By Bill Kelly, CEO, CAIA Association

What is a complex transaction without a battery of lawyers to paper it up. These legal minds are an integral part of most transactions and their presence is mostly felt at the time of deal creation and, maybe even more so, when things go off the rails. Part of the value of good legal advice is to provide the client with as much optionality as possible, particularly when the unexpected comes around. This optionality is often described under the less polite moniker of loophole, which has provided the stand-up comic with countless punchlines to an endless stream of old lawyer jokes. It will not be so funny when the joke is on you.

We are in the stage of the private credit market cycle when cov-lite underwriting is the new standard. Everyone is talking about it, but LPs and GPs are mostly in acceptance mode and it doesn’t seem likely that this practice is going to end well for a lot of these market participants. A related but much less discussed subplot is at work here too and you would need to go to places like page B10 of the Wall Street Journal on a sleepy Friday in late November to discover the more arcane but increasingly popular practice of transferring corporate assets to unrestricted subsidiaries.

Debt issuance at the company level is always subject to a very complex agreement, and if the issuer’s legal counsel has done their job, it will be replete with optionality that favors the issuing company. Surprisingly or not, most agreements specifically talk about the creditor reach back into the issuing company and all restricted subsidiaries. These same agreements also typically allow for asset transfers to unrestricted subsidiaries (by the debt issuer) from a time when this activity was usually thought to be a small but ancillary part of the core business. The actual terms used here are all formally-defined ones in the underlying agreements, and the transfers can take on a level of complexity that goes far beyond a blog post, but a simple example can be instructive.

Assume Company A moved a minority holding of an affiliated company off their balance sheet into a newly created unrestricted subsidiary called SubCo A, a practice that has usually been allowed under standard agreements. This new subsidiary, along with its newfound balance sheet, is not only beyond the reach of Company A’s original creditors, it can also actually issue more debt of its own and pay dividends back to the owner; practices that most likely would be restricted or even prohibited under the original debt issuance by Company A, and may even reset priorities under the capital stack.

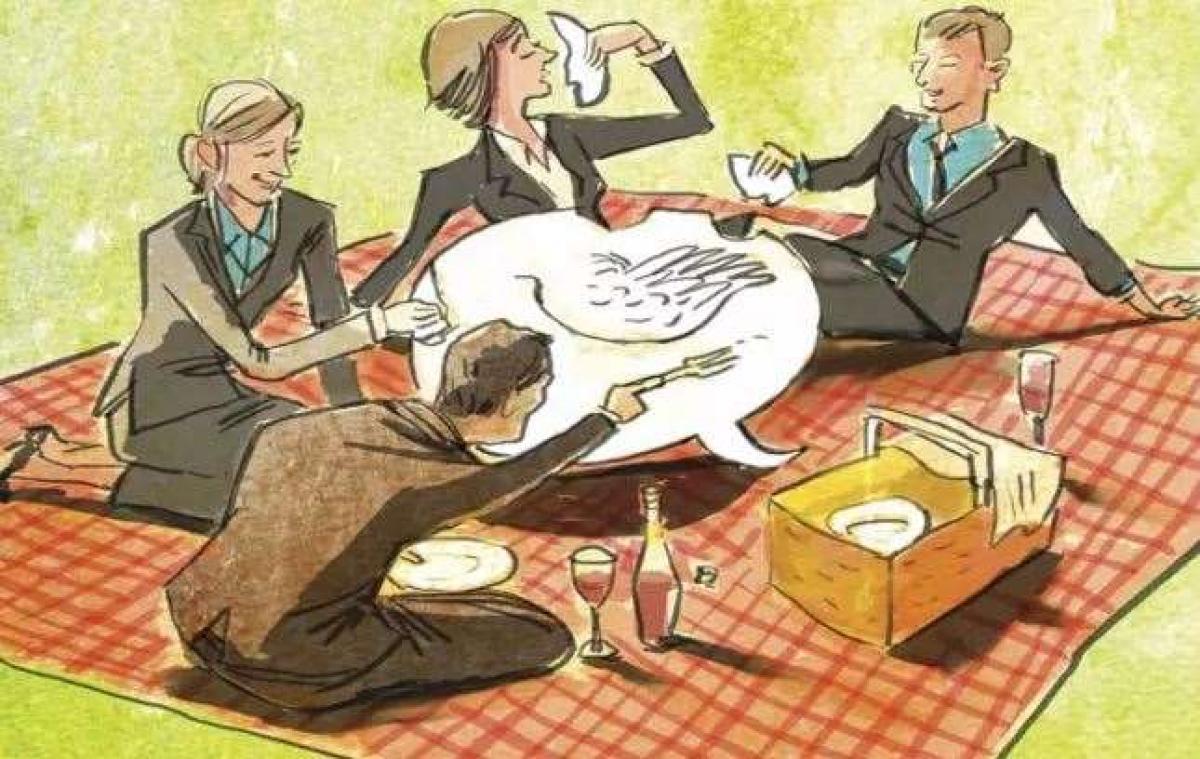

When the sign in the restaurant reads “No Picnicking with Your Own Food,” the smart lawyers swap their smuggled-in sandwiches and the letter of the law dictated by that sign has been followed—even though that is not what the restaurant owner bargained for. When the spit hits the fan in the credit space, your rights as a bondholder will be judged only by what is in the four corners of the agreement. What you thought would happen will not matter at all and you may find yourself with a baloney sandwich when you were expecting Kobe beef.

Seek diversification, education and know your risk tolerance. Investing is for the long term.

Bill Kelly is the CEO of CAIA Association and a frequent contributor to Portfolio for the Future. Follow Bill on LinkedIn and Twitter.