By Anikka Villegas, Senior Fund Strategies & Sustainable Investing Analyst, PitchBook

& Hilary Wiek, CFA, CAIA, Senior Strategist, PitchBook

Despite efforts to dispel misinformation and bring the industry to a shared understanding of ESG, there are still such widely contradictory views of the term and what precisely it involves that undesirable inefficiencies are being generated. Given this and the extreme politicization of ESG, some industry participants have chosen to move away from the term, using different language to describe their sustainability-related risk mitigation and value-generating practices. To get a sense of how prevalent this may become in the industry, this year we asked our 2024 Sustainable Investment Survey respondents how they felt about the term ESG.

Responses ranged from matter of fact to vitriolic. A desire to move away from the term was expressed frequently, and not only by the anti-ESG group. It is unclear when or if this will happen. In the meantime, a portion of the industry will likely continue to denounce “ESG” while engaging in practices that many would consider to be aligned with it, and in doing so will perpetuate the confusion around the term.

While our definitions and frameworks are based on those of prominent ESG-focused industry groups and organizations, as well as the best practices of leaders in the space, we recognize that there are still many vastly different interpretations of ESG. It is helpful to divide the spectrum of opinions into practitioners and nonpractitioners, as both influence how ESG continues to take shape and how it is perceived not only in their own circles but also in the court of public opinion. A full 64% of our respondents stated that they incorporate environmental, social, or governance factors into the process of evaluating and/or managing investments. This provided a robust group to ask about what practitioners are doing, but it also left a good proportion of individuals who could explain why ESG is not part of their investment process.

