Diligence Review Corp., a due-diligence oriented research firm established two years ago, has issued a report on the conflicts it alleges are endemic among U.S. pension investment consultants. It addresses this report to “fiduciaries, internal audit, and risk management professionals.”

Diligence Review Corp., a due-diligence oriented research firm established two years ago, has issued a report on the conflicts it alleges are endemic among U.S. pension investment consultants. It addresses this report to “fiduciaries, internal audit, and risk management professionals.”

DRC compiled its data from the Form ADVs filed with the Securities and Exchange Commission under the Dodd-Frank Act. The Form requires a good deal of information whence the authorities, research firms like DRC, and for that matter any inquiring persons checking in through the website the SEC has established for this purpose, can make judgments about conflicts on the part of the investment advisers who had done so.

DRC identified for purposes of its study 155 pension investing consulting firms, each of whom had registered with the SEC as IAs. Furthermore, each of these had assets under its purview that exceeded an aggregate value of $200 million, and was in the business of selecting other advisors.

A 58/42 Split

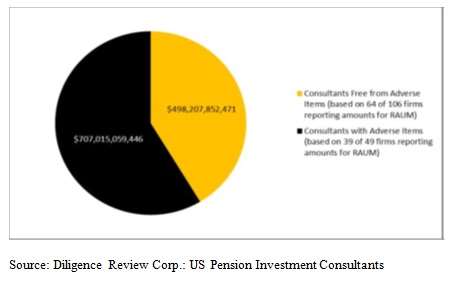

DRC found that roughly 58 percent of the assets under management by the firms surveyed are under the oversight of consultants who were either in conflicted situations or who had “adverse items” in their own institutional pasts.

DRC cautions that it is “nearly impossible for plan fiduciaries to understand the business structure of their pension investment consulting firm simply by attending consultant finalist presentations, reading marketing materials, or visiting the firm’s website.” This is why the Form ADV requirement serves a need, although “it can take some experience to interpret Form ADV content.”

Getting You to Churn

One of the sorts of conflict of interests included in that 58 percent figure is the dual role of a consultant that is also a broker-dealer, that is, a “person, company, or other organization that trades securities for its own account or on behalf of its customers.” Although DRC doesn’t put things this baldly, a broker has an interest in getting customers to churn. If the broker is also a consultant, though, this presumably conflicts with its fiduciary role in any situation where ever the best approach is a more passive buy-and-hold strategy that doesn’t generate a lot of transactions.

So: why would a pension plan sponsor run the risk of losing out due to that conflict by hiring a consulting firm that is also a sponsor? Perhaps, DRC suggests, because it is dazzled by star managers, that is, because “the firms appear to have access to sophisticated investment managers.” But the DRC also suggests a darker reason, confusion about compensation.

A pension plan sponsor might be attracted by the low flat fee that a consultancy charges for its consulting services, without realizing that this isn’t the salient system of compensation, that “broker-consultants may receive commissions and ongoing payments for transactions that their clients might not know anything about.”

Even if a consulting firm is not itself a broker-dealer, it may serve as the registered representative of a broker-dealer. If you, as a fiduciary, are tempted to hire a consultant that does so (and this category includes Bolton Partners Investment Consulting Group, Cornerstone Advisors Asset Management, and Everhart), then DRC recommends you ask a dozen questions, which the report lists. The questions include: how do you manage the potential conflicts of interest that may exist through these business activities [as a registered rep and as a consultant]? Are the products or services sold through these other business activities ever purchased or used for client accounts? What percentage of our pension plan assets are currently in passive low cost … strategies?

Red Flags and Unwelcome Affiliations

Separate from conflicts of various sorts there is another sort of adverse item, or red flag, of which DERC took account in their survey of pension investment consultants. This consists of affirmative answer to Item 11 in Form ADV, a section that requires the disclosure of criminal, regulatory, or civil actions.

Out of the 155 pension consulting firms in its database, DRC identifies 17 that gave an affirmative answer here indicating what it considers a significant adverse event. These events are often violations of laws or regulations committed by entities affiliated with the consulting entity, including its parent. As the report observes, “Although firms sometimes refer to parent companies and affiliates in their marketing materials and marketing presentations as contributing to their strength, the firms may seek to distance themselves from any violations associated with these affiliates.

The bottom line for a sponsor or fiduciary is that if there is an affirmative answer in item 11, you should examine the situation with care, and perhaps consult legal or other specialized professionals to understand how that situation relates to your own needs and obligations.

DRC says that it hopes it explanations “and suggested questions for exploring key due diligence areas” will help fiduciaries “better navigate issues relating to the examinations of pension investment consultants.”