By William J. Kelly, CAIA, Founder & Managing Member, Educational Alpha LLC

What ails most investors is responsible and informed access to the garden-variety free lunch that comes with diversification. That often begins with the simple exercise of understanding the relative beta of the underlying (low correlation, good; high correlation, bad), and how these options can be used to build the very best risk-adjusted portfolio. That portfolio must meet both your risk tolerance and also be generally matched against realistic and long-term expectations as to probable outcomes. It must also align with the timing and duration of calls on your capital on the liability side of your balance sheet (i.e. tuition expenses, expected costs to support an aging parent, your retirement plans, etc.).

As widely reported in this column, a couple of things happened as we approached the investment buffet table, simply seeking said diversification. The big eaters (defined benefit plans) have mostly sat down fully sated and/or have left the room because they are no longer hungry. In addition, the velvet rope has been lifted for all of us, and it is not just the normal fare on offer. In fact, there is now a separate dessert buffet that awaits us, promising things that look so very appetizing, but are they truly good for us?

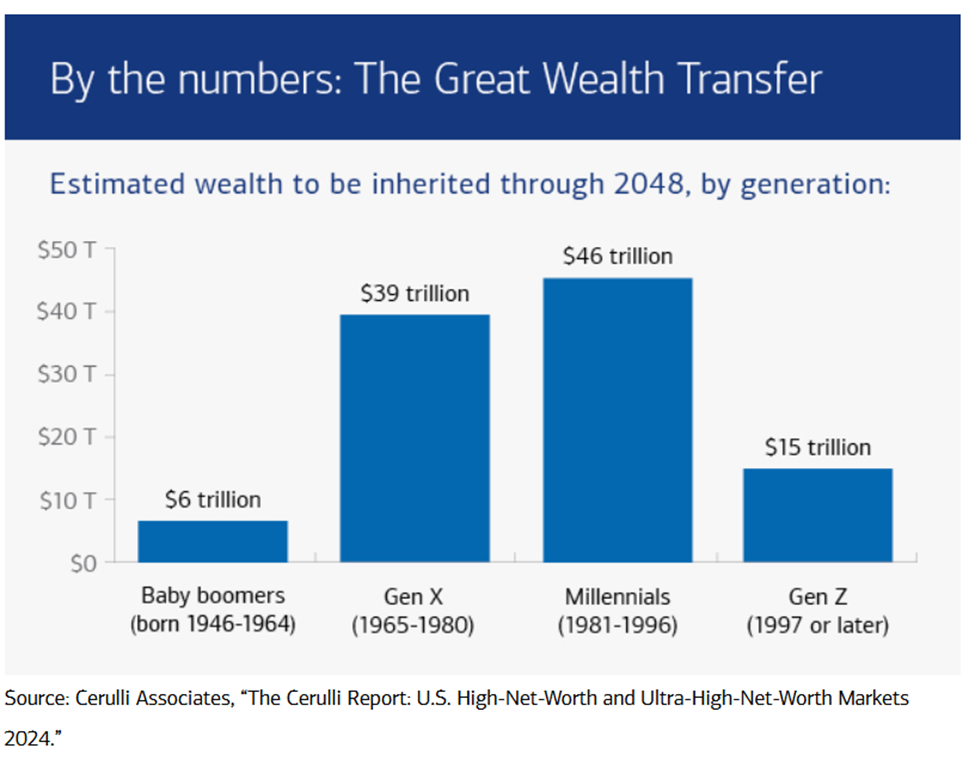

The underlying nutrients from the veggie or fruit stations are truly medicinal beta-blockers, but what about that sundae bar that looks so appetizing? And who amongst us can resist those alpha-un-lockers? There are over 100 trillion reasons why we as individuals are now feeling that embrace.

But what are (the) alternatives when we think about portfolio construction? Access is becoming all but a sure thing and there is no way to DOGE that bullet. In fact, “give me access to the new economy” has become the refrain, but have we taken the time to answer the simple questions of ‘how’ and ‘when’? Like any remedy, there are alternatives, and if we think about beta-un-blockers, which is truly what the individual wants, we should extend the narrative to perhaps consider alternative medicines, absent the fanciful spoon full of sugar.

