By Doris Bao, FRM and Alex Botte, CFA, CAIA, Client Solutions Research team at Two Sigma

In our previous post on inflation, we covered how the Local Inflation risk factor in Venn, Two Sigma’s risk analytics platform, is constructed and we reviewed its historical performance. The primary conclusion was that the factor is designed to capture exposure to a local-currency inflation hedge that benefits a portfolio or investment when inflation surprises to the upside, but otherwise loses money due to being short the inflation risk premium embedded in nominal bonds. To put it in another way, this factor is like buying an “insurance policy” against inflation. You pay a premium (the inflation risk premium), but if inflation is higher than expected, the “policy” pays off for you.

Now that we understand the factor’s construction and theory behind it, in this post we will analyze three assets that are commonly used by investors as inflation hedges: gold, a TIPS fund, and natural resource equities. We will use Venn’s returns-based regression analysis to understand each asset’s risk exposures, including their sensitivity to inflation hedging risk as proxied by our Local Inflation factor.

- Gold

Gold is widely considered a classic inflation hedge. As mentioned in “What Is the Ultimate Safe-Haven Investment?,” in the case of hyperinflation, paper money like the USD is in greater danger of losing value than claims on hard assets like gold.

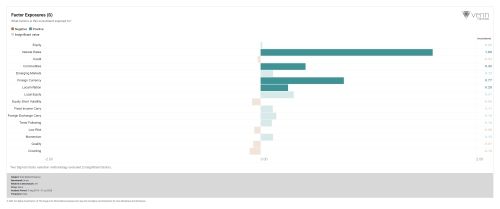

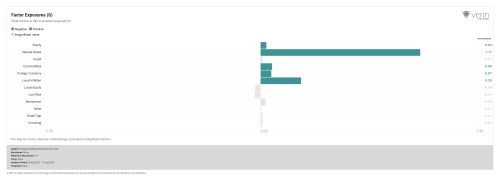

As shown in Exhibits 1 and 2, gold has four main factor exposures (all positive) that drive ~50% of gold’s risk: Interest Rates, Commodities, Foreign Currency, and Local Inflation. The exposure to Commodities is somewhat obvious and expected, so we will spend some time digging into gold’s three other factor exposures.

Exhibit 1: Factor Exposures of Gold

Sources: Venn and Commodity Systems Inc. (CSI). Time period: August 1, 2015 - July 31, 2020, using daily returns.

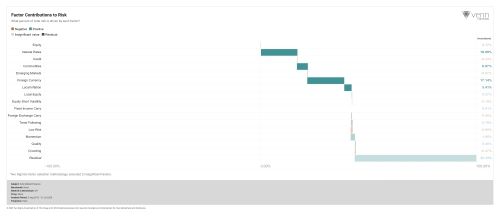

Exhibit 2: Factor Contributions to Risk of Gold

Sources: Venn and CSI. ,Time period: August 1, 2015 - July 31, 2020, using daily data.

First, gold’s exposure to Interest Rates reflects the fact that gold is positively correlated with nominal government bonds globally. This is expected as we mentioned in “Five “Safe-Haven” Assets and Their Performance During the COVID Market Crisis,” bonds and gold are both perceived as safe haven assets. Sometimes gold may even be viewed as a more attractive portfolio diversifier than Treasuries when yields drop (and bond prices rise).

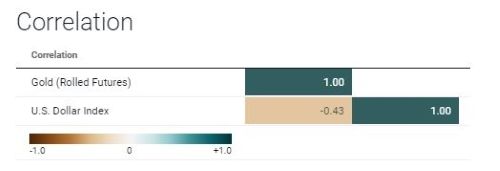

Second, gold’s exposure to the Foreign Currency factor (which is long G10 ex USD currencies funded by a short USD position) highlights that gold has been moving in the opposite direction to the USD. This relationship is also demonstrated by gold’s negative correlation with the U.S. Dollar Index shown below. One major driver 1 of this negative relationship is that gold is denominated in USD, so when USD depreciates relative to other currencies, investors in those countries can buy more gold with the same amount of their local currencies. Thus, demand for gold increases, which then drives up gold prices in USD.

Exhibit 3: Correlation of Gold to U.S. Dollar Index

Sources: Venn and CSI. Time period: August 1, 2015 - July 31, 2020, using daily returns.

