By Tatja (Tati) Karkkainen, PhD, Research, Development and Innovation (RDI), Kiitot

Utility tokens represent a distinct category within the digital economy. They connect blockchain technology to online services such as storage, computation, and communication.

For professionals focused on diversified capital allocation, such as those following the CAIA framework, utility tokens are likely to receive attention as part of a broader diversification strategy.

Commodities such as natural gas, water or electricity may be viewed as raw resources. When these resources are processed and delivered via infrastructure networks to end‐users, they become utilities, services with persistent demand and regulated frameworks. They form part of the real economy’s infrastructure, and their inclusion reflects a principle central to the CAIA Association’s approach to asset allocation: balancing growth and stability across asset classes (CAIA Blog – Is Crypto an Investable Asset Class?). Here, utilities are considered as processed commodities rather than equity-linked utility stocks

In the digital economy, a similar concept is emerging through utility tokens. Just as traditional utilities attract both consumers and investors, utility tokens attract users, hedgers, and speculators. From a valuation standpoint, utility tokens behave like consumption assets whose worth depends on service adoption, token velocity, and protocol efficiency. In contrast, governance tokens resemble equity instruments tied to decision power and treasury allocation. Some projects blend both roles, but in most cases usage intensity, not governance influence, drives market valuation (Florysiak 2024).For related insights on how digital infrastructure underpins asset-value formation, see CAIA’s article Prototype to Profitability: How Digital Assets Capture Value.

The broader adoption of utility tokens within Web3 has been constrained by regulatory uncertainty and limited integration with real-economy systems.