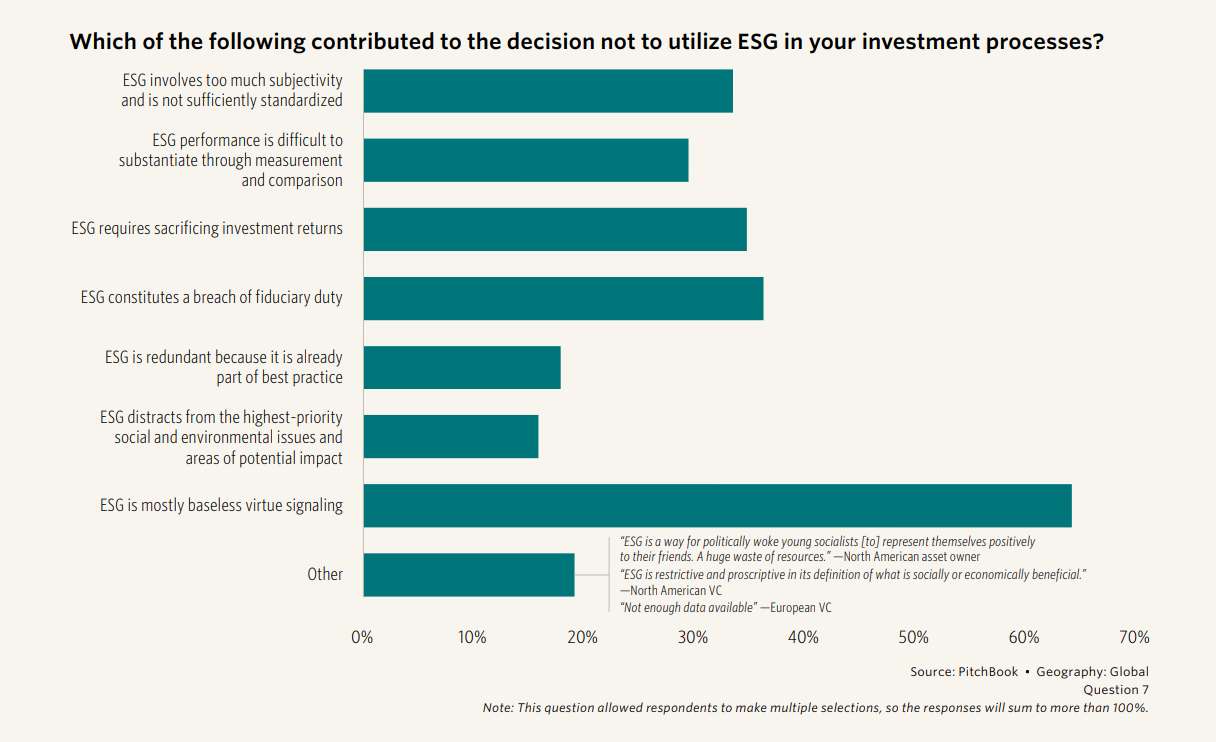

Among nonpractitioners, 64% reported that they believe that ESG equates to baseless virtue signaling. This was the most popular selection for the question about what contributed to the respondents’ decisions not to use ESG in their investment processes. This was not just a North American trend, as this response was chosen across all major geographies and among both GPs and LPs. Interestingly, the second most popular answer, selected by 36% of nonpractitioner respondents, is that ESG constitutes a breach of fiduciary duty. So, while some nonpractitioners think that ESG is all talk and no action, others think it involves such a significant shift in investment strategy that it necessitates accepting below-market-rate returns.

