By Tony Davidow, CIMA®, Senior Alternatives Investment Strategist, Franklin Templeton Institute & Priya Thakur, CFA, Analyst, Franklin Templeton Institute

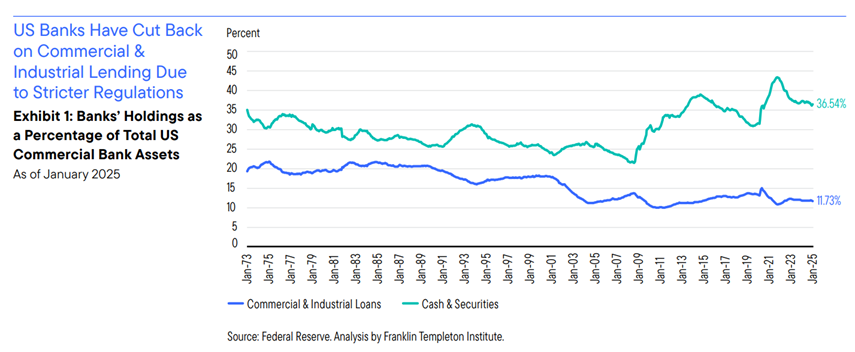

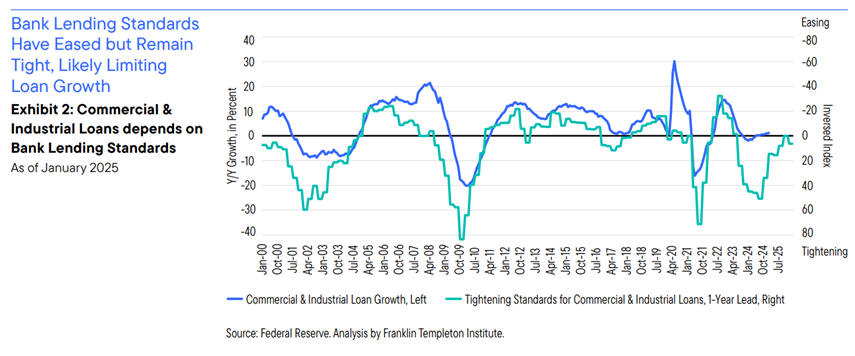

The private credit landscape has evolved significantly over the past few years, driven by various macroeconomic factors, a demand for flexible financing, and advancements in technology. Since the global financial crisis (GFC) in 2008, middle-market corporate and mortgage borrowing have increasingly moved away from banks. Overall, banks’ share of private lending in the U.S. economy has fallen from 60% in 1970 to 35% last year, according to a new National Bureau of Economic Research paper.[i] Leading up to the GFC, banks were the dominant lender of choice for both corporate and asset-backed borrowers, and non-bank lending was seen as an afterthought or last resort. The banking sector experienced a consolidation wave in the 1990s as larger institutions acquired and absorbed regional banks with fewer deposits. By 2008, the number of U.S. banks had dwindled by nearly half from 1990, and banks shifted their lending activities to focus on larger corporate borrowers. After the GFC, banks retrenched from commercial and industrial (C&I) lending activity, partly in response to regulatory reforms and concerns about their balance sheets. Consequently, small- and medium-sized companies needed to find alternative sources of capital. Private credit managers stepped in to fill that void.

