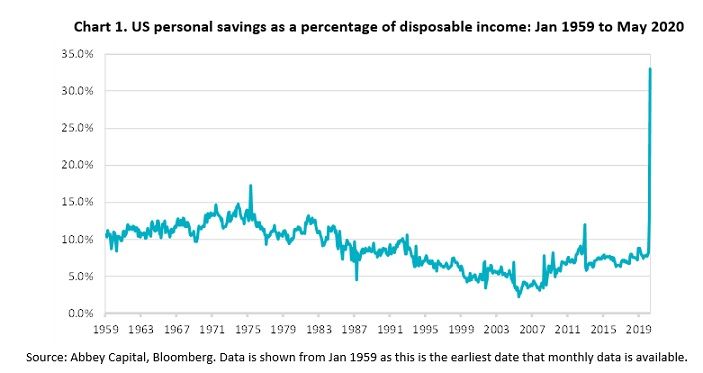

By Alan Dunne, Managing Director, Abbey Capital One of the key questions facing investors at the moment is whether inflation or deflation represents the bigger risk for the coming years. Economists are split on this and one of the reasons for the uncertainty is that COVID-19 represents both a supply shock and a demand shock for the global economy. Because of lockdown measures, the production of certain goods and provision of certain services has been curtailed, reducing aggregate supply. At the same time, because people have been forced to stay at home, the demand for certain goods has also been reduced. An adverse supply shock, such as the oil crisis in the 1970s, is typically inflationary, while an adverse demand shock, such as the Global Financial Crisis (“GFC”), is normally disinflationary or even deflationary. These shocks have prompted an unprecedented policy response, adding to the uncertainty as to whether the net result will be rising or falling inflation. The uncertainty is also reflected in markets with bond yields and inflation swap markets suggesting a low risk of inflation but assets like gold, which is sometimes seen as a hedge against inflation, rising in recent months. What will be the key drivers of inflation? The recent inflation data suggests that the impact on demand, rather than supply, is dominating at this stage with the US consumer price index (“CPI”) for May rising just +0.1% year-on year (“yoy”) and the core CPI rate rising at +1.2%, the lowest rate since March 2011. Eurozone data paints a similar picture with the CPI rising +0.1% yoy in May and core CPI rising +0.9% yoy. Looking ahead, the shape of the economic recovery, as lockdown measures are eased, is likely to be a key driver of the outlook for inflation. A strong V-shaped recovery would diminish deflationary forces and may even see upward pressure on prices, particularly if (1) consumers spend some of the savings accrued during lockdown and (2) prices rise as the supply of certain goods and services remains constrained by social distancing measures e.g. restaurants operating at much less than full capacity.  However, significant uncertainty revolves around both the near-term economic outlook and the longer-term outlook[i]. For example, some economists such as Robert Shiller draw a parallel between the current challenges for the US economy and those of the 1930s, and see potential for a much more cautious consumer in the coming years[ii]. If that materialised if would be a deflationary headwind for the economy. Structural trends Furthermore, coming into this year many of the major structural trends in the global economy were disinflationary. First, demographic trends: as the population ages and more people enter the late working age, savings rise and spending falls. Second, technology has encouraged disintermediation in certain services (e.g. Uber) encouraging competition and downward pressure on prices. Increased automation and use of robotics have displaced labour and stymied wage growth and worker bargaining power in many sectors. Third, high debt levels in the aftermath of the GFC were a headwind for growth, as consumers deleveraged. However, against this there is a growing sense that the coronavirus pandemic may have brought the global economy to an inflection point which may mark a shift in the economic paradigm of recent decades. For one, the pandemic has highlighted the interdependence of global supply chains. Many companies had, up until now, emphasised efficiency of supply (such as in Just-in-Time inventory management) over certainty of supply. The pandemic has exposed the risk of this approach. Companies may choose to bring more parts of the supply chain to their home market even if that results in higher costs. That could add to price pressures over time. More generally, the rising tensions between the US and China, such as the trade war, the restrictions on Huawei and recent moves to stop Chinese firms listing on US exchanges, mark a reversal of the trend of globalisation and greater integration of China into the world economy. Globalisation, via access to a cheaper supply of labour and greater efficiency of production, had been one of the key trends underpinning falling inflation in recent decades. A possible paradigm shift in policy? More fundamentally, COVID 19 appears to have motivated a shift in economic policy in favour of more active fiscal policy and greater coordination between monetary and fiscal policy. In the aftermath of the GFC, monetary policy and the use of quantitative easing (“QE”) was the primary policy lever. While QE was successful in stabilising financial markets, its impact on the broader economy is still debated. While many commentators equated QE with money printing, in reality QE results in an increase in reserves in the banking system but the excess liquidity does not necessarily trickle down into the real economy unless bank lending increases.