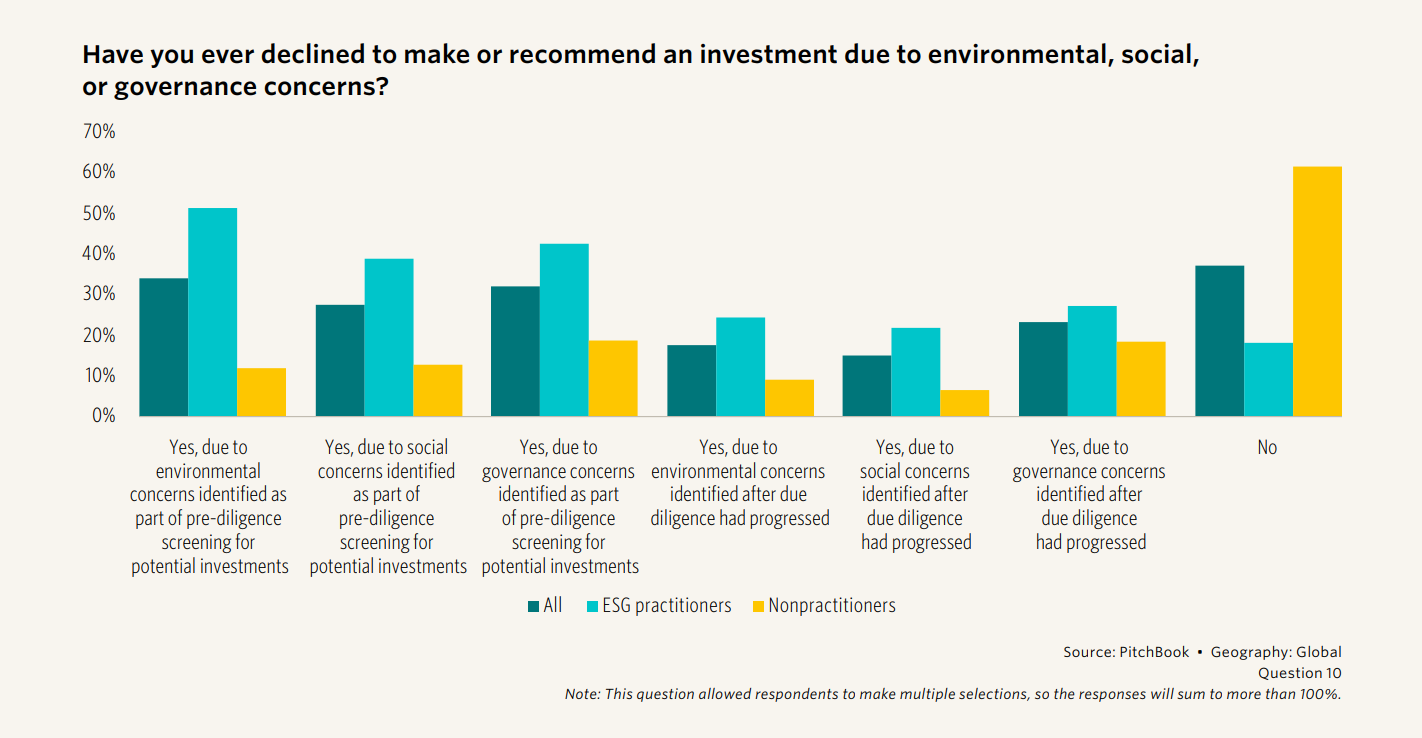

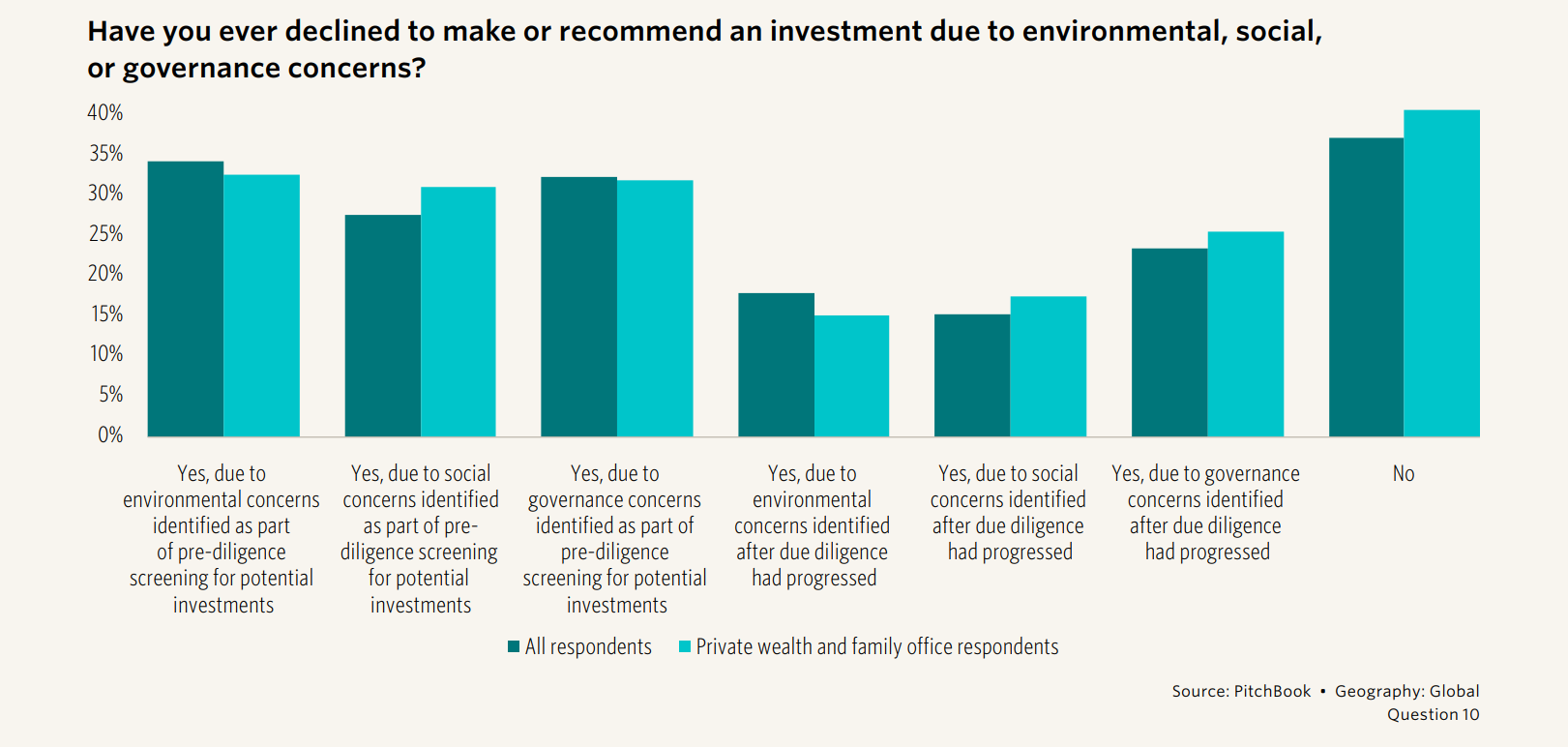

In practice, both ESG practitioners and nonpractitioners decline to make or recommend investments due to environmental, social, or governance concerns. Of the pool of respondents who said that they do not incorporate ESG factors into their investment evaluation and management processes, 39% have forgone an investment or recommendation because of ESG issues. In other words, even those who state that they are not using ESG do use it under some circumstances, showing a disconnect between what they think ESG is and their own ESG-related practices. For comparison, 82% of ESG practitioners have declined an investment or recommendation for ESG reasons. In terms of the types of ESG-related deal breakers for each, nonpractitioners were more likely to decline an investment or recommendation for governance reasons, while practitioners were more likely to decline for environmental reasons.

