By William J. Kelly, CAIA, Founder & Managing Member, Educational Alpha LLC

The article headline is so much more than a tongue-twister, although I do dare you to try and say it three times, and fast!

The Perplexity herein is a venture-backed startup circa Dec 2023, and their killer app is an AI-enabled search engine tool. According to a recent Wall Street Journal article, the latest funding round should bring in $500 million of fresh capital along with a lofty valuation of $14 billion.

Put aside for the moment that there were four rounds of fundraising for Perplexity in 2024 alone, and that the penultimate valuation was struck at $9B just a few months ago (a cool 55% ROI for those investors!). This is rarefied mid-cap air if we use our grandfather’s public equity market as a valuation proxy. Within this same market cap zip code, you will find well established names (and founding years) such as DICK’S Sporting Goods (1948), BJ’s Wholesale Club (1984), SharkNinja (1994), and Warner Music Group (1958). Across these four names (with an average age of 54 years), you will also note annual revenues in the range of $6B to $21B, and TTM net income from a low of about $500M to a high of $1.2B.

Back in VC land, the thirty-month-old Perplexity has recently eclipsed the $100M mark in annualized revenue; an impressive milestone for sure but a tiny fraction of the aforementioned sample of card-carrying members of the $14B club. Exact profit numbers are always hard to divine in the hallowed halls of venture capital, but when you query the Perplexity AI search engine, you find that the company is “highly under-monetized” and that “there is no direct evidence from recent reports that the company is profitable.”

To be fair, Perplexity is the future of AI, and the chosen basket of public companies are selling more proletariat products such as Nike sneakers, hoard-ably packaged toilet paper, blenders, and Ed Sheeran’s music. I do not suspect that any of these public companies will (ever!) experience a market-cap pop of their own anywhere near +55% in any given quarter, but the downside risk for them is likely far less than an early-stage start-up that sometimes has a tendency to go to zero.

The hackneyed Twain-ism of history not repeating but often rhyming might be apropos if we take the business model of Perplexity and put it through the Web 1.0 lens. The ultimate success for them and their investors is highly dependent upon kneecapping and/or taking market share from the likes of Alphabet and Microsoft; two well-established companies with a combined balance sheet prowess of $1T, and their own views as to who will (sustainably) dominate the search engine business.

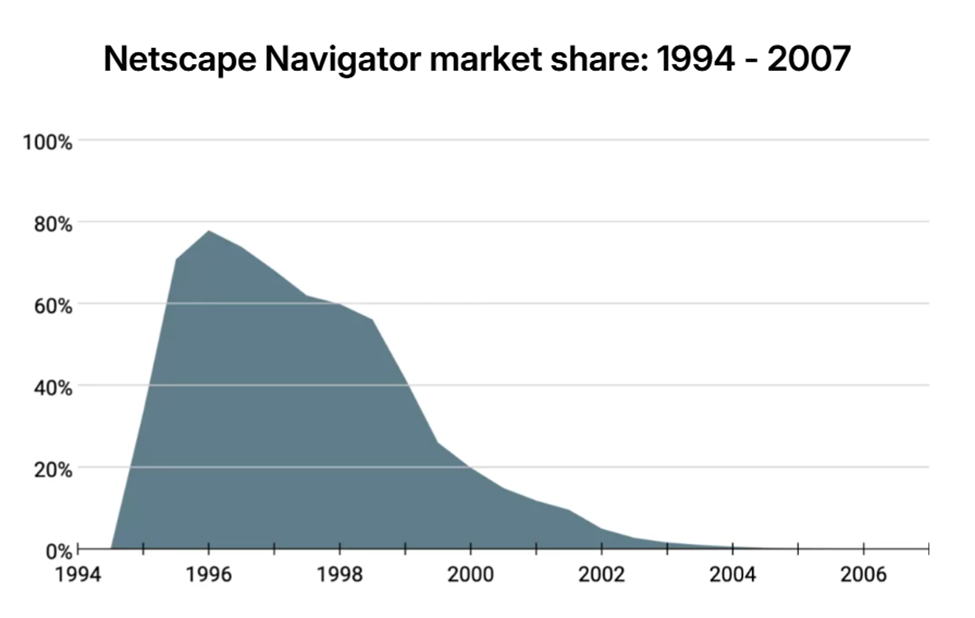

Does anyone remember Netscape? They truly owned the Web 1.0 search engine space with almost 80% market share in the mid-1990’s according to TechSpot.

Today you can find them in the “Could Have Bin (pun intended)” section of Bonaventure(capital) Cemetery right next to the more freshly dug plot of someone named Skype (2003-2025). The grave marker there reads, “Here lies the prior owner of one-third of the video calling market until mercilessly shivved in the back by an assailant named Zoom.”

None of this is to say or imply that any start-up cannot be a tremendous success. Look at Amazon, which just celebrated its 28th anniversary since its IPO back in May of 1997. Had one invested $1,000 back then, it would be worth a cool $2.7M today, or a gain of 250,000% according to Perplexity AI... and speaking of Amazon, founder Jeff Bezos is also an investor in Perplexity. But before mimicking his investment thesis, consider this: he (or more likely his family office venture fund) participated in a prior $74M fund raising round. While the Perplexity cap table is not publicly disclosed, let us assume on the (very) high end that Bezos was 50% of that raise. That level of commitment would represent about 3 basis points of his net worth, and if it were ever marked to zero, it is very unlikely that the repo man will come to repossess Koru.

Every investor should think about an innovation sleeve within their portfolio because ‘perplexity’ is the realm of ambiguity and complication, which is the idiosyncratic risk exposure that alpha junkies crave. However, and especially with new and disruptive technology, there is often a first-mover disadvantage; “Ask” Jeeves or Netscape if you have any doubt! Due diligence is critically important, as is a discipline to not concentrate your exposure within a single name, nor to a specific vertical within the perceived disruptive value chain.

Seek education, diversity of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

About the Contributor

William (Bill) J. Kelly, CAIA is the Founder and Managing Member of Educational Alpha, LLC where he writes, podcasts, and speaks on a variety of investment related topics, focused on investor education, transparency, and democratized access to differentiated risk premia. Previously he was CEO of CAIA Association since taking this leadership role in 2014 until his retirement in 2024. Prior to that, Bill was the CEO of Boston Partners, and CFO and COO of The Boston Company Asset Management, a predecessor institutional asset manager. In addition to his current role, Bill is also the Chairman and lead independent director for the Boston Partners Trust Company and serves as an independent director for the Artisan Partners Funds, where he is also Chair of Audit Committee and a designated Audit Committee Financial Expert. He is also currently an Advisory Board Member of the Certified Investment Fund Director Institute within the IOB (Dublin) which strives to bring the highest levels of professionalism and governance to independent fund directors around the world. Bill began his career as an accountant with PwC where he earned his CPA (inactive).

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/