A new paper from the Alternative Investment Management Associations discusses the role of hedge fund managers in the non-bank lending environment, and finds that the market for lending by such entities continues to grow because it serves a need: financing small and medium sized entities that otherwise would have difficulty accessing either the capital markets or available lending from banks.

A new paper from the Alternative Investment Management Associations discusses the role of hedge fund managers in the non-bank lending environment, and finds that the market for lending by such entities continues to grow because it serves a need: financing small and medium sized entities that otherwise would have difficulty accessing either the capital markets or available lending from banks.

New legislation and the regulation that has remodeled the banking industry in the years since the global financial crisis has diminished the lending that banks are willing to do to the private sector. This is especially important in Europe, where roughly 80% of corporate lending is bank financing. The introduction to the report references a recent survey by the European Central Bank that showed that the supply of bank loans to mid-market corporates in the Euro area has declined for five straight years.

There is something of a contrast with the United States here. In the U.S., banks are far less decisive: 80% of all corporate lending takes place through the capital markets.

But alternative funds are playing a greater role over time in both markets. In the U.S., the loan funds’ assets under management have tripled since Jun 2012. In the EU (working from a lower baseline) AUM has quintupled over the same period. Globally, private debt financing is now approximately 6% of the total estimated funding for small and medium sized enterprises. AIMA predicts that this percentage could reach between 15% and 20% within the next five years.

Two or More Sides to That

That’s a double-sided prediction. At least. After all, the percentage could conceivable grow to 20% without any actual (absolute) increase in loan fund AUM at all, simply as a mathematical reflection of the decline of bank lending to SMEs. But the authors of this paper appear not to believe that the percentage increase will be of that standing-still sort; they expect it will be a matter of loan funds stepping in to fill a void. Also, (thirdly?) there’s a demand-side pull to consider, since even SME firms in the real economy that have adequate financing from banks and/or the capital markets sensibly want to diversify their sources thereof. By looking to non-bank lenders they can get more flexible terms and quicker decision making.

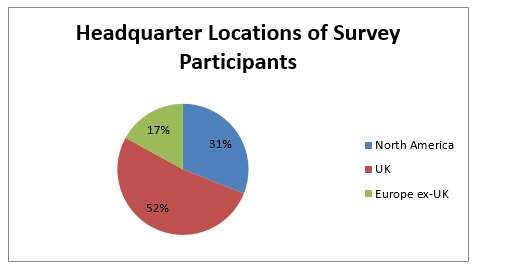

For the paper, “Financing the Economy,” AIMA surveyed asset managers that collectively allocate approximately $85billion to private debt strategies. Of these, roughly one-sixth are headquartered in Europe ex-UK, a little over one-half in the UK, and the remainder (31%) in North America.

Source: Adapted from Figure 1, AIMA, Financing the Economy

Further, the surveyed firms occupied a number of distinct niches within the asset management world. Forty percent were hedge funds; 9% finds of funds investing predominantly in fixed income and credit funds; 15% traditional asset managers, and so forth.

Amongst the hedge funds who participated in the survey, nearly half (46%) had a predominant focus on fixed income/credit. But large numbers were multi-strategy or equity hedge funds also. Smaller slices were event driven and relative value arb.

Some Healthy Percentages

The upshot of the survey is that more than 80% of the managers involved are lending to SMEs and their equivalents. A little over 50% are investing in distressed debt and are in that capacity providing financing to struggling companies otherwise very likely to fail. A very healthy 95% provide financing for acquisition/expansion or refinancing.

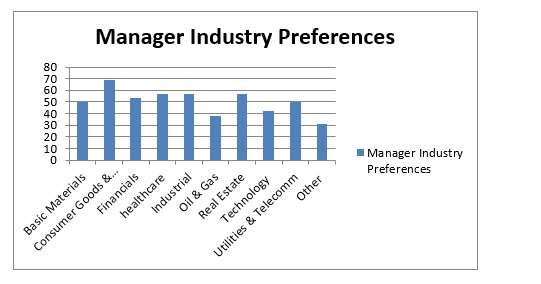

A lot of different industry sectors receive these loans from these non-banks. The largest flow goes to the consumer goods and services industry See the next graph.

Source: Adapted from Figure 8, AIMA, Financing the Economy

After the survey data, the paper provides a number of case studies, that is, examples of private debt funds and the sorts of ‘real economy’ business that they support.

The CEO of AIMA, Jack Inglis, summarized the gist of these case studies thus: “[M]any small and medium sized businesses would miss out on growth opportunities or fail altogether if it were not for the absolutely vital support of hedge funds and other alternative asset managers.”