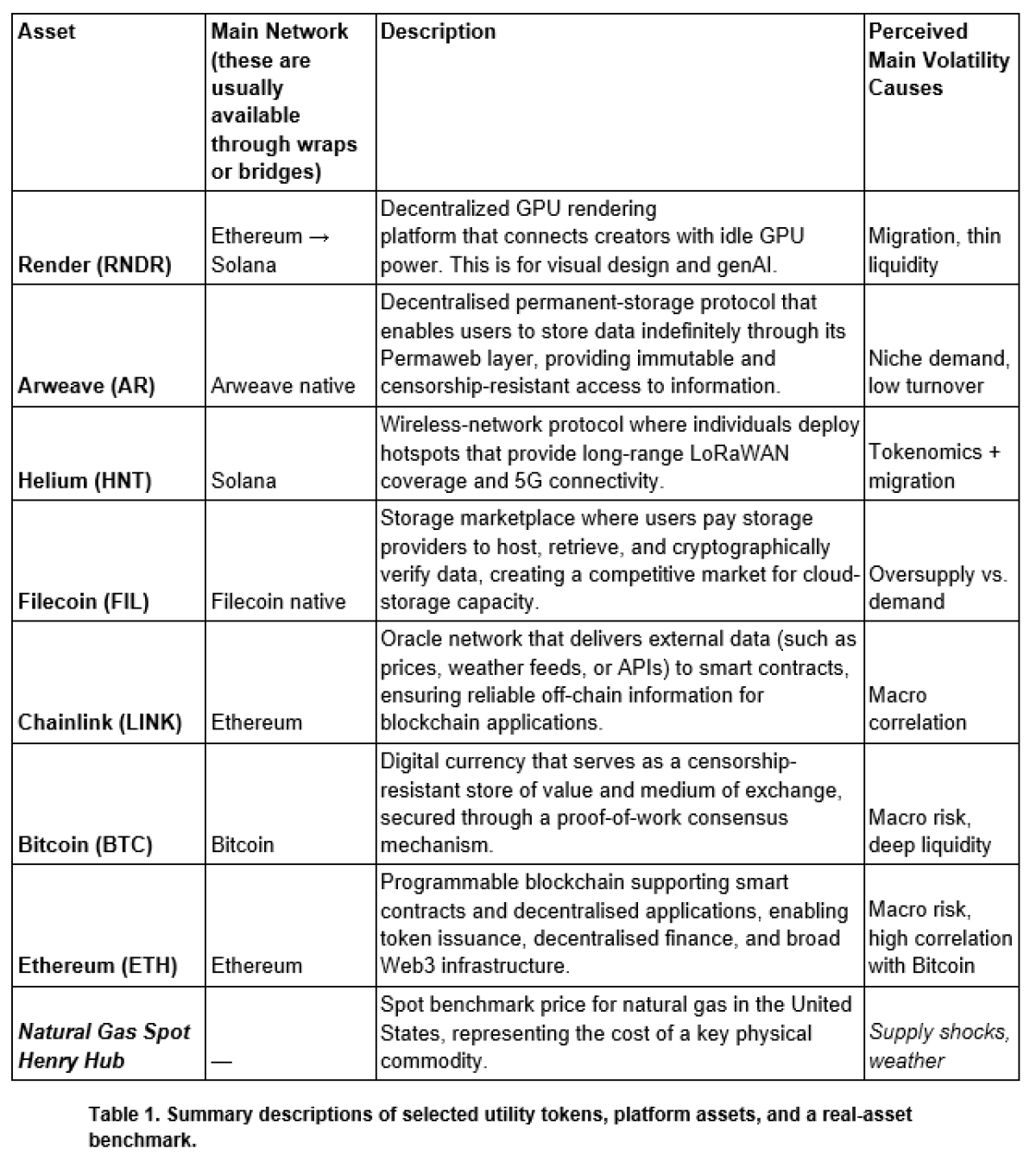

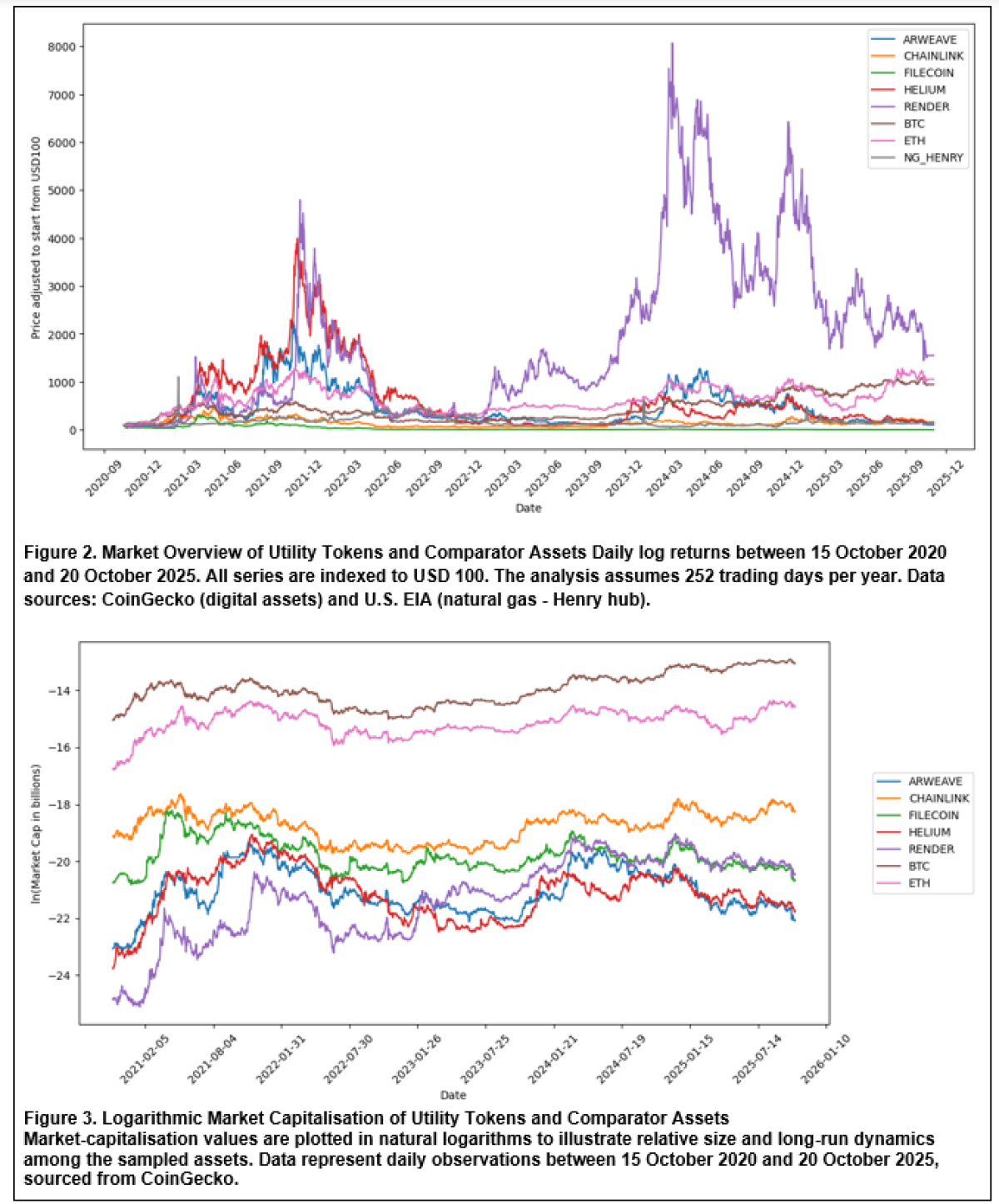

To illustrate, consider the leading utility tokens that form the operational base of the decentralised digital economy and their return characteristics of Render, Arweave, Helium, Filecoin and Chainlink. As a quick comparison we include Ethereum and also Henry hub natural gas spot as a real life utility commodity price proxy

Together, these tokens represent roughly US $13.3 billion in market capitalisation, small compared to Bitcoin, yet critical to blockchain infrastructure. Chainlink, Render and Filecoin belong in the top 100 cryptos by market capitalization.

