By Diane Harrison

By Diane Harrison

The ongoing debate between friends and foes of quantitative strategies centers on which approach is superior: a fundamental quantitative strategy or a discretionary strategy developed and managed by human decision-making? The truth is neither—like people, some ‘quants’ are better than others, some more accurate, some more sensitive—but both strategies are vulnerable to the unknown. And while neither systematic nor discretionary approaches are 100% accurate, each offers compelling investment advantages for investors willing to do their homework. Yet quantitative approaches tend to get lumped together by the ill-informed as risky, scary, and not user-friendly strategies that should be avoided by all but the most sophisticated investor class.

READING BETWEEN THE SIGNALS

2014 could be viewed as the year of revived investment interest in all things “quant. The Newedge Trend Index, which tracks firms that use models to profit from market trends, gained slightly over 19 percent in 2014. In comparison, the S&P500 returned just over 14% (dividends reinvested), giving quants the edge over broad indexes. Diehard fans of the discipline were rewarded with a fourth quarter boom in performance, which also captured the attention of former skeptics used to shying away from the dreaded “black box” approach to markets.

While the precipitous drop in oil prices over the latter half of November and December contributed much to the trend followers’ gains, other model-driven approaches captured profit in rising financials, particularly government bonds, and falling commodity prices, which rode oil’s price plunge lower. There are numerous reports and analyses available outlining the strong trending performance stories of 2014, but this is not one of them. Rather, this article suggests why quantitative strategies should lose their reputation as an esoteric and mysterious investment choice and why they deserve a place at the table for all investors looking to build a well-balanced portfolio.

A PICTURE IS WORTH 1000 WORDS

Quantitative strategies rely on a consistent and scientific approach to analyzing market data. One of the common advantages put forth by followers of quantitative strategies is their ability to look at a large universe of data to uncover the best dislocations and capitalize upon them. With their systematic diagnosis of real-time market pricing, some quants have the ability to assess a far greater portion of the market than the most skillful individual discretionary manager can ever hope to monitor. Before we get into more of the advantages quants offer, a brief detour into a mathematical example of such expansive forecasting might prove illuminating to this concept of how wide a universe of potential paths quants can cover.

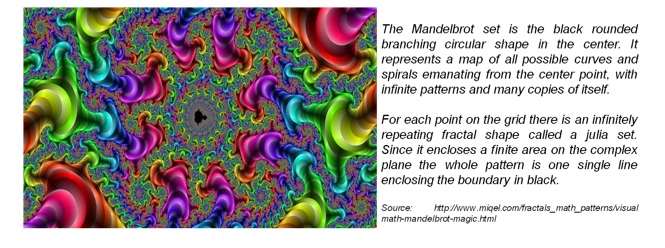

Often credited as the “Father of Fractal Geometry,” Benoît B. Mandelbrot was born in Poland in 1924, moved to France in 1936, and later to Cambridge, Massachusetts, where he died in 2010. He was an unconventional thinker who saw unique relationships in geometry that applied to both math and nature. His approach led him to the concept of fractal geometry which he applied to physics, biology, finance, and many other fields. He coined the term “fractal” to refer to a new class of mathematical shapes whose uneven contours could mimic the irregularities found in nature. One of his most famous illustrations of fractals appears in the image called the Mandelbrot Set.

The fractal analogy illustrates the potential that some quantitative strategies offer through their ability to encompass a vast universe of market data in search of potential exploitable opportunities. These strategies can scan financial markets, such as equities and bonds, and commodity data, widening the universe in which to uncover market dislocations. Discretionary approaches which rely primarily on human judgment typically do not have the capacity to implement such deep analysis on a daily basis in a comparable universe of potential markets.

8 MORE REASONS WHY THINKING INSIDE THE BOX CAN BE A GOOD THING

1—Market Agnostic: There are other advantages over discretionary approaches that quantitative strategies offer investors. One of the strongest arguments in favor of taking a close look at quants includes the disciplined ability to work in rising or falling markets. While this is also true for long/short strategies of all kinds, the wider universe of potential markets coupled with a quant strategy’s ability to be formulated to extremely sensitive price triggers means that investors may be able to capture smaller incremental profit potentials when participating in such strategies.

