By Stephen Blewitt and Nathaniel Margolis

In case you missed it, we recently published an article discussing real assets and their potential as an inflation hedge. We recommend reading that article prior to this one, where we’ll provide a more in-depth analysis. With that, let’s jump in.

What Does Prior Research Tell Us?

There has been extensive research evaluating whether different asset classes effectively hedge inflation. However, until 2021, the global economy experienced over three decades of relatively low inflation, limiting the scope of past analyses. With new inflationary trends, researchers now have a different set of data to evaluate, and we will need to see what evolving research shows.

Most of the research has only focused on public market securities because of the lack of robust long-term data for private assets. As private markets become more established, future research may shed light on how these assets perform as inflation hedges compared to public markets.

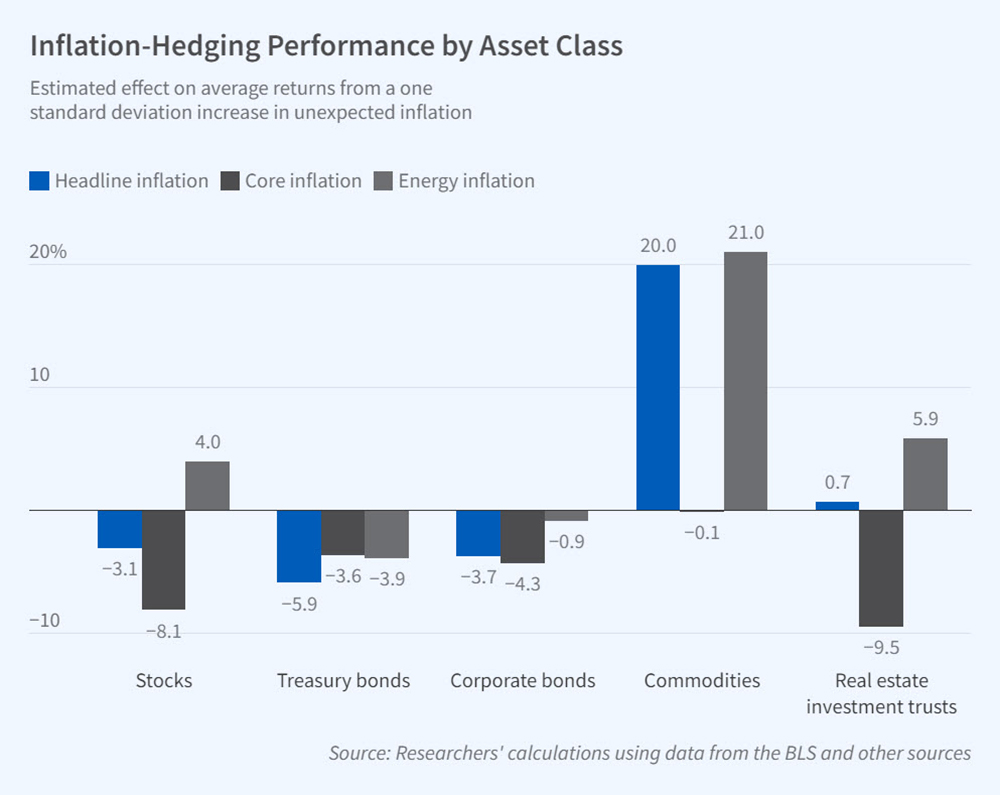

A June 2022 National Bureau of Economic Research (NBER) Working Paper by Fang, Liu, and Roussanov offers insights into public asset classes’ inflation-hedging capabilities. The study found that, in the short term, only commodities provide a hedge against inflation, and that the commodity with the greatest impact was energy. They also found that none of the traditional asset classes, including commodities, provided meaningful protection against expected inflation. Instead, commodities are only protected against unexpected inflation. Over a longer period (eight quarters), the study concluded that no asset class provided meaningful protection against inflation, although currencies did protect against expected inflation while commodities again showed meaningful protection against unexpected inflation. While this is only a single study, and others may reach different conclusions, it offers a cautionary perspective for investors aiming to protect portfolios from inflation.

Do Private Assets Hedge Inflation Differently Than Public Assets?

Two recent papers have looked at specific categories of real assets and whether private assets behave differently than public assets as they relate to inflation.

In their research, Baral and Mei analyzed private and public farmland and timberland assets and concluded that they do not provide a consistent hedge against inflation. The authors sliced the data by time horizon and length of periods examined, and looked at nominal inflation, expected inflation, and unexpected inflation. While a few slices demonstrated results that were statistically significant, most were not.

A key trend identified was that private farmland and timberland investments were positively correlated with inflation before the 2008 financial crisis, but this hedging ability weakened afterward. Conversely, public farmland and timberland investments, which previously showed no correlation with inflation, have exhibited improved hedging capabilities since 2008.

Unfortunately, the authors did not propose a specific theory for what caused this shift. Perhaps future studies will evaluate this trend. The sizes of the public and private markets for each asset class are small, which may lead to anomalies caused by the results of individual managers or properties. Also, the public companies may hold more debt than the private asset indices, which can amplify returns and distort the comparison. Additionally, operating strategies such as: i) where managers invest (geographically), ii) what types of trees or crops they invest in, and iii) whether they operate directly or lease to others, can materially impact their financial results.

In their paper, Brown, Lundblad, and Volckmann showed that private infrastructure and real estate have performed better than their public market counterparts in the post-pandemic recessionary period.

From 2005–2019, private infrastructure outperformed public infrastructure by 2.1 percentage points annually. During the post-pandemic recessionary periods (2020–2021 and 2022–2023), this outperformance grew to 6.7 and 11.0 percentage points annually, respectively.