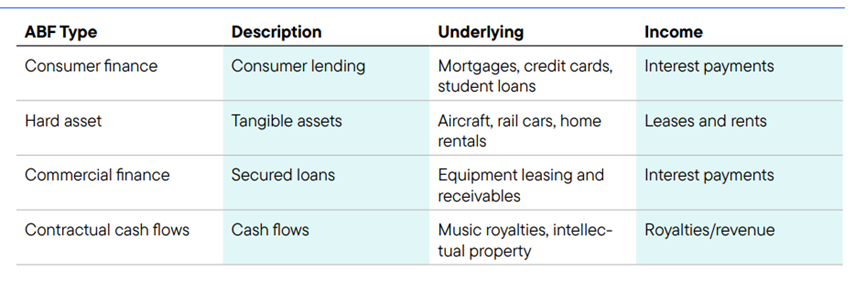

In recent years, private credit managers have expanded their reach by lending to various forms of asset-based financing, which can be divided into financial assets (consumer finance and small business financing) and hard assets (airplane and equipment leasing and residential financing). One of the advantages of ABF is the fact that cash flows are contractually derived from pools of capital. Following the collapse of Silicon Valley Bank in 2023, banks have been reluctant to lend capital to small and middle market opportunities, instead favoring large corporate assets.

Private credit market dynamics

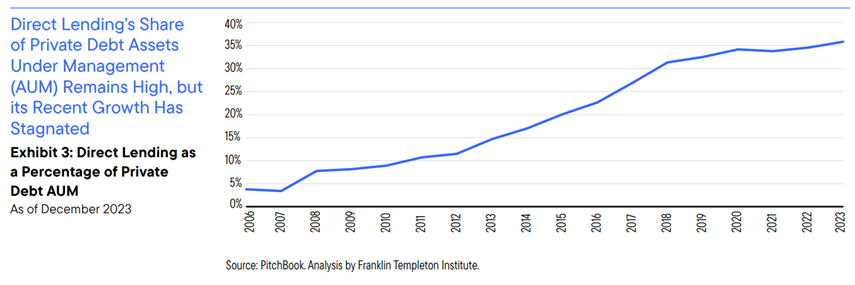

Growth of private credit—direct lending

Private credit markets continue to increase in size and importance. PitchBook estimates they currently stand at around US$1.6 trillion (including around US$500 billion of dry powder). The U.S. market accounts for the lion’s share (around US$1.1 trillion), with Europe accounting for most of the remainder. A large portion of private credit assets are invested in direct lending.

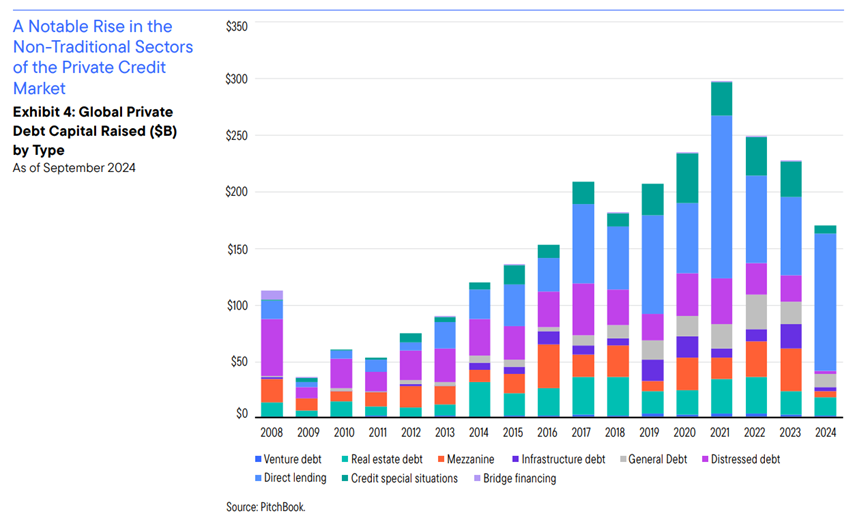

Recent private credit allocations have shifted to less traditional areas of the private credit market due to several factors, including banks’ reluctance to lend, the need for flexible financing, and technological advancements, among others. Asset owners have begun to focus on alternative sources of income. Specifically, areas like ABF, real estate debt, and other types of debt financing.

