By Dennis Mothoneos, CAIA, Co-Founder and Managing Director, Clearway Capital Solutions

Over the past fifteen years, private credit has evolved from a niche form of alternative credit investing into core building block for institutional and private wealth portfolios. Following the Global Financial Crisis, banks retreated from traditional corporate lending while private markets stepped in as institutional investors—pension funds, insurers, sovereign wealth funds, endowments, and family offices and private wealth—sought alternative yield in an environment of low interest rates and narrow credit spreads. Consequently, global private credit assets under management increased from around USD300 billion in 2010 to more than USD1.6 trillion by 2023. Projections suggest this figure could surpass USD2.3 trillion by 2027.[1][2]

The appeal of private credit is that it offers corporate borrowers, who may not have access to public bond markets or that prefer the confidentiality and flexibility of direct negotiations with lenders, bespoke lending solutions. For investors, private credit typically delivers contractual cash yields in the range of 6–10% for unlevered senior secured lending, with the potential for equity-like returns if structured with warrants or other equity participation instruments. Given private credit is marked less frequently and vehicles are often closed-end structures with, realised volatility appears lower than their public market equivalents. This so-called “smoothness” in volatility is attractive to investors seeking stable returns. However, the features that have enabled private credit’s growth—bespoke structuring, illiquidity, and limited secondary market trading—also impose constraints. Investors must accept multi-year lockups at the vehicle level, limited ability to rebalance at the security level, and reliance on cash flow distributions. For institutional investors and private wealth groups, this poses challenges associated with liquidity budgeting, diversification of return drivers, and the concentration of credit risk at the security level with limited secondary trading.

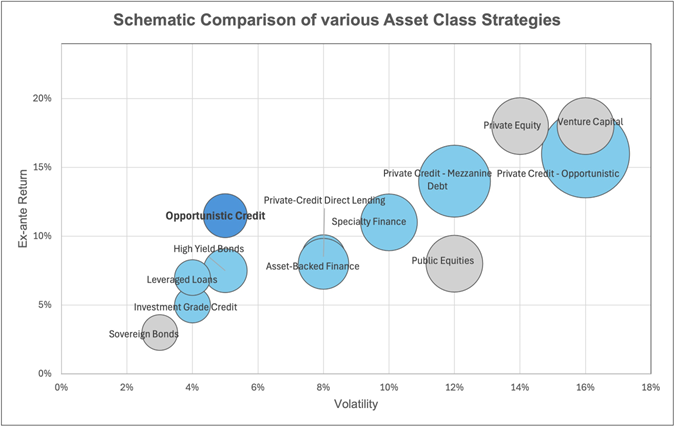

Opportunistic Credit offers an interesting complement for institutional and private wealth investors. Unlike private credit, Opportunistic Credit strategies invest predominantly in liquid or semi-liquid public credit instruments, including high-yield bonds, leveraged loans and convertible bonds, issued by stressed borrowers. The strategy generally attempts to capture mispricings and inefficiencies in credit markets, often triggered by idiosyncratic company events or by market dislocations. By combining carry from high-yield securities and loans with capital appreciation as events resolve, prices “normalize” and the underlying bonds and loans are pulled to par, Opportunistic Credit provides investors with a differentiated source of return and risk. Furthermore, Opportunistic Credit managers typically employ hedging strategies such as shorting to actively manage balance sheet and single credit exposure, allowing them to potentially partially protect the portfolio during periods of heightened volatility. In summary, Opportunistic Credit sits at the intersection of liquid/semi-liquid credit, hedge fund-style trading, and opportunistic event-driven investing, providing a distinct risk/return profile compared to its private credit counterparts. See Chart 1 for the approximate risk/return profile of Opportunistic Credit against various categories of private credit and other asset classes.

Chart 1. Diversity of Credit Sub-Asset Classes

Source: Clearway Capital Solutions estimates, Cliffwater 2025 Asset Allocation Report, Cambridge Associates Outlook 2025. Notes: Asset-Backed Finance (Real Estate, Infrastructure, Equipment Loans). Speciality Finance (Consumer Loans, Trade Finance, Aircraft/Shipping Leasing/Financing)

Diversification Across Liquidity and Return Drivers

Private and Opportunistic Credit occupy different positions along the liquidity spectrum. Private credit is typically illiquid with limited secondary trading and requiring capital commitments extending five years or more. In contrast, Opportunistic Credit offers quarterly or semi-annual liquidity through instruments that actively trade in secondary markets. While not as liquid as investment grade bonds, it provides greater flexibility than private credit. This intermediate liquidity profile allows institutional investors and private wealth allocators to rebalance and recycle capital more readily than in private credit structures. For allocators managing multi-asset portfolios, the ability to balance illiquid exposures with tactical, semi-liquid strategies provides an important complement. We should note this greater flexibility of Opportunistic Credit comes with a liquidity discount of returns.

