By Chase A. Kinnison

Growth investors are often seen as pursuing high-valuation companies with untapped earnings potential, while value investors gravitate toward lower-valuation securities that are perceived as undervalued based on fundamentals. Despite their seemingly polarizing approaches, both styles share a common objective: identifying opportunities where the price paid is less than its deemed intrinsic worth. These strategies are inherently correlated and are better understood as interconnected points along a unified framework: the Value Continuum.

The Value Continuum underscores the common goal of generating and realizing capital appreciation through opportunities that are often misunderstood or underestimated. Importantly, it highlights the synergistic relationship between growth and value within portfolio construction. Simply, growth creates value, and there is value in growth - they are not opposing forces but interwoven stages of capital appreciation.

Growth vs. Value

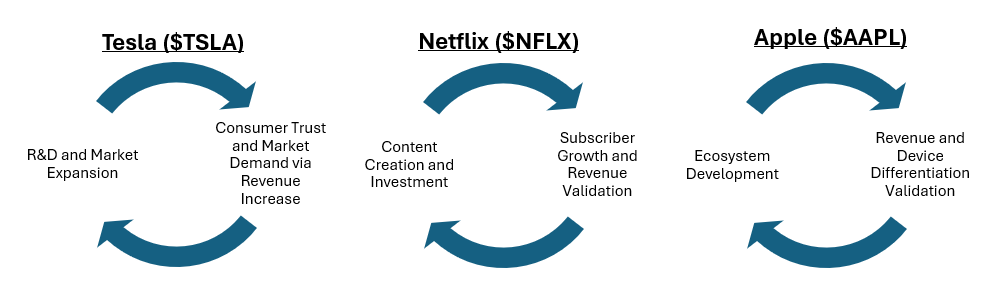

Traditional growth investing prioritizes companies positioned for rapid expansion, fueled by innovation, market leadership, or transformative opportunities and supported by fundamentals. These assets often trade at premium valuations, reflecting their promise of future earnings potential and scalability. Yet growth, for all its forward-looking ambition, does not stand alone, and often finds its roots in value—whether through reinvestment of strong cash flows, strategic capital allocations, or accretive acquisitions.

Value investing focuses on identifying assets priced below their estimated intrinsic worth, and with fundamentals that are available to sustain and/or unlock growth. These investments are typically characterized by financial prudence via lower price multiples, and appeal to investors who emphasize and require a discount to intrinsic value. Moreover, anchored in a time-tested and disciplined methodology is the prospect of revitalization; as undervalued investments recover and gain momentum, their growth potential unfolds, and connects the principles of value with the dynamism of growth.

While growth and value managers share the same ultimate objective of identifying compelling investments, their starting points set them apart:

A growth manager begins with a focus on companies, sectors, or industries demonstrating significant potential for future expansion or market leadership and then evaluates whether the current valuation can be justified by those growth prospects.

Conversely, a value manager focuses on identifying companies trading at a discount to their intrinsic worth and works to substantiate why the market has overlooked or misunderstood the company.

Both fundamental approaches demand meticulous analysis, but it is their initial lens—growth potential versus undervaluation—that distinguishes the two strategies. Simply put, growth managers identify companies they like and justify the valuation; value managers identify valuations they like and justify the company.

