By Mark Garfinkel, Sr. Portfolio Manager at Liquid Strategies, LLC

As the private credit market surges toward $3 trillion in assets1, concerns are growing over the potential formation of a bubble—driven by too much capital chasing too few high-profile lending opportunities. Rather than focusing on whether the market is in a bubble, this article explores how to strategically manage risk within a private credit portfolio.

Risk Management of a Private Credit Portfolio in a Crowded Market

As private credit grows into a $3 trillion asset class, concerns over risk and overvaluation loom large. Yet, the solution isn’t avoiding private credit—it’s about managing it wisely.

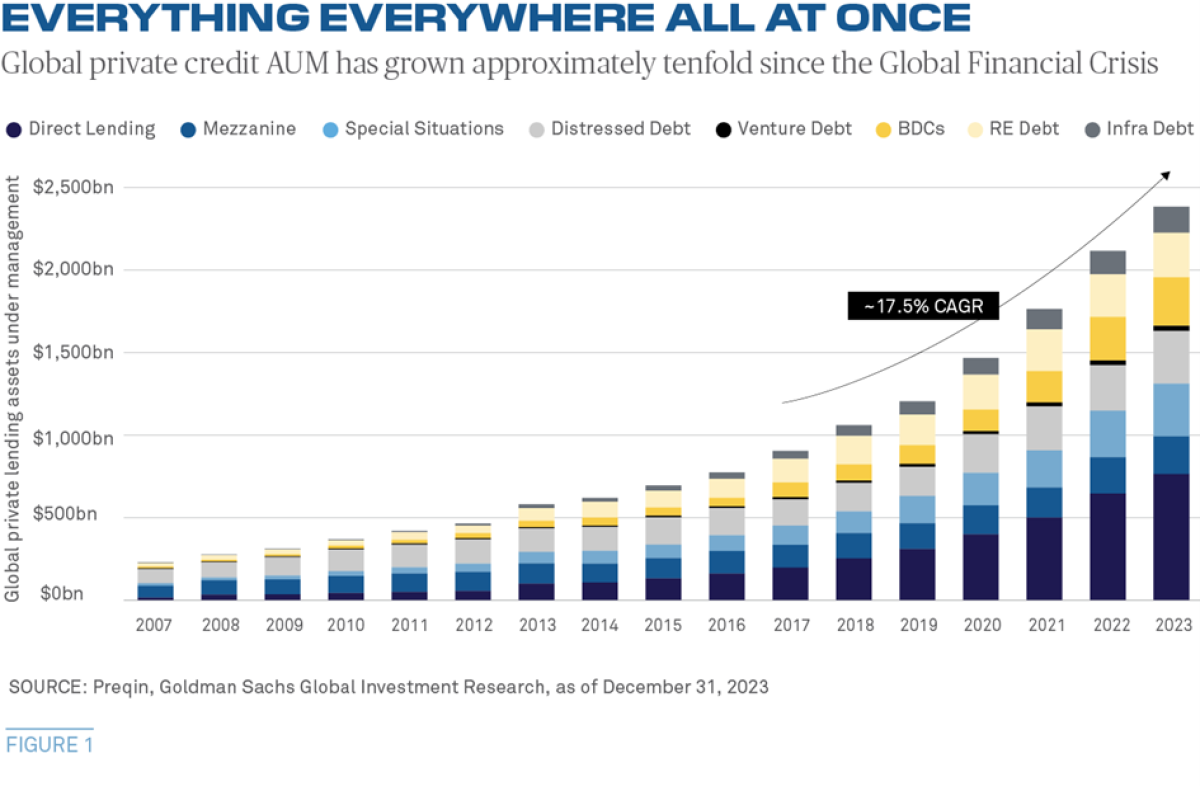

Private credit refers to loans made by non-bank lenders directly to private businesses, a segment that expanded rapidly post-2008 as regulatory constraints limited bank lending. Today, the market faces a new challenge: excess capital flowing into a narrow segment of large, private equity-sponsored companies. Figure 1 illustrates how combined credit categories—including distressed, venture, real estate, BDCs, and infrastructure debt—have surged more than tenfold post-GFC.