How and why ESG practitioners persist

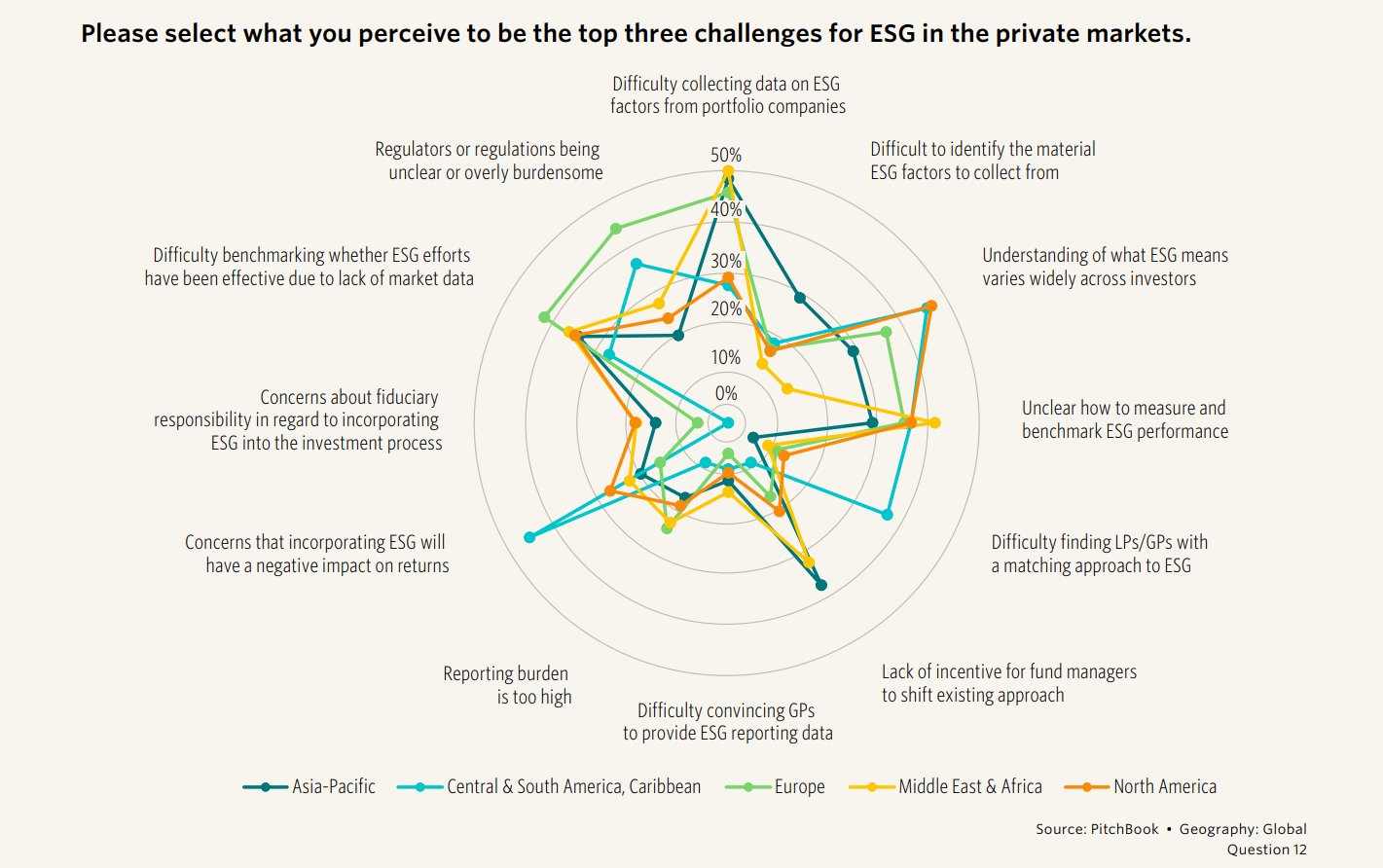

Utilizing an ESG framework comes with many challenges. As we explore in the “What is ‘ESG’ now?” section, efforts to bring convergence on what exactly it means to “do ESG” have not been fruitful in the private markets. On a global scale, this, combined with difficulties collecting ESG data from portfolio companies, exacerbates issues with benchmarking ESG’s effectiveness due to lack of market data.

