By Brian A. Schroeder, the founder of OCIO Monitor, a specialty consulting firm that provides due diligence of investment consultants and outsourced chief investment officers.

Here are the Top-3 reasons why investment committees are not a good use of time and resources, likely lowers returns and negatively impacts governance. This piece is short-and-to-the-point hoping more people will read it.

No. 1: Stockholm Syndrome of the Committee Members

Prudent institutional investors should never see their investment consultant or OCIO as a friend. The service is too important to be clouded by emotions, especially given the high fees. Healthy skepticism and doubt (not contempt) should accompany every interaction between client and consultant/OCIO.

Investment committees often meet monthly. Much like a teacher-student relationship, the committee members are a captive audience that meet, discuss and craft policy and strategy looking up to the expert. This familiarity and constant contact often create a collegial and friendly atmosphere such that they now share a foxhole.

The recommendations by the investment committee to the full board are often "rubber stamped" because they have already been vetted and pre-approved. If not, why have the investment committee?

Since committee members are emotionally invested and own the results, can they objectively evaluate the advice and make needed improvements if they are not making profitable decisions? Human nature says, "doubtful."

No. 2: They Want to be Fooled

The "teacher" shares a foxhole and also grades the exams. What is the incentive to give failing test scores? Investment consultants and OCIOs are very clever in how they report. Read Is my OCIO Better at Dressing up Performance than Generating it? to discover the many ways they make performance look better.

Do boards of trustees and investment committees want to be told that their decisions cost value? Does the investment consultant or OCIO want to be fired for giving bad advice?

Remember, many trustees/directors of institutional investment plans are elected or politically appointed. These positions often have generous perks of travel, conferences and other niceties. Further, internal staff are often compensated based on performance. Does anyone have the incentive to question "positive" results or possibly be a whistleblower?

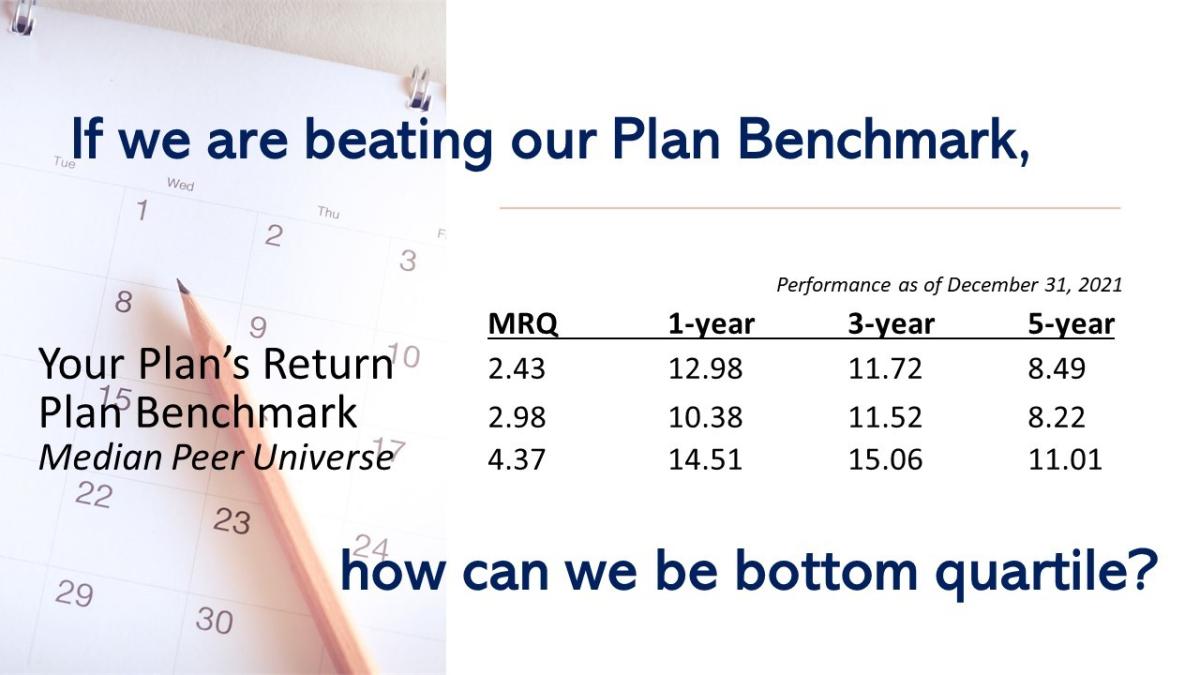

In short, will the investment committee or full board ever critically question their results? You would be amazed at how many plans are both "above benchmark" and bottom-quartile in a peer universe at the same time.

No. 3: The Do Something Dilemma

In order to keep getting paid and justify one's existence, one must always be doing something. This is my 14th year of performing due diligence of investment consultants and OCIOs, and I can say there is one absolute "law" I have learned: There is an inverse relationship between activity and success.

Without fail, the worst-performing investment consultants and OCIOs I have reviewed made the most changes. The best performing made the fewest changes and were patient.

Going back to the article about dressing-up performance, frequent change is great camouflage. So, no matter if the changes are helping or hurting, change helps to obfuscate and muddy the waters for determining performance attribution. Thus, change is constantly put forth by consultants and OCIOs.

To make matters worse, why the heck is an investment committee meeting so often if they are not making any changes? The conflicts and incentives to always be doing something are a dangerous combination that lowers returns, increases costs and negatively affects governance.

About the Author:

Brian A. Schroeder is the founder of OCIO Monitor, a specialty consulting firm that provides due diligence of investment consultants and outsourced chief investment officers. He has over 30 years of investment experience, as both an institutional manager and consultant.

He is the leading objective and unbiased due diligence provider on behalf of institutional plan sponsors. He has worked for pensions, foundations and endowments with assets up to $15 billion. Besides quantitatively determining their value-add and discovering behavioral finance heuristics, he is likely the leading expert in benchmarking and performance reporting transparency. He has been consulted by academics and recently presented to the Securities Exchange Commission’s Division of Exams’ investigators on how to spot performance reporting fraud when conducting routine firm inspections.

Schroeder has spoken at the International Foundation’s Trustee Master's Program, the Investments Institute and the ISCEBS Symposium. In July 2014, Benefits Magazine published his article “Multi-balanced Model: The Missing Link in Investment Approaches?” and, in May 2019, “3 Simple Strategies for Adopting a Passive Investment Consulting Approach” and, in July 2020, “Investing in Response to the Covid-19 Response.”

His analysis is novel by quantitatively scoring the value-add of investment consultants and OCIOs in their five main duties- strategic asset allocation, tactical asset allocation, rebalancing, active manager hiring and active manager firing.

Schroeder has a Bachelor of Arts degree in economics and a Master of Science degree in financial analysis. He served for 3 years on the Riverton, Utah Committee for Economic Development and is a volunteer at the Salt Lake City YWCA.