Figure 1: Private Credit Explosion Across Debt Types

Source: Preqin, Goldman Sachs Global Investment Research.

Note: As of December 31, 2023.

Where the Capital Is Going

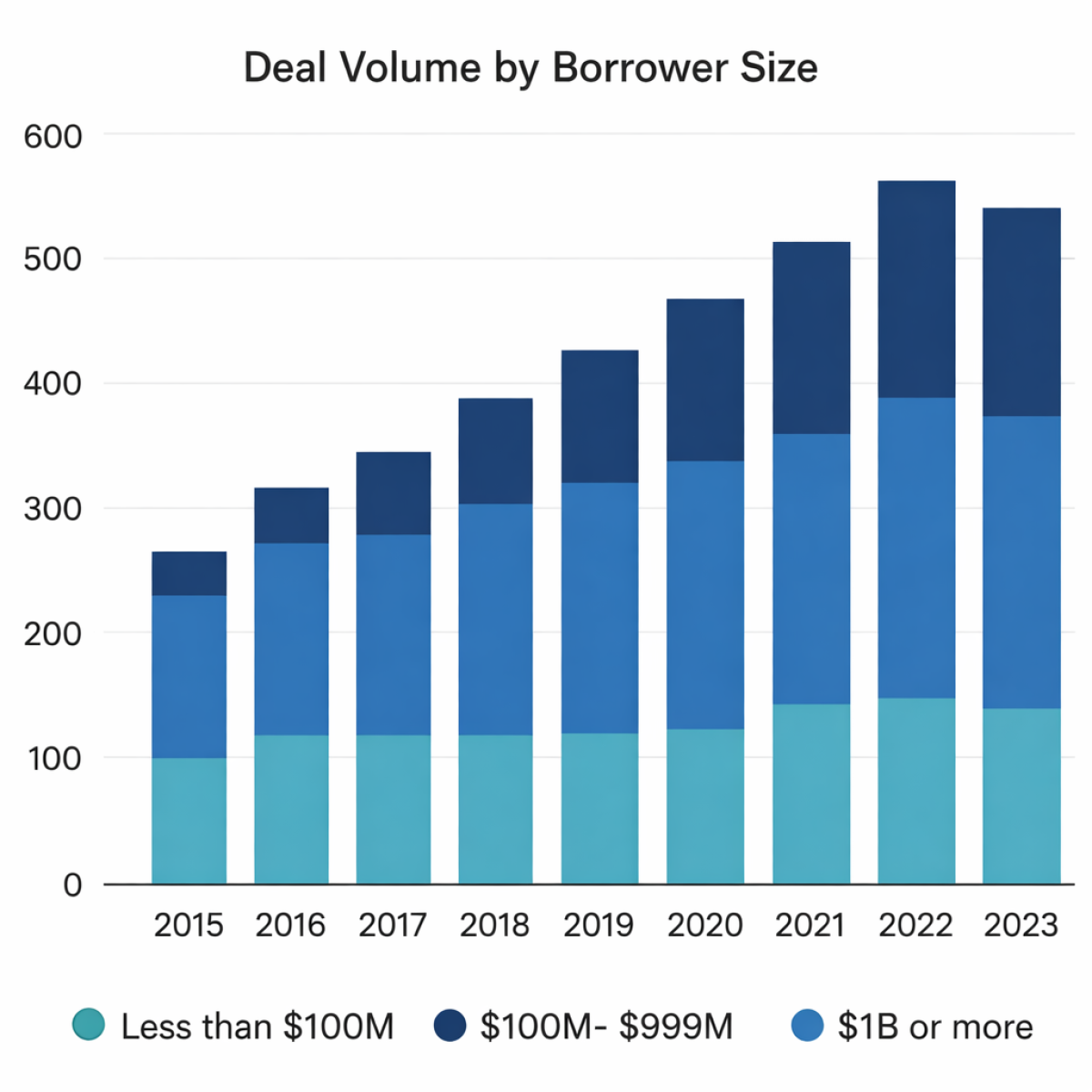

Most inflows have chased large borrowers—companies with EBITDA above $100 million and loan needs well into the hundreds of millions. This influx has commoditized that part of the market. With widespread competition, interest spreads have compressed, covenants have loosened, and lenders have taken on more risk to win deals. Figure 2 shows that that most private credit deal flow continues to favor larger borrowers (>$100M), with the highest capital concentration in the mid to upper end of the market.