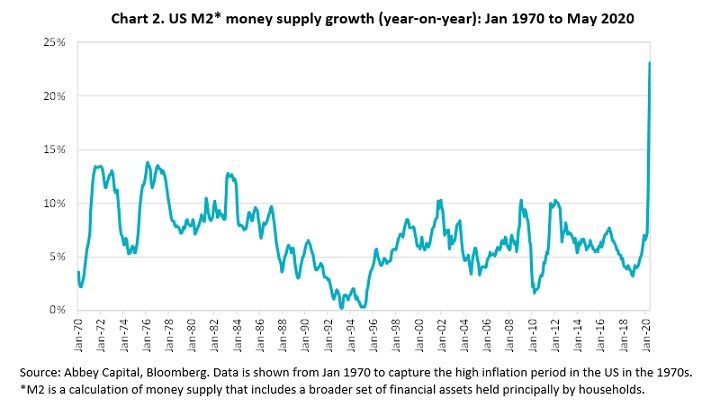

However, significant uncertainty revolves around both the near-term economic outlook and the longer-term outlook[i]. For example, some economists such as Robert Shiller draw a parallel between the current challenges for the US economy and those of the 1930s, and see potential for a much more cautious consumer in the coming years[ii]. If that materialised if would be a deflationary headwind for the economy. Structural trends Furthermore, coming into this year many of the major structural trends in the global economy were disinflationary. First, demographic trends: as the population ages and more people enter the late working age, savings rise and spending falls. Second, technology has encouraged disintermediation in certain services (e.g. Uber) encouraging competition and downward pressure on prices. Increased automation and use of robotics have displaced labour and stymied wage growth and worker bargaining power in many sectors. Third, high debt levels in the aftermath of the GFC were a headwind for growth, as consumers deleveraged. However, against this there is a growing sense that the coronavirus pandemic may have brought the global economy to an inflection point which may mark a shift in the economic paradigm of recent decades. For one, the pandemic has highlighted the interdependence of global supply chains. Many companies had, up until now, emphasised efficiency of supply (such as in Just-in-Time inventory management) over certainty of supply. The pandemic has exposed the risk of this approach. Companies may choose to bring more parts of the supply chain to their home market even if that results in higher costs. That could add to price pressures over time. More generally, the rising tensions between the US and China, such as the trade war, the restrictions on Huawei and recent moves to stop Chinese firms listing on US exchanges, mark a reversal of the trend of globalisation and greater integration of China into the world economy. Globalisation, via access to a cheaper supply of labour and greater efficiency of production, had been one of the key trends underpinning falling inflation in recent decades. A possible paradigm shift in policy? More fundamentally, COVID 19 appears to have motivated a shift in economic policy in favour of more active fiscal policy and greater coordination between monetary and fiscal policy. In the aftermath of the GFC, monetary policy and the use of quantitative easing (“QE”) was the primary policy lever. While QE was successful in stabilising financial markets, its impact on the broader economy is still debated. While many commentators equated QE with money printing, in reality QE results in an increase in reserves in the banking system but the excess liquidity does not necessarily trickle down into the real economy unless bank lending increases.  In contrast, the recent measures, have been more aggressive and are much more targeted at getting cash into the real economy. In the US, the $3trn fiscal package amounts to approximately 14% of GDP and further policies are under consideration. At the same time, the Federal Reserve (“Fed”) has substantially increased the size of its balance sheet by buying both government and corporate bonds at a much faster rate than immediately after the GFC. Together, this has resulted in a significant growth in US money supply, which could translate into higher inflation over time. Although in theory central banks would respond to higher inflation by tightening policy, before COVID-19 there was already a debate underway amongst policymakers about the possibility of letting inflation run above target following periods of below target inflation[iii]. That suggests policymakers may be slower to shift policy in response to a pick-up of inflation. The aggressive fiscal supports are not just confined to the US: Germany has also announced significant fiscal support, seemingly abandoning its traditional “black zero” balanced budget rule. While the long -term economic outlook is uncertain, one consequence of COVID-19 which seems indisputable is much higher government debt levels across the world. What are the implications for asset allocation? A world that may be characterised by higher debt levels and significant uncertainty as to whether inflation or deflation represents a greater risk presents a new challenge for investors. If we were to see deflation, like in the 1930s, based on history that would be negative for equities but positive for bonds. Alternatively, if we were to see a significant pick-up in inflation, or even stagflation, that would be negative for real returns on financial assets and real assets may be favoured. The current uncertainty highlights the importance of holding diversified portfolios, with exposure to a range of traditional and alternative assets and strategies with the potential to deliver returns in different market environments. Many economists draw a parallel between the current scenario and the substantial increase in government debt during World War II. One of the consequences of higher debt levels is that we may see pressure on central banks to maintain interest rates at low levels and maintain asset purchases to ensure higher bond issuance is not disruptive for bond markets i.e. coordination of monetary and fiscal policies. We are already seeing this with the ECB’s Pandemic Emergency Purchase Programme and the Fed’s commitment to buy large amounts of government debt at a time when issuance will have to rise. Indeed, in the UK the Bank of England has agreed to temporarily finance government spending directly. Financial repression is potentially negative for government bonds In the decades after World War II, debt levels were brought back to more manageable levels by keeping interest rates low (a process known as financial repression). This could take the form of direct yield curve control by the central bank (something which has been discussed by Fed officials and is already the policy of the Bank of Japan).