In terms of gold’s exposure to the Local Inflation factor, it is important to keep in mind that the Local Inflation factor has been residualized against the four core macro factors: Equity, Interest Rates, Commodities, and Credit. Thus, it only captures the inflation hedge that is above and beyond the hedge that it already has from common risk exposures to these higher-order factors. The inflation hedging functionality of gold has been partly captured by Commodities factor already. Commodities as an asset class are generally considered inflationary hedges 2, so some inflation hedging property has already been embedded in the Commodities factor exposure.

However, there is still some extra inflation hedge exposure that is not captured by the core macro factors. This makes sense, as historically, gold futures have exhibited a negative correlation with real yields. When inflation is expected to increase and nominal yields haven’t caught up 3, real yields will be hurt. At the same time, investors tend to hold more gold to hedge inflation. Gold’s negative relationship with real yields is demonstrated in Exhibit 4 by its positive correlation with inflation-linked bonds (whose prices increase as real yields fall).

Exhibit 4: Correlation of Gold to TIPS Index

Sources: Venn and CSI. Time period: August 1, 2015 - July 31, 2020, using daily returns.

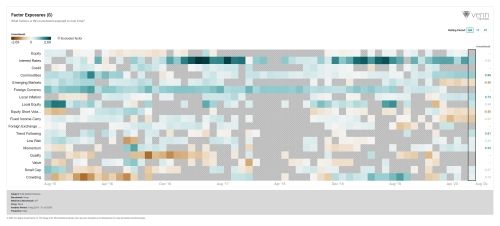

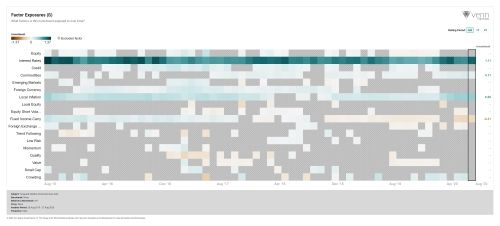

Finally, another interesting observation about gold’s exposure to the Local Inflation factor is revealed by factor trend analysis. In Exhibit 5 we see that while gold’s Local Inflation exposure came in and out during the recent 5 years, it has increased dramatically this year, particularly during the COVID-19 crisis. In fact, the long-term correlation between gold and the Local Inflation factor is only 10%, but has increased to 58% in 2020.4 This suggests that during periods of financial crises, when investors’ fear of high inflation surges, demand increases for inflation-hedging assets like gold, leading to this sudden increase of gold’s exposure to the extra inflation hedge captured by the Local Inflation factor.

Exhibit 5: Trend of Factor Exposures of Gold

Sources: Venn and CSI. Time period: August 1, 2015 - July 31, 2020, using daily returns and a rolling 6-month window.

- TIPS Mutual Fund: Vanguard Inflation-Protected Securities Fund

As discussed above, the raw input to Venn’s Local Inflation factor is an inflation-linked bond index’s excess returns relative to a Treasury index of the same duration. Unfortunately, it would be difficult for the average investor to obtain this long-short exposure directly. However, many investors use TIPS mutual funds as a way to hedge against inflation, even if they are not isolating the interest rate risk.

We’ll analyze one such TIPS mutual fund: the Vanguard Inflation-Protected Securities Fund, which has over $16B in assets as of this writing.5 As mentioned in this Morningstar analyst report, the fund is intended to be a pure-play inflation hedge for its investors. It avoids ancillary risks that some other TIPS funds have by not investing in credit or commodities.

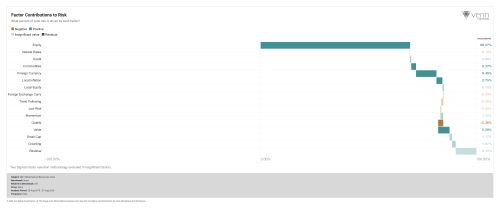

The report also notes that TIPS funds in general tend to invest in bonds further out on the curve, which introduces more interest rate risk relative to intermediate-term bond funds. We see that play out in the factor analysis results with the fund exhibiting an Interest Rates beta greater than 1.0 over the past 5 years and driving the majority of the fund’s risk (~50%, as seen in Exhibit 7). The second important factor in explaining ~25% of the fund’s risk over this period is Local Inflation, with a statistically significant beta of 0.28. A trend analysis in Exhibit 8 suggests that both of these factors have been consistent over this period. Just as in the case of gold, the Local Inflation factor in particular has become more important in the last several months, as seen by the increasingly blue squares in the Local Inflation row all the way to the right of Exhibit 8. Additionally, the correlation between the fund and Local Inflation has increased to 84% in 2020 from its long-term average of 49%.6

