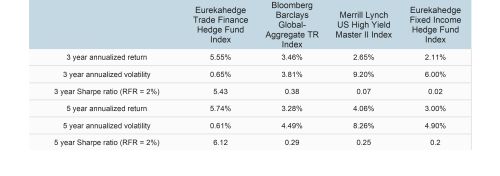

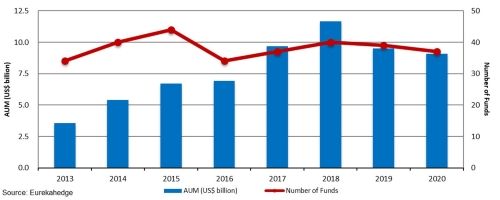

By Annie Yung 2020 certainly has had many challenges across markets, and trade finance has been no exception. Trade finance is critical for global companies for support of operations and to enable the expansion of trade and growth. The COVID-19 pandemic has fueled a growing funding gap and has exposed supply chain vulnerabilities, with real economy participants pressured to seek alternative funding sources. This has created an opportunity for institutional investors in search of yield that complements existing portfolios with credit, duration, and liquidity diversification. Trade finance includes several different forms of financing and payment methods to facilitate domestic and international trade of manufactured goods and commodities. Commodity trade finance supports end-to-end commodity flows across the energy, agricultural and metal commodity value chains, including producers, processers, consumers, and traders. Trading intermediaries, such as banks and other financial institutions, provide many financial products to reduce payment and supply risk. Financing solutions can provide advance payment to the seller, while extending payment terms to the buyer, enabling both parties to manage working capital more efficiently. In our opinion, trade finance-related investments provide superior risk-adjusted total returns (i.e., vs. Treasuries) with historically low volatility, consistent cash flow, and low correlation to other asset classes. Eurekahedge Trade Finance Hedge Fund index returned 5.34% and 6.7% in 2019 and 2018, respectively.  Source: Eurekahedge as of May 31, 2020 The International Chamber of Commerce (ICC) estimated that in 2016 the total global trade finance market was approximately US$16 trillion and predicts that it will reach US$19 trillion in 2020. In the wake of the pandemic, a significant funding shortfall is expected. In July 2020, the WTO and ICC issued a joint statement estimating that up to US$5 trillion may be required to finance a rapid rebound in global trade flows. With the growing complexities of global trade, supply chain finance solutions are more critical than ever for companies managing working capital and operational needs. Reduced liquidity and higher trade credit insurance premiums have driven credit spreads higher across the board.

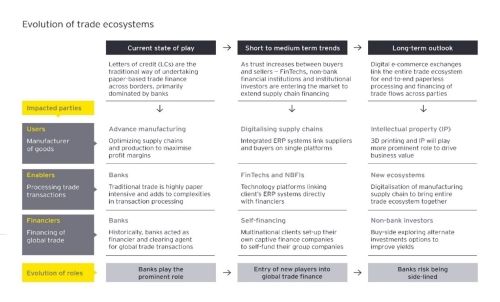

Source: Eurekahedge as of May 31, 2020 The International Chamber of Commerce (ICC) estimated that in 2016 the total global trade finance market was approximately US$16 trillion and predicts that it will reach US$19 trillion in 2020. In the wake of the pandemic, a significant funding shortfall is expected. In July 2020, the WTO and ICC issued a joint statement estimating that up to US$5 trillion may be required to finance a rapid rebound in global trade flows. With the growing complexities of global trade, supply chain finance solutions are more critical than ever for companies managing working capital and operational needs. Reduced liquidity and higher trade credit insurance premiums have driven credit spreads higher across the board.  Source: Ernst & Young While banks provide most financing to the market, some are exiting the space due to an increase in regulatory requirements, capital costs, and specialized resources required to support the business. For finance trades, banks and investors must rely on paper records of invoices, bills of lading, commercial contracts, and inspection certificates to manage collateral. COVID-19 has further highlighted the market’s unsustainable reliance on paper records. Specifically, the reliance on paper-based processes requires significant resources and expertise, including in-person staff. With these challenges exposed, the magnitude and pace of automation are likely to increase exponentially. Technology investments and adoption will be critical for participants across the market. While trade finance has been around for centuries, it does require a significant amount of expertise to originate, structure, and manage risk. New investors including asset managers and insurance companies in search of yield are emerging. Investors can invest directly in a transaction or in a pool of transactions through an investment vehicle (e.g., fund or SPV). Trade related private credit transactions include, but are not limited to, import/export, inventory, and receivables/payables financing. Financing is used to manage short-term working capital needs of companies and average between 90-120 days in tenor. Deals are typically scalable and repeatable, with returns determined by underlying credit, deal structure and jurisdiction. Traditionally, institutional investors have participated through syndication facilities or intermediaries who provide market expertise, origination capabilities and infrastructure. Managers of the funds or SPVs tend to focus on specific sectors and/or regions where they have significant expertise. This alleviates the onerous due diligence, infrastructure, and technology investments required to support transactions. The trade finance market is evolving, and there is an opportunity for institutional investors to meet the real economy’s growing demand for trade finance solutions.

