By William (Bill) J. Kelly, President, and CEO of the CAIA Association.

A View Through the $WRBY Readers

“How about the next line up?... that dreaded gut punch coming out of the visual acuity test! Few of us will escape it, and it is humbling when you realize that you couldn’t decipher the simple letter E that once seemed like the size of an elephant for so many taking this test in our early elementary years. It turns out that many things in life are not as they might always appear. The recent public offering of the Warby Parker ($WRBY) shares was not only a product that solves for the aforementioned affliction, but it also brought into focus some important investment themes that don’t always get the attention they deserve.

The democratization trend continues a relentless march toward greater retail access to the private markets. This would seem to be a necessary consequence as the individual is now the one responsible for their investment and longevity risks as a consequence of the secular decline in defined benefit pension plans around the world. Under such a scheme, the institutional fiduciary had broad and unfettered asset class access to construct the very best risk adjusted portfolio and to also match long-dated liabilities against less liquid investment options such as private equity. Why then, should the ‘little guy’ not be able to capture that same illiquidity and complexity premia that cannot be had in the public markets?

Well, just like that fuzzy E on the eye chart, the former has been diluted in a deep sea of dry powder, and the latter has become challenged by the increasing efficiencies in the private markets where (according to Pitchbook) median buyout multiples in the IT sector stood at 20 times EBITDA in 2020. The DeFi notion of greater liquidity via tokenization (a feature that is often mischaracterized as a benefit) will only further dent the value proposition of this premia advantage. Perhaps it is time to review the bidding through a fashionable pair of those anti-reflective and scratch-free readers and this you can do from your home too.

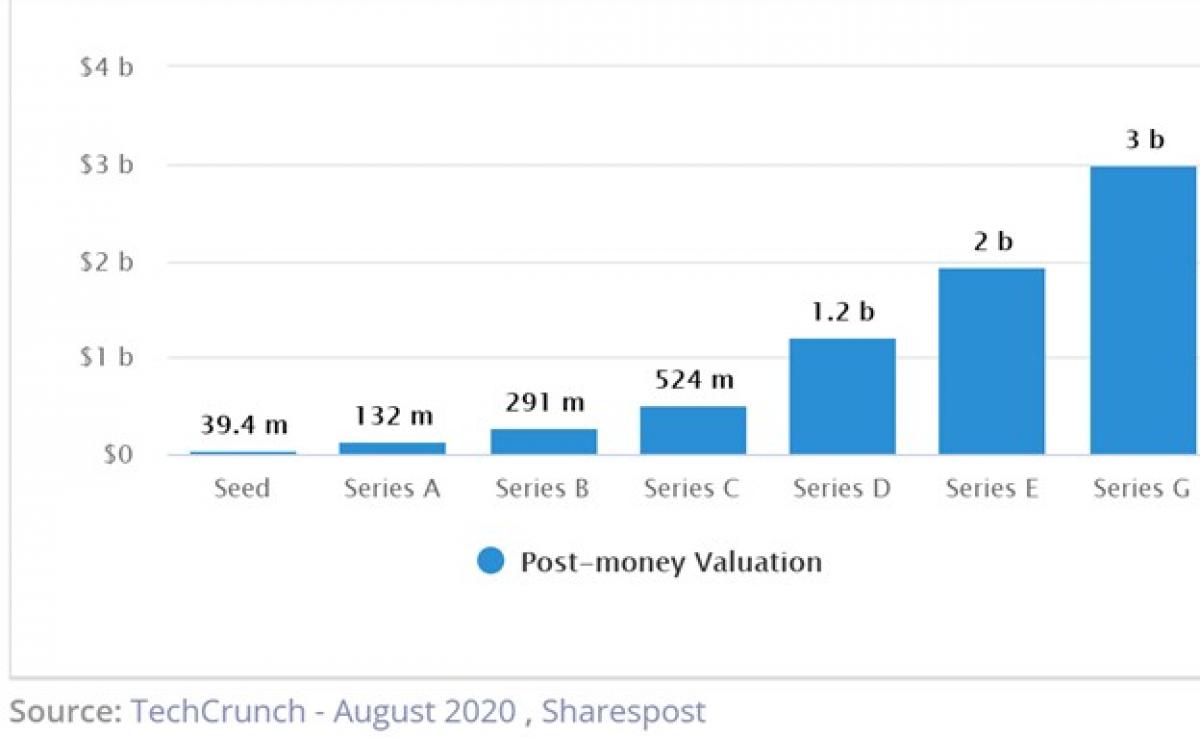

An interesting 2019 piece from our friends at Thinking Ahead Institute has actually aged quite well. On their page five they focused on Spotify as a base case of an IPO that was not offering anything new, and they very easily could make the parallel case for the $WRBY DPO just last month. This fact-based analysis highlights the very best value proposition for accessing the private markets and it has nothing to do with an illiquidity premium, or anything that is even remotely complex… in fact, it is quite simple. The home of capital formation and value creation is now (mostly) in the private markets, and the Series funding rounds and attendant valuations for $WRBY over the 12 years it was a private company tell the real story.

The Series G round happened just over a year ago and the DPO gave that group of investors a cool unlevered 2X+ return in a very short period; a paltry sum when compared to the IRR on the earlier rounds, but what about the fortunate public market participant? They got in at the public version of a “Series H” round which closed at a valuation of $6.8B, where they were the liquidity providers for the sellers from those early seed rounds. Value creation from here is open to discussion and maybe debate, but the prospects and challenges seem clear through a Forbes lens.

Armed with this 20/20 hindsight, perhaps it is time for a focus on a new investment acuity. Let us stop talking about ‘illiquidity’ and ‘complexity’ as the drivers of the asset class premium offered by private equity, and focus instead on how we can get every investor greater access to an earlier entry point in capital formation chain.

Seek education, diversity of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

About the Author:

William (Bill) J. Kelly, CEO of the CAIA Association, is an asset management industry veteran with extensive managerial and boardroom experience gained through successive CFO, COO, CEO and Independent Board director roles.

He has led both start-ups and full-scale global organizations. Bill is the former CEO of Robeco Investment Management, a subsidiary of the Netherlands-based global asset management organization with over $200 billion of assets under management, where he oversaw all aspects of United States business, including portfolio management, distribution and product development. He also was responsible for the strategic growth, introduction, and positioning of new managed products in the US and Europe, including alternative investments. Bill was a founder and former CEO of Boston Partners Asset Management, a self-funded partnership enterprise, which became one of the industry’s largest and most successful start-up money management organizations. Previous to that, he served as CFO of The Boston Company Asset Management and earlier in his career held various positions at Bear Stearns and was an auditor at PricewaterhouseCoopers.