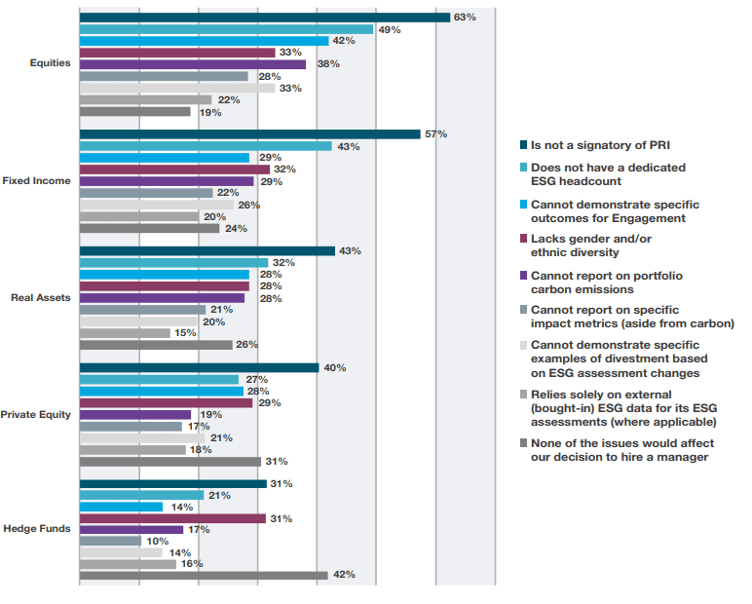

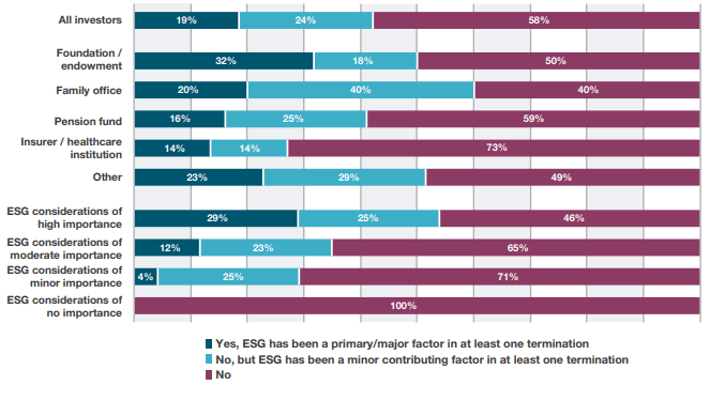

By Aaron Filbeck, CFA, CAIA, CIPM, FDP, Director of Global Content Development at CAIA Association “In a real magic act, everything is fake.” – Wanda Maximoff, WandaVision (2021) A harmless phrase used in the latest addition to the Marvel Cinematic Universe, WandaVision. The protagonist, Wanda Maximoff, has created a false reality by using her mind-control powers to take over a small town and create her own suburban utopia. Only, none of it’s real. And as we get further into the story, we begin to see cracks in the system. People temporarily breaking out of the perfect life that Wanda has created for them. But perfection is in the eye of the beholder, and the only person Wanda is fooling is herself. ESG’s Infinity War As always, I have to find a way to bring pop culture into my writings, and this week’s victim is ESG. I consider myself a fan of ESG, and CAIA Association has certainly embraced it through our educational outlets. But, to me, there is a difference between the ESG issues worth considering and the implementation of ESG products and processes. I believe we are in the early stages of the latter. Call it greenwashing, or just a wash-out, but we have a ways to go in this regard. Supply and demand has played a part in the recent and rapid adoption of ESG throughout the investment process. In some regard, active asset managers face mounting pressures to deliver higher excess returns (and keep those clients invested to collect those fees), and institutional investors are facing increased pressure to become more environmentally and socially conscious around the investments they own. The comfort of the false reality A recent survey of asset owners found that 60% of institutional investors believe that ESG issues play a major role in manager selection, up from just 41% two years prior. It’s encouraging to see investors are beginning to pay attention to important issues such as climate change, stakeholder wellbeing, and good corporate behavior, but it’s still very difficult to see how that plays out in practice. According to the survey, simply being a PRI signatory and/or having someone on staff with “ESG” in their title seemed to check the boxes for many allocators (see Figure 1). Yet, demonstrating ESG integration, such as providing carbon emissions data, impact metrics, or examples of divestment/escalation, fell further down the list – something that should concern even the most evangelical ESG proponent. The PRI itself, which aims to educate investors, has lamented the shallower motivations of some signatories, who “have joined the PRI, not out of any desire to incorporate sustainability into their investment practices, but to win mandates.” In turn, PRI’s CEO Fiona Reynolds says her organization has worked hard to raise minimum standards and argues that “being a PRI signatory should not be the only due diligence test for investors.” Figure 1: Reasons NOT to Hire a Manager Based on ESG Issues Source: BFinance  ESG violations typically had little sway on the firing of managers (see Figure 2). If I can crudely summarize, ESG is important to asset owners but not important enough to fire an existing manager? Where is the disconnect? Why go through all that effort on the front end, only to keep violators on the back end? Figure 2: Has an ESG Issue Led to a Manager Termination? Source: BFinance

