By William J. Kelly, CAIA, Founder & Managing Member, Educational Alpha LLC

Alpha has always been elusive. Often, when found, that trade gets very crowded, the inefficiencies and asymmetric information edges get rinsed out, and beta enters the room. This can take decades, and while the opportunity never goes away, it certainly moves asymptotically lower, where very few remain below the curve.

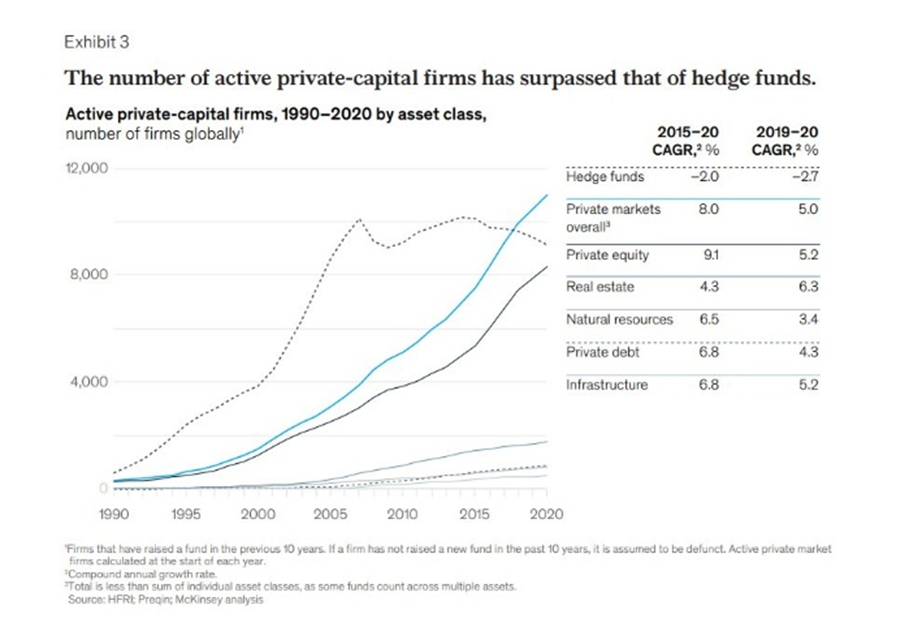

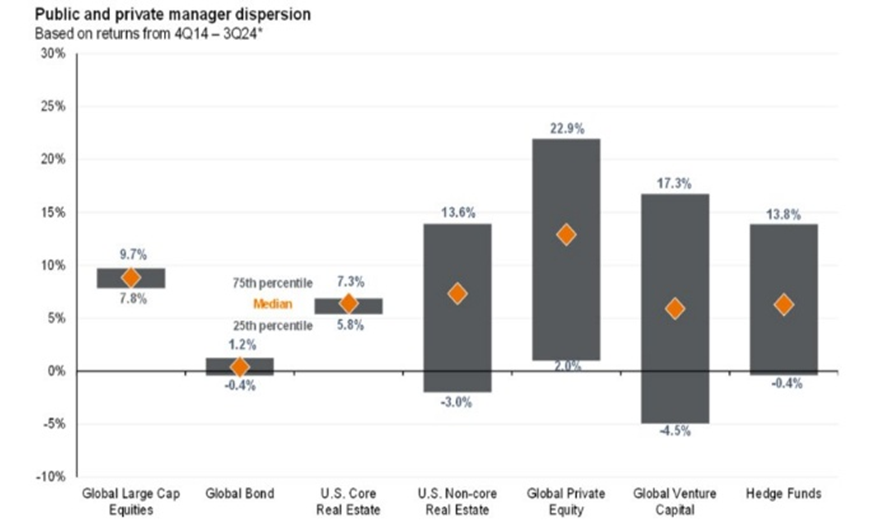

The Endowment Model is a perfect example of this phenomenon. Gathering the complexity and illiquidity premiums was once (almost) an automatic, especially when there were only two dozen private equity GPs in the world in the early 1980’s. As that number has now eclipsed 10,000 it is quite easy to understand the difficulties of finding alpha and the impetus behind inter-quartile investment performance dispersion that is measured in thousands of basis points.

There will always be a video to kill the radio star but it is the smart money that knows when it’s time to move on to the next big thing, and sometimes big things do not come in byte-sized packaging.

