By Jonathan Cornish, CFA, is the Founder & Portfolio Manager of 38x Holdings - a long-biased investment firm based in Miami, Florida.

“Performance comes, performance goes. Fees never falter.” - Warren Buffett, 2017 letter to Berkshire Hathaway shareholders.

A common assumption in investing is that performance fees align incentives between investment managers and their clients. “Management fees encourage asset gathering, while performance fees encourage performance”, the thinking goes.

This is fuzzy thinking - one that I engaged in a few years back, I’ll admit.

There are many ways to demonstrate this. Let me start by showing how performance fees encourage asset gathering (contrary to the accepted wisdom that performance fees discourage asset gathering by encouraging performance).

Imagine two hedge fund managers: Manager A and Manager B - both of whom charge their clients a 20% performance fee (that crystallizes at the end of each year) over a hurdle (the return of the stock market) and a 0% management fee.

For year 202X the stock market is up 10%.

Manager A has $100 million in AUM and generates 50% gross performance for the year (generating $50 million in gross performance, $40 million in gross excess performance over the market, and $8 million in performance fees). Manager A outperforms the stock market by 40% on a percentage basis for the year.

Manager B has $10 billion in AUM and generates 11% gross performance for the year (generating $1.1 billion in gross performance, $100 million in gross excess performance over the market, and $20 million in performance fees). Manager B outperforms the stock market by 1% on a percentage basis for the year.

Manager A’s performance is 39% superior to Manager B on a percentage basis. Despite this, Manager A receives $12m less than Manager B in performance fees.

This example demonstrates that hedge fund managers focused on maximizing their own performance fee generation are incentivized to grow assets even at the degradation of performance[i].

A counter argument to this is that management fees scale linearly with asset growth, while performance fees don’t (if we assume that performance decays alongside asset growth). That may be so (unless the manager implements loyalty discounts on management fees or otherwise steps down management fees as assets grow), but if the manager believes he can outperform at high levels of assets then he will still generate more performance fees from growing assets and thus the manager will still be incentivized to grow assets. Linear or not, more assets drive more performance fees.

In my 6 years as an allocator, I heard multiple managers tell me with a straight face that the reason why they charged performance fees was to align their incentives with ours. This always made me shudder.

In this article I demonstrate several reasons why performance fees aren’t all they’re cracked up to be, and several ways in which we can show management fees to be less onerous than is popularly believed.

But before we get into that, let’s discuss the statistics behind performance fees:

Researchers found that hedge funds with headline, contractual performance fees of 20% charge an effective performance fee of 50% over time - a staggering figure.

These researchers analyzed the returns of over 6,000 hedge funds from 1995 to 2016. The discrepancy between the contractual performance fee of ~20% and the effective performance fee of ~50% stems from the following:

- Performance fees do not “cross” across funds, and

- Investment managers (and their allocators) often discontinue investment activity following losses.

Performance Fees Do Not “Cross” Across Funds

Investors cannot offset gains & losses across funds.

As the researchers (Ben-David, Birru and Rossi) put it:

“The aggregate profits from [an allocator’s portfolio of hedge funds] combine the results of winning and losing funds; however, the losses produced by losing funds cannot be used to diminish the incentive fees owed to winning funds. A particularly absurd illustration of this mechanism occurred in 2008. Despite the aggregate loss of $147.1bn before fees (-26.6%), [allocators] still paid incentive fees of $4.4bn in that year. Thus, the cross-sectional variation in hedge fund performance causes the aggregate ratio of performance fees-to-profits to be higher than the nominal performance fee rate. The lack of cross-fund performance netting also gives hedge funds an incentive to offer multiple investment strategies using separate vehicles (i.e., becoming fund families) rather than consolidating them into a single fund.”

There are arguments for why incentive fees make sense at the individual hedge fund level. But for allocators, who have portfolios of hedge funds, the performance fee structure is a costly way to operate. What makes sense at the individual manager level does not necessarily make sense at the allocator level.

Investment Managers (and Their Allocators) Often Discontinue Investment Activity Following Losses

Most hedge funds have a high-water mark provision which stipulates those allocators don’t pay incentive fees unless the hedge fund is above their prior peak (performance-wise). Many investors contend that the high-water mark mitigates some of the issues of performance fees. This is true, however high-water marks do not completely alleviate these issues.

When hedge fund managers are well below their high-water mark, it can take several years for them to recover above that HWM. During that time, the hedge funds are likely to experience outflows from disappointed investors as well as a lack of inflows from new investors. This reduces the asset base from which the fund can charge management fees at the same time as performance fees are zero, making it difficult to compensate employees at high levels.