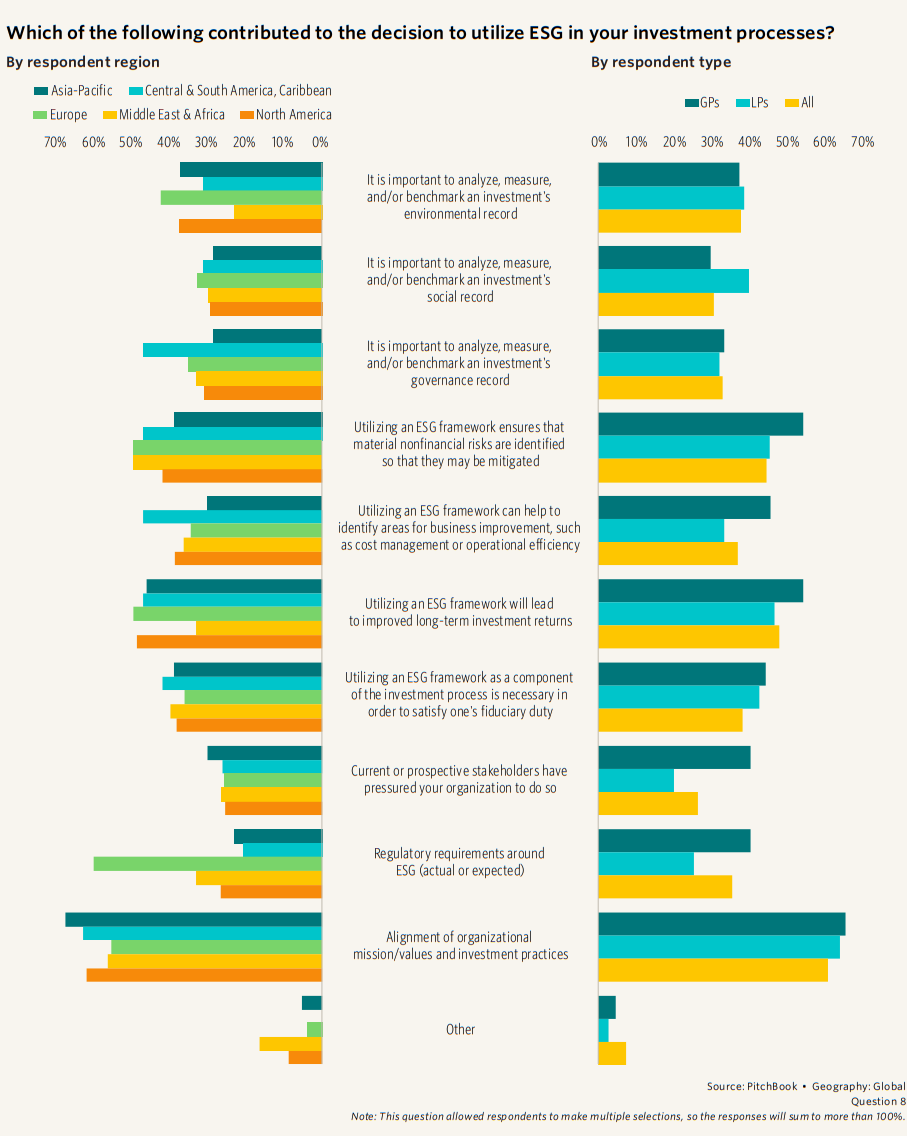

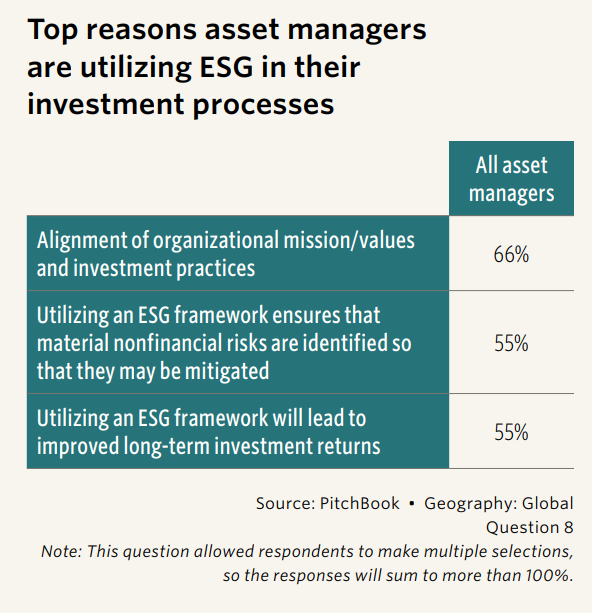

Despite these and other challenges, 64% of our respondents report that they continue to utilize an ESG framework as part of their investment process. Their reasons for this are manifold, but the most often-cited motivation is alignment of organizational missions or values and investment practices. This was the top motivation for all responses globally, though in Europe the most common response was that ESG is used because of the actual or expected regulatory requirements around it. Nonetheless, alignment of organizational missions or values was the second-most-popular reason cited for that region and globally among respondents.

It is important to note that much of the public discourse around the reasoning for using ESG has focused on the second-most-selected answer overall: that utilizing an ESG framework will lead to improved long-term investment returns. In part, this can be attributed to the fact that, as ESG has come under fire, one of the key talking points of the anti-ESG contingent has been that ESG prioritizes “feel-good” investing above maximizing IRRs. It is likely that asset managers have outwardly downplayed the role that missions and values have had in the development and maintenance of their ESG programs, choosing instead to highlight the potential financial benefits. Still, as the debate rages on about whether ESG harms or improves returns while the specter of a recession looms, more conclusive evidence to the latter would likely make it a more powerful motivator relative to missions and values.

The asset manager perspective

Because our survey questions allow us to segment our asset manager population, we will call our venture capital respondents VCs and everyone else, including funds of funds, non-VCs.

