By Robert Hoffman, Managing Director, Investment Research and Kara O’Halloran, Associate, Investment Research, FS Investments Structured products are no stranger to the limelight. Once only garnering interest from niche Wall Street trading floors, collateralized debt obligations (CDOs) and mortgage-backed securities (MBS) have become household names, as these products were cited as primary culprits of the financial system meltdown in 2008. Now, as the world continues to grapple with the fallout stemming from the COVID-19 outbreak, structured products are back in the forefront. This time, fingers are pointed at collateralized loan obligations (CLOs) as many believe they may pose an outsized risk in the current market environment. In this note, we discuss why we disagree with these assertions, and why we believe, if accessed correctly, CLOs present a source of opportunity.

CLOs defined

Before determining their investment merits, it is necessary to define what CLOs are—and perhaps more importantly what they are not. CLOs are structured credit products backed by pools of corporate loans. Typically, CLO managers purchase between 150–200 loans and finance these purchases by issuing debt and equity backed by the pool of loans. The debt securities issued are organized into tranches, each with their own risk/return profile depending on priority of payment and claim on the underlying loans. Tranches are typically risk-rated by the major rating agencies and organized by seniority. Most deals are structured with tranches rated AAA, AA, A, BBB, BB and occasionally B, with an unrated equity tranche at the bottom. Principal and interest earned on the underlying loans are used to make payments to CLO investors according to a “waterfall” mechanism. Senior-most debt investors are paid first, and lower-rated tranches are paid sequentially thereafter in order of seniority. Equity tranche holders are paid any excess spread—the difference between income received from the collateral and the amount paid to service debt investors. They serve as the “first loss” position in that any losses incurred impact the collateral backing the equity first, but these tranches offer the possibility of higher return. Frequently CLOs are associated with CDOs. And while their acronyms and structures resemble one another—they are both backed by income-producing assets, organized into tranches and securitized—the similarities stop there. CDOs are backed by other forms of debt—mortgages, credit card receivables, auto loans, etc. The headline-making products during the Global Financial Crisis were predominantly CDOs, along with “CDO-squareds” (essentially mortgage CDOs that owned pools of other mortgage CDOs) and MBS. CLOs have explicit investor protections in place, such as diversification and credit enhancement tests, which, along with features such as active management and transparency, help manage risk.

CLOs impacted during COVID crash

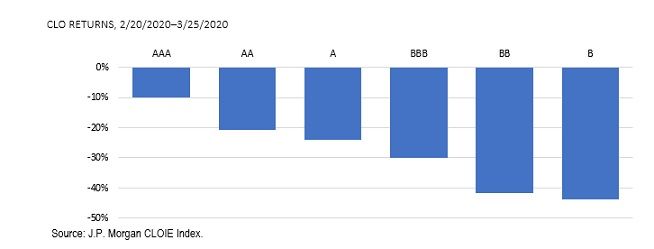

CLOs were not immune to the COVID-19-induced market rout in March. The sell-off was broad based and indiscriminate, driven by a combination of need for liquidity and concerns about the impact that broad credit weakness would have on the asset class.  Investors faced with margin calls, as well as investment grade-focused ETFs and mutual funds faced with outflows, dumped even the highest-quality CLO tranches. As liquidity dried up, the market largely shut down and concerns began to grow about a systemic market problem. CLOs were not melting down in a vacuum. The asset class to which they are inextricably linked, senior secured loans, was experiencing troubles of its own. The virtual standstill in economic activity all but assures deteriorating cash flows for many loan issuers, which in turn means a higher percentage of loan issuers expected to be downgraded by the rating agencies. This fueled even more worries for CLOs as they are limited in the amount of CCC rated debt that they can hold—typically a maximum of 7.5% of total portfolio value. If that threshold is breached, the CLO must begin carrying the excess CCC assets at market value as opposed to par. Given the steep decline in loan prices during March, and with most loans still trading below par, this would result in a decline in overall portfolio value, which may then require the CLO to divert interest payments from lower-rated tranches to either purchase more collateral or pay down senior CLO holders.

