By Marko Papic, Chief Strategist, BCA Research & Author of Geopolitical Alpha

Blaming geopolitics for one’s poor performance has become a rite of passage for many investors, both public and private. Just do a quick survey of the quarterly “LP letters” bemoaning poor performance or spend some time sitting in on a CIO’s “apology tour” across the ecosystem, from venture to hedge funds, and you would think that investors are woefully unprepared for the dawn of the new world.

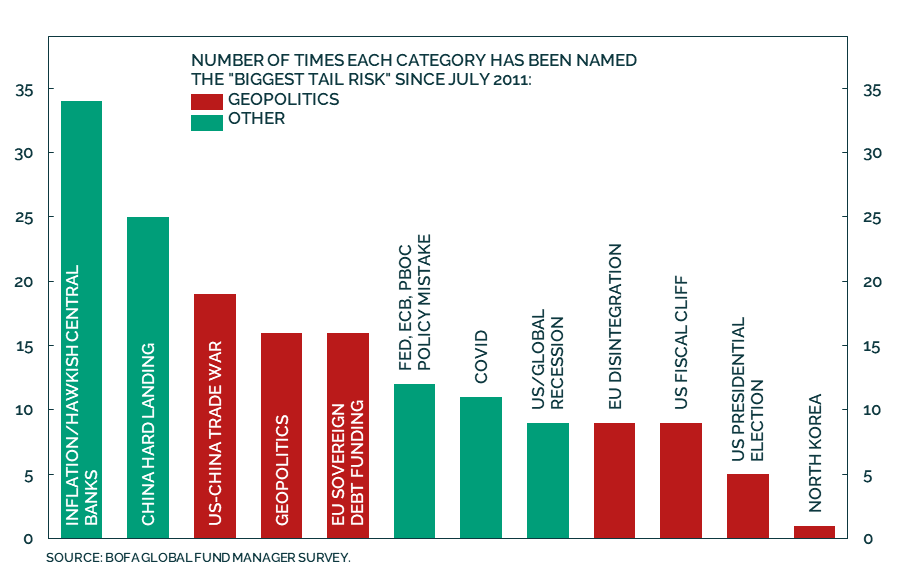

Our epistemic community is woefully unprepared. But there is nothing new about the “new world” we are supposedly living in. A quick gander at the Bank of America Global Fund Manager Survey, which began in the summer of 2011, shows that in 75 months (which is 45% of the time), a geopolitical issue was cited as the primary tail risk to the market. And this is being generous, as I did not include the inflation worries of 2022-2023, Coronavirus, and China “hard landing” in the policy/geopolitical camp (even though I clearly think that they belong there).

Geopolitics did not become relevant overnight. Since 2008, the world has sped up. There are many reasons that I don’t want to articulate here, but the quick version is that a multipolar ordering of global power leads to a higher propensity of military conflict. The delta in geopolitically induced market VOL is just going to stay higher. I’ve spent the better part of my career making the case for this conclusion, including in my book Geopolitical Alpha.

My main passion is the intersection of geopolitics and markets. But I am also passionate about leaving our epistemic community better off for the future generations. Our problem is not ignorance of the fact that geopolitics matters, but rather the lack of frameworks to analyze it.

For most investors, particularly the senior ones signing consultant and research checks, the solution is in wheeling out past-expiration-date policymakers into conference rooms and in front of board meetings, expecting them to add value.

This is folly, if not downright medieval. You wouldn’t hire an ex-CEO to do bottom-up equity analysis, so why would you hire an ex-politician to do a top-down geopolitical one? I call these fine gentlemen (note: almost always… gentlemen) the Wizards of Oz. They, on occasion, provide good context but almost always overstate the reliability and usefulness of their network or “intelligence.”

Most investors think that the way to political or geopolitical insight is through access to intelligence, but I have never met an investor who listens to quarterly CEO calls and expects to hear the truth. And every time a big hedge fund manager goes on Bloomberg to proclaim that a certain company is the stock to buy, veteran investors scoff that they are “selling their book.”

Investors should not treat chats with policymakers and political insiders any differently. For a community that has its BS detector set to high when it comes to the markets, investors are awfully gullible when it comes to insights from smoke-filled rooms in DC (or any other place).

