Authored by Georgina Tzanetos, Director of Content

Alternatives used to feel exclusive, but now everyone’s on the guest list.

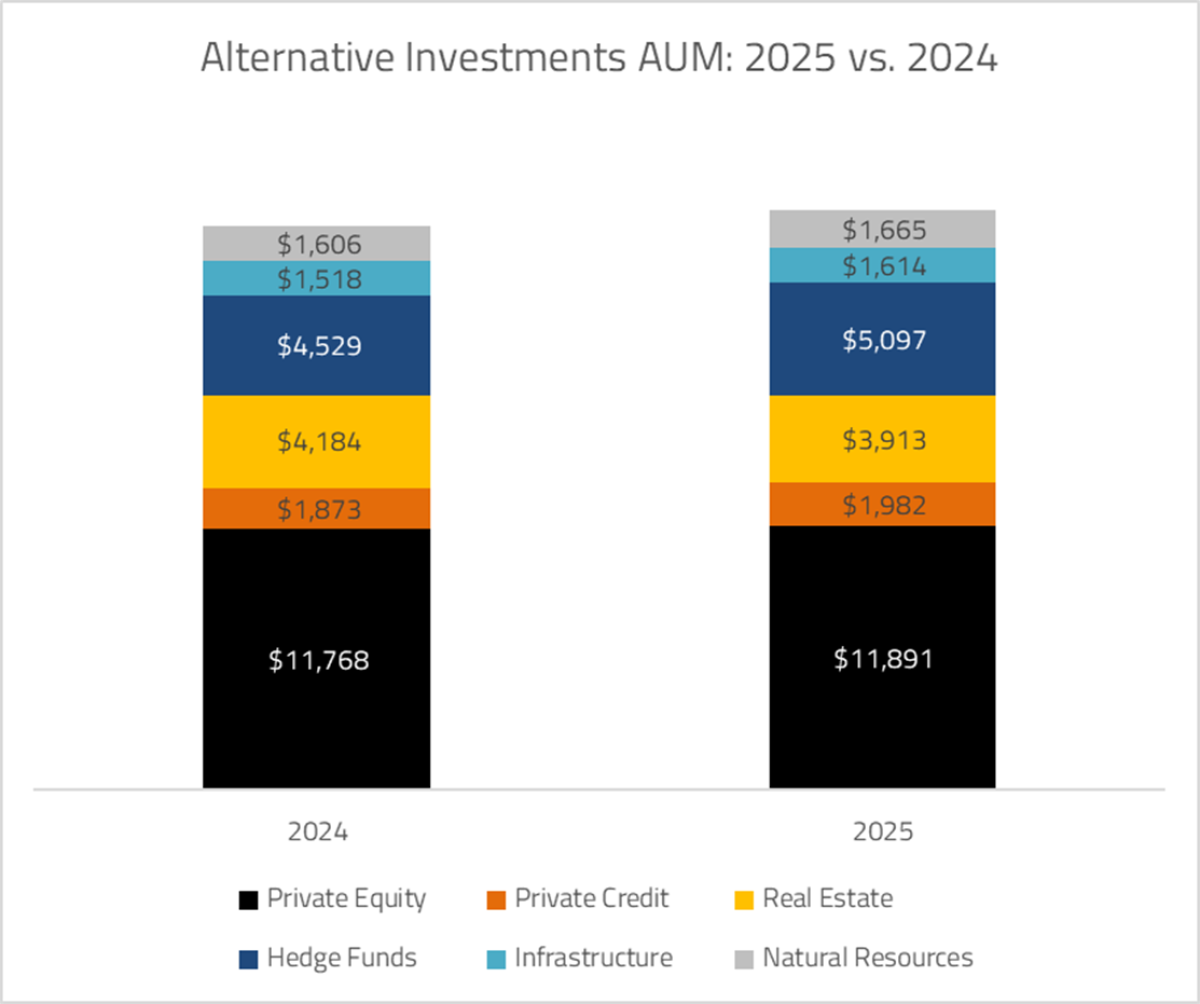

What was once a velvet-rope event for institutional investors has turned into a full-blown block party. Based on some preliminary figures from the CAIA Association, private markets have grown to nearly $26.2 trillion in assets in 2025, and the guest list keeps growing: retail investors, tokenized assets, and semi-liquid structures are all finding their way in. The energy is certainly electric—but the dance floor is getting crowded.