Issue #1: Hedge Funds Often Close Down When Below Their HWM:

Many hedge funds shut down while they are under their high-water mark. Faced with a poor track record, these managers know it’ll take many years for them to turn their track record around (if they ever do) and raise new assets, and they know that they won’t be able to charge performance fees until they either raise new assets and/or get back above their high-water mark. Faced with this dilemma, many managers choose to shut down (either permanently, or they shut down only to reopen under a new firm name a few years later).

But when a fund is liquidated following losses, allocators lose the ability to earn back their capital without paying performance fees. For example, if Manager X is down 20% and then shuts down, and the allocator redeems their $80 (down 20% from $100) and then invests it into another hedge fund that generates +25% gross performance taking that $80 up to $100, then the allocator will have to pay $4 in performance fees and they will actually have $96, despite standing still on a gross performance basis. If they were still invested in the first fund, then that +25% performance would not have had any corresponding performance fees paid on it and they would have their full $100. For a fund without a HWM that doesn’t close, the allocators would pay performance fees twice, too. This is exactly what HWMs are supposed to prevent. However, the very presence of HWMs can make it likely that managers shut down. Thus, HWMs don’t always serve their purpose.

Issue #2: Allocators Redeem from Managers with Poor Recent Performance

Furthermore, many allocators redeem from managers that are under their high-water mark (because the allocators are disappointed with the managers’ recent underperformance). This is due to return-chasing behavior from allocators. Redeeming capital from funds that are underwater is a poor strategy for the aforementioned reason.

As an allocator I would rather have a high-water mark in place than not have it, but you have to be aware that high water marks have their drawbacks, too. High water marks make investment firms more fragile and can perversely contribute to the very problem they are meant to solve (a discrepancy between total performance and fees paid).

“Heads I Win; Tails You Lose”

Performance fees represent a “heads I win, tails you lose” proposition for managers.

To demonstrate this, picture you & I going to Las Vegas together. In Vegas you generously (naively?!) give me a portion of your hard-earned money for me to play the slot machines, and you pay me 20% of the profits I generate there on your capital. Of course, this is a great proposition for me, but not so great for you: Heads I win, tails you lose.

The stock market is not a lottery system like Vegas, although there are a lot of similarities. However, this analogy is useful to conceptualize the principal-agent problems associated with money management, particularly when performance fees are involved. For money managers, performance fees that crystallize annually are akin to an option with an expiry on December 31 every year that the manager is in business.

Performance Fees Are an Option for Managers

For a wealth-maximizing manager, a return stream of +50%, -33%, - 20% could be desirable, even though it’s a poor return stream for allocators. If rational, self-interested hedge fund managers had the option to secretly “sign up” to that return stream, many would - even though it’d be a terrible deal for clients.

This return stream illustrates the problem of annual crystallization as much as it illustrates the problem of optionality. It’s hard to disaggregate the two, because an option is only valuable if it can be exercised (such as it can be annually with annual crystallization).

It's worth considering the value of optionality for fund families when the fees don’t cross across funds. Consider two options for a fund manager with $1 billion in AUM:

- The manager generates a performance fee on an equally weighted basket of 500 stocks that returns 20% in aggregate for the year, or

- The manager generates a performance fee on each of those 500 underlying stocks (the manager has an equal amount invested in each of these stocks).

Running this analysis for stocks that range in performance from -80% to +120% (such that the return of the whole index is +20%), the value of the first option is $40 million, whereas the value of the second option is $359 million. The reason for the discrepancy is that the manager is able to charge a performance fee on each of the stocks that rise, while not having the negative-returning stocks net against the performance of the positive-returning stocks.

It’s the same principle for annual crystallization as it is for fund families – except that instead the of the option being across stocks each year, the option is across time. The more frequently the option can be exercised, the more valuable it is – just the same as the more options one has in general, the higher the expected payout is from these options in aggregate.

Performance fees are, in effect, an option on future performance. Clients don’t view their own capital as an option, but many performance-fee-charging managers do.

Annual Crystallization Is a Rip-off

If this all seems a bit theoretical, a real-world example of this occurred in January 2021. A well-respected hedge fund with ~$10bn in AUM was up ~50% net in 2020 and crystallized ~$1bn in performance fees on December 31st, 2020. By the end of January 2021, the fund was down 53%, according to the Wall Street Journal (down ~25% gross on a 13-month basis, which is hardly a disaster but also doesn’t justify charging performance fees for). 12 months is an arbitrary time-period over which to charge fees, as this example shows.