ESG violations typically had little sway on the firing of managers (see Figure 2). If I can crudely summarize, ESG is important to asset owners but not important enough to fire an existing manager? Where is the disconnect? Why go through all that effort on the front end, only to keep violators on the back end? Figure 2: Has an ESG Issue Led to a Manager Termination? Source: BFinance  Determining what’s real and what’s not Mr. Hart: You know, I owe my success to being a keen judge of character. No skeletons in your closet, eh, Vision? Vision: I don’t have a skeleton, sir. Mr. Hart: Glad to hear it. Your future in this company depends on it. A silly exchange in one of the earlier episodes of the WandaVision but still a nice parallel. Pay no attention to the man behind the curtain! Vision is not human by any means, but he walks, talks, and interacts with everyone else as if he is. I guess we could say he’s greenwashing as a human! Like Vision’s human-ness, it’s become harder and harder to differentiate the real from the fake, and investors have to dig a little deeper and ask better questions. “How do you link ESG issues to better outcomes in the portfolio?” As a fiduciary, the most important thing we can do for our clients (whether they are individuals or beneficiaries) is achieve the best possible outcomes on their behalf. If ESG 1.0 was about doing good, ESG 2.0 is about doing well while doing good, and ESG investing is some kind of “factor” or secondary lens that an investor uses to make sure companies (or managers) are “compliant.” Even if the jury is out on performance (we can look at aggregates that suggest there is a case for ESG in returns, but micro-level results still somewhat conflict), let’s think about this more conceptually. With the proliferation of data and ratings providers, we may be missing the point of the exercise. Rather than creating a dashboard of ESG factors, and hoping for all green, perhaps we should go back to basics and ask simpler questions, like how might climate change and the resulting carnage impact this manager’s positioning? Or how might lapses in social awareness increase the reputational risks within their portfolio? A wise woman once said, “If I were told ‘here’s an additional set of tools you can use that may or may not lead to lower risk, higher risk-adjusted returns, and better outcomes,’ I would be foolish to not at least consider it.” ESG isn’t political or the be-all and end-all, it’s another data point in a mosaic of the decision-making process. Consensus remains undecided on the performance benefits of ESG, but perhaps incorporating it could lower your risk and left-tail events? “How are you supposed to engage with a company, when you have no stake in that company’s future?” This was one of the most important questions brought up at a recent panel discussion I moderated for PensionBridge ESG Summit 2021. Divestment has become a headline issue for many institutional asset owners, especially for endowments, who have experienced increased pressure to divest from fossil fuel investments. The question becomes this: as a pool of long-term capital, is it good enough to abdicate engagement, avoid landmines, and simply be a bystander? So far, it seems like it’s worked out. A recent study argued that endowment performance has largely been unimpacted by their divestment decisions over the past decade – but this was largely over a period where energy and commodities have underperformed the rest of the portfolio, to the point where energy’s representation in listed equity indexes are a fraction of what they once were. Correlation doesn’t necessarily mean causation…we still have a multi-trillion dollar economy that remains highly dependent on fossil fuels and energy (weakening as it might be). For a long-term investor, the financial opportunity might be in the change in corporate behavior (otherwise known as ESG momentum) rather than the absolute level. For those who choose to engage with companies, “How do you promote a more inclusive work culture?” Preqin recently identified that less than 20% of employees were women in the alternative investments industry, and less than 12% represented senior roles. Diversity is sorely lacking in this profession, which suggests we may be missing an opportunity for better decision-making. Look no further than Meredith Jones, who has done far more in-depth research on the topic and suggests that a lack of diversity is “making us poorer.” Diversification extends beyond portfolios of asset classes; it expands to the teams that manage them, and we must ask better questions around intentionality of senior leadership. It’s easier to look at an org chart and count the proportion of white males, or see a statement of commitment, than to dig deep into the underlying intentions of those in power. Diversity responsibilities don’t simply rest on the shoulders of GPs, either. Before LPs get into corporate culture and team dynamics, they typically screen prospective managers out. But, how can you expect to get ahead if you can’t ever get ahead? In a field that’s largely been dominated by homogeneity, even the standard metrics that allocators consider before committing capital may carry implicit biases of their own – minimum track record, minimum assets under management are two of the most common. How can you compete as a newcomer in a world where the rules favor the established? The season finale Wanda Maximoff: Vision, this is our home. Vision: Then let’s fight for it. The way we get ahead in this business is by asking better questions and having the humility to admit we don’t know what we don’t know. After all, fiduciaries are always defending their “home”: their clients and beneficiaries. In due diligence, we already can’t take things at face value. In ESG, we really can’t take things at face value – sometimes, reality is worth discovering.

