RCM Alternatives, a Chicago-based asset manager specializing in managed futures products, has published a new white paper asking the naive-seeming question, “Why Alternatives?”

The paper begins with the observation that many alternative investors look to this field for an answer to a specific problem: hedging the long position in equities shared by most investors. One is “naturally’ long, directly or indirectly, and this natural state of affairs is a problem because equities are subject to strong downdrafts. There’s a once-in-a-century storm every decade or so: consider in this context the dotcom bust; the global banks’ crisis; the equity markets’ reaction to Brexit.

At first blush, there are two distinct reactions to this big problem: (1) buy some non-correlated stuff, or (2) buy some negatively correlated stuff. There’s a drawback with each. First, negatively correlated stuff (like VIX futures) is expensive. You’ll be paying hefty premiums throughout bull markets for this insurance against the eventual bear market.

Best of Both Worlds

Non-correlated stuff is not so expensive. But (or consequently) it isn’t as reliable an insurance pay-off when trouble comes, either. Commodities are not correlated with equities, but commodities fell along with equities in 2008. “We feel pain in real time,” RCM’s paper reminds us, “not on a smoothed, average basis.” So … the goal of many investors, in studying the alternatives world, turns out to be the acquisition of the best of both worlds, low cost and effective hedges against the vagaries of the equities world.

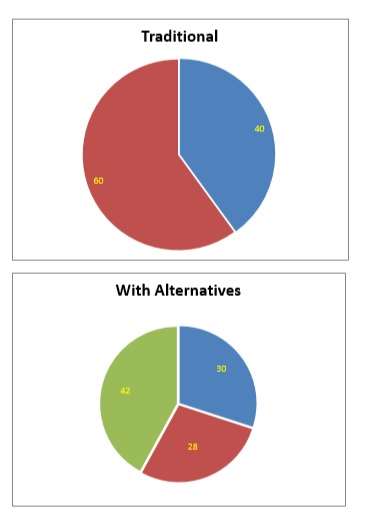

Does it work? Addressing that question, RCM compares “a traditional 60/40 portfolio to a portfolio containing a 30% allocation to managed futures.” The 40% bonds in the traditional portfolio thus becomes 28% to bonds in the revised portfolio (because 28 is 40% of 70), and the 60% stocks becomes 42%.

The change produces important consequences. The maximum loss for the portfolio in question drops from 32% to 21%. The worst 3 year result eases from a loss of 20% to a loss of just 7%. Are returns dragged down by this protection? No: they actually go up. RCM adds here the necessary qualification that they are working from past results and that part performance “is not necessarily indicative of future results.”

Tangled Spaghetti

What kind of alternative assets will work best to address the big problem with which we began; the need to hedge one’s natural equity-long stance?

The white paper’s authors call this question a “spaghetti dinner” in tribute to its tangled character. Then they quote BMO Global Asset Management on how even the categorization of the subject can be confusing.

“Hedge Fund Research lists four broad categories and 37 subcategories (plus four types of fund of funds); these do not always square with Morningstar’s system of categories …. Investors may not know what they’re getting.”

The white paper recommends a consideration of Welton’s approach to classification. Welton Investment Corp. has built into a recent publication on the subject the recognition that the “equity cluster” is a lot wider than merely equities. The equity cluster includes real estate and fixed income arb. True diversification requires getting out of that cluster, into the commodities cluster or the managed futures/global macro cluster.

How Much to Allocate

Different investors take very different approaches to determining how much of their portfolio should go to alternative assets. Some merely ask themselves how much they are comfortable taking out from the traditional niches. Others look to statistical approaches such as the efficiency frontier.

But too few investors take a really liability-driven approach, and that is what this white paper recommends. Allocation percentage should be matched by return expectations.

That of course is easier said than done. Pension plans, the white paper tells us, are “well known for having target return numbers … and equally well known for missing those targets terribly.” A family office too should consider its liability stream, and seek to match its returns thereto.

The point is that a small slice of Alternatives within a large traditionalist pie may not do a lot of good. Assuming stock and bond returns are 6.5% annually, and an investor wants a 5% allocation to Alternatives to let him/her hit a 10% portfolio return, how well will those Alts have to do? The math isn’t controversial: the answer is 76.50%.

As the authors of the white paper say: “Wowsers.”