Intralinks, in partnership with Global Fund Media, has surveyed the opinions of limited partners: they’ve been asking LPs what they think about their GPs/managers in the alternative investment context.

The bottom line of the survey is that LPs are looking in the near future to increase their allocations in alternatives. Yet there are still worries about the whole field – about the risks, the level of fees, the transparency, and the illiquidity.

The survey also yields some insight into market sectors as investors see them now.

But let’s begin at the beginning.

Who were the respondents? There were more than 140 LPs involved. Geographically, they came mostly from North America (52%), Europe (31%), and the Asia-Pacific (15%). In institutional terms, 22% were public pension plans, 15% were consultants, and 13% were either endowments or family offices.

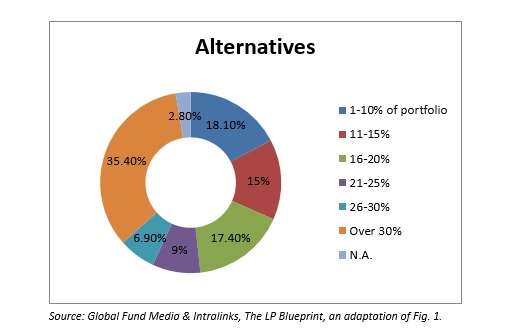

More than one-third of the LPs said that they have more than 30% of their portfolio in alternatives. The doughnut-graph on portfolio allocation looks like this:

The report on this survey quotes one respondent, the fund administrator to a large U.S. pension plan with an alternatives allocation around 26%, who says “we have … rotated out of hedge funds into multi-asset funds, which seem to be the flavour of the day. We have exposure to two funds-of-hedge funds. We also have exposure to real estate and infrastructure but private equity is the highest allocation.”

Very Firm Ideas

The manager of a family investment vehicle in New York says that there are four main areas for that fund’s alternative investing: hedge funds, private equity, real estate, and credit funds. This respondent added, “There are a lot of private credit funds today. We’ve been active in this area for many years now.”

LPs have very firm ideas not just about a general intention to expand investment in alternatives but about the specific strategies they would like their GPs to employ on their behalf. The report quotes Mark Roberts, chief investment officer for Ironsides Asset Advisors: “We’ve been growing our distressed allocation over the past four years and are looking to add another distressed manager into our scheme. We’ve been pretty consistent investing in our middle and small buyout fund allocations. We have a preference to the small buyout GPs today.”

Satisfied? Not “Very”

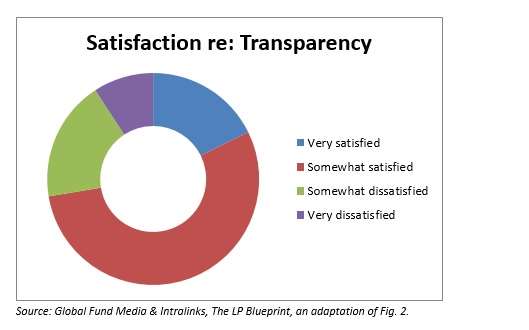

The survey asked the respondents whether they were satisfied with the amount of transparency they’ve been getting from their GPs. This yielded another doughnut, as below.

The small size of the “very satisfied” bite of this doughnut suggests to the author of the report that “there is still a long way to go to bridge the gap in expectations.”

Of course private equity funds are a long-term buy-and-hold strategy by nature. But illiquidity is no excuse for opacity, the report says. Institutional investors “increasingly want to review their portfolios in aggregate, across the liquidity spectrum.” The global financial crisis changed attitudes, turning transparency from a side issue into a central concern for investors.

On the other hand, a Swiss respondent to the survey confided that he thinks a concern with providing data to investors can go too far, because it can draw managers’ attention away from their core responsibility.

“Their job is to find good investment opportunities,” he said, and adds, “I don’t see a problem with managers using a one- to two-month time lag in terms of reporting to LPs.”

Market Sectors

As noted above, the surveyed LPs have very definite ideas about in which market sectors they want their alternative asset managers to invest. They cited technology most often as a desirable sector (50.4%), followed closely by healthcare (48.9%) and infrastructure (44.4%). Real estate, energy and power, and consumer goods are also sectors that receive a lot of interested attention from survey respondents.

The above-mentioned Mark Roberts said that his institution has “had historic exposure to healthcare so I wouldn’t say we are looking to grow that but equally we’re not looking to reduce it.”

The Swiss investor said that while he considers health care and technology both interesting areas, the specific decisions must be left to the manager, “our investors don’t want to influence managers in terms of how they invest, or where they invest.”