By Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP

Managing Director, Global Content Strategy, CAIA Association

Asset-based lending (ABL) has undergone a quiet but significant transformation in recent years. Once viewed primarily as a capital source of last resort, used only when traditional cash flow-based financing wasn’t available, the asset class has evolved into a key player into the private credit universe. For investors seeking differentiated risk exposures, tighter collateral protections, and potential portfolio diversification, ABL has increasingly become an area of interest.

However, like most areas of the private markets, these strategies aren’t without complexities and risk. As the asset class evolves from mainstream assets (real estate, inventory, etc.) to esoteric ones (royalties, consumer finance, and NAV lending), you can no longer paint it with a broad brush.

ABL’s Evolution: Like Direct Lending, But Different

Historically, ABL was closely associated with distressed companies or, at best, borrowers who were unable to meet the underwriting requirements of cash flow lenders. This perception was rooted in legacy use cases, often involving regional banks and borrowers with unpredictable operating performance.

However, like the rest of the credit complex, things changed after the GFC. Regulatory tightening on banks has restricted their ability to serve all borrowers, particularly those experiencing short-term income statement volatility. Like cash flow-based (“direct”) lending, asset-based private credit managers have stepped in to fill this void. Today, ABL is no longer confined to distressed situations—it is being used proactively by public and private companies as well as by private equity sponsors seeking incremental liquidity or more flexible capital solutions.

While not as large as direct lending in terms of AUM, ABL is now considered a mainstream financing tool. It can be used to enhance liquidity from working capital, offer structural alternatives to traditional debt, or support growth and M&A activity. In fact, it is not uncommon for asset-heavy companies to choose ABL even when cash flow-based financing is technically available.

Expanding Collateral: An Evolving Opportunity Set

Another key development in the ABL space is the expanding menu of eligible collateral types. While traditional ABL was primarily tied to working capital (like accounts receivable, inventory, and occasionally equipment) or hard assets (like real estate), today’s lenders have evolved their collateral set to include many esoteric assets.

Today, ABL may be structured around a variety of collateral types, including:

Health care, drug royalties, and life sciences receivables

Recurring revenue streams from software and services businesses

Specialized real estate or infrastructure assets

Net asset value (NAV) of private fund portfolios

Consumer finance receivables, including BNPL, and retail credit

The evolution of these collateral types has enabled private lenders to structure loans that align with the unique characteristics of specific industries. It has also made ABL applicable to sectors that were previously underrepresented in more “traditional” private credit allocations (if that’s such a thing!)

The Role of Private Markets in a Shifting Ecosystem

Private capital has played a critical role in the modern evolution of ABL. Unlike banks, which typically operate under an “originate-to-distribute” model and are highly sensitive to regulatory capital requirements, private lenders tend to take a more customized and asset-focused view of what they originate. They are naturally less constrained in terms of underwriting complexity and collateral diversity.

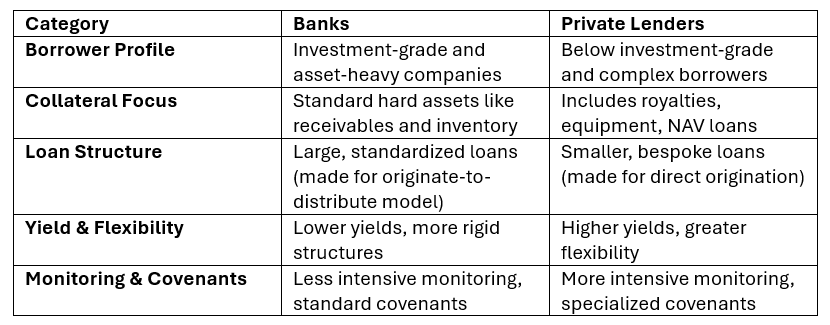

However, the line between banks and private lenders isn’t a clear one. In some cases, there is overlap in terms of sectors or collateral types. However, to summarize some of the differences, I’ve made a short summary of the differences in Table 1.

Table 1: Banks vs. Asset-Based Lenders

Source: CAIA Association

Importantly, as we are seeing in direct lending, private lenders and banks are not always in competition and work together on certain deals. Banks may retain deposits, while private lenders originate and hold the loans. Alternatively, private credit firms may provide interim or transitional financing with the expectation that banks will eventually take over the position once a borrower becomes eligible for lower-cost institutional funding.

Structural Features and Risk Management in ABL

A significant fundamental difference between ABL and cash flow-based lending is how loans are structured and risk is managed. In cash flow-based lending, underwriting is focused on enterprise value, financial projections, and the sponsor’s track record. In contrast, ABL centers around the liquidation value of specific assets and the ongoing monitoring of those assets throughout the loan’s lifecycle.

Key structural elements include:

Loan-to-Value (LTV): Lenders typically provide a percentage of collateral’s value in the form of a loan, ensuring a margin of safety. The LTV is often calculated based on a discounted or stressed valuation scenario and can sometimes be adjusted if the asset is a recurring revenue generator.

Amortization and Self-Liquidation: Many ABL structures are amortizing, or are repaid directly from the cash flows of the underlying asset—such as customer receivables, lease payments, or inventory turnover. Cash flow-based loans are typically bullet payments.

Dynamic Monitoring: Unlike cash flow loans, which often rely on quarterly reporting, ABL facilities are monitored far more frequently. Asset quality checks and valuations may be updated weekly or monthly, and triggers can be tied to real-time asset performance.