The same thing happened with a discretionary macro hedge fund, according to Bloomberg. The partners of this hedge fund were paid $1.2 billion in fees for the fiscal year ending March 31, 2021, after the firm generated a 44% return for the prior year. However, the fund lost 25% over the following 6 months, meaning that their total return over the period was +8%, compared to a +19% gain on average for hedge funds over that period. If this firm’s performance fee crystallized every 18 months instead of every 12 months, their compensation would have been ~$1 billion lower.

Some managers charge performance fees that crystallize over several years rather than just over one year. This mitigates the issues of annual crystallization but does not get rid of the issues entirely (for example some managers have a 3-year crystallization period, however allocators like university endowments theoretically have an infinite time horizon so there is still a large mismatch between the managers’ crystallization period and the allocators’ time horizon).

On the other hand, I have come across certain quant funds that charge performance fees quarterly. Their argument is that the lifecycle of their trades is very short and so the time horizon over which they’re judged should also be very short. By this logic, a short crystallization period does indeed align fees with investment horizon & the “full cycle return” of the strategy. Furthermore, the managers highlight how their return streams are uncorrelated to equity & credit markets, and how that must mean their returns are pure alpha and thus worth paying high gross fees for.

However, this misses a few elementary points. For one thing, quarterly crystallization is a complete misalignment (usually) with the allocators’ investment horizon. By the logic of aligning performance fees with time horizons, one could form a strategy of buying 1-month-long options and charging performance fees at the end of each month (or in Vegas, charging fees with each pull of the slot machines). Furthermore, while it’s true that many of these strategies have low correlation to broader equity & credit markets, they often have hidden correlation to one another & to flows in their respective niches. These managers often underperform at the same time as one another: A lack of correlation to equity markets does not mean a lack of correlation to anything. While these quant managers are not tied to the economy/markets per se, their “full cycle return” should incorporate the various periods during which quant managers underperform in unison – and these periods often last far longer than a quarter. Finally, if fees crystallize every quarter, then it is extremely difficult for allocators to compound at high rates over time, no matter what the underlying strategy.

Performance Fees Incentivize Funky Year-End Behavior

Incentive fees also encourage funky behavior around year-end. For example, managers that are outperforming their benchmark index going into the final few days/weeks of the year will be inclined to “hug” their benchmark index for the remainder of the year to ensure that their performance remains above their benchmark. If the manager’s hurdle is a hard number (e.g., 6% or 0%), then the manager that has outperformed this hard hurdle going into the final days of the year will be incentivized to shift the portfolio into cash to ensure that an end-of-year crash in the market doesn’t wipe out the manager’s performance fees for the year.

On the flip side, managers that are underperforming their benchmark coming into their year-end are incentivized to take on additional risk in the hopes of rising above their benchmark.

This may all seem a bit hypothetical, but I can assure you it’s not. In my 6 years as an allocator, I saw funky year-end behavior firsthand on numerous occasions. Most notably, in December of 2021 many equity managers were underperforming the S&P 500 because the index’s performance for the year was largely driven by Apple, Google, Facebook, Tesla and a handful of other stocks. Managers that didn’t own those stocks were underperforming. With a few weeks to go before Christmas, several of these underperforming equity managers started buying cryptocurrencies.

These crypto purchases could, of course, simply be because these managers suddenly became true crypto believers in the month of December. A cynic, however, would say that at least some of these managers purchased crypto currencies to boost their volatility in the hopes of exceeding their benchmark. The cynic would point to the fact that very few managers that were outperforming the index made the same such moves into cryptocurrencies. Heads the managers win, tails their clients lose.

Performance Fees Generate Negative Convexity

At another simple level, performance fees cap your upside, while providing no such downside protection. Since your gross upside performance will always be reduced by 20%, while your gross downside performance has no such 20% buffer, investing in firms that charge performance fees will result in your portfolio having higher downside volatility than upside volatility (an unfavorable portfolio characteristic).