Introduction to the Value Continuum and its Framework

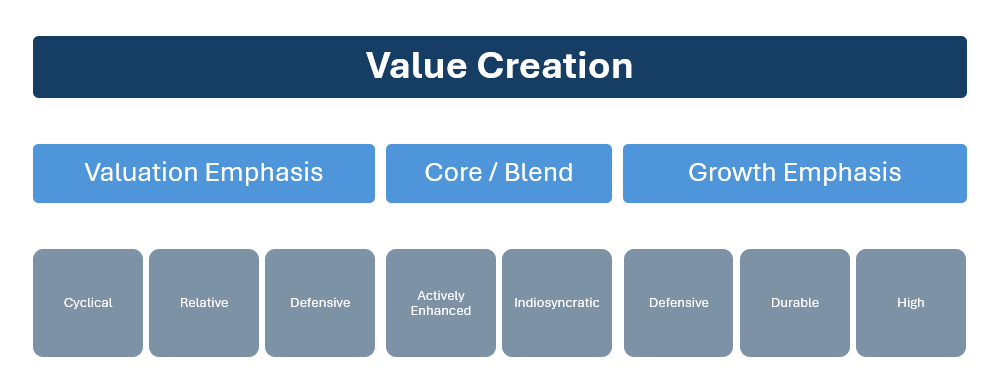

The Value Continuum is a dynamic framework that balances growth and value strategies within portfolio construction, emphasizing adaptability and interconnectedness. Designed specifically for portfolio construction, this framework provides investors with a multidimensional lens to navigate the complexities of investment strategies. By addressing qualitative nuances, the Value Continuum serves as a versatile tool for constructing diversified and resilient portfolios, particularly in the context of fund-of-funds.

Central to this framework are eight uniquely defined investment styles. Inspired by the Morningstar Style Box, these styles leverage common industry jargon to ensure ease of understanding while introducing a fresh perspective to portfolio diversification. Together, they form a guide for achieving intentionality and diversification within the continuum's dynamic approach.

Cyclical Value

Cyclical Value strategies emphasize a contrarian approach, where managers actively "zig and zag" with the market to capitalize on opportunities during periods of transition or dislocation. These strategies focus on undervalued companies within sectors or regions poised to benefit from cyclical recoveries, macroeconomic shifts, or sentimental rebounds. By dynamically adapting to wherever opportunities arise, Cyclical Value strategies leverage their flexibility and market insights to generate returns.

Furthermore, these strategies place a higher emphasis on a margin of safety, typically requiring assets to trade at a discount of 30% or more to intrinsic value. By prioritizing businesses that trade at a significant discount to intrinsic value, Cyclical Value strategies inherently tilt toward companies with proven operational histories, lower growth uncertainty, stable cash flows, and established end client bases. The strategy’s ultimate objective is to exploit inefficiencies created by sentiment-driven market cycles, while maintaining disciplined valuation principles. Cyclical Value strategies demand patience and a long-term perspective, as returns are inherently uneven, often concentrated in short periods with speedy, robust gains when the market recognizes undervalued opportunities.

These strategies should be primarily benchmarked to the respective value benchmark, with the secondary benchmark being the core.

Relative Value

Relative Value strategies prioritize assets that are attractively priced compared to peers or industry benchmarks rather than strictly undervalued. These strategies leverage comparative analysis to uncover pricing inefficiencies, typically through three main perspectives:

First, strategies may prioritize the cheapest half of the market, systematically focusing on investments that are undervalued compared to their peers or the benchmark.

Second, they can adopt a probabilistic approach via an upside-to-downside perspective and emphasize a predefined ratio to balance potential gains against losses.

Third, they can utilize a price-to-quality perspective, where the margin of safety is inversely correlated to the quality of the company—higher-quality firms may warrant a smaller margin of safety due to their perceived resilience and reliability; but, nonetheless, a discount to intrinsic value is required.

Within the portfolio, Relative Value provides a stabilizing influence, delivering more consistent, risk-adjusted returns via an adaptable valuation methodology.

These strategies should be primarily benchmarked to the core benchmark, and the secondary benchmark being the value, with the expectation that the strategy, over the long term, outperforms the core benchmark with a valuation sensitive philosophy and process.

Defensive Value

Defensive Value strategies prioritize companies with stable cash flows and resilient business models that can weather economic downturns. These investments prioritize capital preservation and income generation, acting as a stabilizing force within the portfolio. The objective is to mitigate risk while providing a reliable source of returns during periods of uncertainty or market volatility.

These strategies should be implemented and monitored with an emphasis on downside protection and the ability to compound returns attractively over the long-term.

Actively Enhanced Core

Actively Enhanced Core strategies are designed to be highly adaptable and flexible, employing benchmark-aware risk management with marginal active tilts. These strategies prioritize alignment with their benchmark, operating within a defined tracking error budget to limit deviations and ensure disciplined adherence to the benchmark’s structure. Tactical adjustments are introduced selectively and, on the margin, responding to market conditions, economic trends, or sector-specific opportunities, while preserving the integrity of the stylistically core allocation. This approach strikes a balance between delivering consistent, long-term performance and optimizing risk-adjusted returns through calculated enhancements that are both responsive, controlled, and systematically defined.