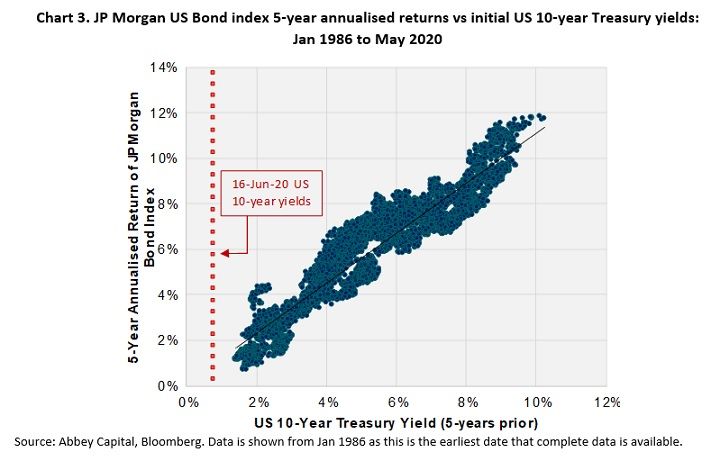

In contrast, the recent measures, have been more aggressive and are much more targeted at getting cash into the real economy. In the US, the $3trn fiscal package amounts to approximately 14% of GDP and further policies are under consideration. At the same time, the Federal Reserve (“Fed”) has substantially increased the size of its balance sheet by buying both government and corporate bonds at a much faster rate than immediately after the GFC. Together, this has resulted in a significant growth in US money supply, which could translate into higher inflation over time. Although in theory central banks would respond to higher inflation by tightening policy, before COVID-19 there was already a debate underway amongst policymakers about the possibility of letting inflation run above target following periods of below target inflation[iii]. That suggests policymakers may be slower to shift policy in response to a pick-up of inflation. The aggressive fiscal supports are not just confined to the US: Germany has also announced significant fiscal support, seemingly abandoning its traditional “black zero” balanced budget rule. While the long -term economic outlook is uncertain, one consequence of COVID-19 which seems indisputable is much higher government debt levels across the world. What are the implications for asset allocation? A world that may be characterised by higher debt levels and significant uncertainty as to whether inflation or deflation represents a greater risk presents a new challenge for investors. If we were to see deflation, like in the 1930s, based on history that would be negative for equities but positive for bonds. Alternatively, if we were to see a significant pick-up in inflation, or even stagflation, that would be negative for real returns on financial assets and real assets may be favoured. The current uncertainty highlights the importance of holding diversified portfolios, with exposure to a range of traditional and alternative assets and strategies with the potential to deliver returns in different market environments. Many economists draw a parallel between the current scenario and the substantial increase in government debt during World War II. One of the consequences of higher debt levels is that we may see pressure on central banks to maintain interest rates at low levels and maintain asset purchases to ensure higher bond issuance is not disruptive for bond markets i.e. coordination of monetary and fiscal policies. We are already seeing this with the ECB’s Pandemic Emergency Purchase Programme and the Fed’s commitment to buy large amounts of government debt at a time when issuance will have to rise. Indeed, in the UK the Bank of England has agreed to temporarily finance government spending directly. Financial repression is potentially negative for government bonds In the decades after World War II, debt levels were brought back to more manageable levels by keeping interest rates low (a process known as financial repression). This could take the form of direct yield curve control by the central bank (something which has been discussed by Fed officials and is already the policy of the Bank of Japan).  However, government bond yields are already close to record lows suggesting low future nominal returns. With financial repression, the real returns on government bonds could be negative as nominal yields are suppressed below inflation levels to help reduce the real value of debt over time. Such a development may prompt investors to increasingly seek alternatives to traditional equity-bond portfolios.