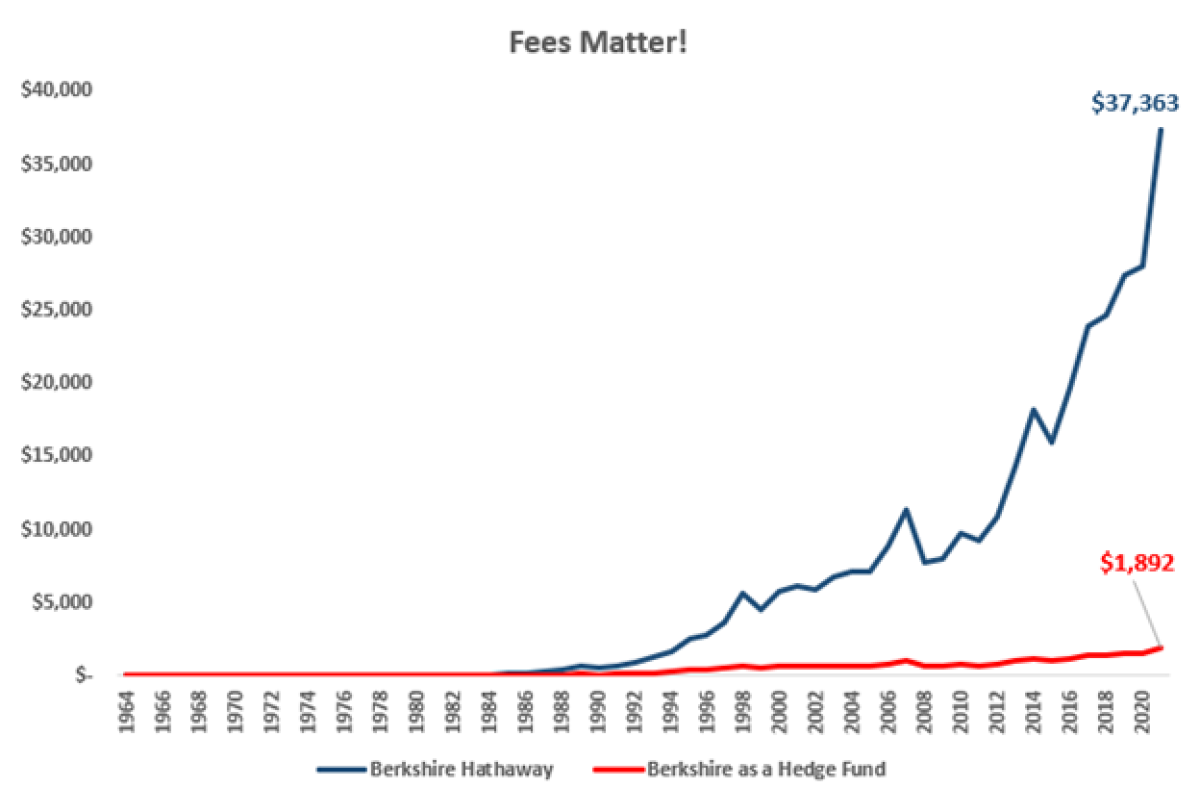

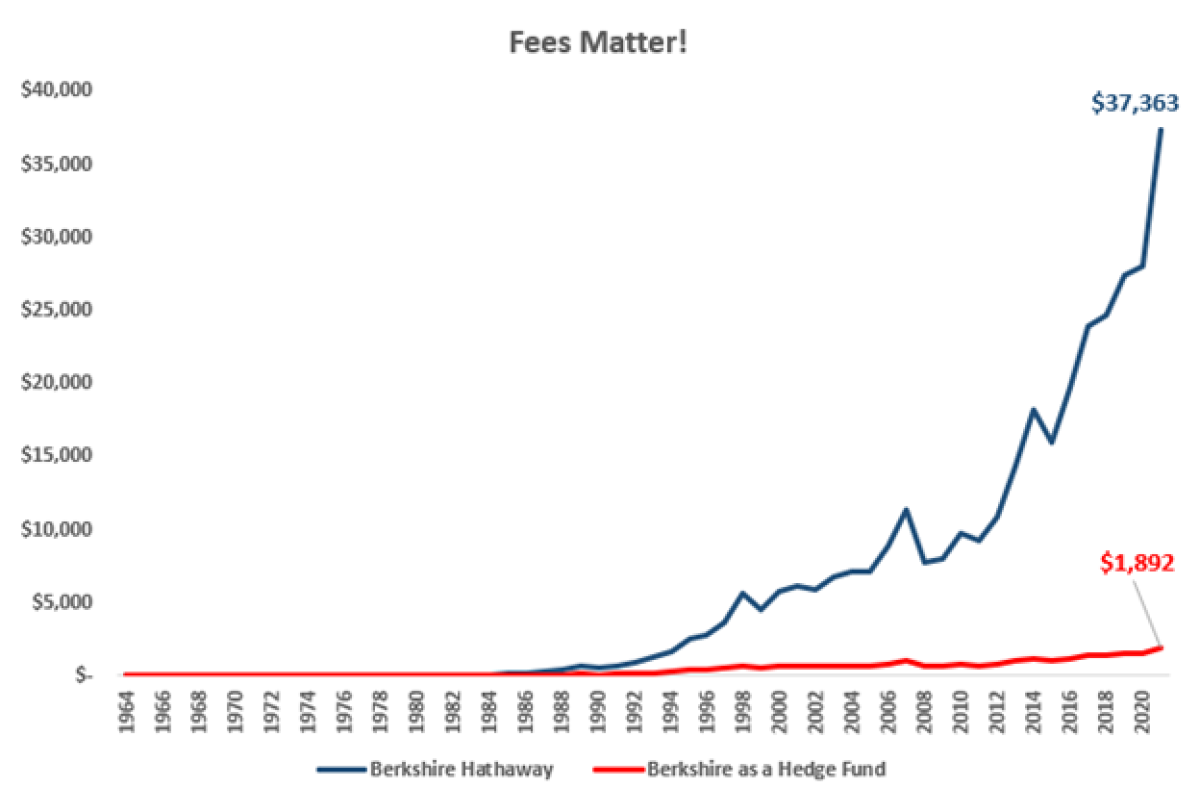

To verify these comments all you need to know is how to multiply and how to subtract. Performance fees impose a substantial drag on allocator performance over time. For example, consider how Berkshire Hathaway’s performance would have been different had Buffett charged traditional hedge fund fees:

$1 invested in Berkshire Hathaway in 1965 (when Buffett became CEO) was worth $37,363 by the end of 2021 (representing a 20.3% CAGR). If Berkshire was a hedge fund charging a 2% management fee and a 20% performance fee, $1 invested in 1965 would be worth ‘just’ $1,892 (14.2% CAGR). For reference, this would still outperform a dollar invested in the S&P 500 in 1965, which was worth $298 at the end of 2021 (10.5% CAGR).

A fair criticism that remains against management fees is that they’re charged regardless of performance.

I concur with this criticism, however it’s less damaging than you might assume, and there are ways to mitigate this fact even further.

#1: Managers Can Cap AUM To Mitigate Asset Gathering

To ensure that the manager doesn’t endlessly raise assets, the manager could set a limit to their asset size. For example, the manager could cap assets at a certain amount below their capacity.

From personal experience managers tend to cap their assets right at what they deem their capacity to be. For example, if a manager deems the capacity for their strategy to be $10 billion, they will tend to cap their assets at $10 billion. This means that the manager has no ability to “grow into” their capacity.

I recommend capping assets at a maximum of half of one’s capacity, and ideally much lower than that. I also recommend returning capital any time the manager reaches 100% of capacity. A cynic would say that managers will simply raise their stated estimates of their own capacity - for example, they might say their capacity is now $20 billion, rather than $10 billion. The only solution is to partner with truly honest managers.

