The Austrian Financial Market Authority pulled the plug on Austria’s “bad bank” on March 1.

The Austrian Financial Market Authority pulled the plug on Austria’s “bad bank” on March 1.

This is the end of an experiment Austrian initiated in 2009, when it nationalized what was then known as Hypo Group Alpe Adria, an institution then 113 years old. This was a “too well connected to fail” institution, active throughout central Europe and as far east as the Ukraine.

Almost exactly a year ago, in March 2014, Austria announced that it was splitting HGAA into three units: a Balkan group (called the SEE Network); an Italian bank; and a “bad bank,” Heta Asset Resolution, designed to contain the stuff nobody wanted to buy. Austria planned to sell each of the first two and wind down the third in an orderly way.

Pursuant to the wind down, the government passed a law wiping out $1 billion of subordinated debt.

The plan hasn’t been entirely a failure. The Balkans’ unit post split-up sold in December 2014 to a PE firm, Advent International Corp. Advent received some assistance in this deal from the European Bank of Reconstruction and Development.

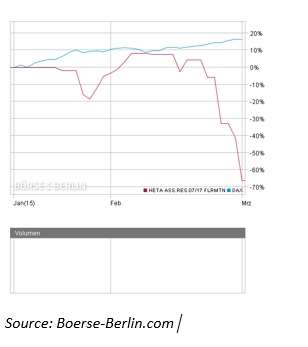

But the orderly wind-down of Heta? Not going so well. The chart above gives the HETA bond prices (in red, the DAX is in teal.)

The Latest News

Over the weekend that began March, auditors found that the billions already invested in this wind-down would not be enough, that there was still a €7.6 billion [$8.54 billion) hole to be filled. The government said, “Not our problem,” and effectively announced that the creditors [senior creditors – the only creditors left standing] would be taking the hit. There is a moratorium on payment of the bank’s bonded debt, affecting first the €950 million due this month. How much of a haircut the bondholders will end up taking is still up in the air.

This has certainly taken some of Europe’s attention away from the melodrama in Athens. The obvious though necessary point to make first is that this is AUSTRIA. This isn’t one of the “periphery” countries to whose crises the world has become accustomed in recent years. It’s a major de facto insolvency at the heart of the Eurozone.

What is behind it? Somebody will have to point the finger at the state of Carinthia in the south of Austria. Carinthia fueled Hypo’s investments in the Balkan region in the 1990s and into the new millennium, guaranteeing its debts.

Speaking of those guarantees … it isn’t clear what is the status thereof, except that Austria’s finance ministry says the state’s guarantees won’t be triggered “immediately.”

Conspiracies and BCTs

The second point to be made is that the timing is such as might pique the attention of conspiracy theorists. The announcement comes less than two weeks after the country’s Constitutional Court announced that it was going to review the several challenges that have been filed against a law passed last year at the expense of the subordinated debt holders of the same bad bank. The prospect of such a constitutional review raised the legal/fiscal stakes anyway, so (a theorist might suggest) the government has decided to raise them still further. “I’ll see your constitutional claims and push in more of my own power-political chips by going after the senior debt holders.”

A final point (for now): it is fitting that Austrian Business Cycle Theory should be illustrated so neatly by developments in Austria. The founders of Austrian BCT were saying, in essence, that easy credit, often actively promoted as a political/policy imperative, leads to a fun party but a nasty hangover. There is no real need to focus on what specific needle pricked the bubble. The bubble – any bubble – collapses because that’s what bubbles do. They are frail things.

In this case, this mess, the mess created because JörgHaider’s Carinthian government decided to guarantee a party, endures.