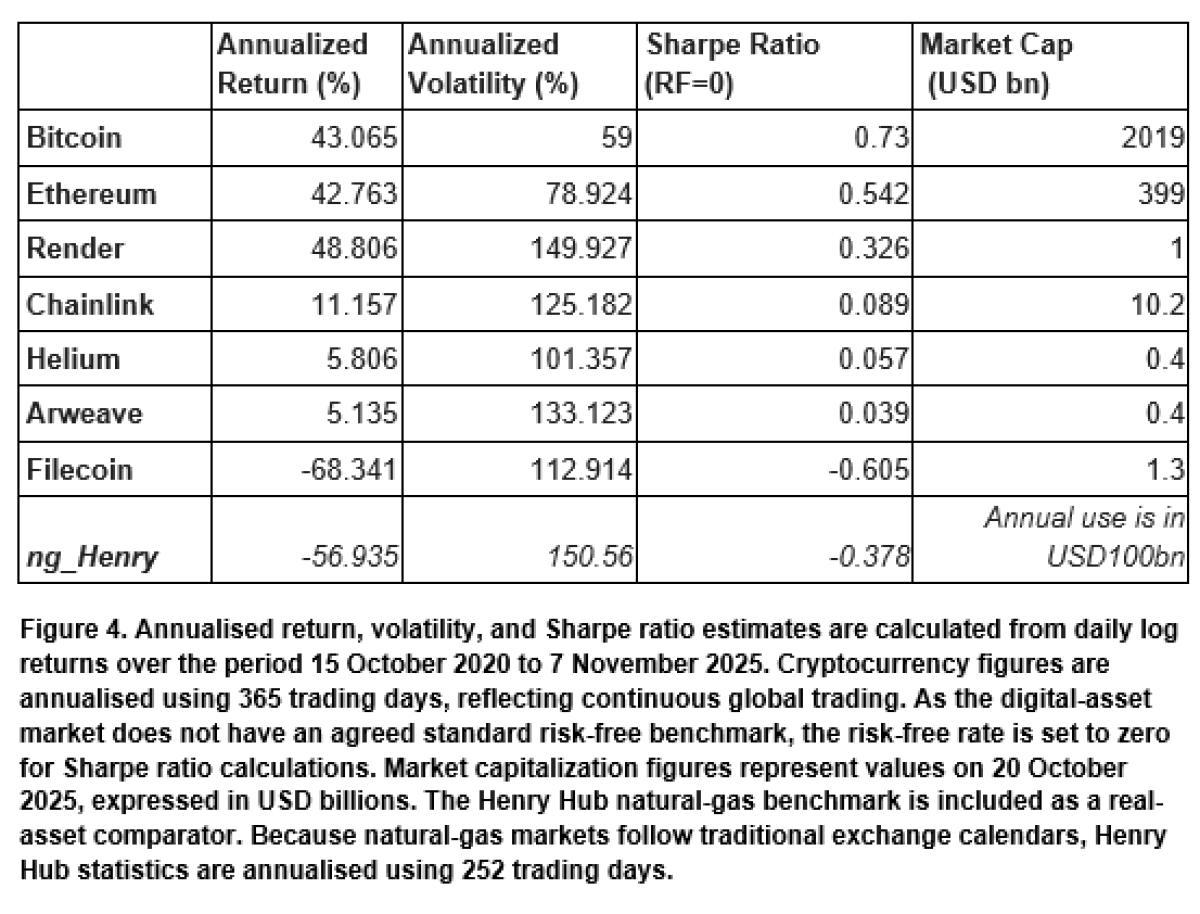

Utility tokens exhibit substantially higher volatility than leading market cryptocurrencies, reflecting their dependence on demand in application. Among them, and perhaps unsurprisingly, Render displays notably stronger performance, with the highest annualised return in the sample, driven by increasing demand for decentralised GPU rendering and AI-related computational capacity. Other utility tokens show weaker risk-adjusted performance, inconsistent or cyclical user demand, and token-specific supply dynamics.

Natural gas prices are influenced primarily by macro forces such as weather patterns, storage levels, and supply shocks, whereas digital utility tokens react more sharply to ecosystem growth, technological adoption cycles, regulation and speculative market behaviour. Real utilities commodities and utility tokens will remain structurally high-risk assets.

