By David Moreno, CFA, Indexes Manager, EPRA

In recent months, most central banks across Europe have shifted from a hawkish stance to a more accommodative monetary policy, marking the beginning of an interest-rate-cutting cycle. In the Eurozone, after an intense period of rate hikes in 2022 and 2023, the ECB implemented four 25-basis-point cuts in 2024. In the UK, the movement was much more moderate, with just 2 movements by the Bank of England totaling a reduction of 50 bps, while the Swiss and Swedish national banks started the cutting cycle earlier and cut interest rates by 125 bps and 150 bps, respectively. This shift not only aims to avoid impacting economic growth under easing inflationary pressures but also brings renewed optimism to the listed real estate (LRE) sector, a key beneficiary of lower interest rates. Under this new dynamic, cost of debt, capital raising, and expected performance are key variables to analyze.

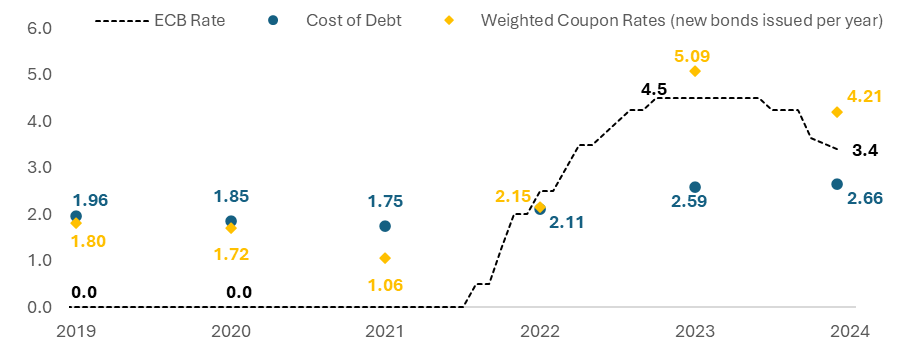

Evolution of ECB Rate, Cost of Debt, and Coupon Rates for TOP50 property companies

Source: EPRA Research

Although most central banks in Europe increased their rates by more than 400 bps in 2022 and 2023, the average overall debt costs for Top50 European property companies increased by only 91 bps, making it clear that the sector was well prepared for such changes. Therefore, the easing cycle opens new opportunities and brings new dynamics to the sector (see EPRA’ latest Market Research report. [1]

Why Listed Real Estate is Poised to Benefit

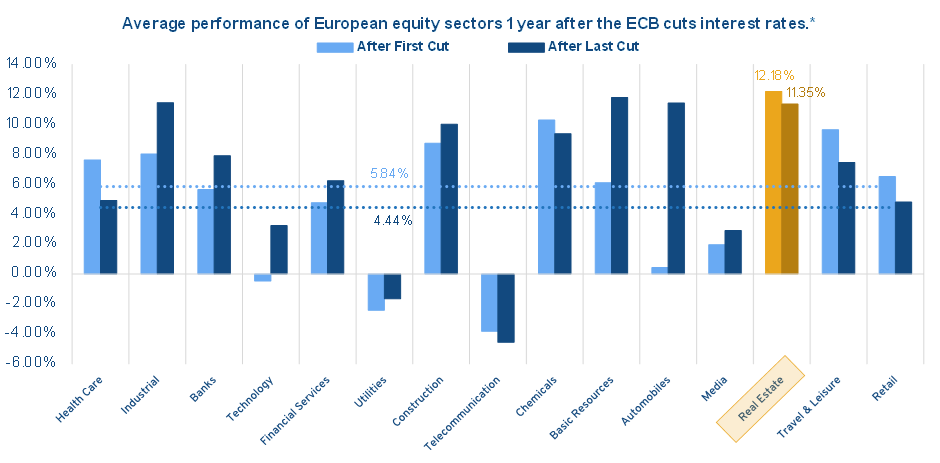

The listed real estate sector has historically shown strong performance during most rate-cutting cycles. Data from previous cycles (2001–2016) demonstrates that LRE outperformed common equities in Europe, with an average annualized price return of 12.18% in the year following the first rate cut vs 5.8% for other equity sectors. The outperformance is still significant 12 months after the end of the easing cycle, with LRE returning 11.4% vs an average of 4.4% for general equity. This resilience is underpinned by structural factors unique to the European market, including prudent leverage practices and the sector’s sensitivity to short-term interest rate movements. However, past cycles show mixed performance outside Europe, indicating that local factors play a critical role in shaping outcomes.