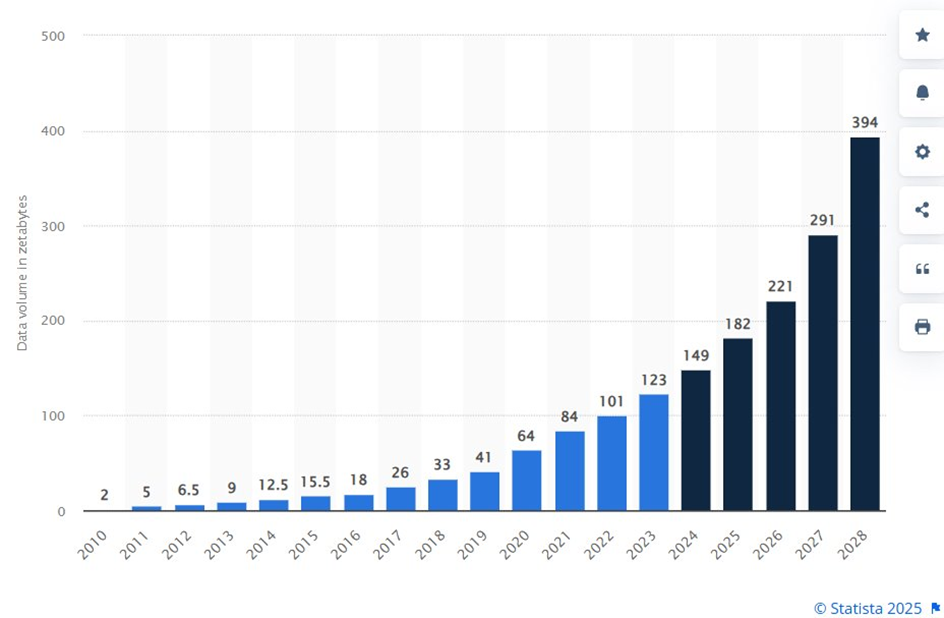

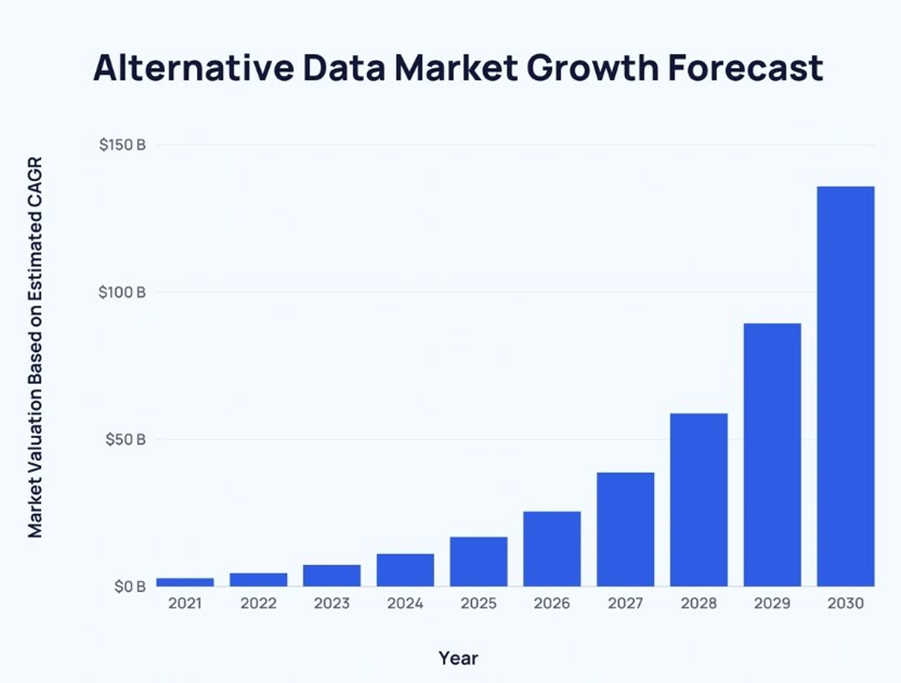

The term byte comes from the field of data science, having been coined by Werner Buchholz less than 70 years ago. He needed a ‘warehouse’ for eight bits to make a byte, and the harnessing of computing power began quite a disruptive run of its own. It took another 60 years before we reached the Zettabyte era, where the amount of computing power and alternative data would make Herr Buchholz’s contribution seem quaint. The zettabyte was a packaging play holding 8.0E+21 bits or, for the more mathematically challenged, that is the equivalent of a 1, followed by twenty-one zeros. Every tweet, ‘like’, comment, or text has gotten digitally swept up in this momentum (we are now at about 125ZB), and the money management community has begun the search for alpha herein as they spend billions in pursuit of that end.