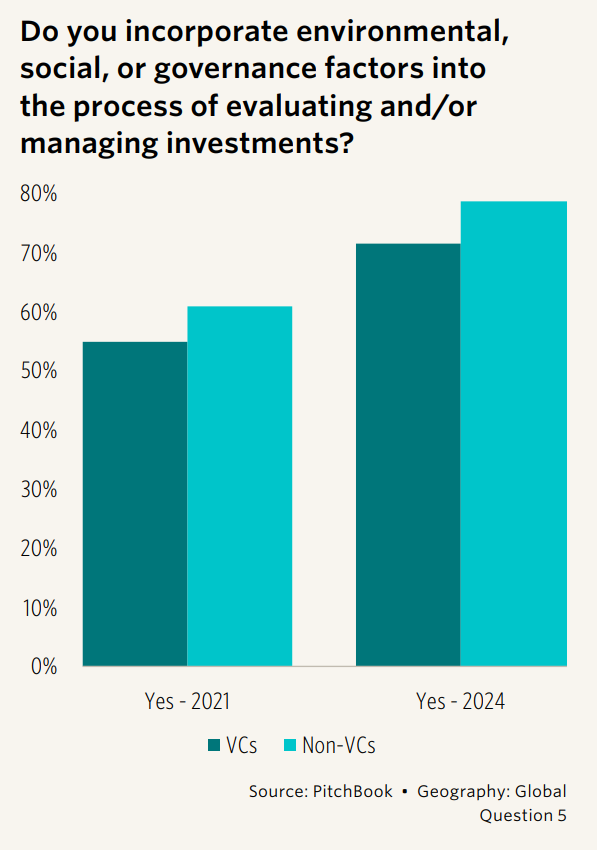

In a lot of ways, VC and non-VC asset managers were similar in their views this year. Our VCs were less likely to be implementing ESG into their investment process, while our non-VC GPs were less likely to be Impact investors. But overall, well over half of our asset managers continue to have sustainable investment offerings, despite the growing wave of negativity coming from various quarters in the past several years.

For those who have adopted ESG practices into their investment process, the rationale for doing so has been a split of seeking an improved risk/return profile and aligning investments to an organizational mission. Over half of our GP respondents selected each of these options in a multiselect question. While naysayers frequently decry any involvement of values in the pursuit of investment returns, the other two of the top three rationales may be persuasive to some who seem to think ESG is only about feelings. Comparing non-VCs with VCs, over half of non-VCs chose “Utilizing an ESG framework as a component of the investment process is necessary in order to satisfy one’s fiduciary duty,” compared with only about one-third of VC respondents.

Practitioners also talked about how environmental, social, or governance factors have led to their decision to discontinue diligence on a potential investment opportunity. The most common situation, reported by 39% of GP respondents, has been to decline an investment due to environmental concerns in pre-diligence. That said, VCs said this only 32% of the time, compared with 49% of non-VC GPs, likely because there is very little yet to look at, environmentally speaking, when evaluating a startup. For similar reasons, 34% of our VC respondents had never declined to make an investment due to ESG concerns, whereas only 24% of the non-VCs had never done so. Some VCs may feel that their companies are early enough in their lifecycles that they can tackle ESG principles down the road.

When we asked them about challenges for ESG in the private markets, our VC respondents chose “Difficult to identify the material ESG factors to collect from portfolio companies” much more than our non-VC GPs, which does play into the idea that early-stage companies are just too nascent to be measuring and reporting on ESG factors. That said, only 18% of the VC respondents chose this option versus 4% of the non-VC GPs, so while there was a big variance, neither selected the option in a large way. VCs were less likely to choose “Difficulty benchmarking whether ESG efforts have been effective due to lack of market data” or “Regulators or regulations being unclear or overly burdensome” as challenges compared with their non-VC peers in asset management. Essentially, asset managers working with more mature companies are more likely to see benchmarking and regulation as challenges faced by ESG practitioners, as they have more to measure and are subject to more regulations.

That said, across GPs, the top challenges were similar: “Difficulty collecting data on ESG factors from portfolio companies,” “Unclear how to measure and benchmark ESG performance,” and “Difficulty benchmarking whether ESG efforts have been effective due to lack of market data” were selected by the most people in each grouping.

The percentage of asset managers offering Impact products has also gone up since our 2021 survey. In 2021, 58% of VCs and 56% of non-VC GPs said they offered Impact investment strategies to external parties. This year, the responses grew to 71% of our VCs and 63% of our non-VCs. Interestingly, none of our VC investors said that concessionary returns are acceptable, with 64% of VCs and 63% of non-VCs saying that market-rate returns are top of mind in their Impact investment approach.