Reasons for growth in private credit

The attractiveness of private credit is rooted in its flexible structure. The asset class offers borrowers the opportunity to tailor their financing structures over a longer time horizon, outside of the volatility experienced in public markets. Borrowers see that the private markets can offer greater certainty on deal closure, more financing options, the ability to work with fewer lenders, and more efficient loan restructuring when necessary. This blend of bespoke terms and ongoing opportunity is allowing private credit to compete head-on with numerous liquid markets. Supporting this competitiveness is the ability of private lenders to provide capital to high-quality companies without forcing a share price reset or generating meaningful dilution. Private credit managers are often able to negotiate better terms and covenants, and they can make provisions meant to offer downside protection for lenders, such as a company’s need to maintain specified thresholds for liquidity and leverage. Loans with strong covenants are different from those in the public markets, which have typically been “covenant-lite,” following the resurgence of the leveraged loan market in 2011, post-GFC.

Innovative strategies

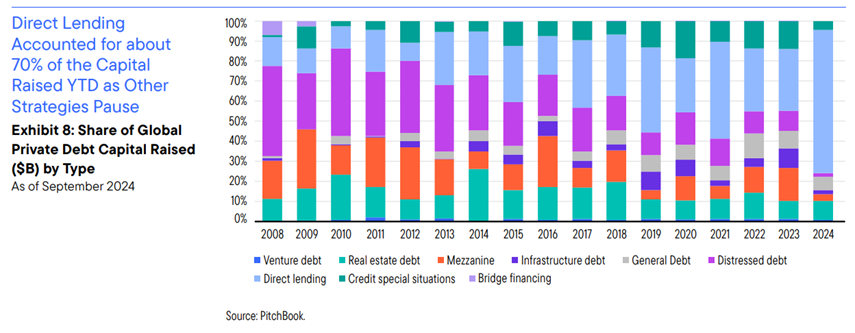

According to PitchBook’s H1 2024 Global Private Debt report, direct lending remains the preferred strategy within private debt, accounting for 54.9% of the overall mix of funds closed year-to-date (YTD). Mezzanine and infrastructure debt funds were in high demand last year. However, beneath the surface, private debt remains highly diverse, with fund sponsors continually innovating and developing new strategies to fill the gaps left by traditional bank lenders. Asset-based financing (ABF), or asset-based lending (ABL), has grown dramatically in recent years. Unlike a corporate bond whose return depends on the performance of the issuer, ABF’s return depends on the cash flows of the underlying assets. ABF is bespoke, privately originated, and negotiated by a private credit fund that can diversify exposures by duration, quality, and type of collateral. Private credit managers can invest across various ABFs, providing managers the flexibility to tailor portfolios to meet precise risk and return criteria, and provide attractive relative value. The four major categories are consumer finance, hard assets, commercial finance, and contractual cash flows.

Sizing the opportunity

According to McKinsey, the potential addressable market for private credit exceeds US$30 trillion across a diverse range of asset classes. The opportunity set is much broader than traditional corporate lending, with ABF representing a growing and diverse set of opportunities. While there have been concerns about the amount of capital flowing into direct lending, we believe that the future growth of the private credit market will come from new verticals, including ABF and commercial real estate debt, which represent attractive areas of financing. ABF has emerged as a new avenue for deploying capital and represents a broad and diverse set of opportunities, from auto loans to aircraft leases and music royalties, among others. For skilled managers, the ABF market offers an opportunity to tap into an area with potentially healthier spreads and less market efficiency. As direct lending has become increasingly competitive, yields in many pockets of ABF look more attractive. In recent years, there has been a substantial drop-off in bank-originated ABF. We believe that private credit lenders will play an increasing role in ABF, filling the “financing gaps” from some banks’ more selective appetite to lend capital.

There are several advantages of ABF relative to traditional corporate lending. The repayment of the obligation is provided by contractual cash flows from a discrete pool of collateral, rather than the general obligations of traditional corporate lending. ABF not only can provide diversification, but it also has the potential to deliver alpha, versus the highly competitive direct lending market where spreads have come down substantially. Benefits of the expansion of private credit into ABF include differentiated sources of capital available to borrowers and the potential for higher alpha for investors. While the potential for higher returns and broader diversification from ABF may be enticing for investors, this alpha stems from the less understood and more complex nature of the assets.