Source: Ernst & Young While banks provide most financing to the market, some are exiting the space due to an increase in regulatory requirements, capital costs, and specialized resources required to support the business. For finance trades, banks and investors must rely on paper records of invoices, bills of lading, commercial contracts, and inspection certificates to manage collateral. COVID-19 has further highlighted the market’s unsustainable reliance on paper records. Specifically, the reliance on paper-based processes requires significant resources and expertise, including in-person staff. With these challenges exposed, the magnitude and pace of automation are likely to increase exponentially. Technology investments and adoption will be critical for participants across the market. While trade finance has been around for centuries, it does require a significant amount of expertise to originate, structure, and manage risk. New investors including asset managers and insurance companies in search of yield are emerging. Investors can invest directly in a transaction or in a pool of transactions through an investment vehicle (e.g., fund or SPV). Trade related private credit transactions include, but are not limited to, import/export, inventory, and receivables/payables financing. Financing is used to manage short-term working capital needs of companies and average between 90-120 days in tenor. Deals are typically scalable and repeatable, with returns determined by underlying credit, deal structure and jurisdiction. Traditionally, institutional investors have participated through syndication facilities or intermediaries who provide market expertise, origination capabilities and infrastructure. Managers of the funds or SPVs tend to focus on specific sectors and/or regions where they have significant expertise. This alleviates the onerous due diligence, infrastructure, and technology investments required to support transactions. The trade finance market is evolving, and there is an opportunity for institutional investors to meet the real economy’s growing demand for trade finance solutions.  Sources: Allied Market Research, Bloomberg, Ernst & Young, EurekaHedge, Finastra, ICC, WSJ, WTO Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information and discussion purposes only. Annie Yung is a Managing Director at Argentem Trade Services (ATS). ATS provides investable short-duration, trade related credit assets in the metals and minerals sector. Annie has more than20 years of experience in financial and commodity markets. Sources: How Corporate Banks Can Ride the Disruptive Wave of Global Trade Insurance Snarls U.S. Supply Chains ING Alleges Father-Son Fraud After Commodity Fund Collapses Money Managers Lured by Rich Returns Venture into Risky World of Trade Finance Trade-Finance-Fund-Managers-Outperformed-Major-Hedge-Fund-Strategies-Amidst-COVID-19-Pandemic-Strategy-Profile-June-2020 Trade Finance Market Outlook Trade Financing and Covid 19 WTO, ICC and B20 Call for Action to Narrow the Growing Trade Finance Gap

Sources: Allied Market Research, Bloomberg, Ernst & Young, EurekaHedge, Finastra, ICC, WSJ, WTO Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information and discussion purposes only. Annie Yung is a Managing Director at Argentem Trade Services (ATS). ATS provides investable short-duration, trade related credit assets in the metals and minerals sector. Annie has more than20 years of experience in financial and commodity markets. Sources: How Corporate Banks Can Ride the Disruptive Wave of Global Trade Insurance Snarls U.S. Supply Chains ING Alleges Father-Son Fraud After Commodity Fund Collapses Money Managers Lured by Rich Returns Venture into Risky World of Trade Finance Trade-Finance-Fund-Managers-Outperformed-Major-Hedge-Fund-Strategies-Amidst-COVID-19-Pandemic-Strategy-Profile-June-2020 Trade Finance Market Outlook Trade Financing and Covid 19 WTO, ICC and B20 Call for Action to Narrow the Growing Trade Finance Gap

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org