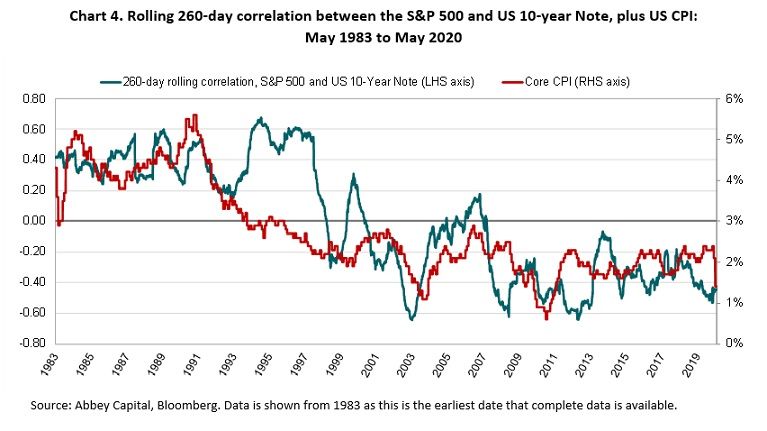

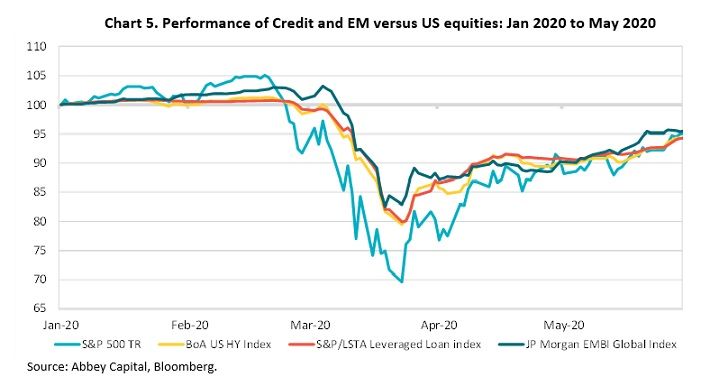

However, government bond yields are already close to record lows suggesting low future nominal returns. With financial repression, the real returns on government bonds could be negative as nominal yields are suppressed below inflation levels to help reduce the real value of debt over time. Such a development may prompt investors to increasingly seek alternatives to traditional equity-bond portfolios.  Declining inflation has also contributed to the negative correlation between bonds and equities which has been particularly favourable for a 60-40 equity-bond portfolio in recent years. In the 1980s, when inflation was a greater concern, upside (downside) surprises in inflation were negative (positive) for both bonds and equities as the inflation premium in bond yields rose (fell), producing a positive correlation between bonds and equities. As inflation fears have subsided, growth considerations have tended to drive the correlation: weaker growth tends to be favourable for bonds but not for equities (and vice versa). Higher inflation not only reduces the real return on bonds but potentially reduces the diversification benefit of holding bonds in a portfolio with equities. Investors are therefore left with the challenge of finding alternatives for government bonds, ideally with a low or negative correlation to equities and protection against possible inflation. Assessing the alternatives Although low nominal yields on government bonds may again prompt investors to “reach for yield” in fixed income, as they did in the aftermath of the GFC, the sharp sell-off in credit and emerging market debt in March, at the height of the COVID-19 crisis, highlights the procyclical element of these assets and how they may struggle to give diversification from equities in a significant equity downturn. Corporate and high yield bond exchange traded funds also traded below fair value during the crisis in March as liquidity in these markets dried up. Granted, investors may take the view that the Fed is effectively backstopping credit markets with their recent move to buy corporate bonds but yields on the best credits have since fallen substantially and some categories of high yield bonds are not eligible for purchase under the Fed’s Secondary Market Corporate Credit Facility program. Inflation protected bonds may be increasingly attractive to investors given the rising inflation risk but real yields on 10-year US Treasury Inflation-Protected Securities (“TIPS”) are currently -0.50%.