Commercial real estate debt

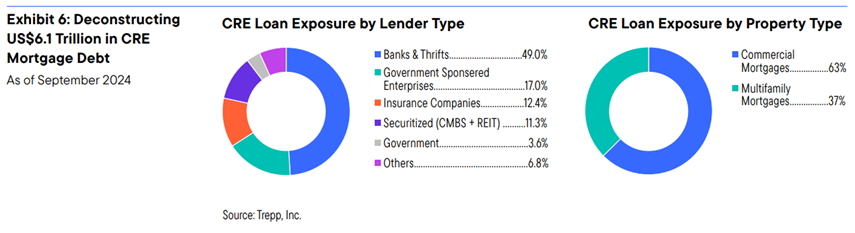

As private credit has expanded over the years, we believe that commercial real estate debt offers one of the most attractive opportunities, with about US$6.1 trillion debt outstanding.[ii] The lender base is quite diverse and includes banks, agencies, life insurance companies, commercial mortgage-backed securities (CMBS) issuers, debt funds, and mortgage real estate investment trusts (REITs).

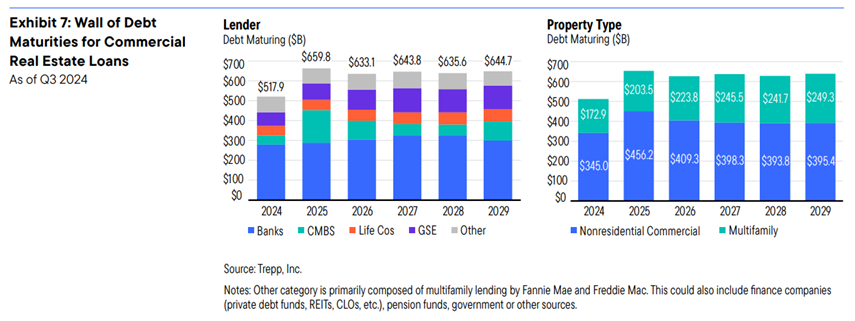

The commercial real estate market has faced numerous challenges, particularly since the Federal Reserve began raising interest rates in early 2022. However, we believe that this disruption has created opportunities for seasoned managers. The resultant rise in financing costs, deceleration in rent growth, and decline in property valuations have significantly impacted the market. The office sector has been especially hard hit, driven by reduced demand due to work-from-home policies. There is a “Wall of Debt” that will need to be refinanced in the next couple of years, and banks will likely be reticent to lend capital, creating an opportunity for private credit managers who can negotiate favorable terms. Private credit managers can now be “term makers” versus “term takers,” which was the environment in 2021.

Capital raised for real estate debt has increased

As noted, direct lending has been the dominant private credit strategy, representing 54.9% of the overall mix of funds closed YTD. We believe that ABF and CRE debt will fuel the next wave of growth, with commercial real estate debt representing an attractive opportunity given the current market environment, its strong risk-adjusted results, and its low correlation to other investment options.