Investors faced with margin calls, as well as investment grade-focused ETFs and mutual funds faced with outflows, dumped even the highest-quality CLO tranches. As liquidity dried up, the market largely shut down and concerns began to grow about a systemic market problem. CLOs were not melting down in a vacuum. The asset class to which they are inextricably linked, senior secured loans, was experiencing troubles of its own. The virtual standstill in economic activity all but assures deteriorating cash flows for many loan issuers, which in turn means a higher percentage of loan issuers expected to be downgraded by the rating agencies. This fueled even more worries for CLOs as they are limited in the amount of CCC rated debt that they can hold—typically a maximum of 7.5% of total portfolio value. If that threshold is breached, the CLO must begin carrying the excess CCC assets at market value as opposed to par. Given the steep decline in loan prices during March, and with most loans still trading below par, this would result in a decline in overall portfolio value, which may then require the CLO to divert interest payments from lower-rated tranches to either purchase more collateral or pay down senior CLO holders.

Fed expands stimulus to include CLOs

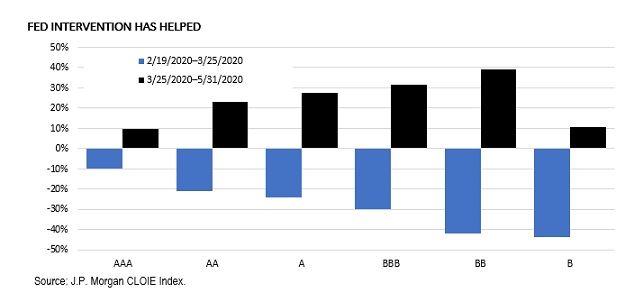

During its initial rescue missions in late March, the Federal Reserve seemingly left CLOs behind. Then, on April 9, the central bank announced CLOs would be included in the Term Asset-Backed Securities Loan Facility (TALF) program, but initial requirements were so rigid that the impact on CLOs was minimal. On May 12, the Fed announced a further easing of restrictions on TALF eligibility. Initially, CLO collateral was limited to newly issued loans (and with the primary loan market all but shut down, this wasn’t much help). Now, collateral can include loans originated any time after January 1, 2019, providing support for new CLO issuance. The Fed also allowed for more covenant-lite loans to back CLO pools. These moves, plus the broader market rally, helped the CLO market. But their recovery, especially in lower-rated tranches, has lagged broader credit on a relative basis.

Current opportunities

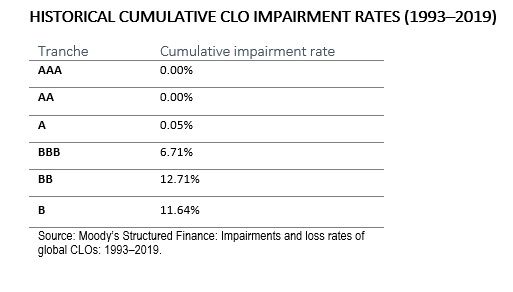

Higher-quality CLO tranches, primarily AAA and AA rated, have performed well in recent weeks, driven by Fed support and an investor base primarily composed of banks, life insurance companies and other long-term investors less likely to be forced sellers. Now we see opportunities in upper mezzanine tranches which have historically proven very resilient with low loss rates. Note that the figures below are cumulative impairment rates over a 26-year period. If annualized, these figures would be well below similarly rated corporate credit.

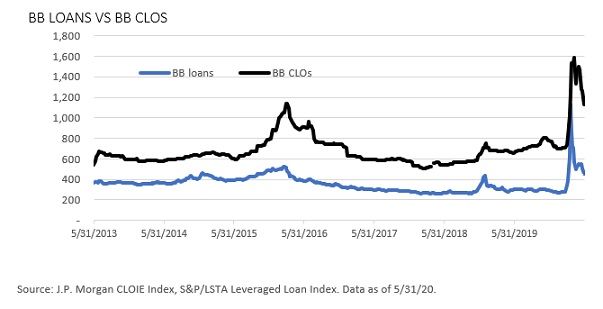

A delayed recovery for the CLO market is not surprising, as historical data shows a tendency for underlying loans to rebound first. Current spread levels indicate we could see further tightening. To date, BB and B rated loans have retraced 80% and 72% of their spread widening, respectively, while BB and B rated CLOs have retraced only 60% and 22%, respectively. Given current index prices, if CLOs were to return to their February highs, that would imply roughly an additional 5.21% return for A rated tranches, 11.22% for BBB rated and 29.65% for BB rated.[1] These numbers are calculated solely on current index prices, do not include yield and exclude the potential benefits of active management. For comparison’s sake, looking at the corporate bond market shows that A rated bonds have already returned to February highs. Current levels imply an additional 2.1% price return for BBB rated and 5.9% for BB rated. So, bearing A rated risk in the CLO market offers the potential of an additional 500 bps return over bearing A rated risk in the corporate market.