The expectation for Actively Enhanced Core strategies is to deliver a more predictable return pattern, and to lay the foundation of the portfolio by maintaining the integrity of the core allocation while offering incremental enhancements in response to market dynamics.

These strategies are expected to outperform the core benchmark with an emphasis on consistency over magnitude in excess returns.

Idiosyncratic Core

Idiosyncratic Core strategies typically appear as "core" or a blend of growth and value within the Morningstar Style Box, reflecting their unique characteristics. These strategies may demonstrate marginal tilts toward either growth or value, yet their foundation lies in a specific investment philosophy, which inherently qualitatively biases them one way or the other. Most often, this is via a growth-oriented philosophy executed through a conventional, value-focused implementation practice. This distinct approach results in highly idiosyncratic return patterns, where outperformance is primarily driven by stock selection and occurs when the market aligns with and rewards the thesis behind individual holdings. In addition, these strategies can notably outperform or underperform even in a normalized market environment, where no extreme growth or value trends dominate. This unpredictability underscores their distinctiveness, as returns are dependent on the manager’s ability to identify mispriced opportunities and the market’s eventual recognition and validation of these assets.

While both Idiosyncratic Core and Actively Enhanced Core strategies are core-oriented, they differ fundamentally in their design and implications for portfolio implementation. Idiosyncratic Core strategies, despite their core-like appearance, can introduce a misalignment of expectations due to their unique, philosophy-driven approach and differentiated implementation style. This misalignment may lead to heightened volatility in returns, as their performance is inherently tied to the idiosyncratic nature of stock selection and market conditions. As a result, implementing an Idiosyncratic Core as a core mandate requires careful consideration, as it may challenge traditional notions of consistency and stability often associated with core allocations.

The primary benchmark for these strategies should be the core index with a secondary benchmark being one’s actuarial hurdle rate.

Defensive Growth

Defensive Growth strategies aim to deliver stability through consistent and durable growth. These strategies tend to be forward-looking, prioritizing capital appreciation driven by reliable growth trajectories while maintaining lower risk profiles compared to higher-volatility growth categories. Defensive Growth strategies are expected to deliver long-term growth approximating the combined effect of global GDP expansion, dividend yield contributions, and inflation adjustments, reflecting their focus on stable, resilient companies with steady growth trajectories.

Importantly, Defensive Growth seeks out stability within growth-focused investments, while Defensive Value leverages stability to capture opportunities in undervalued assets. Both provide essential balance to a portfolio but differ fundamentally in their approach—one emphasizing reliable growth potential, the other extracting undervalued durability. Strategies deemed to be Defensive Growth should be implemented and monitored with an emphasis on downside protection.

Variant Growth

Variant Growth strategies target investments where the manager holds a differentiated view on a company’s growth trajectory compared to consensus expectations, via either the magnitude and/or duration of growth. These strategies focus on identifying mispriced opportunities where growth potential is underestimated by the market. The objective of the portfolio is to add contrarian insights and diversify the growth segment while enhancing overall returns. Moreover, these strategies focus on uncovering growth opportunities that are underestimated or overlooked, relying on contrarian insights to capture the upside when market expectations are exceeded.

In contrast, Relative Value emphasizes exploiting comparative pricing inefficiencies, targeting assets that appear attractive relative to peers or benchmarks. Likewise, Relative Value strategies tend to emphasize a variant perception of the timing of a growth catalyst. Variant Growth thrives on forward-looking, differentiated opportunities, while Relative Value aims to benefit from narrowing valuation gaps. Together, these strategies represent complementary but distinct approaches: one driven by bold growth perspectives that challenge consensus, and the other rooted in a disciplined valuation methodology.

These strategies should be primarily benchmarked to the core benchmark, and the secondary benchmark being the growth version of the benchmark with the expectation that the strategy, over the long term, outperforms the core benchmark with a growth-oriented philosophy and process.

High Growth

High Growth focuses on investments in companies that demonstrate sustained, above-average growth rates, often exceeding double digits or a predefined absolute hurdle. These companies are typically market leaders or innovators operating in sectors with significant expansion potential, driven by scalability, technological advancements, or transformative business models. While these investments may command premium valuations, their robust growth trajectories offer substantial long-term upside. High Growth strategies invest in companies with elevated price multiples, reflecting their premium valuations, but with the expectation that the underestimated growth potential, once fully recognized by the market, will justify and eventually align with their higher price multiples through robust earnings expansion and market validation.