The problem is that we have been outsourcing policy, political, and geopolitical analysis for so long that we have become lazy. Geopolitics is here to stay, as a major factor of both harvesting alpha and searching for beta. As such, we are not just outsourcing knowledge, but our very fiduciary duty to a cabal of former policymakers that, let’s be frank, quite often don’t know how their mortgage statement works.

There are three particular weaknesses in the financial industry that make it poorly prepared for the geopolitical and political shifts afoot.

The Quant Obsession: By the late twentieth century, a PhD in political science could be awarded to a student who knew very little about actual politics. By the 1990s, economics had won the war of social sciences. It dominated academia to the point that political scientists no longer produced research that any policymaker, businessperson, or investor paid attention to. Meanwhile, with politics and geopolitics stuck in their Goldilocks settings, the finance profession turned to modeling based on macroeconomic and market inputs, because exogenous factors like elections and wars largely ceased to matter for the most liquid markets.

Self-selection: As investment decisions became more and more akin to engineering problems, the industry stocked up with… “engineers.” I call this hiring flood the ascendance of the “Newtonian Investor.” The Newtonian Investor is a finance professional who bests his peers through a superior understanding and manipulation of mathematical rules. This investor is like the engineer who constructs the most durable bridge by best accommodating actual Newtonian laws of physics. But the laws of economics are not so fixed, and they are subject to change along with everything else when a paradigm shift occurs.

Ideology: The 1980s electoral defeats of demand-side policies gave laissez-faire a mythical and religious staying power in the financial industry. Investment professionals became ideologically wedded to a set of beliefs. However, the laissez-faire ideology often comes with a disdain for government and politics that denigrates the very act of political analysis. As such, a true investment professional came to be someone who read The Wall Street Journal and did not bother with the political world because it was beneath them to do so. But one’s fiduciary responsibility as a custodian of others’ assets demands a nonideological, nihilist approach to investing and politics.

Of course, investors should still use quant tools and approach their craft with scientific rigor. But the Goldilocks Era of geopolitical tailwinds allowed investors to become overly focused on macroeconomics and the markets. Investors would benefit from applying that same rigor to politics.

There are empirically driven frameworks for analyzing politics that do not involve cozying up to politicians at cocktail parties. I present such a framework, focused on material constraints, both in Geopolitical Alpha and the latest version of the CAIA curriculum. There are other frameworks that present a repeatable, falsifiable, and scalable approach to politics.

The onus on investors starting their careers is to seek these frameworks out. The onus on their superiors is to start thinking of diversity, in the hiring context, in a more holistic and nuanced perspective. Diversity is not just about gender, age, or race. It is also about frameworks, approaches, and academic disciplines. It won’t do your firm any good to stock up with “diverse” investment professionals who don’t know how a reconciliation bill works or why Iran’s air force is dilapidated. Maybe it is time to even… gasp… hire an anthropology major, on occasion.

This view is only novel to investors who cut their teeth in the heyday of American military and laissez-faire ideological hegemonies. To those who invested when the world was messier, the ideas here are obvious.

The truth is that there is nothing that difficult about becoming an investment professional. Finance and economics barely require advanced math to understand. Yes, we have made the language barriers to entry onerous – by referring to the bond market, for example, as “fixed income,” “credit,” and “rates,” for some odd reason. But the truth is that this stuff can be picked up on the fly.

As such, the first step for those who control hiring decisions in our ecosystem is to give the kids with humanities and “softer” social sciences a chance. The second is for investment firms to start taking frameworks for analyzing geopolitics and politics seriously.

About the Contributor

Marko Papic is a macro and geopolitical expert at BCA Research. He provides in-depth analysis that combines geopolitics and markets in a framework called GeoMacro. He is also the author of Geopolitical Alpha: An Investment Framework for Predicting the Future. At BCA, Marko leads the firm’s premier service, BCA Access. Previously, Marko was a partner at an alternative asset management firm in California, where he provided investors and clients with controversial market calls, bold views, and around-the-clock research. He helped seed global macro hedge funds and curate several funds across public and private markets. His work on incorporating geopolitics into the asset management industry is part of the CAIA curriculum.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/