By Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP, Managing Director, Head of UniFi by CAIA™ at CAIA Association

The analogy of building a house is not too far off from constructing a diversified portfolio. If asset allocation is like deciding the location of your new home, there’s many more steps to take before your portfolio is move-in ready. In Part I of this new three-part series from Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP, Managing Director, Head of UniFi by CAIA™ at CAIA Association, will walk through some basic frameworks for advisors approaching portfolio construction with alternative investments. Portfolio construction is a mix of art and science, and every client’s needs are different. By the end of the series, an advisor should better understand the factors and characteristics to consider when constructing a portfolio.

Nailing Alternative Investment Portfolio Construction

Much ink has been spilled on asset allocation and alternative investments – how much should I allocate? What happens if I put 10% in alternatives vs. 20%? That is not the focus of this article. Instead, we’ll focus on a more interesting question: Now that I know what I want in my portfolio, what do I include in it?

To a Hammer, Not Everything Should Be a Nail

There are many different types of alternative investments, each with its own set of risks and potential rewards. It is important to thoroughly research and understand the characteristics of each type of alternative investment before including it in the portfolio. For example, private equity investments involve buying ownership stakes in privately held companies, while hedge funds use a variety of strategies not available in traditional fund formats to generate returns. Real estate investments can provide potential income through rent payments and appreciation, while commodities such as gold or oil can provide a hedge against inflation.

If alternative investments weren’t heterogeneous enough, their sub-categories are just as diverse. In addition to the type of alternative investments, it is also important to consider the specific investments within each category. Diversification within each asset class can also be important to mitigate the risk of any single strategy dominating the portfolio’s risks. Take real estate as an example, core real estate, in many ways, is viewed as a fixed income alternative – income oriented, high principal protection, low risk. On the complete opposite end of the spectrum, opportunistic real estate comes with great risk of loss of capital, minimal to no income and a focus on price appreciation. For most alternatives, one characterization does not fit all.

Laying the Foundation

While crafting an investment policy statement is important in all cases, it’s especially important for advisors and clients attempting to build out an alternative investment allocation.

Before any allocations are made, it’s important to better understand the client’s objectives and constraints, especially regarding liquidity and taxes, since many alternative investment strategies are not as liquidity and/or tax friendly as more traditional, long-only strategies and their vehicles.

One of the most complicated processes will be the creation of the client’s policy portfolio. In general, this policy portfolio is meant to be a long-term investment portfolio that is designed to meet the specific needs and objectives of the client. They are designed to be relatively stable and are not typically adjusted frequently. However, many of them utilize ranges for different asset classes (e.g., 50-70% for global equities). Additionally, they are often managed using a passive investment approach, used as a starting point for the client and advisor to define success at the portfolio- and manager-level.

Effectively, the advisor truly only has three means of influencing client return:

- Asset allocation (i.e., the policy portfolio)

- Market timing / tactical allocation

- Security/fund selection

Research has consistently shown that asset allocation is the most meaningful decision an advisor can make and will drive most of the future return. Hence, the advisor’s focus should be on adopting the most robust and appropriate policy portfolio for their client. From there, effectively incorporating alternatives into the portfolio can improve overall outcomes.

When utilizing alternative investments, the traditional policy portfolio approach brings about two important issues that need to be addressed:

- For clients desiring heavy allocations to private markets, it’s very rare that the stated allocation objective is always met in practice due to the lumpiness of cash flows during commitment strategies. In other words, if the client has a stated objective of 10% in private equity, the actual allocation could be 5% or 15%, depending on market conditions, the rest of the portfolio’s performance (known as the denominator effect), and the net cash flow distributions (commitments vs. realizations) from the private market funds themselves.

- To mitigate this risk, advisors should ensure that the asset class ranges within the policy portfolio are flexible enough to accommodate a long-term commitment strategy. Additionally, clients should be made aware that the allocation is a stated objective that will deviate over time within a stated range, with a goal of averaging the stated objective over the long term.

- Since the policy portfolio uses passive investments (indexes) to create the allocation, benchmarking illiquid, or more complex strategies could prove more difficult since there typically aren’t passive equivalents in the marketplace. Remember, a good index should be representative and investible at the very least!

- To mitigate this risk, advisors may have to get creative with how they benchmark alternative investments. In this author’s opinion, there are three ways to benchmark alternative investments strategies within a portfolio, none of which are perfect but may help:

Total Portfolio – comparing a strategy relative to the entire portfolio’s performance

to determine if it added value.

Absolute return – selecting an absolute return target (e.g., cash + 4%).

Relative return – like active managers, benchmark the alternative investment to

a public index.

When constructing a portfolio that includes alternative investments, the advisor should decide whether they want the inclusion to be a top-down or bottom-up decision. In other words, are alternative investments an asset allocation decision or a manager selection decision? In practice, the decision will likely include a bit of both, but both approaches bring forth different implementation decisions.

Top Down (Asset Allocation) Decision

In the top-down decision, the advisor must create an asset allocation that explicitly allocates to different alternative investments. In other words, an allocation that’s 50% global equities, 30% global fixed income, and 20% alternative investments. The potential issues with this approach are twofold:

- First, sectioning off a 20% catch-all allocation to “alternative investments” ignores the heterogeneity of the underlying strategies. Managed futures strategies are very different from private credit, and long/short equity is very different from real estate.