Price return of European equity sectors after interest rate easing cycles (2001 - 2016)

* Apr/01-Dec/01 (150 bps), Nov/02-Jul/03 (125 bps), Apr/08-Oct/08 (300 bps), Oct/11-Dec/12 (75bps), May/14-Apr/16 (40bps).

** Indexes used (price returns): STOXX600 for equity sectors and FTSE EPRA Nareit Developed Europe for Real Estate

Source: EPRA Research

The Current Pressure in Government Bonds in Europe

Despite the cautious pace of rate cuts, government bonds across the continent recently experienced significant pressure, mostly because of increasing fiscal and economic uncertainty. During the last 3 months, the yields of the 10y government bonds increased by 28 bps in Germany, 27 bps in France, 14 bps in Italy, 15 bps in Switzerland, 28 bps in Sweden, and 36 bps in the UK. However, European investors can remain optimistic. The ECB’s strategic shift aims to stimulate lending activity, with the real estate sector being one of the key beneficiaries of this movement, thereby supporting returns and earnings from listed property companies.

Capital Raising and Refinancing Costs: A Manageable Challenge

European property companies are navigating a period of increased refinancing activity, with approximately 43% of outstanding debt maturing between 2025 and 2027. Encouragingly, lower policy rates are expected to reduce refinancing costs compared to the elevated borrowing costs of the past two years. Although the average cost of debt has risen moderately, from 1.75% at the end of 2021 to 2.66% in June 2024, it remains manageable and reflects a sector that has adapted well to a higher-rate environment.

