity can be… complicated. In my view, this liquidity mismatch represents the most significant risk in this new world of “retail” alternatives. It may not be a matter of if it goes wrong, but when such a mismatch leads to a meaningful market failure.

According to NACUBO (Exhibit 1), large endowments allocate more than 50% of their portfolios to alternative investments. Unlike retail investors, most endowments have a perpetual time horizon and can afford to take on such illiquidity. Retail investors would be ill-advised to assume similar levels of illiquidity risk. They would also be ill advised to attempt to replicate institutional portfolio allocations or expect similar returns, but more on that in a moment.

Exhibit 1: Asset Allocation of North American Endowments

All this being said, I still believe that retail investors can benefit from private market exposure. Historical and projected long-term risk premia (Exhibit 2) are highly favorable for private market investments, so it would be understandable to expect even modest allocations earning the median return to be accretive. The key lies in setting realistic expectations, particularly around returns, diversified exposure, dispersion across managers, and individual holding periods.

Exhibit 2: 10-year expected risk premiums

Stick to the Rivers and Lakes That You’re Used to

Capturing these median returns is far from straightforward. There are no passive index funds that offer broad-based exposure to private markets. Achieving proper diversification requires investors to diversify not only across managers and strategies, but also across vintages - demanding significant capital and resources. Institutional investors lacking resources or expertise address this challenge through funds of funds. Unfortunately, these vehicles are largely inaccessible to retail investors and come with their own drawbacks, most notably a double layer of fees placing a drag on returns and eroding alpha.

For retail investors, target date funds may offer an analogous solution. If the allocations are managed so that investors are getting diversified exposure across holdings and time, this can be a good outcome for investors. While target date funds are not illiquid vehicles, investors tend to buy and hold these funds rather than trade in and out[1]. The composition of the portfolio should also have sufficient liquidity to manage any rebalancing or early withdrawals.

Long-term investment vehicles such as target date funds, defined contribution plans, and other retirement accounts represent the most appropriate mechanisms for delivering private market exposure to retail investors. An important consideration for these vehicles is whether they can deliver top-quartile alpha in addition to capturing the beta of the private markets. The impressive returns delivered by large endowments come not just from capturing private market risk premia, but also from enhanced returns via superior fund selection.

Institutional investors may have greater confidence in expecting above-average returns, due in large part to their distinct advantage in manager selection. In addition to having greater experience and resources for due diligence, they often enjoy access to top-tier managers. For example, many top performing fund managers are either closed to new investors or do not have products available for retail investors. This doesn’t mean that all retail accessible funds are subpar, but it’s reasonable to assume that the average quality available to retail investors is likely lower than that available to institutional investors.

You’re Moving Too Fast

Going back to our endowment returns, if a retail investor buys into a new fund offering exposure to private markets, they shouldn’t be surprised when they drastically underperform the median. Similarly, expecting to generate 1st quartile returns with any kind of consistency is a recipe for disappointment. In fact, I believe there’s an even greater risk for retail investors to earn below median performance and therefore reduce or eliminate any benefit from capturing the enhanced risk premium (i.e., beta) of private market investments. Institutional investors have an edge in capital, time horizon, fund and manager access, due diligence, and experience. Expecting retail-accessible products to replicate the ensuing performance is unrealistic.

In summary, the landscape holds promise but requires caution. So, what’s the balanced path forward for retail investors?

For advisors, this means guiding clients towards long-term, diversified fund structures and away from the flashy, fee-heavy products that promise more than they can deliver. A fund advertising 30% exposure to private markets may sound appealing, but what is that allocation almost certain to provide? Higher fees and, potentially, more variability of performance. Keep your (and your clients’) expectations realistic (don’t assume that interval fund you’ve been eyeing is likely to produce 1st quartile returns!) and don’t assume that liquid structures with alternative allocations will deliver the same benefits as endowment portfolios.

Clear, realistic communication upfront is the best way to avoid the inevitable disappointment of those who, wanting to have it their way or nothing at all, mistakenly believe they can replicate the experience of large, well-resourced institutions. Access alone doesn’t mean equal outcomes, and some waterfalls aren’t worth chasing.

More Resources:

https://www.congress.gov/congressional-record/volume-171/issue-124/house-section/article/H3506-1

https://www.dol.gov/newsroom/releases/ebsa/ebsa20250812

https://www.reuters.com/business/blackrock-looks-expand-private-markets-retirement-plans-2025-06-26/

https://www.advisorperspectives.com/articles/2025/08/25/alts-401-k-antithetical-fiduciary-advice

https://caia.org/blog/2025/01/13/young-money-quantifying-private-wealth-management-opportunity

https://caia.org/sites/default/files/2025-07/IWR25MayJun%20A%20Safer%20Way.pdf

https://www.pionline.com/opinion/pi-opinion-caia-alternatives-dc-plans/