By Shreekant Daga, CAIA, CFA, FRM, Associate Director and Authorized Signatory for CAIA India LO.

The strong set forth the rules while the weak are left with no choice but to follow.

When talking about ESG and how it is relevant to all, a few primary questions need to be addressed first.

- Which countries bought about the problem of emissions over the last couple of centuries?

- The current environmentally hazardous emissions are done by whom? Focus not on the location of emission but the domicile of the company responsible for it.

- Aren’t social initiatives always labelled? Has advertising evolved to wear a cleaner mask?

- Who measures governance and how? The vantage of governance for some countries is internally focused (for us, by us) whereas for some is externally focused (for them, by them). Why?

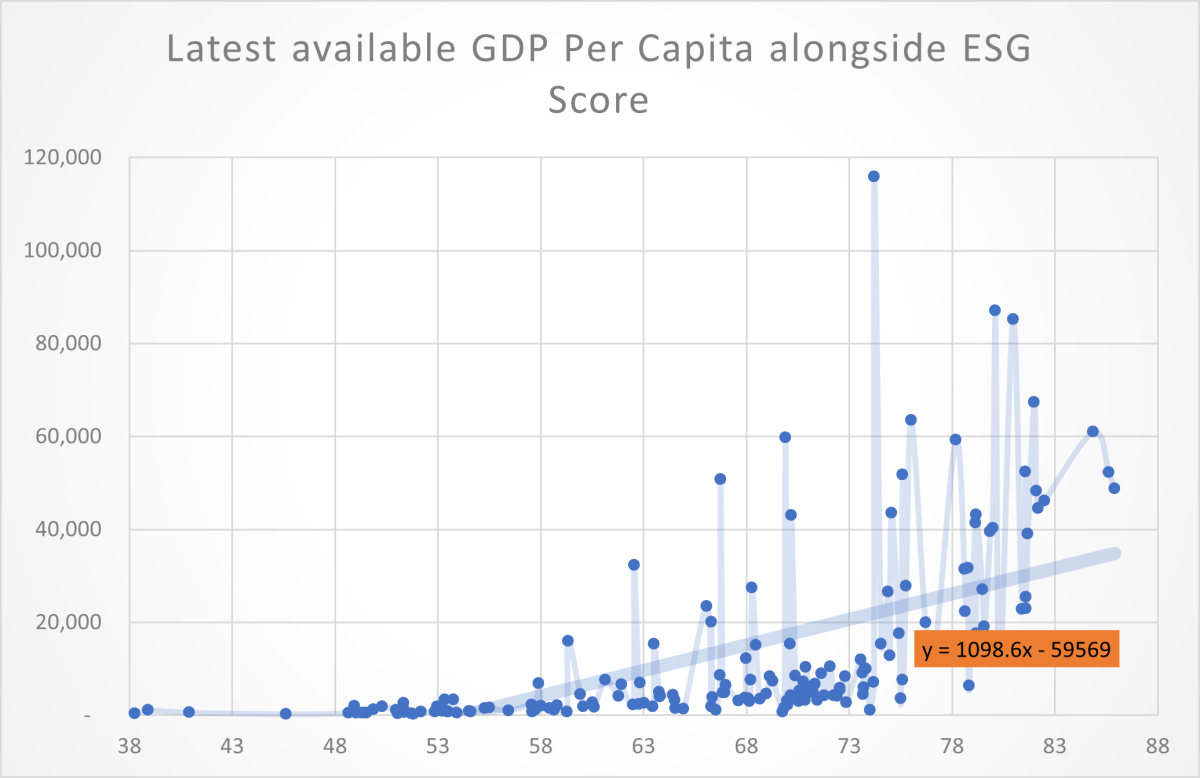

The world today has several problems and most are more pressing than the moniker of ESG. The below chart has the latest per capita GDP of countries (from World Bank) alongside their ESG score (from the Sustainable Development Report).

As most would imagine, the ESG rankings are poor for those with lower per capita GDP. The contrast is such that the average per capita of the top 33 ESG rated countries exceeds the sum of per capita for the bottom 33 ESG rated countries. To move from mathematics to plain English, the average individual from the top 33 countries contributes more than the average individual in the bottom 33 countries – put together! So much for us to talk about income equality…

Scholars talk about how productivity and technology impact GDP but the honest answer to this problem is mispricing. Whether blue or white collared, the individuals performing tasks are not fungible and goods and services are differently priced regionally. Mispricing is also evident within each country between urban and rural location pockets which have price steps for the same goods and services delivered.

Concepts such as PPP demonstrate the bi-polar nature of managed exchange value. The pricing methodology itself for necessities and technology aren’t comparable. Necessities required to survive are cheap while frills acquired under the pretext of technological advancement are priced without basis. Necessities are supposed to be priced around cost plus margin while technology is priced on the maximum price realizable alongside economic order production.

The tracking mechanism for global trade of goods, does not denominate and account for the weight of goods exported or the mispricing of human effort would become glaring clear.

Now coming back to the expected developments around ESG, we can expect to see focus on environment in countries with higher per capital while production facilities continuing to being moved to lower per capita countries where environmental regulations are less stringent. Flow of money will dictate the contours of terms and even laws for smaller countries. Capitalism has an ugly face and hence the social mask will be put up to show inclusivity alongside those who innocently believe this is for being righteous. Along the end of the investment cycle, the cousin of diligence, governance would be disappointed that the imposed terms were not kept locally. What purposefulness can achieve; stringency can just admire!

If ESG needs to be addressed, inequality needs to be addressed prior to that.

Issues such as quality of education, clean sanitation, comparable health facilities for all, eradication of hunger, etcetera are concerns to a large majority of individuals who are underrepresented and have no voice. The solution to income inequality can be fundamentally addressed with appropriate pricing for goods and services.

ESG can and should wait.

About the Author:

Shreekant Daga is a CAIA, CFA and FRM charter holder. Shreekant pursued Bachelor’s in Management from Narsee Monjee College and later did his Master’s in Management from Jamnalal Bajaj Institute of Management Studies (JBIMS). He also holds a Master’s in Commerce from Mumbai University. He is an alumnus of Bombay Stock Exchange Training Institute, having completed the certificate programme on capital markets. He has also acquired several certificates from the National Stock Exchange in Financial Markets.

Prior to joining CAIA Association, Shreekant had gathered experience in Structured Finance. His experience encompasses investment banking in debt capital markets, handling stressed assets, global RMBS deal evaluation, securitization, stress assets rating and mutual fund rating. Shreekant has worked with organizations such as ICICI Bank, Deutsche Bank Group and India Ratings and Research (Fitch Ratings). In mid-2018, he joined the Chartered Alternative Investment Analyst (CAIA) Association, the international leader in alternative investment education and provider of the CAIA designation, as Associate Director at India liaison office wherein he looks after India operations.

Shreekant has been a visiting faculty at JBIMS and has taught subjects such as Fixed Income, Global Markets & Financial Institutions and Structured Finance. He has been involved in mentoring students at his alma mater for their year-long projects. He has also graded final year MSc students of Mumbai University on their year-long projects. He has also featured in newspapers, magazines, press releases and article on the web. His name also features on the list of educational professionals on the MHRD website. True to the cross function that he maintains with education and industry, Shreekant has 4 research papers presented and published at international forums and journals respectively.