By Nicolas Rabener @Factor Research

INTRODUCTION

In 1973, the U.S. Food and Drug Administration (FDA) published the first regulations that required the nutrition labeling of certain foods as consumers were left in the dark about what they were eating. The regulations evolved and culminated in the widely-recognized nutrition facts panel in 1994, which provides standardized information on the calories and composition of most foods. Although this has not prohibited the obesity crisis in the US, at least consumers have transparency on how much fat, cholesterol, sodium, carbs, and protein they are eating.

Investors would similarly benefit from higher transparency via standardized labeling for investment products as it is often unclear what they contain. One of the largest information asymmetries within the investment industry can likely be found in hedge funds, which typically appear mysterious and secretive in their strategies and investment behavior.

In this short research note, we will analyze five well-known hedge funds from a factor perspective and conduct a simple performance replication via factor-mimicking portfolios.

HEDGE FUND SELECTION

Our selection of five hedge funds is based on these being available in the UCITS format, which provides daily price data for analysis. These hedge funds all feature impressive track records and manage USD billions in assets. The strategies are quite diverse and the focus is mostly on equities.

The five hedge funds and their strategies are the following:

- York Event-Driven fund: Event-driven strategy

- PSAM Global Event fund: Event-driven strategy

- Standard Life GARS fund: Multi-asset macro strategy

- Marshall Wace TOPS fund: Equity market neutral strategy

- AQR Equity Market Neutral fund: Equity market neutral strategy

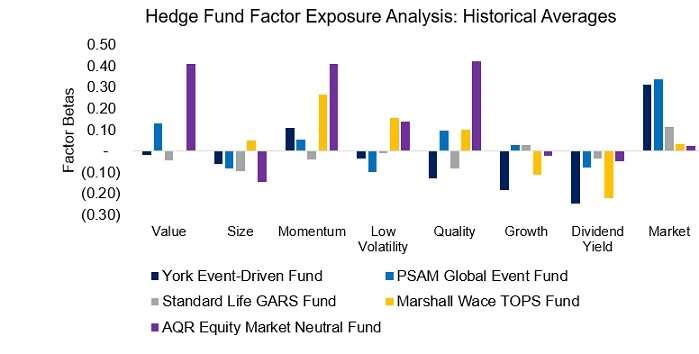

FACTOR EXPOSURE ANALYSIS

First, we conduct a factor exposure analysis of the five hedge funds via a regression analysis using common equity factors. The analysis highlights mixed factor exposures, which is to be expected given the heterogeneous investment strategies. The comments are as follows:

- Nearly all hedge funds show negative exposure to the Size factor, which implies they have minor small cap exposure. The focus on large cap stocks is due to the large amounts of assets managed by the hedge funds, which imposes liquidity requirements for the stock selection process.

- York and PSAM exhibit positive exposure to the stock market, which means they have net exposure and are not fully hedged.

- Standard Life GARS shows the lowest factor exposures on average. Given that the hedge fund invests across asset classes, equity factors should not be able to explain the returns very well.

- AQR pursues a factor-focused equity market neutral strategy by allocating to Value, Momentum, and Quality factors, which the factor exposure analysis confirms.

Source: FactorResearch

YORK EVENT-DRIVEN FUND

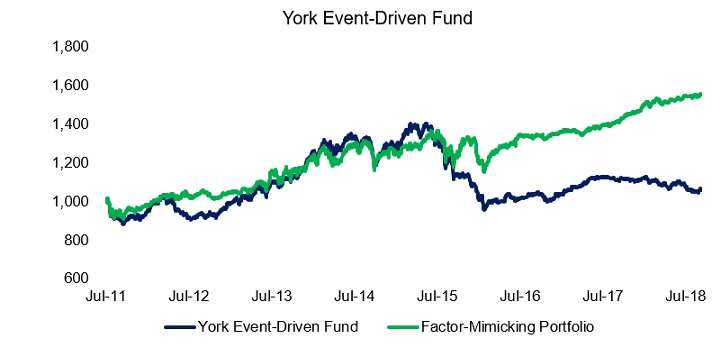

The York Event-Driven fund is managed by US-based York Capital Management and comprises three core strategies: risk arbitrage, special situations, and distressed credit. The portfolio consists mainly of US large cap equities and is highly concentrated with some positions like Altaba, the remains of Yahoo! Inc, reaching almost 10%.