Return drivers also differ. Private credit returns are largely dependent on deal origination, underwriting quality, and borrower performance, whereas Opportunistic Credit returns are driven by market dislocations, technical selling, idiosyncratic company events and fundamental credit research. For example, downgrades by rating agencies may trigger forced selling from investment grade mandates, creating temporary mispricings that Opportunistic Credit managers can potentially exploit. Similarly, liquidity crunches in sectors such as energy (during the 2014 oil price collapse) or travel (during the COVID-19 pandemic) created so-called stressed opportunities where bonds and loans were priced assuming worst-case scenarios, but the underlying credit fundamentals, in most cases, ultimately proved resilient. Private credit cannot typically capture these types of opportunities, as private credit strategies are primarily focused on other drivers rather than the tactical trading of secondary market inefficiencies. By combining private credit’s deal-driven yield with Opportunistic Credit’s tactical alpha generation, institutional investors and private wealth allocators can diversify across return drivers.

Implementation Challenges

Institutional investors and private wealth allocators must weigh the implications of including Opportunistic Credit in multi-asset portfolios alongside private credit:

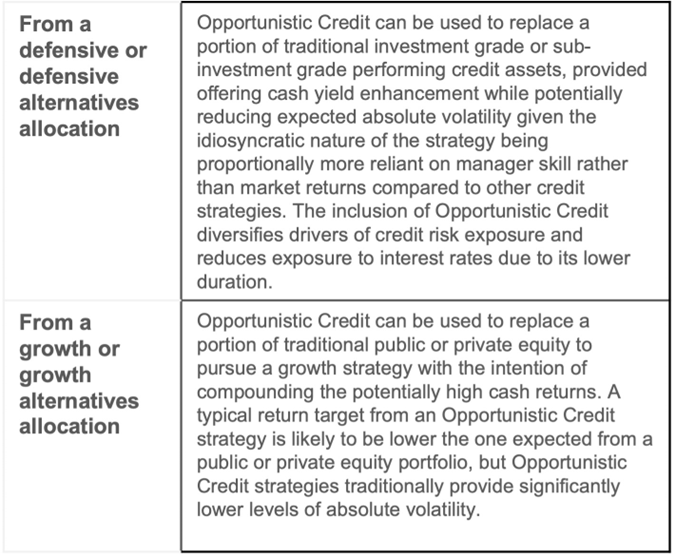

First, if Opportunistic Credit is funded from the defensive portion of a portfolio, replacing part of investment-grade or performing sub-investment grade allocations, it provides yield enhancement and diversifies duration risk. If funded from the growth or alternatives sleeves, replacing a portion of public or private equity, it reduces expected volatility while compounding attractive returns, although at a lower level than equities. These trade-offs should be explicitly modelled, considering the portfolio’s risk/return objectives and liquidity requirements. See Chart 2 summarising the funding sources of an Opportunistic Credit allocation.

Chart 2. Funding an Allocation to Opportunistic Credit

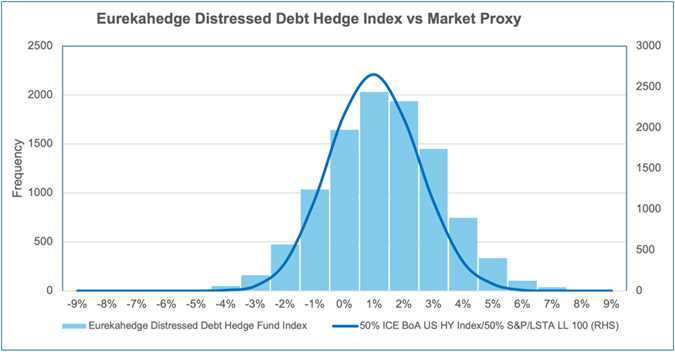

Second, benchmarking and modelling Opportunistic Credit presents unique challenges. Unlike private credit, in which there are no commonly accepted benchmarks, but performance can be tracked against peer quartiles or broad private debt indices, the Opportunistic Credit strategy has no universally accepted benchmark. Allocators and consultants often use proxies such as the ICE BofA U.S. High Yield Index and the S&P/LSTA Leveraged Loan Index in equal proportions. However, these indices fail to capture the non-linear and asymmetric nature of Opportunistic Credit returns, which are influenced by hedging, shorting, and event-driven factors. Though still imperfect, a more accurate approach is to reference hedge fund indices that track distressed debt or event-driven credit strategies. See Chart 3 for an estimation of the Opportunistic credit historical risk/return profile. Even so, allocators must contend with index construction biases, survivorship issues, and representativeness. [3] Institutional investors and private wealth allocators need to supplement quantitative modelling with qualitative judgment, incorporating manager-specific risk and return expectations rather than assuming benchmark-like behaviour.