Although both are growth-oriented, Variant Growth and High Growth occupy different segments of the business lifecycle, with Variant Growth often focusing on companies in more mature phases where the market underappreciates their growth potential, while High Growth targets early-stage or rapidly expanding businesses with above-average, double-digit growth trajectories driven by innovation or market disruption.

These strategies should be primarily benchmarked to the growth benchmark, with the secondary benchmark being the core.

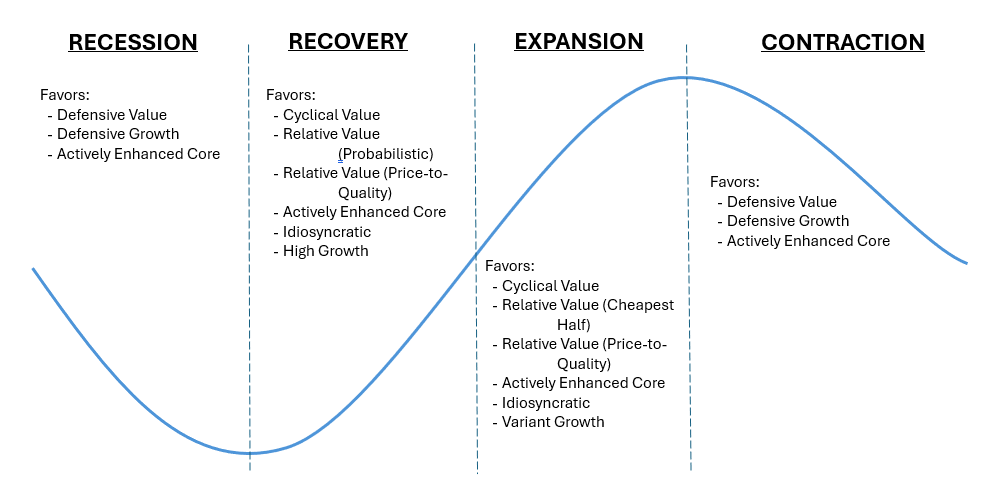

Navigating Economic Trends

Each category represents a unique investment approach, strategically positioned along the spectrum to capture distinct phases of market cycles or investor objectives. Rather than being rigid or static, these categories are designed to accommodate fluidity at the portfolio level, achieved through active management and the ability to tilt allocations in response to market conditions. Each manager or fund maintains a clearly defined philosophy and process within their assigned category, ensuring consistency and reliability. Additionally, the eight buckets within the Value Continuum are structured with clear and distinct objectives and goals, ensuring that each category serves a specific and complementary purpose in the overall portfolio. Moreover, the portfolio can adapt dynamically, allowing for shifts across the Value Continuum based on external factors such as economic trends, sector rotation, changes in sentiment, and/or investor preferences. This adaptability empowers investors to actively manage risk and opportunity while maintaining the integrity of the managers' individual mandates.

The Value Continuum framework demonstrates how seemingly aligned categories, such as Cyclical Value and Relative Value on one side of the spectrum, or Variant Growth and High Growth on the other, can complement rather than compete with one another. By fostering collaboration between categories within each side of the spectrum, the Value Continuum enhances portfolio construction, ensuring a cohesive and resilient allocation strategy.

In conclusion, the Value Continuum offers a framework that bridges adaptability and intentionality in portfolio construction. By blending traditional style box familiarity with a dynamic, interconnected approach, it empowers investors to achieve enhanced diversification and strategic alignment. This framework not only redefines investment categorization but also serves as a practical guide for navigating the complexities of modern portfolio management.

About the Contributor

Chase Kinnison is a seasoned investment professional and Texas Tech University graduate with deep expertise across public markets, including equities, fixed income, and hedge funds. As a public equity specialist, he led the redesign of the New York State Nurses Association’s public equity portfolio, enhancing index alignment and portfolio construction. Known for his thoughtful approach, responsiveness, and transparency, he excels in manager due diligence and relationship management, ensuring strategic alignment and long-term investment success. His strategic insight shapes forward-thinking approaches to portfolio management, balancing risk, opportunity, and long-term resilience.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/