Declining inflation has also contributed to the negative correlation between bonds and equities which has been particularly favourable for a 60-40 equity-bond portfolio in recent years. In the 1980s, when inflation was a greater concern, upside (downside) surprises in inflation were negative (positive) for both bonds and equities as the inflation premium in bond yields rose (fell), producing a positive correlation between bonds and equities. As inflation fears have subsided, growth considerations have tended to drive the correlation: weaker growth tends to be favourable for bonds but not for equities (and vice versa). Higher inflation not only reduces the real return on bonds but potentially reduces the diversification benefit of holding bonds in a portfolio with equities. Investors are therefore left with the challenge of finding alternatives for government bonds, ideally with a low or negative correlation to equities and protection against possible inflation. Assessing the alternatives Although low nominal yields on government bonds may again prompt investors to “reach for yield” in fixed income, as they did in the aftermath of the GFC, the sharp sell-off in credit and emerging market debt in March, at the height of the COVID-19 crisis, highlights the procyclical element of these assets and how they may struggle to give diversification from equities in a significant equity downturn. Corporate and high yield bond exchange traded funds also traded below fair value during the crisis in March as liquidity in these markets dried up. Granted, investors may take the view that the Fed is effectively backstopping credit markets with their recent move to buy corporate bonds but yields on the best credits have since fallen substantially and some categories of high yield bonds are not eligible for purchase under the Fed’s Secondary Market Corporate Credit Facility program. Inflation protected bonds may be increasingly attractive to investors given the rising inflation risk but real yields on 10-year US Treasury Inflation-Protected Securities (“TIPS”) are currently -0.50%.  Real assets such as property and infrastructure should provide protection against higher inflation for long-term investors but may not be attractive for investors valuing liquidity. The recent stress period in markets in March, when some investors faced capital calls from investment managers, again highlighted the value of maintaining liquid assets in portfolios. Unsurprisingly, flows into gold have picked up substantially in recent months amid concerns about the debasement of fiat currency. Our research suggests that gold has a low long-term correlation to equities, is liquid and historically tends to perform well when real yields fall (as one expects in a period of rising inflation)[iv]. However, from a diversification perspective, gold sold off in March 2020, as it did in October 2008, amid the general liquidation of assets and surge in the US dollar. Historically, the trend in the US dollar has tended to exert a significant influence over gold’s performance. Within the liquid alternative universe, the current uncertainty in the outlook may increase the case for adding more directional strategies like managed futures to portfolios. The bi-directional nature of these strategies means that they have the potential to profit from trends to the upside or downside in markets, should they emerge.

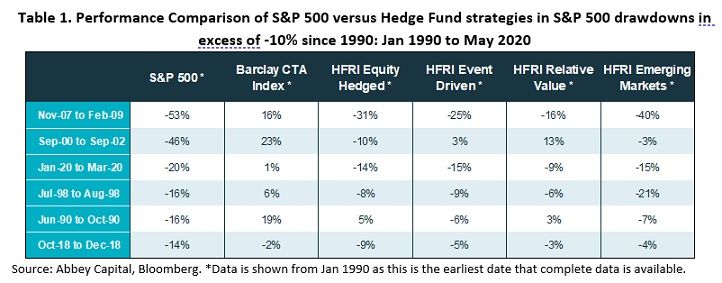

Real assets such as property and infrastructure should provide protection against higher inflation for long-term investors but may not be attractive for investors valuing liquidity. The recent stress period in markets in March, when some investors faced capital calls from investment managers, again highlighted the value of maintaining liquid assets in portfolios. Unsurprisingly, flows into gold have picked up substantially in recent months amid concerns about the debasement of fiat currency. Our research suggests that gold has a low long-term correlation to equities, is liquid and historically tends to perform well when real yields fall (as one expects in a period of rising inflation)[iv]. However, from a diversification perspective, gold sold off in March 2020, as it did in October 2008, amid the general liquidation of assets and surge in the US dollar. Historically, the trend in the US dollar has tended to exert a significant influence over gold’s performance. Within the liquid alternative universe, the current uncertainty in the outlook may increase the case for adding more directional strategies like managed futures to portfolios. The bi-directional nature of these strategies means that they have the potential to profit from trends to the upside or downside in markets, should they emerge.  Managed futures strategies were one of the few hedge fund strategies which delivered positive performance in Q1 2020, as the sharp reappraisal of the economic outlook prompted strong moves in bonds, equities and industrial commodities. Higher inflation could also create directional moves in commodity markets, in particular, and to the extent that inflation rates diverge across countries, could also prompt greater directional moves in currencies. While the performance of managed futures was not as strong for a period in the 2010s as in the previous two decades, our research suggests that this may have been linked to a market environment characterised by fewer major moves in markets and a macroeconomic backdrop of slow and steady growth and benign inflation[v]. If we are moving into a more uncertain macroeconomic environment, potentially with higher inflation, there is the potential for higher volatility and stronger directional moves in markets. Conclusion The conundrum facing investors is that in the event of deflation, cash and fixed income will likely perform best but with interest rates and bond yields at record lows, the opportunity cost of holding such assets is high. Furthermore, given the large and growing level of public debt there