This is still early days, and we now have LLMs, quantum computing, qubits, and generative AI on the case trying to sort out this vast sea of inefficiencies. To the winner goes the spoils, but we cannot let those same spoils pollute, denigrate, or destroy the concept of privacy, ethical business practices, and the gray area between what is simply suitable versus what is in the best interests of the client. This should be of specific note and concern when the algorithm is charged with sorting that out.

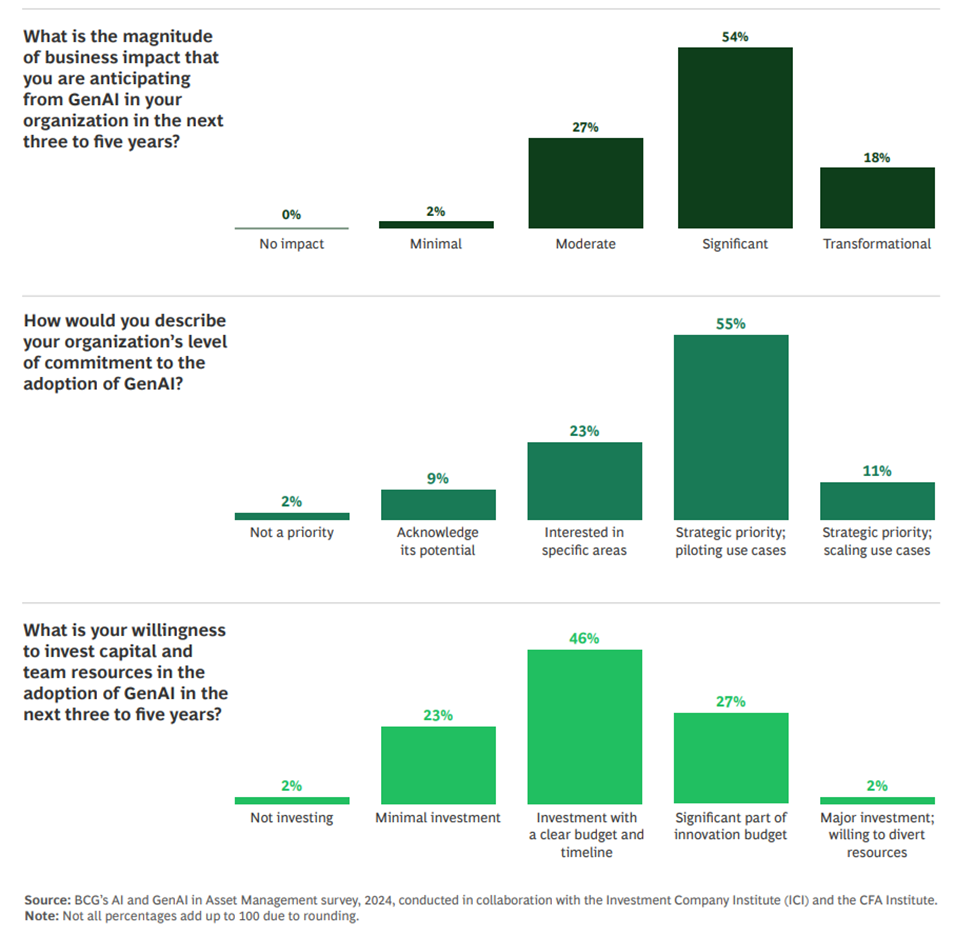

BCG put out a relevant report last year (AI and the Next Wave of Transformation), which provides some timely insights into the current state of play. It is interesting to note that over 70% of the surveyed asset managers (collectively overseeing $15T of client assets), indicated that the anticipated magnitude of business impact from GenAI will be either ‘significant’ or ‘transformational.’ No surprise there, but the expectation seems to suggest that the GenAI app will do most of the heavy lifting! Absent a substantial deployment of balance sheet capital, it is a bit hard to reconcile how we realistically get there when less than 30% of those surveyed indicate ‘significant’ and/or ‘major’ resources to be committed to this undertaking.