For private real estate, performance was less distinct before the pandemic, with a slight underperformance of 0.1% annually compared to public real estate (2005–2019). However, private real estate outperformed public real estate by 0.7 percentage points annually from 2020–2021 and 6.3 percentage points annually from 2022–2023.

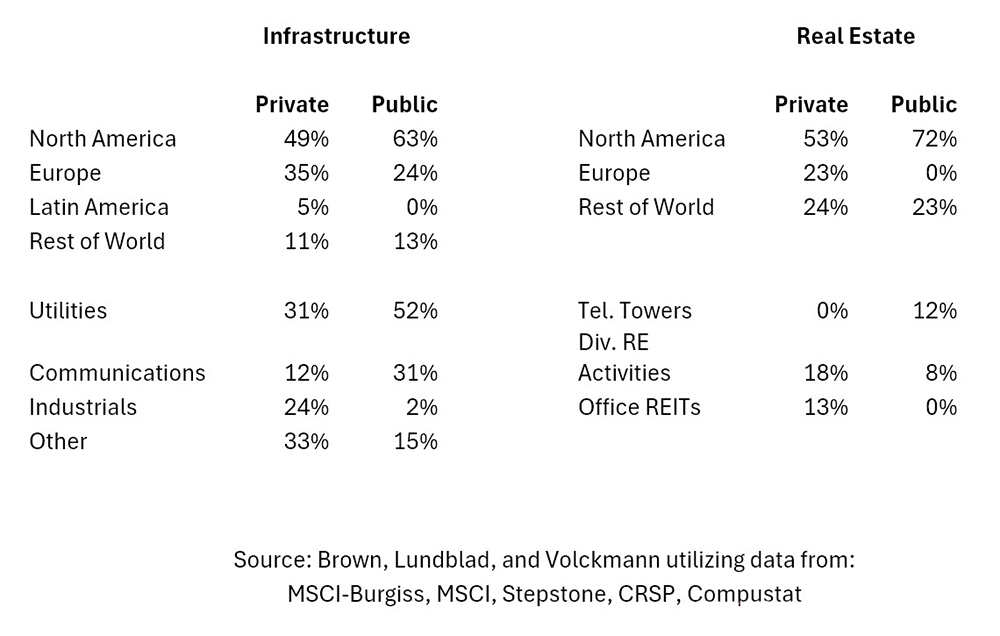

Evaluating possible reasons for this outperformance, the authors demonstrated that the assets held by private funds are meaningfully different from those held by public funds. This is important because it may inform investors’ portfolio allocation decisions, particularly if inflationary pressures are a concern. It also highlights how private assets can be a meaningful diversifier for investor portfolios.

Specifically, the authors showed that the mix of assets in public funds differed from private funds in terms of geographic and sector composition.

Geographic and Sectors Allocations for Private and Public Real Asset Funds

Key Takeaway

While Brown et al. did not conclude that either public or private infrastructure and real estate are definitive inflation hedges, they suggested private real assets may offer more effective inflation protection than public real assets based on investment performance during the recent inflationary period.

Private Real Assets, Inflation, and Individual Investor Portfolios

Large institutions have the luxury of hiring expert teams to conduct proprietary research and advise their investment teams to manage inflation risks. However, with unclear conclusions about how private (or public) assets can be used to hedge inflation, how should individual investors approach this challenge?

For starters, the research suggests that by including private real assets in their investment portfolios, high-net-worth individuals can benefit from diversification and the potential for higher returns. If private assets indeed outperform public assets over the long term, which some studies suggest, they could provide an additional buffer against long-term inflation for investors with longer time horizons.

Individual investors may also consider using private real assets to hedge specific inflation risks that could impact their short-to-medium-term purchasing power and balance sheets. But to do so, they need to clearly understand the objectives of fund managers and whether those managers are hedging inflation risk at the asset level or not.

There are strong indications that energy assets may hedge short-term inflation spikes. However, we believe that the benefit may depend on whether fund managers operate their assets to allow for the commodity price variability to flow through to the investor. When evaluating energy investments for potential inflation hedging, investors should ensure they understand the fund managers’ hedging strategies, how the investments are structured, and whether the commodity price variability flows through to the investor in the short term or not.

Other real assets may offer similar hedging protection if they allow for unconstrained and immediate pass-through of cost increases. For example, real estate with short-term leases, or long-term “triple net” leases with uncapped rent increases tied to relevant price indices could serve as effective hedges. Again, investors should ask fund managers how they manage leases and operating costs to maximize the likelihood of the expected benefit.

Finally, investors must assess how they prioritize inflation risk compared to other risks they are trying to mitigate in their portfolios. While inflation risk may have become more prominent in recent times, attempting to hedge it through private real assets may introduce other risks that are potentially more significant, such as illiquidity or lack of attractive investment opportunities. All these factors, and more, must be weighed carefully when making asset allocation decisions.

Future Research Is Needed to Better Assess Private Real Assets and Inflation Hedging

With the significant growth of private markets, researchers will have access to more robust data to analyze how private assets can mitigate inflation risks. It will be particularly useful to analyze the data against the backdrop of today’s higher inflationary environment. As new studies emerge, we expect investors will gain clearer insights into when and how private real assets can be used as an effective hedge.

In the meantime, we recommend that investors review the abstracts and conclusions of the papers cited here to deepen their understanding of the potential value of allocating capital to private real assets. For additional perspective, the Federal Reserve reports “The Great Inflation, 1965–1982” and “The Rise (and Fall) of Inflation During the Early 2020s” offer important historical insights into inflation and a detailed examination of its recent spike. Armed with these resources, investors will be better equipped to make more informed decisions about incorporating private real assets into their portfolios.

About the Contributors

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/