Determining what’s real and what’s not Mr. Hart: You know, I owe my success to being a keen judge of character. No skeletons in your closet, eh, Vision? Vision: I don’t have a skeleton, sir. Mr. Hart: Glad to hear it. Your future in this company depends on it. A silly exchange in one of the earlier episodes of the WandaVision but still a nice parallel. Pay no attention to the man behind the curtain! Vision is not human by any means, but he walks, talks, and interacts with everyone else as if he is. I guess we could say he’s greenwashing as a human! Like Vision’s human-ness, it’s become harder and harder to differentiate the real from the fake, and investors have to dig a little deeper and ask better questions. “How do you link ESG issues to better outcomes in the portfolio?” As a fiduciary, the most important thing we can do for our clients (whether they are individuals or beneficiaries) is achieve the best possible outcomes on their behalf. If ESG 1.0 was about doing good, ESG 2.0 is about doing well while doing good, and ESG investing is some kind of “factor” or secondary lens that an investor uses to make sure companies (or managers) are “compliant.” Even if the jury is out on performance (we can look at aggregates that suggest there is a case for ESG in returns, but micro-level results still somewhat conflict), let’s think about this more conceptually. With the proliferation of data and ratings providers, we may be missing the point of the exercise. Rather than creating a dashboard of ESG factors, and hoping for all green, perhaps we should go back to basics and ask simpler questions, like how might climate change and the resulting carnage impact this manager’s positioning? Or how might lapses in social awareness increase the reputational risks within their portfolio? A wise woman once said, “If I were told ‘here’s an additional set of tools you can use that may or may not lead to lower risk, higher risk-adjusted returns, and better outcomes,’ I would be foolish to not at least consider it.” ESG isn’t political or the be-all and end-all, it’s another data point in a mosaic of the decision-making process. Consensus remains undecided on the performance benefits of ESG, but perhaps incorporating it could lower your risk and left-tail events? “How are you supposed to engage with a company, when you have no stake in that company’s future?” This was one of the most important questions brought up at a recent panel discussion I moderated for PensionBridge ESG Summit 2021. Divestment has become a headline issue for many institutional asset owners, especially for endowments, who have experienced increased pressure to divest from fossil fuel investments. The question becomes this: as a pool of long-term capital, is it good enough to abdicate engagement, avoid landmines, and simply be a bystander? So far, it seems like it’s worked out. A recent study argued that endowment performance has largely been unimpacted by their divestment decisions over the past decade – but this was largely over a period where energy and commodities have underperformed the rest of the portfolio, to the point where energy’s representation in listed equity indexes are a fraction of what they once were. Correlation doesn’t necessarily mean causation…we still have a multi-trillion dollar economy that remains highly dependent on fossil fuels and energy (weakening as it might be). For a long-term investor, the financial opportunity might be in the change in corporate behavior (otherwise known as ESG momentum) rather than the absolute level. For those who choose to engage with companies, “How do you promote a more inclusive work culture?” Preqin recently identified that less than 20% of employees were women in the alternative investments industry, and less than 12% represented senior roles. Diversity is sorely lacking in this profession, which suggests we may be missing an opportunity for better decision-making. Look no further than Meredith Jones, who has done far more in-depth research on the topic and suggests that a lack of diversity is “making us poorer.” Diversification extends beyond portfolios of asset classes; it expands to the teams that manage them, and we must ask better questions around intentionality of senior leadership. It’s easier to look at an org chart and count the proportion of white males, or see a statement of commitment, than to dig deep into the underlying intentions of those in power. Diversity responsibilities don’t simply rest on the shoulders of GPs, either. Before LPs get into corporate culture and team dynamics, they typically screen prospective managers out. But, how can you expect to get ahead if you can’t ever get ahead? In a field that’s largely been dominated by homogeneity, even the standard metrics that allocators consider before committing capital may carry implicit biases of their own – minimum track record, minimum assets under management are two of the most common. How can you compete as a newcomer in a world where the rules favor the established? The season finale Wanda Maximoff: Vision, this is our home. Vision: Then let’s fight for it. The way we get ahead in this business is by asking better questions and having the humility to admit we don’t know what we don’t know. After all, fiduciaries are always defending their “home”: their clients and beneficiaries. In due diligence, we already can’t take things at face value. In ESG, we really can’t take things at face value – sometimes, reality is worth discovering.

←

Back to Portfolio for the Future™

Educational Alpha | Breaking the Fourth Wall of ESG

March 14, 2021