EDHEC Risk Institute, in collaboration with ERI Scientific Beta, surveyed 114 investment professionals between June and September 2017 about their motivation and interests with regard to equity factor strategies. It found that many, especially on the asset owners’ side of things, were strikingly distant from the state-of-the-art in analytical approaches in this field.

Who Were the Respondents?

The respondents were a diverse group in several respects. In terms of geography: though more than half the respondents come from Europe, close to a quarter each come from North America and the rest of the planet. As to the function of the respondents professionally: the largest group were portfolio or fund managers. Another 20% were CEOs or managing directors of investing institutions, 10% were associates or analysts and another 10% were (gasp) vice presidents.

When the respondents were asked whether they actually used a multifactor framework for equity investment, 73% said “yes,” 18% said “not yet, but I am going to do so,” and the remaining 9% said simply “no.”

Who Were the Analysts?

EDHEC has now posted an analysis of the results of the survey of this group. This analysis has three authors: Noël Amenc, professor of finance at EDHEC Risk and CEO of ERI Scientific Beta; Felix Goltz, head of applied research at EDHEC-Risk; and Veronique Le Sourd, a senior research engineer there.

One striking finding is that a multi-factor strategy is quite often implemented in the context of passive investment. Even when the investing is dynamic, the factors are usually based on risk budget management, not an active view of expected returns.

Specifically, 31% of the survey respondents who manage assets say that they use factors passively, and 46% of the respondents who own the assets say the same.

On performance, although 55% of managers say that they allocate dynamically “on the basis of views on the future short-term or medium-term performance of factors,” only 15% of the owners say that.

On risk management, 56% of the managers say they allocate dynamically “to manage a simple risk budget objective,” and 31% of asset managers say the same.

Score-based vs. Beta-based

The paper focuses, too, on the distinction between score-based factor design choices and statistical beta-based risk analyses. Score based design choices lead to efforts to time the markets, or to maximize factor intensity within a portfolio. More sophisticated beta based analysis looks to the cyclicality and conditionality of each factor’s premium.

When investors were asked which metrics they used to allocate between equity factors, the answer “scores calculated and normalized on the basis of the characteristics of the stocks making up the portfolios or the indexes representative of the factors” clearly dominated. It was the answer of 43% of participants. The second most common answer (at 26%) was, “more complex techniques taking factor exposure dynamics into account (autoregressive model, regime switching model, Kalman filter).”

In a statement, lead author Amenc said, “While investor interest in dynamic factor investing is growing, it should be recognized that the techniques used for risk management or risk control do not correspond to the state of the art.”

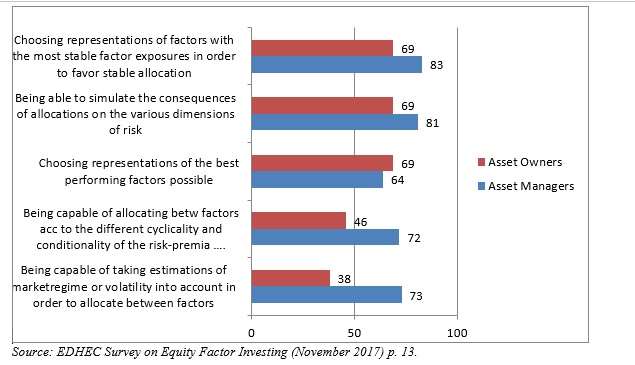

Respondents were asked which concerns they considered “very important” in risk factor investing, and which “less important.” A whopping 82% said that “choosing representations of factors with the most stable factor exposures in order to favor stable allocations” was very important. Only 68% said that “being capable of taking estimations of market regime or volatility into account in order to allocate between factors” was very important. The 14% difference between the two numbers again may be taken to illustrate a static and risk-management orientation in such matters.

Asset Owners vs. Dynamism

Dividing the answers to that question between asset managers (blue bars) and asset owners (red bars), one gets this:

Insofar as there may be said to be a bias against dynamism here, it is operating chiefly amongst the asset owners.

Lionel Martellini, the director of EDHEC-Risk, said, “We see from the survey that investors, and especially asset owners, are ultimately aware of the difficulties and the technical progress to be achieved to master dynamic factor allocation.” EDHEC wants to continue “producing applied academic research on the subject so as to enhance our collective understanding of the benefits and limits of dynamic approaches to factor investing.”

A recent publication discussing the same issues and worth noting here is a study last year on “factor exposure and portfolio concentration” by FTSE Russell.