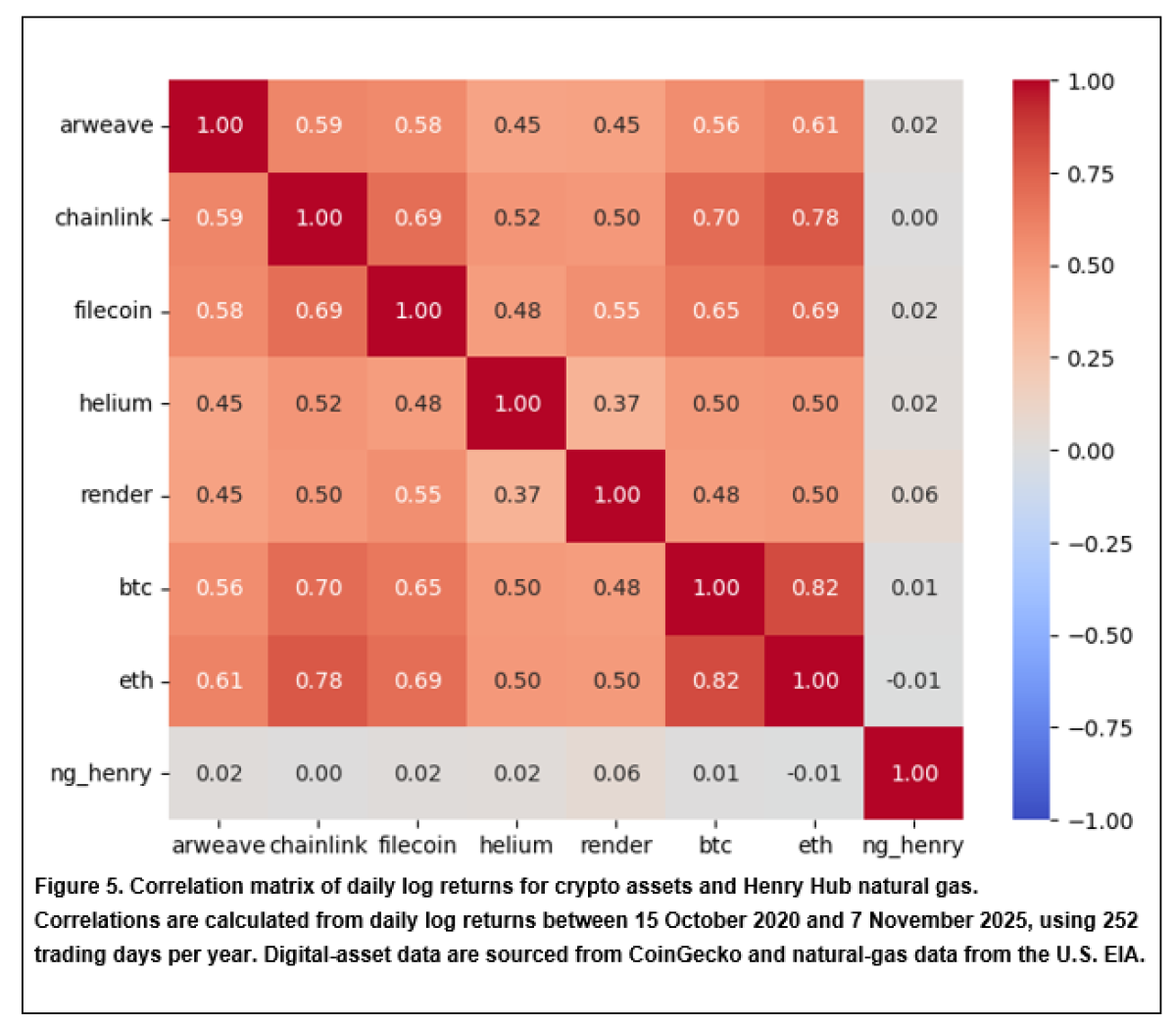

The correlation table results show that utility tokens, platform tokens, and major cryptocurrencies move together to a significant degree, with most pairwise correlations falling in the moderate to high range. Bitcoin and Ethereum remain the most closely linked pair, and smaller utility tokens such as Arweave, Chainlink, and Render follow the broader crypto-market cycle. By contrast, Henry Hub natural gas exhibits essentially zero correlation with all digital assets, reflecting its physical-market drivers and independence from speculative crypto-market dynamics.

With automation by AI, tokenisation, the distributed ledger technology offer decentralised digital economy services. Within this framework, utility tokens act as access instruments while forming part of a protocol’s incentive model. Cong, Li, and Wang (2021) show that utility-token prices arise from platform adoption, user network effects, and transactional demand. Much like commodities, their price dynamics emerge from usage, scarcity, and network activity rather than income-based valuation

This positions utility tokens as the infrastructure layer of crypto markets, distinct from governance tokens, which convey voting rights or protocol influence. In the same way that utility stocks anchor equity portfolios, utility tokens could one day anchor digital-asset allocations, offering exposure to the functional backbone of Web3 rather than its speculative extremes.

In the United States, regulation of utility tokens remains fragmented and primarily driven by interpretation and enforcement. The Securities and Exchange Commission (SEC) applies the Howey Test, established in SEC v. W. J. Howey Co. (1946), to determine whether a digital asset qualifies as a security under the Securities Act of 1933 (Supreme Court, 1946). An asset is a security if it involves an investment of money in a common enterprise with an expectation of profit derived from others’ efforts. Tokens used purely for consumption, such as payment for storage or bandwidth, generally fall outside this definition, though many issuers have faced scrutiny when early token sales were framed as investment opportunities.

The SEC’s 2019 Framework for “Investment Contract” Analysis of Digital Assets (SEC, 2019) acknowledged that a token initially issued as a security may evolve into a non-security as its network becomes decentralised and gains real utility. The Commodity Futures Trading Commission (CFTC) also claims jurisdiction when tokens behave like commodities. The result is a hybrid environment in which a single token may be subject to multiple agencies, depending on its purpose and distribution model.