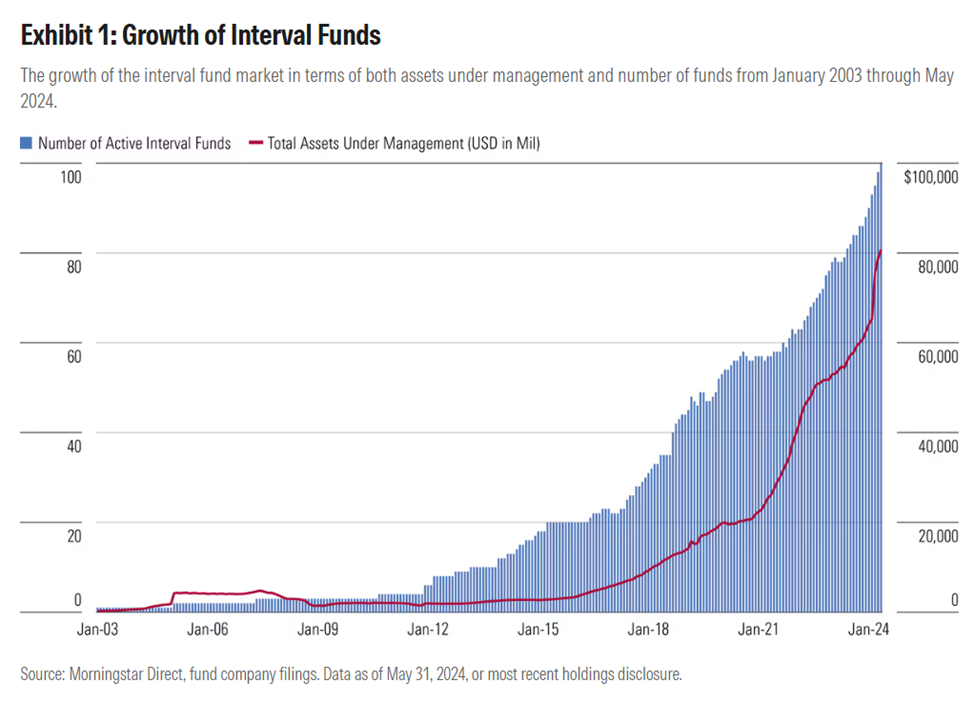

The prescribed packaging of choice for alternatives seems to be the interval fund, and by Morningstar’s estimate the march to $100B was all but a certainty as we entered 2025.

It’s important to note, this Morningstar data excludes private placements such as BREIT and BCRED, which would alone double the AUM tally in this space. However, even at a couple of multiples of $100B, it remains a tiny fraction of the $100T+ in motion under the aforementioned wealth transfer tsunami.

All of this brings us back to alternative medicine, or the practice of dispensing solutions in non-traditional ways, especially when we are talking about non-traditional investments. The UK, along with the London Stock Exchange Group, might be one example of a new kind of test-kitchen to solve for what ails the retail investor.

While PISCES might sound like a ‘fishy’ code name, it is the very descriptive and self-effacing acronym for Private Intermittent Securities and Capital Exchange System that is currently in play in the UK market. At its core, it is basically an organized secondary market for investors to (intermittently) gain access to private companies. It is still early days for this alternative initiative, but it bears watching and understanding the inherent opportunities and risks, as we collectively seek the very best outcomes the individual investors rightfully expect and deserve.

I will finish this essay with one last medical treatment (or maybe lack thereof!) that dates back to my time as an incessant road warrior. My very best ports-of-call were the many universities around the world where my student deck always ended with what has become my favorite page, featuring Hippocrates, the Father of Medicine, and the important lessons of therapeutic nihilism.

It would be hard to argue that this message has not stood the test of time, but have we embraced it wholesomely? We stand on the precipice of democratization within a complex industry that seems to have a bias for asset gathering over true and sustainable value creation. Is that the alternative medicine which will cure what ails the average individual investor?

Seek education, diversity of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

About the Contributor

William (Bill) J. Kelly, CAIA is the Founder and Managing Member of Educational Alpha, LLC where he writes, podcasts, and speaks on a variety of investment related topics, focused on investor education, transparency, and democratized access to differentiated risk premia. Previously he was CEO of CAIA Association since taking this leadership role in 2014 until his retirement in 2024. Prior to that, Bill was the CEO of Boston Partners, and CFO and COO of The Boston Company Asset Management, a predecessor institutional asset manager. In addition to his current role, Bill is also the Chairman and lead independent director for the Boston Partners Trust Company and serves as an independent director for the Artisan Partners Funds, where he is also Chair of Audit Committee and a designated Audit Committee Financial Expert. He is also currently an Advisory Board Member of the Certified Investment Fund Director Institute within the IOB (Dublin) which strives to bring the highest levels of professionalism and governance to independent fund directors around the world. Bill began his career as an accountant with PwC where he earned his CPA (inactive).

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/