A new paper by David H. Bailey and Marcos Lopez de Prado suggests that one of the consequences of over-reliance on traditional portfolio performance metrics such as the Sharpe ratio is: too many hedge funds are too quick to fire their portfolio managers.

A new paper by David H. Bailey and Marcos Lopez de Prado suggests that one of the consequences of over-reliance on traditional portfolio performance metrics such as the Sharpe ratio is: too many hedge funds are too quick to fire their portfolio managers.

Specifically, skilled managers are hitting the dust before they have an opportunity to win their way back from a draw-down.

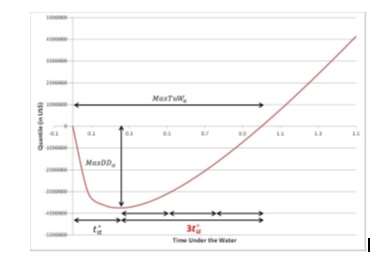

One recurrent problem for those who hire and fire portfolio managers of course is that it is difficult to be sure that a particular negative outcome is the consequence of bad luck or a lack of skill. Bailey and de Prado, in “Draw-down-based Stop-Outs and the ‘Triple Penance’ Rule,” offer a two-part approach to answering that question, based on cumulative loss from a high water mark (draw-down, or DD) and the time elapsed since the last high water mark (time underwater or TuW).

Theory and Practice

By developing both concepts, DD and TuW, and combining them, they formulate what they call a “triple penance rule,” that is: under standard portfolio theory assumptions, it takes three times longer to recover from the maximum draw-down for a particular strategy (MaxDD) than it did to get there.

Source: Bailey & de Prado.

Further, the Triple Penance rule applies regardless of the Sharpe ratio of the particular portfolio manager.

Yet if the Sharpe ratio is irrelevant to the time necessary to recover from MaxDD: why is it very relevant to the stop-out limits that hedge funds typically create for their PMs? As these authors note, hedge funds typically allow more leeway, greater stop-out limits, to PMs with higher Sharpe ratios. Why?

These authors answer that the assumptions on which the triple penance rule is based, the assumptions of classical finance theory, are in error. The actual practice of hedge funds recognizes this. Thus, actual “penance,” the return to a prior high water mark, can occur in much less than three times the period of the draw-down.

The key erroneous assumption is that portfolio outcomes are independent and identically distributed (IID). That is: there is no serial correlation of portfolio performance. IID means that portfolio results are a lot like flipping a coin once a day: the results of the flip Tuesday aren’t correlated in any way with Monday’s flip and are to no degree predictive of the results of Wednesday’s flip.

Scrapping IID

Bailey and de Prado suggest that IID has been adopted in portfolio theory simply because it makes computations easier. But they contend that Monte Carlo experiments can overcome the computational difficulties. Their own Monte Carlo experiments allowing for some serial dependence of outcomes offer “an analytical estimate of drawdown potential” that may be integrated with the same authors’ work in optimization problems.

Specifically, they downloaded a series of monthly net asset values from Bloomberg for the Hedge Fund Research Indices and selected them in a series from January 1, 1990 to January 1, 2013, for 265 data points and found that there is no IID, there is serial correlation, and that this serial correlation allows for periods of penance a good deal lower than three, as low as 1.6.

The higher the level of serial correlation, the lower the penance.

That’s important because it indicates that good managers who have experienced a draw-down could get back to the high water mark in tolerable amount of time, and that funds that stop out their managers too quickly, in effect firing them, may be doing themselves and their investors a disservice.

Bailey is the complex systems group leader at Lawrence Berkeley National Laboratory. De Prado is the head of global quantitative research at Tudor Investment Corporation and a research affiliate at Lawrence Berkeley.