In the European Union, the Markets in Crypto-Assets Regulation (MiCA) provides a unified and technology-neutral framework that clearly distinguishes between asset-referenced tokens, investment tokens, and utility tokens. A utility token is defined as “a type of crypto-asset which is intended to provide digital access to a good or service, available on DLT, and is only accepted by the issuer of that token” (European Commission, 2020). MiCA’s clarity is an important differentiator from the US system. It establishes disclosure and consumer-protection requirements for issuers and confirms that tokens serving a genuine access function fall outside traditional financial-instrument regulation.

Across Asia, regulatory responses vary widely. Singapore and Hong Kong have adopted risk-based frameworks aimed at balancing innovation and investor protection. Singapore’s Payment Services Act (2019) treats certain tokens as digital payment tokens, while its regulator, the Monetary Authority of Singapore (MAS), distinguishes utility tokens from securities if their function is non-investment. Hong Kong’s Securities and Futures Commission (SFC) applies a similar distinction, allowing utility tokens to operate without licensing when they are used solely for access to goods or services. In contrast, China maintains strict prohibitions on crypto trading and token issuance, steering digital-asset activity into regulated state-backed initiatives such as the digital yuan.

For investors and professionals, this divergence underscores the global complexity of digital-asset regulation. As the CAIA Association notes, “digital assets can span multiple classifications simultaneously, requiring investors to adopt flexible frameworks for valuation and risk.” (CAIA Blog – How to Build a Crypto-Specific Sector Risk Model).

Utility tokens also differ from governance tokens, which provide voting rights and influence over protocol decisions. Usually these may be securities that can distribute profits. Utility tokens derive their value primarily from service demand rather than control. In some projects, both functions coexist, but network usage remains the dominant (long-term) value driver. After all, the network effects are the main driver of cryptocurrencies.

Even though utility tokens serve operational purposes, they remain volatile due to market sentiment and network growth cycles. Futures and options contracts can help hedge exposure, especially for enterprises that depend on token-denominated services. This might make them suitable for crypto treasuries who are looking for volatility.

It’s likely that these assets may be included in diversified index portfolios. A Utility Token Index could be designed based on market capitalisation, transaction activity, or usage metrics. Such an index would differ from large-cap crypto indices by focusing on decentralised services rather than payment or smart-contract platforms.

Concluding Thoughts

As adoption grows and usage replaces speculation, utility tokens may exhibit lower relative volatility and assume a role similar to defensive assets within the digital-asset universe. For CAIA professionals, they represent an emerging area of analysis within asset allocation, combining tangible on-chain utility with tradable market characteristics. After all, utility tokens are not valued using traditional discounted cash-flow models.

As regulation matures across jurisdictions, from MiCA in Europe to evolving frameworks under the SEC and CFTC in the United States and innovation-driven regimes in Asia, utility tokens are likely to form a distinct and credible sub-sector of the digital-asset market. Ultimately, they reflect the convergence of finance, infrastructure, and technology, providing service-based value rather than purely speculative exposure and potentially becoming the digital economy’s equivalent of traditional utility stocks.

About the Contributor

Tatja (Tati) Karkkainen, PhD, is a researcher and innovator specialising in financial technology, digital assets, and alternative investments. She leads Research, Development and Innovation (RDI) activities at Kiitot, focusing on digital asset valuation, tokenisation, DeFi, and regulatory technology (RegTech). Her focus is in SME services.

Dr Karkkainen is the author of The FinTech Evolution: Technology Push, Market Pull Dynamics, and Inertia and passed her CAIA exams within a year. Her work bridges academia and industry, combining econometric analysis, blockchain applications, and policy insight to explore how emerging technologies transform financial systems.

She has collaborated internationally on fintech education and research initiatives and contributes regularly to discussions on digital-asset markets and the future of financial infrastructure. Any comments: please direct to tatja@kiitot.fi.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/