Figure 2: Deal Volume by Borrower Size

Source: LTSA Private Credit Trends Report, May 2025

Figure 2 also provides two notable takeaways:

- Borrowers under $100M remain underrepresented in terms of volume, even as total market deal flow grows.

- From 2015 to 2023, deal volume peaked around 2022, with notable share growth in $1B+ deals.

In this highly efficient environment, outsized returns become harder to find. But does that mean all private credit is overvalued? Not necessarily.

Value Flows from the Forgotten Streams

The largest areas of the private lending market, much like the largest river systems, have been fully explored and mapped. These are the obvious, well-traveled channels of capital that are visible, deep, and widely pursued by institutional investors because it is familiar, liquid, and scalable. Yet there are thousands, if not millions, of smaller tributaries ripe for further exploration. While these areas are not always as obvious to the naked eye, proper exploration can identify undercapitalized and/or misunderstood lending niches that flow with potential. The overlooked corners of the private credit world—small businesses, niche lenders, and specialized asset-based finance—offer higher yields, tighter covenants, and better collateralization. These borrowers are often too small for large private credit firms and constrained by traditional bank lending standards.2

For risk-conscious investors, this is fertile ground. Markets with fewer lenders and less capital create favorable dynamics: lenders can command better terms, reduce loan-to-value, and maintain underwriting discipline. These inefficiencies enable enhanced risk-adjusted returns without taking undue risk.

Risk Management Framework

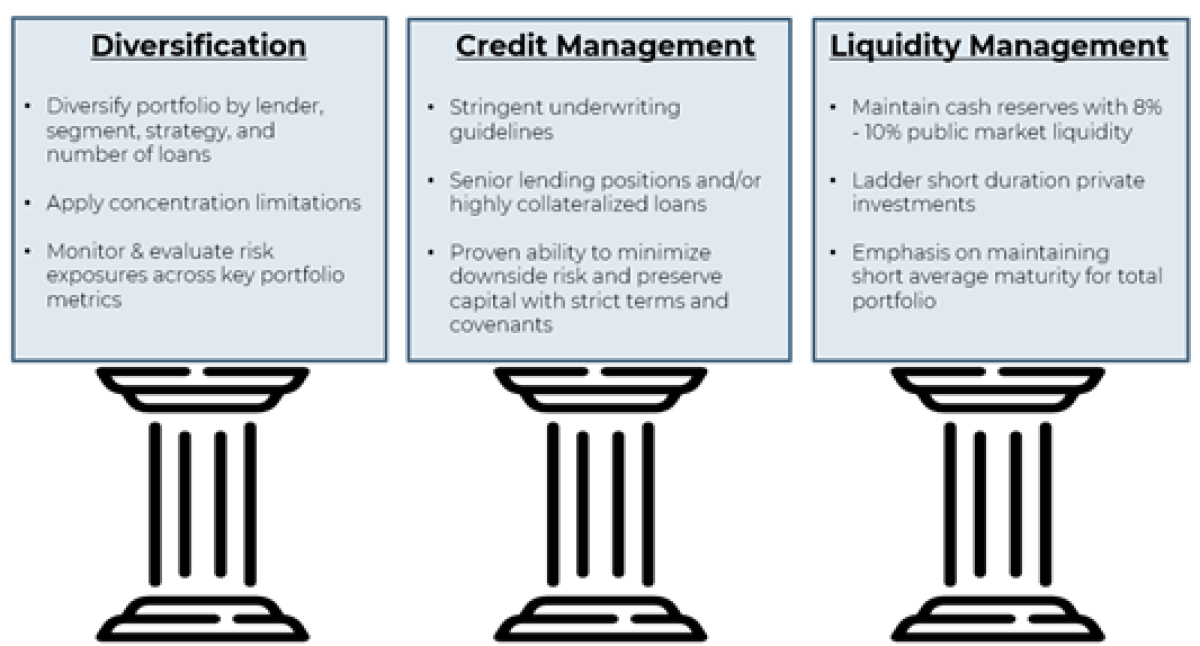

The most effective way to manage risk in private credit is through a three-pronged strategy:

- Diversification

- Invest across multiple segments (e.g., real estate, legal finance, factoring, consumer finance).