These results imply that the fund’s risk predominantly is driven by interest rate fluctuations and has delivered on its intention of providing an inflation hedge, as it would be expected to pay off if inflation surprised to the upside.

Exhibit 6: Factor Exposures of the Vanguard Inflation-Protected Securities Fund

Sources: Venn and Morningstar. Time period: August 28, 2015 - August 27, 2020, using daily data.

Exhibit 7: Factor Contributions to Risk of the Vanguard Inflation-Protected Securities Fund

Sources: Venn and Morningstar. Time period: August 28, 2015 - August 27, 2020, using daily data.

Exhibit 8: Trend of Factor Exposures of the Vanguard Inflation-Protected Securities Fund

Sources: Venn and Morningstar. Time period: August 28, 2015 - August 27, 2020, using daily data and a rolling 6-month window.

- Natural Resource Equities: S&P Global Natural Resources Index

Some investors might consider natural resource stocks to be a good source of protection against inflation, although the hedge might not be as “pure” as some of the other assets we’ve analyzed. These stocks might be influenced significantly by other risk factors like stock market risk and commodities risks that could dilute their effectiveness as an inflation hedge.

We see this displayed in the factor analysis results in Exhibit 9 for a global natural resources stock index. The index exhibits a global Equity beta greater than 1.0, indicating more sensitivity than average to the stock market. Among its other factor exposures is commodities risk with a statistically significant beta to the Commodities factor of 0.34. Finally, there is positive Foreign Currency exposure, likely due to the global nature of the index and the stocks within it being sensitive to foreign currency fluctuations relative to the USD. These three risks accounted for over 80% of the index’s volatility. The positive Local Inflation beta of 0.22 was statistically significant, but it only contributed less than 3% to the risk of the index. As expected, the inflation hedging aspect of natural resource stocks, as proxied by this index, was out shadowed by other, more predominant factor risks.

Finally, similar to what we observed for the TIPS mutual fund and gold, the exposure to the Local Inflation factor appears to have increased recently, as seen in Exhibit 11, and the index’s correlation with the factor in 2020 is 63%, compared to its long-term average of 21%.7 However, it’s also interesting to note that this exposure has been inconsistent over the period, only becoming important to the index more recently. Its contribution to the index’s volatility is rising as well, although still immaterial. The index’s most consistent, dominant risk factor appears to be Equity.

Exhibit 9: Factor Exposures of the S&P Global Natural Resources Index

Sources: Venn and SIX. Time period: August 28, 2015 - August 27, 2020, using daily data.

Exhibit 10: Factor Contributions to Risk of the S&P Global Natural Resources Index

Sources: Venn and SIX. Time period: August 28, 2015 - August 27, 2020, using daily data.

Exhibit 11: Trend of Factor Exposures of the S&P Global Natural Resources Index

Sources: Venn and SIX. Time period: August 28, 2015 - August 27, 2020, using daily data and a rolling 6-month window.

In conclusion, factor analysis using Venn’s Local Inflation factor is a quantitative way to gauge how hedged your portfolio or investments are to inflation in the local currency area (above and beyond the hedge from higher-order factors). In this post, we analyzed three assets that are typically viewed by investors as inflation hedges and reviewed their factor output. Visit the Vennsights blog to read our next post about inflation where we will discuss the current inflation environment and provide a few practical workflows for asset allocators that are managing their portfolio’s risk and inflation sensitivity during these uncertain times.

Doris Bao, FRM and Alex Botte, CFA, CAIA are on the Client Solutions Research team at Two Sigma, focusing on the research of new factors and methodologies for the Two Sigma Venn platform. They can be reached at doris.bao@twosigma.com and alex.botte@twosigma.com respectively.