Given current index prices, if CLOs were to return to their February highs, that would imply roughly an additional 5.21% return for A rated tranches, 11.22% for BBB rated and 29.65% for BB rated.[1] These numbers are calculated solely on current index prices, do not include yield and exclude the potential benefits of active management. For comparison’s sake, looking at the corporate bond market shows that A rated bonds have already returned to February highs. Current levels imply an additional 2.1% price return for BBB rated and 5.9% for BB rated. So, bearing A rated risk in the CLO market offers the potential of an additional 500 bps return over bearing A rated risk in the corporate market.

Give secondary markets a second look

The Federal Reserve’s actions certainly aided CLOs, as a “don’t fight the Fed” mentality has been evident broadly throughout markets in recent weeks. The Fed’s actions in this space have helped reignite the primary issue market—CLOs had their strongest week of new issuance since February following the Fed’s recent TALF 2.0 expansions. Because CLOs are a key source of demand for senior secured loans, representing roughly 60% of all purchases, the uptick in CLO formation in recent weeks should further boost technical aspects in the loan market. Beyond the primary CLO market, however, we see certain structural elements in the CLO market that make the secondary market equally compelling, which supports our thesis that CLO spreads could tighten further.

- CLOs are (almost) never forced sellers: The tests and triggers we discussed above do not force a CLO liquidation. They are designed as investor protections and are in fact functioning exactly as they should, forcing managers to take actions to de-risk portfolios. Looking at overcollateralization tests, for example, shows that tripping one of these mechanisms does not mean a CLO has defaulted; it simply means that there is less margin of safety. The initial consequence is that cash flow will be directed away from the equity holders of the CLO and toward the debt holders. When establishing a CLO pool, the total value of the underlying assets must exceed the dollar amount of CLO securities issued—essentially, a CLO must be overcollateralized to give a cushion against declining underlying loan values. As of May 20, roughly 19% of CLOs have failed junior overcollateralization tests, meaning payments to the junior and equity tranches may have been temporarily halted and used to either purchase more collateral or satisfy senior obligations. For context, at the peak of the GFC, 56% of U.S. CLOs failed an overcollateralization test, and not a single AAA tranche ever defaulted.

- CLOs are actively managed: Managers can buy and sell underlying collateral, subject to certain limitations. In market environments like today’s, where prices are depressed and yields are high, managers may be able to purchase loans at attractive prices, increasing the overall amount of collateral backing the CLO and benefiting from potential price appreciation as markets recover.

- CLOs are less exposed to technical pressures: Roughly 60%–65% of AAA CLO holders are life insurance companies or banks. These long-term investors are less likely to be in a forced selling position.

- CLOs are transparent: Unlike their financial crisis-causing cousin, CDOs, CLOs backed by syndicated loans are transparent—every loan which underlies them is known, and generally each is rated and may be freely tradable. These are not “black box” investments—managers know exactly what they are buying.

This last point is possibly the most crucial in the current environment. It would be naïve to say for certain that any market, CLOs included, will come out of this COVID crisis completely unscathed. There is just too much we don’t know yet. Not just the underlying loans but CLO tranches themselves have been and will be downgraded—there is little avoiding that—but downgrades do not mean defaults. Managers with the tools and ability to accurately and, perhaps more importantly, quickly assess the underlying pools of loans and the structures that they are in will be best positioned in this environment. If there’s one thing the last few weeks has shown, it’s that things can change—fast. Certain structured products may have shouldered much of the blame back in ’08, but we’d advise those looking to scapegoat CLOs today to take a closer look. [1] J.P. Morgan CLOIE Index. Implied forward return calculated using May 31, 2020 index price. For questions or comments, contact research@fsinvestments.com.

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org