is a strong suspicion that there will be a bias from policymakers to lower debt levels via financial repression over time, allowing a pick-up in inflation. Cash and government bonds offer little protection in this scenario. To account for the competing requirements in a portfolio of returns, low correlation to equities, liquidity and possible inflation protection, investors may need to build robust portfolios with a broader mix of assets and strategies. As part of this mix of diversifying strategies, the shift in the market and macroeconomic environment may be particularly interesting for directional strategies like managed futures at this juncture given their historical low correlation with equities and the potential to profit from major trends to the upside or downside in markets*. *Diversification does not assure profit, nor does it protect against a loss in a declining market. Description of Indices S&P 500 Index (Start Date: March-1957) The S&P 500 Index is an index of 500 US stocks chosen for market size, liquidity and industry grouping, among other factors. It is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in its aggregate market value. S&P 500 Total Return Index (Start Date: Feb-1988) The S&P 500 Total Return Index (“S&P 500 TR”) is a market capitalisation-weighted price-only index, comprised of 500 widely-held common stocks listed on the NYSE and NASDAQ. The performance data of the S&P 500 Total Return Index includes the reinvestment of all dividends but does not subtract fees or expenses. JP Morgan US Government Bond Index (Start Date: Dec-1985) The JP Morgan US Government Index is a leading measure of US government bond market performance. The index measures the total return of US Treasury securities across the whole yield curve. BoA US HY Index (Start Date: Aug-1986) ICE BofA US High Yield Index (“BoA US HY Index”) tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. JP Morgan EMBI Global Index (Start Date: Dec-1993) The J.P. Morgan Emerging Markets Bond Index Global Index ("JP Morgan EMBI Global Index") tracks total returns for traded external debt instruments in the emerging markets. The EMBI Global includes US dollar-denominated Brady bonds, loans, and Eurobonds with an outstanding face value of at least $500 million. S&P/LSTA Leveraged Loan Index (Start Date: Jan-1987) The S&P/LSTA Leveraged Loan Index (the Index) is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Barclay CTA Index (Start Date: Jan-1987) The Barclay CTA Index is an equal weighted Index. There are currently 510 programs included in the index and it is rebalanced annually. To qualify for inclusion in the index, an advisor must have four years of prior performance history. HFRI Equity Hedge Index (Start Date: Jan-1990) The index includes investment managers who maintain positions both long and short in primarily equity and equity derivative securities. Strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. HFRI Event Driven Index (Start Date: Jan-1990) The index includes investment managers who maintain positions in companies involved in corporate transactions of a wide variety such as mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Event Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company specific developments. HFRI Relative Value Index (Start Date: Jan-1990) The index includes investment managers who maintain positions in which the investment thesis is predicated on realisation of a valuation discrepancy in the relationship between multiple securities. Managers employ a variety of fundamental and quantitative techniques to establish investment theses, and security types range broadly across equity, fixed income, derivative or other security types. HFRI Emerging Markets Index (Start Date: Jan-1990) Emerging Markets funds invest, primarily long, in securities of companies or the sovereign debt of developing or 'emerging' countries. Emerging Markets regions include Africa, Asia ex-Japan, Latin America, the Middle East and Russia/Eastern Europe. Important Information, Risk Factors & Disclosures This document contains information provided by or about Abbey Capital Limited (“Abbey Capital”). It is for the purpose of providing general information and does not purport to be full or complete or to constitute advice. Abbey Capital is a private company limited by shares incorporated in Ireland (registration number 327102). Abbey Capital is authorised and regulated by the Central Bank of Ireland as an Alternative Investment Fund Manager under Regulation 9 of the European Union (Alternative Investment Fund Managers) Regulations 2013 ("AIFMD"). Abbey Capital is registered as a Commodity Pool Operator and Commodity Trading Advisor with the U.S. Commodity Futures Trading Commission (“CFTC”) and is a member of the U.S. National Futures Association (“NFA”). Abbey Capital is also registered as an Investment Advisor with the Securities Exchange Commission (“SEC”) in the United States of America. Abbey Capital (US) LLC is a wholly owned subsidiary of Abbey Capital. None of the regulators listed herein endorse, indemnify or guarantee the member’s business practices, selling methods, the class or type of securities offered, or any specific security. While Abbey Capital has taken reasonable care to ensure that the sources of information herein are reliable, Abbey Capital does not guarantee the accuracy or completeness of such data (and same may not be independently verified or audited) and accepts no liability for any inaccuracy or omission. Opinions, estimates, projections and information are current as on the date indicated on this document and are subject to change without notice. Abbey Capital undertakes no obligation to update such information as of a more recent date. Pursuant to an exemption from the CFTC in connection with accounts of qualified eligible persons, this report is not required to be, and has not been, filed with the CFTC. The CFTC, the SEC, the Central Bank of Ireland or any other regulator have not passed upon