2—Risk/Reward Linkage: Virtually all quantitative strategies have a built-in risk management model which is integral to the alpha generation of the approach. Unlike discretionary approaches, which rely upon a separate override or risk management execution process, quantitative methodology is continually assessing actions based on a series of interrelated criteria that generate the strategy’s next step. This inherent risk management process is scientific in approach and immune to the psychological fallacies which can impact discretionary approaches, particularly in sharply moving markets.

3—Proprietary Models:Perhaps one of the most powerful attributes of a quant strategy is that it offers a unique approach to the markets that is very difficult to replicate. It is possible that two or more managers will separately come to identical methodologies and build out proprietary systems that will mimic each other, but it is not very likely that will occur. Much like snowflakes, quants exist in the same conditions but formulate unique reactions to their similar environments, giving investors exposures that are uncorrelated to other investment allocations in their portfolios.

4—Customized Leverage: Another advantage of quants is their ability to use leverage in the exercise of their strategy. This factor has been painted with a broad brush of negativity since the infamous demise of Long Term Capital Management in the mid-1990s, which was largely caused by the firm’s reckless and excessive use of leverage. Twenty years later, quantitative strategies offer a wide range of adjustable leverage based on investors’ risk tolerances. The prudent use of leverage consistent with a particular methodology can yield attractive and relatively conservative results for investors.

5—Scalability:Quantitative models, while often extremely labor intensive to develop, test, and build out, have the advantage of being very scalable once proven and activated. A manager who has done the proper research and development can start a quant fund with relatively small funding and scale very quickly with no degradation to the methodology of the approach, based upon the markets in which the approach operates. Not only does this protect early-stage investors from declining performance issues related to a new fund’s rapid growing pains, but this feature can also be very useful in attracting institutional investors sooner in the fund’s growth, as they require a large fund size to meet suitability requirements as investors.

6—Historical Backtesting: Another advantage quantitative strategies offer potential investors is the ability to look backward in the markets and see how the strategy might have performed over specific time periods. Discretionary managers cannot mimic this type of objective backtest, though some claim to be able to do so. The due diligence advantages of the quant’s illustrative backtest can be valuable to investors as they model their own portfolio allocations with a component of the strategy substituted for some of their original allocation mix to determine if the strategy would have performed better for their needs.

7—Diagnosis of Potential Weaknesses: Perhaps even more valuable as an ongoing diagnostic tool is the ability for quantitative strategies to be evaluated through their real-time performance as they operate in today’s markets. As markets change behaviors, it is simple to monitor the expected versus actual performance of the model to determine if it is behaving according to plan. This allows for the quant manager to diagnose potential weaknesses in the model and make refinements going forward.

8—Potential for Lower Costs: Due to their independent nature and built-in operational efficiencies, most quantitative strategies require fewer staff to manage. While a minority of quant teams might employ multiple analysts engaged in the development and refinement of several quant strategies, typically the quants are able to offer lower fee costs to investors to reflect the largely independently operation of the approach.

TO QUANT OR NOT TO QUANT? THAT IS THE QUESTION…

There is no magic bullet solution built in a black box that can protect investors against previously unseen market reactions. The best any systematic strategy can offer is exactly the same as what discretionary strategies can offer—the opportunity to capitalize on the as-yet-unknown market movements based on what is known about the past. The important thing to remember about quantitative strategies is essentially true for all: they model on historical data, react to present conditions, and cannot predict the future. Some are extremely robust and sensitive to the merest whisper of incongruence in the markets, but none has the ability to control future behaviors—not their own and certainly not of the markets in which they move.

Diane Harrison is principal and owner of Panegyric Marketing, a strategic marketing communications firm founded in 2002 and specializing in a wide range of writing services within the alternative assets sector. She has over 20 years’ of expertise in hedge fund marketing, investor relations, sales collateral, and a variety of thought leadership deliverables. Panegyric Marketing received consecutive year awards in 2013-14 as IHFA’s Innovative Marketing Firm of the Year and AI’s Marketing Communications Firm of the Year- US. A published author and speaker, Ms. Harrison’s work has appeared in many industry publications, both in print and on-line.