#2: Asset Gains from Strong Performance Lead to Higher Management Fees

Management fees don’t encourage pure asset gathering. A manager with $100m in AUM that generates 100% in profits will now have $200m in AUM and will double his/her management fee income just the same as if they had reached $200m in AUM purely through raising an additional $100m of assets.

Of course, once a manager has run up to its asset cap, the only way to grow one’s compensation is to generate strong performance. And a manager that returns capital will be eschewing compensation. But this is the same dilemma for managers that charge performance fees.

#3: Achieve Alignment by Having Chefs That Eat Their Own Cooking

The purest alignment comes from the manager investing in the strategy alongside clients. If a manager invests a substantial portion of his/her net worth into the strategy then the manager will be incentivized to generate strong performance[i], regardless of the fee structure.

#4: Without Good Performance, Fee Paying Assets Under Management Will Dwindle

This is a fact of life, no matter what the fee structure is. Over the long run, investment firms live & die by their net performance. If a manager thinks they need performance fees to incentivize their performance, then they clearly don’t understand this simple fact. Eschewing performance fees (and charging low fees in general) is the easiest way to boost net returns to clients, which in the long run increases the durability of client assets.

#5: Implement Loyalty Discounts

Loyalty-based discounts are everywhere. Coffee shops and restaurant chains offer discounts such as one free coffee after every X purchased coffees (or after spending $Y in the coffee shop), assuming you sign up for the discount by leaving your name & phone number/email address. Airlines upgrade your flying status after you’ve flown a certain number of miles with them, assuming you’ve signed up for frequent flier miles. Amazon gives members credit points for purchases spent on the site that can later be redeemed for purchases.