the merits of participating in any trading programs or funds promoted by Abbey Capital, nor have they reviewed or passed on the adequacy or accuracy of this report. Risk Factors: Trading in derivatives contracts is not suitable for all investors given its speculative nature and the high level of risk involved, including the risk of loss. This brief statement cannot disclose all of the risks and other factors necessary to evaluate a participation in a fund managed by Abbey Capital. It does not take into account the investment objectives, financial position or particular needs of any particular investor. Prospective investors should take appropriate investment advice and consult with their own professional advisors with respect to legal, financial and taxation consequences of any specific investments they are considering in any of the funds managed by Abbey Capital. Investors must make their own investment decision, having reviewed the private placement memorandum carefully and consider whether trading is appropriate for them in light of their experience, specific investment objectives and financial position and using such independent advisors as they believe necessary. The information herein is not intended to and shall not in any way constitute an invitation to invest in any of the funds managed by Abbey Capital. Any offer, solicitation or subscription for interests in any of the funds managed by Abbey Capital shall only be a private offering to qualified investors pursuant to the relevant private placement memorandum and subscription agreement and no reliance shall be placed on the information contained herein. Past results are not indicative of future results. Investing in managed futures is not suitable for all investors given the level of risk involved, including the risk of loss. [i] Are we heading into another Depression? www.ft.com (subscription required)3 June 2020 [ii] Shiller, R. Why We Can’t Foresee the Pandemic’s Long-Term Effects, NY Times 29 May 2020 [iii] Brainard, L (2020) Monetary Policy Strategies and Tools When Inflation and Interest Rates Are Low. Speech at the 2020 US Monetary Policy Forum [iv] Recent performance of gold and managed futures May 2020 and Managed Futures or Gold? October 2018, www.abbeycapital.com [v] The Market Environment For Trendfollowing, September 2019, www.abbeycapital.com

Managed futures strategies were one of the few hedge fund strategies which delivered positive performance in Q1 2020, as the sharp reappraisal of the economic outlook prompted strong moves in bonds, equities and industrial commodities. Higher inflation could also create directional moves in commodity markets, in particular, and to the extent that inflation rates diverge across countries, could also prompt greater directional moves in currencies. While the performance of managed futures was not as strong for a period in the 2010s as in the previous two decades, our research suggests that this may have been linked to a market environment characterised by fewer major moves in markets and a macroeconomic backdrop of slow and steady growth and benign inflation[v]. If we are moving into a more uncertain macroeconomic environment, potentially with higher inflation, there is the potential for higher volatility and stronger directional moves in markets. Conclusion The conundrum facing investors is that in the event of deflation, cash and fixed income will likely perform best but with interest rates and bond yields at record lows, the opportunity cost of holding such assets is high. Furthermore, given the large and growing level of public debt there is a strong suspicion that there will be a bias from policymakers to lower debt levels via financial repression over time, allowing a pick-up in inflation. Cash and government bonds offer little protection in this scenario. To account for the competing requirements in a portfolio of returns, low correlation to equities, liquidity and possible inflation protection, investors may need to build robust portfolios with a broader mix of assets and strategies. As part of this mix of diversifying strategies, the shift in the market and macroeconomic environment may be particularly interesting for directional strategies like managed futures at this juncture given their historical low correlation with equities and the potential to profit from major trends to the upside or downside in markets*. *Diversification does not assure profit, nor does it protect against a loss in a declining market. Description of Indices S&P 500 Index (Start Date: March-1957) The S&P 500 Index is an index of 500 US stocks chosen for market size, liquidity and industry grouping, among other factors. It is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in its aggregate market value. S&P 500 Total Return Index (Start Date: Feb-1988) The S&P 500 Total Return Index (“S&P 500 TR”) is a market capitalisation-weighted price-only index, comprised of 500 widely-held common stocks listed on the NYSE and NASDAQ. The performance data of the S&P 500 Total Return Index includes the reinvestment of all dividends but does not subtract fees or expenses. JP Morgan US Government Bond Index (Start Date: Dec-1985) The JP Morgan US Government Index is a leading measure of US government bond market performance. The index measures the total return of US Treasury securities across the whole yield curve. BoA US HY Index (Start Date: Aug-1986) ICE BofA US High Yield Index (“BoA US HY Index”) tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. JP Morgan EMBI Global Index (Start Date: Dec-1993) The J.P. Morgan Emerging Markets Bond Index Global Index ("JP Morgan EMBI Global Index") tracks total returns for traded external debt instruments in the emerging markets. The EMBI Global includes US dollar-denominated Brady bonds, loans, and Eurobonds with an outstanding face value of at least $500 million. S&P/LSTA Leveraged Loan Index (Start Date: Jan-1987) The S&P/LSTA Leveraged Loan Index (the Index) is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Barclay