- Maintain limits on exposure per strategy or borrower.

- Adjust position sizing to reduce downside risk in the event of a loss in any one segment.

- Credit Management

- Partner with lending specialists who focus on niche markets and have proven underwriting capabilities.

- Look for strong collateral structures, tight loan terms, and stringent covenant enforcement.

- Emphasize capital preservation over yield chasing.

- Liquidity and Duration Management

- Incorporate short-term private investments and liquid public assets to maintain flexibility.

- Ladder maturities to provide periodic reinvestment opportunities.

- Keep overall portfolio duration short to adapt quickly to changing market conditions.

Private Credit Is Not Monolithic

The phrase "private credit" encompasses a vast and varied universe. Treating it as a single asset class ignores the crucial differences across market segments. Just as one wouldn’t evaluate all equities through the lens of tech stocks, one shouldn’t judge private credit solely by the dynamics of large direct lending deals.

There’s opportunity in specialization—and risk in generalization.

Final Thought

Private credit remains a compelling tool for generating income and diversification. However, sustainable success requires strategic allocation, focused underwriting, and active management. In a market increasingly dominated by large players chasing the same deals, the real potential alpha lies off the beaten path.

In private credit, it pays to be selective. The optimal fishing holes are often the quietest ones.

Sources

- Private credit spans diverse sectors Heron Finance+15NAIC+15Citco+15Citco+1Calamos Investmentssteadfastequity.commeketa.com+1Apollo+7PwC+7flow.db.com+7S&P Global.

- Direct lending is only part of the picture—specialty and niche strategies are significant NAICpaulweiss.com.

- Private credit has delivered relatively strong performance, particularly in volatile or rising-rate environments Heron Finance.

- There’s a divergence between crowded upper-market lending and less-saturated opportunities mckinsey.comalts.coMarketWatchwsj.com.

- ¹Global AUM Growth: The asset class is estimated at $1.7 tn by late 2023 and forecast to exceed $3.5 tn by 2028. CFA Institute Daily Browse+5santanderprivatebanking.com+5Heron Finance+5

- ¹2028 AUM Milestone: Moody’s predicts global private credit AUM will hit $3 tn by 2028, driven by factors like lower interest rates, declining defaults, especially in the U.S. and Europe. Moody's

- Bank Relationships:

- Large U.S. banks’ lending commitments to private credit vehicles (BDCs, PD funds) surged from ~$8 bn in 2013 Q1 to ~$95 bn by 2024 Q4—a ~19.5% annualized growth. federalreserve.gov+2bostonfed.org+2

- As of 2023, bank commitments to PE/PC fund sponsors reached ~$300 bn, or approximately 14% of their non‑bank financial institution lending—up from around 1% in 2013. bostonfed.org

About the Contributor

Mark is a graduate from Vanderbilt University and the Owen Graduate School of Management, where he earned his BA and MBA. Mark has 25 years of experience in the investment and wealth management industry, receiving his Chartered Financial Analyst designation in 1992 and working in various roles ranging from Personal Trust Portfolio Manager to Chief Investment Officer and Lead Portfolio Manager for a highly successful Small Cap Growth investment fund.

Mark worked with SunTrust and Trusco Capital Management for 16 years managing personal trust and institutional equity and balanced portfolios, before developing and launching a Small Cap Growth investment discipline for the firm. Following his tenure with SunTrust, Mark was a founding partner and Chief Investment Officer for Perimeter Capital Management, a predecessor firm to Liquid Strategies, where he continued as the Lead Portfolio Manager for the firm's Small Cap Growth Strategy, helping to raise $2 billion in AUM's for the firm.

Mark brings to Liquid Strategies a wealth of experience and expertise in the financial markets, portfolio management, investment research and evaluation, and client relationships.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/