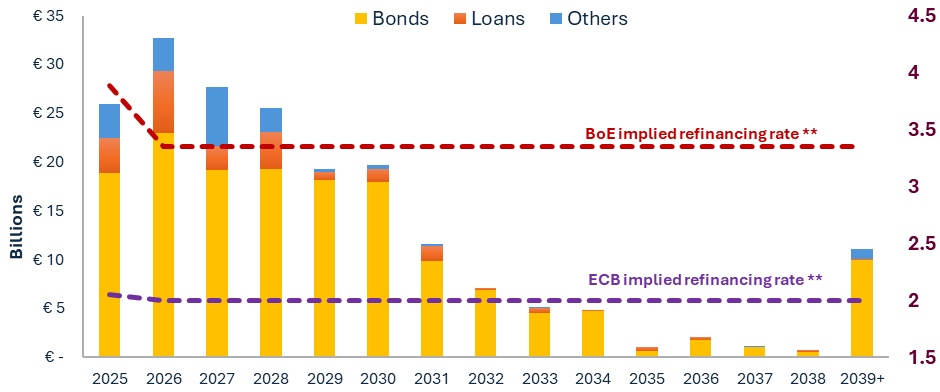

Debt maturity for constituents of the FTSE EPRA Nareit Developed Europe Index

** Implied rates from the Interest Rate Swaps market

Source: EPRA Research, Bloomberg

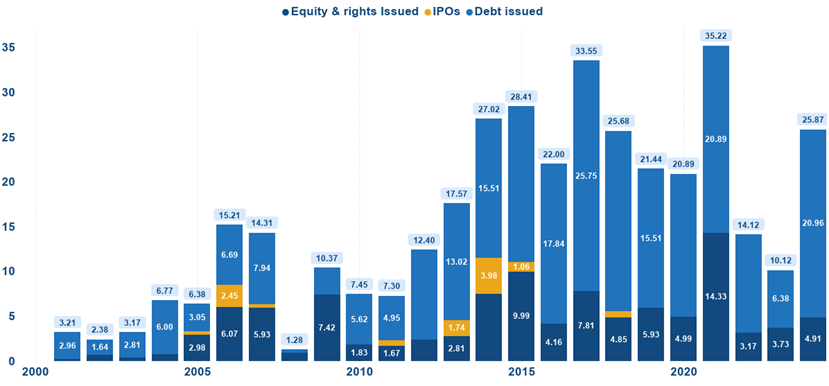

In terms of capital raising, recent history looks promising. European property companies managed to raise a record EUR 25.9 billion throughout the year. Of that, EUR 21 billion were raised through corporate bonds and EUR 4.9 billion through rights issues. Geographically, Sweden took the lead over the rest of the continent, representing 32% of the total, followed by the UK with 21%, and Germany with 17%. Notably, in the past two years, Sweden has represented more than 20% of the total amount raised by the constituents of the FTSE EPRA Nareit Developed Europe Index, highlighting the increasing strength and confidence in the Nordic markets.

Capital Raised by constituents of the FTSE EPRA Nareit Developed Europe Index

Source: EPRA Research.

Moreover, European property companies’ proactive approach to managing their debt profiles has bolstered their resilience. Higher proportions of fixed rate debt, moderate D/E ratios, and longer debt maturity are just some of the key achievements reached by the industry in the last decade (for more detailed insights read EPRA Market Research report. [2] In addition, approximately 80% of outstanding debt consists of bonds, which typically offer longer maturities and more predictable cost structures compared to bank loans. This strategic shift reduces exposure to short-term rate volatility and underscores the sector’s ability to navigate evolving monetary conditions.

Looking ahead, the average cost of debt is projected to rise modestly as companies refinance existing obligations issued at historically low rates. However, this increase is expected to be gradual and manageable, particularly as central banks continue to ease monetary policy.

A Positive Outlook for Earnings and Valuations

Despite the challenges posed by rising financing costs and declining property valuations in recent years, the outlook for LRE is increasingly optimistic. Rental yields are expected to rise modestly, maintaining a favourable spread over financing costs. This spread is critical for sustaining positive leverage and driving earnings growth.

Operational metrics in the sector remain strong, supported by reasonable loan-to-value (LTV) ratios and disciplined capital management. European property companies have made significant efforts to strengthen their debt profiles, positioning themselves to navigate the high interest environment and capitalize on the later benefits of lower interest rates. As a result, we are already seeing a shift in earnings, with reduced impact from capital losses and interest expenses, and a focus on positive property valuations, rental growth, and income generation. This shift is driving improved profitability metrics, such as return on equity (ROE) and return on assets (ROA).

Conclusion: A Promising Recovery for LRE

The listed real estate sector in Europe is well positioned to benefit from the ongoing interest-rate-cutting cycle. With central banks likely to continue easing monetary policy into 2025, LRE stands out as a resilient and attractive asset class. Moderate leverage and debt costs, positive rental growth, and healthy operational metrics provide a solid foundation for recovery.

For both institutional investors and individuals, this environment presents an opportunity to revisit LRE as a compelling option for diversification and growth. As financing conditions improve and operational metrics remains robust, the sector’s long-term potential continues to be strong, offering optimism for a bright future in listed real estate.

About the Contributor

David joined EPRA in 2016 and is in charge of analysing the evolution of listed Real Estate in Europe and managing the FTSE EPRA Nareit Global Index series. He also has more than five years of experience as fixed income strategist and corporate finance analyst. David is an Economist from Universidad del Rosario (Colombia) and has a joint Master degree in Quantitative Economics from Université Paris I Pantheón-Sorbonne (France) and Financial Engineering from Universitá Ca’Foscari di Venezia (Italy). He has been a CFA charter holder since 2019.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/

[1] Turning the Tide: LRE navigating today’s interest rate cycle, EPRA, January 2025.

[2] Reshaping debt profiles: comprehensive analysis of European listed real estate, EPRA, December 2023.