We construct a factor-mimicking portfolio by measuring the factor exposure of the hedge fund on a monthly basis and then allocate to long-short factors for the next month. The resulting portfolio allows investors to distinguish between returns from factors and unexplained returns, which represents alpha.

The factor-mimicking portfolio matched the performance of the York Event-Driven fund relatively closely from 2011 to mid-2015, which indicates that most returns during that period are explained by exposure to common equity factors like Momentum. Thereafter the portfolio outperformed when the hedge fund lost more than 30% between June 2015 and February 2016. The outperformance is likely due to a more diversified portfolio as the factor-mimicking portfolio holds hundreds of stocks and is hardly impacted by changes in single stocks. In contrast, York’s strategy is to speculate on specific events that significantly affect single stocks and take accordingly large positions in these. If the bets go wrong, then this typically results in large losses.

Source: FactorResearch

PSAM GLOBAL EVENT FUND

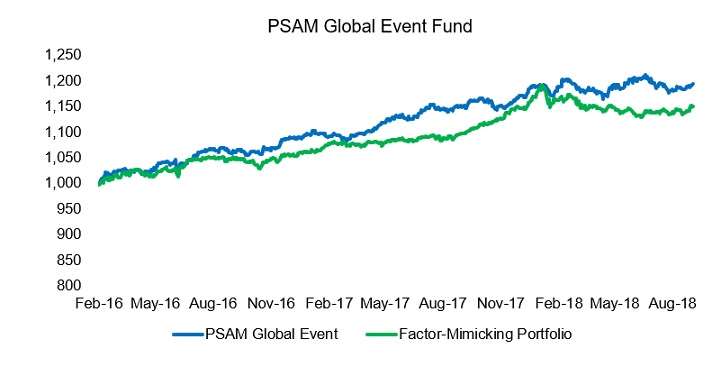

The PSAM Global Event fund is managed by New York-based P. Schoenfeld Asset Management and focuses on merger arbitrage, special situations, and distressed credit. The portfolio is mainly comprised of large cap equities from the US (50%+), Europe, and the United Kingdom.

The factor-mimicking portfolio tracks the performance of the hedge fund from 2016 to 2018, which implies that most returns can be explained by common equity factors and market exposure. The replication could be improved by including fixed income factors given the hedge fund’s exposure to credit.

Source: FactorResearch

STANDARD LIFE GARS FUND

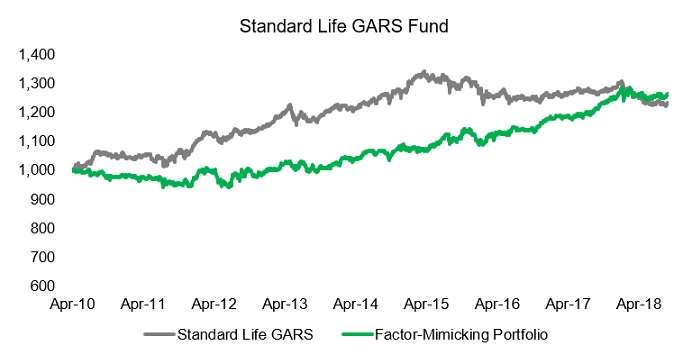

Standard Life’s Global Absolute Return Strategies (GARS) fund was a popular choice for European institutional and retail investors. The hedge fund peaked at more than $30 billion in assets under management in 2016, supported by good performance and moderate fees. The fund aims to generate cash plus 5% by investing in multiple strategies across asset classes, which results in a highly diversified, but complex portfolio. The performance has been declining since 2015 and investors redeemed more than $15 billion.

