The new Intralinks Deal Flow Indicator report merits study by alpha hunters who look for promising mergers & acquisitions. The Indicator shows a flat level, indeed a slightly negative level of early-stage activity in Q1 2014, compared to the last quarter of 2013.

The new Intralinks Deal Flow Indicator report merits study by alpha hunters who look for promising mergers & acquisitions. The Indicator shows a flat level, indeed a slightly negative level of early-stage activity in Q1 2014, compared to the last quarter of 2013.

There is a good deal of variation by region in that QoQ number. The North America number in particular is -6%, whereas the EMEA number is +5%.

Using this as a predictor of 3Q activity, the Intralinks data indicates that M&A activity will be flat this quarter (Q3), compared to last. The report calls this “a not unexpected seasonal result.”

Positive Numbers

Year on year, though, the numbers are positive. Early stage activity is up almost 16%.

In the YoY figures too there is a good deal of variation by region. North American deal flow activity is up by 17% compared to this time last year (YoY).

European deal flow is also up 17% YoY. There is some return of activity even in countries that were regarded as basket cases a year ago. Meanwhile, Germany [never a basket case] continues to act as the continent's safe haven for investors.

Latin America is weaker than either NA or Europe, and early stage M&A activity is down 7% YoY. Dealmakers in the region are said to be optimistic about a turnaround, though.

Deal activity levels in the Asia Pacific region are down, whether measured YoY or QoQ. Japan is doing well, but China is pulling back on it recent aggressive round of overseas acquisitions.

South Korea is an exception to the general decline of merger activity in the region, it is “having its strongest quarter in terms of M&A activity since the financial crisis,” the report says. The International Monetary Fund forecasts real GDP growth for South Korea in 2014 as 3.7%.

Getting back to the global YoY number, up almost 16%. Why?

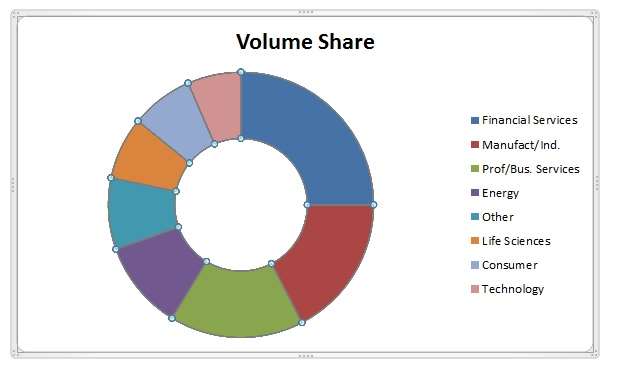

The donut chart below (an adaptation of one in the Intralinks report) shows the volume share of seven top industries, along with the catch-all “other,” in accounting for this bottom line.

Fundamental Shifts

Intralinks’ report suggests that “a handful of fundamental and positive shifts” are at work. On a behavioral note: corporate confidence is returning, and presumably confident managements are more likely to seek out acquisition targets than nervous managements.

Second, credit is available. Indeed, the industrialized economies are awash in it due to the years-long determination of the world’s key central banks.

Third and more specific, a wave of healthcare policy changes in recent years in both Europe and the United States, and these changes appear to be encouraging consolidation in the life sciences sector. In the U.S. the Affordable Care Act is “depressing a reimbursement rate that, in turn, places more importance on cost-saving efficiencies.”

The volume and value of deals on the private equity side increased 10% in Q1 2014. Value of PE deals hit $173.6 billion. This is after “several years of flat PE activity.” Some PE firms are looking to exit positions, but those exits are doing little to reduce the PE space, because they are accomplished, when they are, by secondary buyouts “in which ownership passes from one PE house to another.”

One of the biggest deals of the year so far involved Kohlberg Kravis Roberts and Affinity Equity Partners. AEP, one of the biggest dedicated-Asia PE firms, is a spin-out from UBS Capital Asia. Together, KKR and AEP sold Oriental Brewery, of South Korea, to Anheuser-Busch InBev. For the giant brewery company, this was a strategic move – it increases its exposure in the Far East.

For the two PE firms, it was a very successful exit.

Fans of hard liquor might prefer the report’s discussion of the announcement by Japan’s Suntory Holdings that it will buy the U.S. based distiller responsible for Jim Beam and Maker’s Mark. This is one of a raft of recent deals by Japanese firms that are looking for growth abroad, frustrated by its absence at home.

Possible Dampeners

Despite a generally optimistic note, though, the report cautions that there are possible dampeners going forward.

Most ominous of these would be escalation of the conflict over Ukraine and other former Soviet republics and their ties to Russia could have a significant negative impact on deals, especially in countries with strong business ties to Russia, notably Germany.