CTA Index (Start Date: Jan-1987) The Barclay CTA Index is an equal weighted Index. There are currently 510 programs included in the index and it is rebalanced annually. To qualify for inclusion in the index, an advisor must have four years of prior performance history. HFRI Equity Hedge Index (Start Date: Jan-1990) The index includes investment managers who maintain positions both long and short in primarily equity and equity derivative securities. Strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. HFRI Event Driven Index (Start Date: Jan-1990) The index includes investment managers who maintain positions in companies involved in corporate transactions of a wide variety such as mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Event Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company specific developments. HFRI Relative Value Index (Start Date: Jan-1990) The index includes investment managers who maintain positions in which the investment thesis is predicated on realisation of a valuation discrepancy in the relationship between multiple securities. Managers employ a variety of fundamental and quantitative techniques to establish investment theses, and security types range broadly across equity, fixed income, derivative or other security types. HFRI Emerging Markets Index (Start Date: Jan-1990) Emerging Markets funds invest, primarily long, in securities of companies or the sovereign debt of developing or 'emerging' countries. Emerging Markets regions include Africa, Asia ex-Japan, Latin America, the Middle East and Russia/Eastern Europe. Important Information, Risk Factors & Disclosures This document contains information provided by or about Abbey Capital Limited (“Abbey Capital”). It is for the purpose of providing general information and does not purport to be full or complete or to constitute advice. Abbey Capital is a private company limited by shares incorporated in Ireland (registration number 327102). Abbey Capital is authorised and regulated by the Central Bank of Ireland as an Alternative Investment Fund Manager under Regulation 9 of the European Union (Alternative Investment Fund Managers) Regulations 2013 ("AIFMD"). Abbey Capital is registered as a Commodity Pool Operator and Commodity Trading Advisor with the U.S. Commodity Futures Trading Commission (“CFTC”) and is a member of the U.S. National Futures Association (“NFA”). Abbey Capital is also registered as an Investment Advisor with the Securities Exchange Commission (“SEC”) in the United States of America. Abbey Capital (US) LLC is a wholly owned subsidiary of Abbey Capital. None of the regulators listed herein endorse, indemnify or guarantee the member’s business practices, selling methods, the class or type of securities offered, or any specific security. While Abbey Capital has taken reasonable care to ensure that the sources of information herein are reliable, Abbey Capital does not guarantee the accuracy or completeness of such data (and same may not be independently verified or audited) and accepts no liability for any inaccuracy or omission. Opinions, estimates, projections and information are current as on the date indicated on this document and are subject to change without notice. Abbey Capital undertakes no obligation to update such information as of a more recent date. Pursuant to an exemption from the CFTC in connection with accounts of qualified eligible persons, this report is not required to be, and has not been, filed with the CFTC. The CFTC, the SEC, the Central Bank of Ireland or any other regulator have not passed upon the merits of participating in any trading programs or funds promoted by Abbey Capital, nor have they reviewed or passed on the adequacy or accuracy of this report. Risk Factors: Trading in derivatives contracts is not suitable for all investors given its speculative nature and the high level of risk involved, including the risk of loss. This brief statement cannot disclose all of the risks and other factors necessary to evaluate a participation in a fund managed by Abbey Capital. It does not take into account the investment objectives, financial position or particular needs of any particular investor. Prospective investors should take appropriate investment advice and consult with their own professional advisors with respect to legal, financial and taxation consequences of any specific investments they are considering in any of the funds managed by Abbey Capital. Investors must make their own investment decision, having reviewed the private placement memorandum carefully and consider whether trading is appropriate for them in light of their experience, specific investment objectives and financial position and using such independent advisors as they believe necessary. The information herein is not intended to and shall not in any way constitute an invitation to invest in any of the funds managed by Abbey Capital. Any offer, solicitation or subscription for interests in any of the funds managed by Abbey Capital shall only be a private offering to qualified investors pursuant to the relevant private placement memorandum and subscription agreement and no reliance shall be placed on the information contained herein. Past results are not indicative of future results. Investing in managed futures is not suitable for all investors given the level of risk involved, including the risk of loss. [i] Are we heading into another Depression? www.ft.com (subscription required)3 June 2020 [ii] Shiller, R. Why We Can’t Foresee the Pandemic’s Long-Term Effects, NY Times 29 May 2020 [iii] Brainard, L (2020) Monetary Policy Strategies and Tools When Inflation and Interest Rates Are Low. Speech at the 2020 US Monetary Policy Forum [iv] Recent performance of gold and managed futures May 2020 and Managed Futures or Gold? October 2018, www.abbeycapital.com [v] The Market Environment For Trendfollowing, September 2019, www.abbeycapital.com

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org