Chart 3. Opportunistic Credit Historical Return Profile

Source: Clearway Capital Solutions estimates, Barclay Hedge Fund Indices, Eurekahedge Indices. Historical hedge fund index data is from 01/01/1997 to 31/12/2024. Note, the indices used are only an approximation of Opportunistic Credit investing as forms of distressed investing typically only form one theme in an Opportunistic Credit strategy. Index benchmark data was generated using historical return and volatility data and assuming a normal distribution

Third, the distributional profile of Opportunistic Credit strategies can also complicate multi-asset portfolio optimisation. Opportunistic Credit returns are typically non-normally distributed, exhibiting positive skew and excess kurtosis relative to traditional credit indices. See Chart 3. This reflects the asymmetric payoff structure of stressed and event-driven investments as well as the impact of balance sheet hedging strategies. In this context, traditional mean-variance or Monte Carlo techniques are generally deficient when determining recommended allocations. Instead, investors should employ modelling techniques that account for fat tails and skewness, or scenario-based approaches that stress-test how Opportunistic Credit might behave during drawdowns compared to other strategies. Consequently, investors can more accurately assess the risk reduction and diversification benefits of adding Opportunistic Credit to multi-asset portfolios.

Finally, liquidity stress testing is another important implementation issue. While Opportunistic Credit strategies offer more frequent liquidity than private credit, investors must not assume seamless redemption in all market environments. During periods of market abnormality, such as Q3 2008 or Q1 2020, secondary market liquidity in high-yield bonds and leveraged loans declined, and some managers were forced to implement redemption gates.[4][5] Investors must therefore model not only the contractual liquidity terms of Opportunistic Credit vehicles but also the liquidity of the underlying instruments under stress. The interaction between Opportunistic and private credit is particularly important. For example, the illiquidity of private credit is relatively predictable and contractual, while the liquidity of Opportunistic Credit is conditional and market dependent. Therefore, they require careful portfolio-level liquidity budgeting to ensure redemption obligations can be met even under severe stress.

Qualitative input is also important when assessing allocations to Opportunistic Credit. Institutional and private wealth allocators should prioritise managers with long-track records through multiple credit cycles, stable and well-capitalised investment firms, and sufficiently resourced credit research teams. The operational infrastructure required to manage hedging, collateral, and counterparty risk is also critical, given the complexity of the instruments utilised. For institutional investors and private wealth allocators, this means assigning additional due diligence resources to manager selection and recognising that performance dispersion is likely higher in the Opportunistic Credit cohort than in performing credit strategies.

The Current Market Context

The current credit market environment underscores the value of Opportunistic Credit as a complement to private credit in multi-asset portfolios. As of mid-2025, credit spreads are historically tight, yet all-in yields remain elevated due to the “higher for longer” interest rate environment. Corporate fundamentals are reasonably sound, but higher rates and other market factors like the Trump-administration’s flip-flopping on tariffs and the uneven implementation of AI are dividing credit issuers into winners and losers.[6][7] Current market conditions, including higher rates and policy uncertainty, are generating increased dispersion among issuers, creating opportunities for Opportunistic Credit strategies. Meanwhile, private credit continues to benefit from investor demand for contractual income. However, investor concerns about vintage risk, competition for deals, and leverage at the borrower level have increased. By allocating to both strategies, institutional investors and private wealth allocators can balance the stable yield of private credit with the tactical flexibility and alpha potential of Opportunistic Credit.

Opportunistic Credit complements private credit. Private credit offers stable, long-term yield with illiquidity, while Opportunistic Credit offers tactical, event-driven return potential with moderate liquidity and relatively more reliance on manager skill. A multi-asset portfolio including both strategies is better equipped to navigate both benign and stressed market environments.

About the Contributor

Dennis Mothoneos, CAIA is the co-founder and managing director of Clearway Capital Solutions. He has over 25 years’ experience in institutional/wholesale business development, asset consulting, funds management, and investment research and analysis. He co-founded Clearway Capital over 16 years ago and has successfully helped several high-quality alternative and traditional fund managers to build their businesses in Australia and New Zealand. Dennis is responsible for originating investments, conducting due diligence, perform market research, formulate manager brand profiles, provide input into product development, and develop channels to raise capital.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/

[1] PwC, Siezing the Moment: Growth prospects for Private Credit in Egypt and GCC 2025: https://www.pwc.com/m1/en/publications/2025/docs/pwc-difc-private-credi…

[2] Preqin, 2023 Global Private Debt Report: https://www.preqin.com/insights/global-reports/2023-private-debt

[3] Stafylas, D., Anderson, K. and Uddin, M. (2015) ‘Recent Advances in Hedge Funds' Performance Attribution: Performance Persistence and Fundamental Factors’, SSRN Working Paper. Available at: https://ssrn.com/abstract=2692005

[4] BIS (2015). Oil and Debt. Bank for International Settlements working paper. Available at: https://www.bis.org/publ/qtrpdf/r_qt1503f.htm?utm_source=chatgpt.com

[5] IMF (2020). Global Financial Stability Report: Markets in the Time of COVID-19. Available at: https://www.imf.org/en/Publications/GFSR/Issues/2020/04/14/global-finan…

[6] Charles Schwab, Corporate Bonds: Mid-Year 2025 Outlook June 2025: https://www.schwab.com/learn/story/corporate-bond-outlook

[7] US tariffs: What's the impact on global trade and the economy? July 2025: https://www.jpmorgan.com/insights/global-research/current-events/us-tar…