Tight Covenants and Triggers: ABL structures typically include more frequent and tighter covenant packages. These covenants are designed to detect early signs of trouble and allow the lender to reduce exposure or renegotiate terms before default occurs.

The hands-on nature of ABL means that the real work begins after a deal is originated and provided. For the GP, this has implications for platform design and specialized headcount, meaning that investors should look for GPs or dedicated teams with deep experience in specific asset types and strong infrastructure for collateral verification.

Due Diligence Considerations: Going Several Layers Deep

Evaluating an ABL strategy requires a more layered and asset-specific approach than traditional credit strategies. Investors must assess not only the GP and portfolio company, but also the structure, quality, and liquidity of the collateral backing each loan. While not an exhaustive list, there are a few important considerations investors should make:

Collateral Valuation Methodology: Understanding how a lender estimates liquidation value is essential. This includes understanding the appraisal process, the frequency of valuation updates, and whether multiple valuation methods are used.

Collateral Diversity and Industry Focus: Some managers focus narrowly on specific industries (e.g., healthcare, energy, transportation), which may offer competitive advantages but require deeper scrutiny. Other GPs take a generalist approach, and investors must evaluate whether sufficient expertise exists across collateral types.

Information Reporting and Transparency: Since asset performance directly impacts loan value, frequent and reliable reporting from borrowers is crucial. Investors should evaluate whether the GP has robust systems to track and respond to changes in collateral value.

Operational Infrastructure: ABL is operationally intensive. Investors should understand whether a platform has the in-house capacity to manage frequent updates to asset valuations, covenant compliance, and early-stage workout processes.

Fraud Prevention and Controls: ABL is inherently vulnerable to fraud, particularly in cases where collateral is difficult to verify or easily misrepresented. Investors should examine the manager’s fraud detection capabilities and historical loss experience.[1]

Default and Workout Process: Recovering value in ABL requires specialized experience. Investors should evaluate whether the manager has a track record of successful recoveries across different asset types.

ABL in the Broader Portfolio Context

While it’s technically “credit,” ABL occupies a unique space in portfolio construction. It offers more direct exposure to real assets, which in some cases may provide embedded inflation protection, depending on the underlying collateral. It is also differentiated from traditional direct lending due to its shorter durations, amortizing structures, and asset-tied repayments.

Although some overlap exists with other asset classes (e.g., real estate, infrastructure, private equity), ABL’s structured nature and active monitoring create a distinct risk-return profile. For allocators, the challenge lies in mapping this exposure relative to existing portfolio themes and avoiding unintended concentration in overlapping collateral.

Critically, ABL can also serve as a diversifier within private credit allocations. Because underwriting is focused on asset performance rather than enterprise value, ABL strategies may behave differently in market stress scenarios compared to middle-market direct lending.[2]

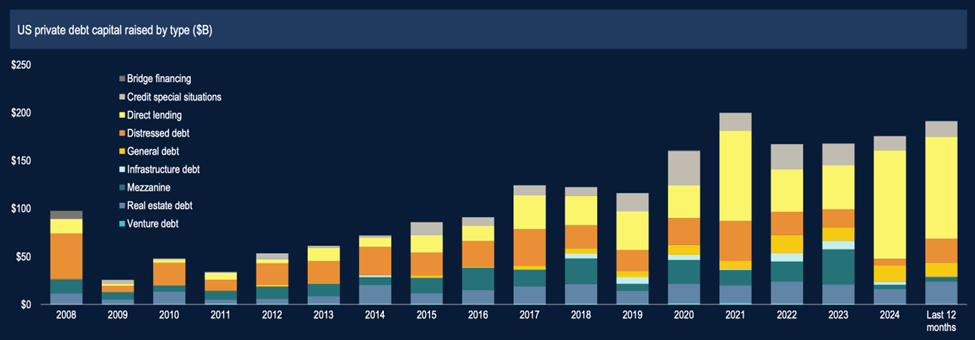

Figure 1: US Private Debt Capital Raised by Type

Source: Pitchbook, May 2025

This is likely one of the primary motivations for investors looking into this segment of private credit. In 2024, as much as 70% of private credit fundraising (as shown in Figure 1) was focused on direct lending strategies, and we may be at the beginning of some cracks on the surface in terms of pretend-and-extend practices.[3]

A Growing Opportunity Set, But Not for Generalists

While there’s plenty of opportunity and anecdotal evidence of growth in this space, the barriers to entry remain high. ABL success requires sector-specific knowledge, deep infrastructure, and strong sourcing channels. Investors should be cautious of newer entrants without a clear track record or institutional capabilities. In many cases, some of the characteristics mentioned above are not easily replicated and can be a source of durable performance differentiation when properly executed.

Putting It All Together

Asset-based lending has transitioned from a niche financing tool to a foundational element of the private credit landscape. Its evolution reflects a broader trend in institutional portfolios: a move toward structured, collateral-sensitive strategies that offer downside protection and differentiated return drivers.

For investors considering an allocation, ABL offers strong potential but also demands more from a due diligence and risk management standpoint. Understanding the strategy’s nuances, assessing platform maturity, and contextualizing its role within the broader portfolio are essential steps for making informed decisions.

Listen to our recent conversation on Asset-Based Lending on Capital Decanted here.

About the Contributor

Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP is Managing Director, Global Content Strategy at CAIA Association. His industry experience lies in private wealth management, where he was responsible for asset allocation, portfolio construction, and manager research efforts for high-net-worth individuals. He earned a BS with distinction in finance and a master of finance from Pennsylvania State University.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/