An underlying fact, noted here for example by our own Shane Brett a year and a half ago, is that “the easiest deposits of Copper … have been exhausted.” Combining that with population growth and the presumed effects of “easing” by various central banks around the world in goosing various economies, combine those facts in turn with the centrality of copper in the modern world, and one can reach the easy inference that copper has to go up, and not just “up” in a vague could-be-very-long-term sense, but up terms of a tradable time horizon.

An underlying fact, noted here for example by our own Shane Brett a year and a half ago, is that “the easiest deposits of Copper … have been exhausted.” Combining that with population growth and the presumed effects of “easing” by various central banks around the world in goosing various economies, combine those facts in turn with the centrality of copper in the modern world, and one can reach the easy inference that copper has to go up, and not just “up” in a vague could-be-very-long-term sense, but up terms of a tradable time horizon.

Copper is an energy play of sorts. It isn’t burnt to generate energy, like coal or crude oil. But it remains the dominant way in which electricity is moved from place to place, and a critical component in motors, appliances, electronic devices, etc. More on the fundamentals here.

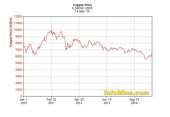

So: why isn’t it on the way up? Why is it below where it was two years, or one year, ago? The chart above shows the three-month contract in copper: it hit a historic high in early 2011 and has been headed down ever since.

One consideration starts with the fact that copper isn’t burnt. It is recyclable, and the ease with which recycling takes place itself improves over time.

Or … Suppression

Another consideration: it is at least possible that deliberate price suppression is at work. One possible culprit, were we to pursue that as a hypothesis, would be the government of the People’s Republic of China. Tyler Durden has engaged in such speculation of late.

Certainly we could make sense of the fact that the primary bears are Shanghai-based on this hypothesis: they might either be cat’s paws of the PRC or they might have made a wise bet on its ability to suppress the price in the way Zero Hedge has outlined.

But the problem with price suppression is that it is very difficult to maintain. Somebody is always ready to step in and buy the bargain-priced stuff, thereby unravelling the plot.

Further, and largely for that reason, suppression-based theories, or theories about how speculators might be acting in anticipation of such suppression, aren’t compelling as explanations of year-to-year outcomes. With all due allowances for such possibilities, there is something else going on.

But let’s shorten our time frame and look at the three-month contract over the course of a single year: copper prices spent the spring and much of the summer of 2014 in the neighborhood of $7,000 per ton. They declined gradually to $6,000 over the course of the fall and early winter, then fell sharply to $5,500 in mid-January of this year, a five year low apparently the result of a bear run by the Shanghai Chaos fund.

In the months since, London based bulls have pulled back against the bears on the other side of the Eurasian landmass, and as of mid-May 2015 the 3-month buyers’ contract is at $6,360. As noted above, this is still well below where it was a year ago, and further below where it was two years ago.

Weakening Demand

To put the question another way: how long will it take before the world again sees copper at around $10,000 a ton, the going price it touched (though briefly) in early 2011?

It seems likely that fear of a broad-based downturn in the Chinese economy has been keeping the underlying pre-speculative demand low.

As Michael Petruski recently observed, “a slowing economy in China has weakened demand for nearly all metal commodities.” The first quarter of 2015 saw expansion in China’s economy, but at the slowest pace in six years. China is the world’s largest consumer of copper.

So the bullish force limiting supply and especially (so that we can include the population increase in our analysis) limiting supply per capita is matched at the moment by bearish forces limiting demand. The underlying balance is perhaps what makes this market seem, for now, like an ideal ground for the tug-of-war of speculators, speculating on each other’s speculations.

Two quick conclusions seem plausible: for the reasons with which we began, it seems very likely that copper will get back to $10K within a time frame wide enough to encompass a full business cycle: say, a frame that takes us out to 2023. Second, though, there could be a good deal more down in the markets before that upswing.