However, loyalty discounts are rare in the realm of investment management. More common are discounts above a certain asset amount (e.g., for allocators that invest >$100 million into a strategy they might receive discounted fees, etc.).

I have nothing against giving discounts to large investors - it can make business sense. However, size-based discounts put smaller investors at a relative disadvantage and do nothing to reward loyal investors who stay invested for a long time. For this reason, I recommend investors do both a size-based discount and a loyalty-based discount. A loyalty fee discount is easier to incorporate for managers in an SMA structure than it is for managers of funds. This flexibility is a benefit of the SMA structure over the fund structure.

In Defense of Performance Fees:

In defense of performance fees, they're better suited to private funds with long life spans and which charge based on net performance over the entire life of the fund. You still have the issues of no-crossing of fees across managers, and the managers are still incentivized to grow assets and raise multiple separate funds. But the issue of annual crystallization of fees is mitigated the longer the length of time assets are locked up for and fees are charged over. On the other hand, private equity firms raise multiple funds, each of which can be considered as an option. Because PE firms usually raise multiple funds, they have multiple bites of the apple (i.e., performance fees/carried interest). Thus, even in private equity performance related fees are far more expensive than the contractual rate.

Allocators argue that they’re okay paying for “alpha”. David Swensen, the pioneer of the endowment model and the (extremely successful, charming, and sadly late) CIO of Yale’s Investment, argued as such in his 2017 annual letter. As he puts it, “net returns matter, not gross fees”.

I agree with Swensen’s comments, however the outperformance of Yale and other endowments over the 20 years that he showed was driven in large part by these endowments’ large (and early) allocation to private equity and venture capital. Yale and other top university endowments have access to the top venture capitalists who do indeed show performance persistence and are worth “paying up for”. This is a form of skill that Yale demonstrated, and I am not here to critique Yale or Swensen.

It’s still possible to outperform when you’re paying an effective incentive fee of ~50% (presumably the effective incentive fee has been much lower at Yale), but the outperformance required on a gross basis is massive.

Most people in the industry at this point would say that enough investors are willing to pay these higher fees to get into the best performing funds and so if Yale/others refused to pay those fees then these top-performing managers could afford to deny Yale/others access. That is likely true, and I provide no solution for this dilemma in this article.

A fair criticism of flat management fees is that the manager gets paid no matter what performance is[ii] (and without a pro rata increase in operating costs), and that managers therefore get paid more for gathering (and maintaining) assets than they do from performance. Hopefully this article has helped to address why management fees with a loyalty discount are a fairer fee structure than commonly thought.

Performance fees are not going to disappear from the industry. The status quo, overconfidence and greed will endure. But next time someone tells you: “we need performance fees to be aligned”, I hope you remember this article and, if willing to accept the fees, you at least ensure those fees are structured in the fairest manner possible.

Footnotes:

[1] The counter argument to this is that Manager B generates more in aggregate performance fees and thus delivers more value in aggregate. However, you’d be hard-pressed to find an allocator that sympathizes with that view when it’s the allocators’ dollars on the line.

[2] One interesting caveat is that institutional allocators often invest a small percentage of their assets into each manager they partner with. For example, many endowments allocate less than 1% of their assets into each fund manager (they often are invested in >100 underlying funds). If a manager has 100% of his/her assets invested into the strategy while the allocator only has 1% of their assets invested, then the manager may be less willing to bear volatility and risk than the allocator is. The fact that the manager’s livelihood is at stake further contributes to this risk tolerance mismatch.

[3] You could look at that as a positive, by the way - since the manager won’t get paid extra for doing something crazy good, the manager is less likely to try to do something crazy bad. This is basically the structure that Berkshire Hathaway runs on since Warren Buffett takes a fixed salary home each year.

About the Author:

Jonny Cornish, CFA, is the Founder & Portfolio Manager of 38x Holdings - a long-biased investment firm based in Miami, Florida. 38x invests in high quality, publicly traded companies with monopolistic characteristics.

Jonny worked for UNC Management Company (a $10bn endowment fund) in North Carolina prior to founding 38x. Jonny graduated from the McIntire School of Commerce at the University of Virginia in 2016, where he played on the men's tennis team and won the NCAA team tennis championship three times. Jonny is from the UK and is a CFA charterholder. If you wish to contact Jonny please do so at jcornish@38xholdings.com.