- Second, an explicit allocation to alternative investments requires the advisor to have a “bucket to fill” no matter the market conditions or the manager options ahead of them. Also, as discussed earlier, some private market strategies never actually meet their allocation targets.

Finally, many of these strategies don’t fit neatly into an asset class since many don’t share the same characteristics. Top-down allocation decisions work well for public, long-only assets because they all tend to move together, and the dispersion of outcomes is minimal.

Bottom-Up (Manager Selection) Decision

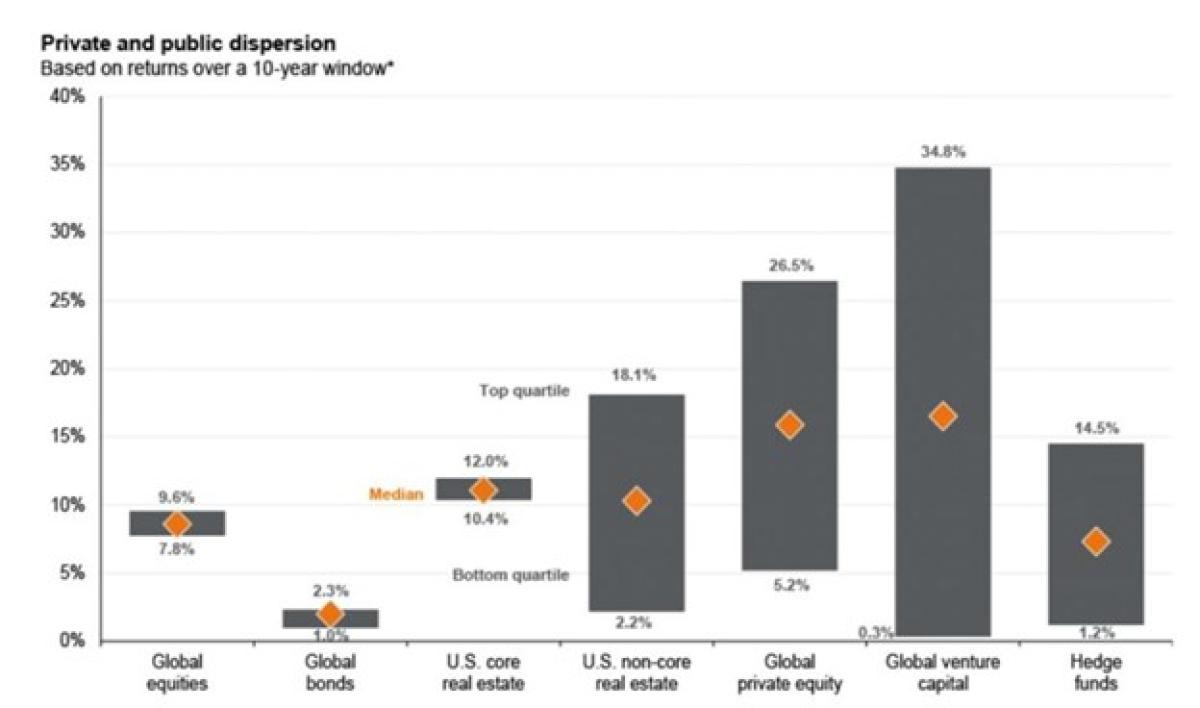

An alternative approach is to integrate these strategies in a bottom-up fashion. In other words, the top-down asset allocation decisions focus on building a policy portfolio of investible indexes, but the advisor has the flexibility to deviate from it when an opportunity presents itself. After all, performance dispersion is rampant in alternative investments, far more than in long-only traditional markets, as shown in Exhibit 1.

Exhibit 1: Private and public dispersion

Source: JPMorgan, Guide to Alternatives Q3 2022

The manager selection approach is used by some institutional investors and mitigates some of the drawbacks of a top-down approach, namely that it doesn’t require the advisor to “fill a bucket” when no good opportunities exist. All decisions are on a relative basis. In other words, an advisor would only choose to allocate to a long/short equity or private real estate manager if they believed the fund manager would add value relative to other options.

There are two potential issues with this approach:

- Whipsawed Decision Making – without asset allocation constraints, the temptation to buy and sell strategies based on short-term market whims could be higher. Sometimes, being forced to “fill a bucket” may help encourage discipline.

- Benchmark Risk – Many of the selected strategies would likely deviate from the policy portfolio benchmark in terms of risk and/or return. For far more benchmark-aware clients, this could cause dissatisfaction when performance deviates from their stated benchmarks.

Best of Both Worlds: Risk-Based Exposures

While I agree that the manager-selection approach is probably better than a pure top-down allocation approach, given performance dispersion, I believe there is a third way to build a portfolio. In the past, I have argued for using a risk-based framework for making allocation decisions.[1] In my view, this approach combines the best of both worlds in that it borrows the discipline of a top-down approach with the flexibility of a bottom-up approach.

If anything, good risk-based frameworks can serve as a powerful overlay to either approach, like the way that factor-based analysis gave us better insights into the investments we own.

In Part II of Nailing Alternative Investment Portfolio Construction, we’ll delve into once the investment philosophy has been determined through the investment policy statement and policy portfolio, what next steps define all that is available to clients.

[1] Filbeck, Aaron. “Rethinking Everything: Building Your Client’s ‘Portfolio for the Future’”. Investments and Wealth Monitor. August/September 2022. https://investmentsandwealth.org/publications/investments-and-wealth-mo…