Given that the hedge fund invests across asset classes, the factor-mimicking portfolio should be able to replicate the performance less efficiently as its building blocks consist exclusively of equity factors. However, although the analysis does highlight a large tracking error between the Standard Life GARS fund and the factor-mimicking portfolio, they share many trends. Some factors like Carry show remarkably similar performance profiles across asset classes, which indicates common factor drivers.

Source: FactorResearch

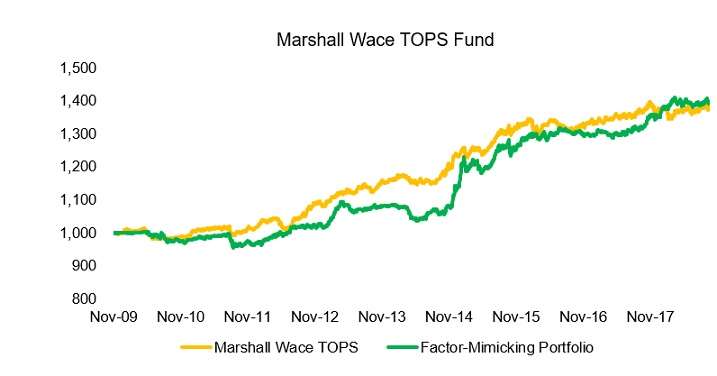

MARSHALL WACE TOPS FUND

The Marshall Wace TOPS fund is based on an interesting debate between the founders of Marshall Wace: do research analysts add value? The hedge fund’s strategy consists of analyzing the track record of analysts and investing in the ideas of the analysts that have consistently generated alpha. Although there are many academic papers that highlight that analysts do not add value, the performance of the Marshall Wace TOPS fund provides contrary evidence. Given the strong performance and complete market neutrality, this makes the hedge fund highly attractive for investors looking for diversification.

However, investors should take notice that the factor-mimicking portfolio is able to broadly replicate the hedge fund’s performance, implying that the returns are explained by exposure to common equity factors rather than by alpha. The factor exposure analysis revealed that the performance can be attributed to the Low Volatility, Momentum, and Quality factors, which performed strongly since 2009.

Source: FactorResearch

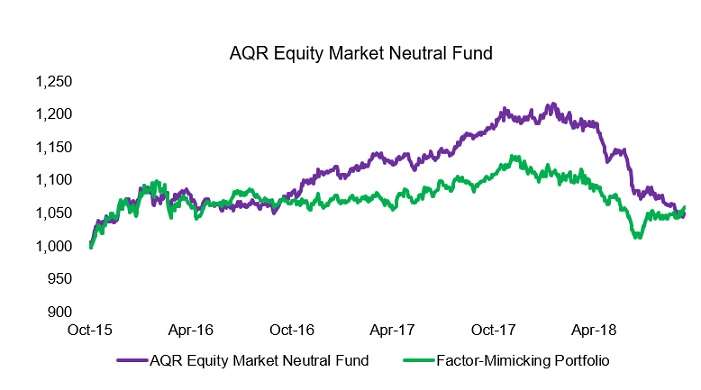

AQR EQUITY MARKET NEUTRAL FUND

AQR is one of the pioneers in the factor investing space and has acquired a stellar reputation as a thought leader by sharing insightful research with their clients and the public. The AQR Equity Market Neutral fund provides investors with exposure to the Value, Quality, and Momentum factors in global equities. The portfolio is highly diversified across markets and completely equity market neutral.

Given AQR’s transparency and focus on factors, investors might expect that the factor-mimicking portfolio efficiently replicates the hedge fund. Although the trends are very similar, the performance of the AQR Equity Market Neutral fund diverged from mid-2016 onwards. Our factor definitions differ slightly from AQR’s, which may explain the tracking error.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that most returns from a few well-known and diverse hedge funds can be explained by exposure to common equity factors. Although this does imply that there is little alpha, hedge fund managers can still create value for investors via portfolio construction. Harvesting factor returns, either directly like AQR or indirectly like Marshall Wace, is challenging. If done successfully with little market exposure, then this creates compelling investment products for investors seeking diversification.