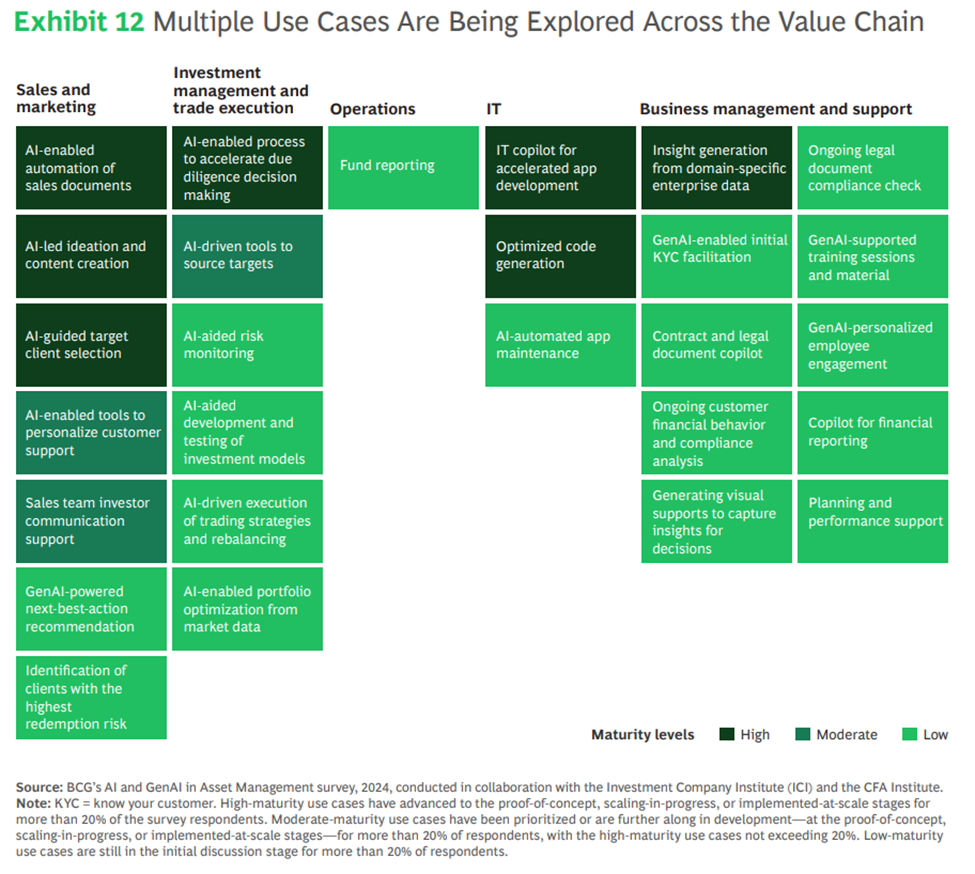

Equally telling (and perhaps a cynical view), it would also appear that the very best use-case is leaning toward asset gathering over value creation (code for alpha!).

Financial services companies are still in the early days of wholesome adoption of generative AI, LLMs, quantum computing, and weaponizing the zettabytes of alternative data to feed them. Different sources of alpha will require different skill sets, and you may just find yourself sitting next to a data scientist who came from prior employers like NASA, Alphabet, Microsoft, or Apple. Future-proofing one’s career has never been more important, especially as these disruptive themes will naturally accelerate and no part of the value chain will remain the same.

Alpha, whether sourced from the private markets or from zettabytes of alternative data, will always be the holy grail. How we define it, and where we mine for it, are what change. The diligent investment professional, whether an alpha hunter or not, should always think about what this means for their career alpha too, and best to do that before someone or some-bot makes that decision for you.

Embrace disruption with continuous learning, as this transformative phase can be a formidable opportunity to reset the trajectory of your career. This is a rare moment where career beta can become your idiosyncratic career alpha, where the zettabyte might just fear you.

Seek education, diversity of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

About the Contributor

William (Bill) J. Kelly, CAIA is the Founder and Managing Member of Educational Alpha, LLC where he writes, podcasts, and speaks on a variety of investment related topics, focused on investor education, transparency, and democratized access to differentiated risk premia. Previously he was CEO of CAIA Association since taking this leadership role in 2014 until his retirement in 2024. Prior to that, Bill was the CEO of Boston Partners, and CFO and COO of The Boston Company Asset Management, a predecessor institutional asset manager. In addition to his current role, Bill is also the Chairman and lead independent director for the Boston Partners Trust Company and serves as an independent director for the Artisan Partners Funds, where he is also Chair of Audit Committee and a designated Audit Committee Financial Expert. He is also currently an Advisory Board Member of the Certified Investment Fund Director Institute within the IOB (Dublin) which strives to bring the highest levels of professionalism and governance to independent fund directors around the world. Bill began his career as an accountant with PwC where he earned his CPA (inactive).

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/