It is possible that the increase we show in fund managers offering Impact strategies has simply been because fund managers are now more willing to state their approach. 43% of our asset managers chose “Perceptions of or concerns about Impact investing equating to concessionary returns” as a top challenge for Impact investing, higher than our overall respondent percentage of 37%. With that perception still part of conventional thinking in some quarters, some asset managers have historically been hesitant to claim an Impact investing label. However, with better information and asset managers learning to be clear about their market-rate intentions, more may be willing to accept the Impact moniker now.

The private wealth perspective

Private wealth and family office respondents were less likely to be incorporating ESG principles into their investment programs, and when they did so, it was more often on a case-by-case basis. 20% always incorporate ESG into their management or evaluation investment opportunities, while another 34% do this some of the time. This leaves 46% of this audience doing nothing related to ESG, compared with 36% in the general respondent population.

Among these investment professionals serving a wide range of individuals, they were the most likely respondent type to say that the understanding of ESG varies widely across investors: 49% said this versus 39% in the general population. This could make it exceedingly difficult to have a uniform ESG program for clients.

Supporting this thought, when asked how they prioritize ESG efforts on a nine-point scale— from clean investments to ones that could be improved through an ESG lens—this group was more barbelled than the overall respondent population, showing that individual investors are more likely to be at one end of the spectrum or another, not melding both approaches. In a theme we see repeatedly in the data, what constitutes ESG investing is not seen as one thing in this group—and this reflects only those who are incorporating ESG.

Private wealth/family office respondents have declined to make an investment based on environmental, social, or governance concerns less often than the general respondent population. Like the general respondent group, the private wealth channel is less likely to decline to make an investment once diligence has started—an interesting finding showing that initial investigation on an investment is more likely to lead to the abandonment of an idea than deeper diligence is. Either fewer identify problems after a deeper dive has started—or they are less willing to stop the deep diligence process when ESG issues are uncovered.

Switching to Impact investing, the private wealth channel is more likely than the greater respondent pool to lean into real estate and away from land. Climate, energy efficiency, affordable housing, microlending, and gender and racial equity were also sustainable investment themes that came up repeatedly among private wealth respondents.

Conclusion

Just as growth or value investing do not mean the same thing to every practitioner, ESG as a concept is being used and understood in a wide variety of ways. As of yet, there is no far-reaching legal or industry requirement that it be just one thing; it is a tool that some choose to use as part of their investment process, just as others use quantitative analysis or EBITDA in their analysis. The politicization of ESG has many practitioners baffled, as who would think to vilify or ban other investment approaches that are used by some but not others? If a fund manager or allocator finds ESG to be a useful framework to identify and address business risks, is this really that different from those who choose to use a SWOT analysis for a similar exercise? If there was only one way to tackle investing, then all portfolios would be 100% alike and there would be no one to take the other side of a trade. Different approaches to investing strengthen the financial markets and should be accepted, if not encouraged.

About the Contributors

Anikka Villegas is a senior fund strategies & sustainable investing analyst at PitchBook, where she publishes primary research on the alternatives space, contributes to core reports, and serves as an ESG and impact investing specialist. Prior to joining Pitchbook, Villegas was an ESG analyst at Bridge House Advisors, an ESG and sustainability advisory firm. Before that, she was an associate at Malk Partners, a consultancy advising private market investors on ESG risk management and value creation. Villegas received a bachelor's degree in philosophy, politics, and economics from Pomona College.

Hilary Wiek, CFA, CAIA is a senior strategist at PitchBook, where she leads PitchBook’s coverage of fund strategies and performance, publishing primary research on the alternatives space and contributing to core report development. Wiek also heads PitchBook’s coverage of the ESG/impact investing space. She has over 20 years of experience in asset owner, manager, and advisory roles. Prior to PitchBook, Wiek was the director of investments at the Saint Paul & Minnesota Foundations. Before that, she worked in senior positions at Segal Rogerscasey, the South Carolina Retirement Systems Investment Commission, Buckingham Financial Group, Dayton Power & Light, and KeyCorp. Wiek received a master’s degree in finance and economics from Case Western Reserve University and a bachelor’s degree in leadership and finance from the University of Puget Sound.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/