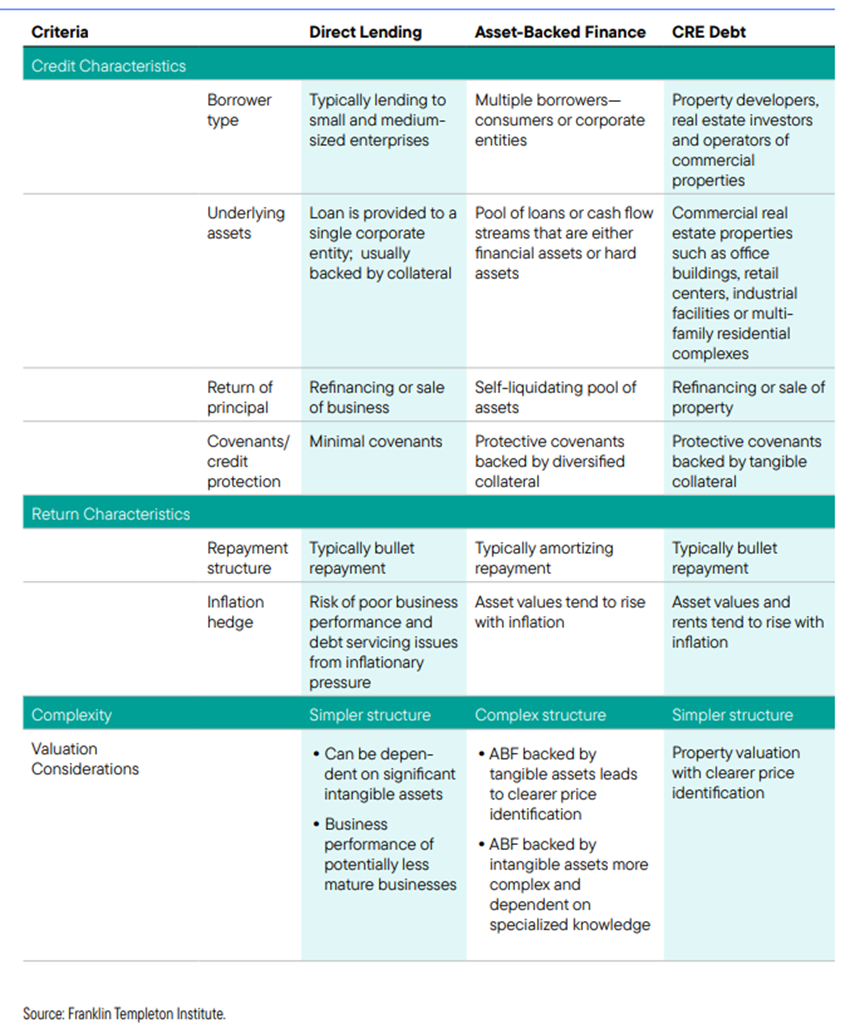

CRE debt’s ability to potentially offer substantial returns at lower risk makes it a compelling option for investors seeking a balanced risk/reward scenario. Historically, CRE debt has served as an effective hedge against inflation. As inflation has risen, so have interest rates, consequently increasing returns from CRE debt investments. If we compare direct lending to ABF to CRE debt, we can see that there are substantive differences in the underlying assets, debt payment, and cash flow.

Private credit represents a diverse set of opportunities from direct lending, asset-based financing, and commercial real estate debt. There are differences in the underlying investments, portfolio characteristics, and sensitivity to economic conditions. We believe it is possible to use them to complement one another and/or as viable replacements for traditional fixed income allocations.

This blog contains excerpts from "The evolution of private credit," published by Franklin Templeton Institute. To access the full paper, please click here.

About the Contributors

Tony Davidow, CIMA® is a Senior Alternatives Investment Strategist at Franklin Templeton Institute. He is responsible for developing and delivering the Franklin Templeton Institute's insights on the role and use of alternative investments. He serves as the host of the award-winning Alternative Allocations podcast. Tony previously held senior leadership roles with Morgan Stanley, Guggenheim, and Schwab, among other firms. He received the prestigious Investments & Wealth Institute Wealth Management Impact Award in 2020 for his contributions to the wealth management industry; and was awarded the Stephen L. Kessler writing award in 2017, and honorable distinction in 2015. He is the author of "Private Markets: Building Better Portfolios with Private Equity, Private Credit, and Private Real Estate" (Wiley 2025).

Priya Thakur, CFA is an Analyst at Franklin Templeton Institute, where she is responsible for delivering insights on alternative investments, the Asia-Pacific region, and emerging markets. She has authored papers on these subjects as part of the Franklin Templeton Institute. She has 15 years of experience in investment research, with a strong focus on economies and markets. Prior to joining Franklin Templeton, Priya held positions at Crisil (an S&P company), MFA Consulting (a boutique wealth management company), and JLT (currently known as Mercer). Her roles at these organizations involved providing analysis and advice to clients regarding economies and markets.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/