Source: CAIA Association, Preqin, Pitchbook, CEFData, Morningstar, HFR

The Dance Floor is a Little… Tight

If 2024 felt crowded, 2025 is the year the floor hit capacity. Private credit, which grew nearly tenfold over the past decade, is now firmly entrenched as a mainstream financing source. After raising $124 billion in the first half of 2025 alone, the asset class is on pace to beat last year’s record, driven by direct lending and a wave of opportunistic and specialty finance strategies targeting higher yields and diversification.

Private equity is facing its own version of crowding. Dry powder currently sits at around $1.68 trillion[1], according to Preqin. This mountain of undeployed capital is creating urgency for managers to put money to work, even as exit routes remain constrained. Despite improving sentiment, deal activity has yet to fully rebound: pricing mismatches between buyers and sellers persist, slowing the pace of transactions. This imbalance has left many GPs leaning on continuation vehicles and secondaries to manage liquidity, while LPs grow increasingly frustrated with delayed distributions.

The crowding effect is about numbers, but it’s also reshaping behavior. In private credit, competition for deals left to loosened underwriting standards, with covenant-lite structures and payment-in-kind facilities are becoming more common. Jumbo loans – those exceeding $1 billion – are on the rise, signaling aggressive deal-making and risk creep. Meanwhile, private equity managers are venturing into niche strategies and co-investments to differentiate themselves, but these innovations introduce complexity and opacity, amplifying governance challenges for allocators.

For investors, the implications in 2025 and going on to 2026 are evident: discipline matters more than ever. In a market where underwriting standards are loosening and liquidity remains elusive, chasing yield without regard for structure or sponsor quality could leave portfolios exposed when the music stops.

No One Likes a Watered-Down Drink

When the market is overwhelmed, quality slips. After years of explosive growth, the race to deploy capital has led to a steady erosion of lender protections and a rise in riskier deal structures. Covenant-lite loans, once a rarity in middle-market transactions, have steadily increased in usage. As we stated last month, the benign environment that fueled private credit’s rise—low rates, low defaults, and abundant liquidity- has shifted dramatically, forcing managers to revisit underwriting assumptions and covenant protections that once seemed bulletproof. Moreover, a report by With Intelligence[2] states that more than 75% of new direct lending deals in the U.S. are covenant-lite, and the use of payment-in-kind (PIK) interest facilities has surged, signaling growing stress among borrowers.

The macro backdrop is amplifying these risks. Higher-for-longer interest rates (the overall level, despite some recent cuts) have compressed spreads, forcing managers to compete aggressively on terms rather than pricing. Again, private credit “grew up” in low rates, low defaults, and loads of liquidity – but that party is very much over. Borrowers are struggling with interest coverage ratios, and while default rates remain modest, the cracks are visible. Fitch Ratings[3] estimates that U.S. private credit defaults climbed to 5.7% in early 2025, up from virtually zero in 2022.

What does this all mean? Well, what looks like alpha might actually be leveraged beta. As one CAIA analysis[4] put it certain private credit instruments ‘promise of equity-like returns with debt-like risk is being tested for the first time in a meaningful way. In other words, the cocktails may still look fancy, but they’re watered— and the hangover could be severe if disciplined underwriting doesn’t return. For allocators, this means doubling down on due diligence. Scrutinize covenant packages, monitor PIK exposure, and understand the sponsor’s track record in workouts.

This is not all to say these behaviors are somehow unique. It would be unfair to categorize private market lenders as the first to loosen the reins of financial oversight. We know too well about the covenant-lite loans that surged during the buyout boom after the 2008 financial crisis, reducing lenders’ ability to intervene early. Lest we also forget how public lenders faced “creditor-on-creditor violence” as loose covenants enabled asset transfers and up-tiering maneuvers during the J. Crew and Neiman Marcus bankruptcies (RIP), leaving some lenders severely impaired. Public markets walked so private markets could swan dive into the plotline for Wolf of Wall Street 3, but the larger wisdom remains. Lenders will loosen standards when economic conditions compel them to do so – it is up to the investor to discipline themselves against this. Those who do not, on either side of the aisle, will lose the competitive advantage.

Meanwhile, it looks like coat check is backed up too—and the line isn’t moving quickly. Liquidity pressure across private markets has increasingly been absorbed the secondaries ecosystem, which is not just growing, but booming. In the beginning of the year, Paris-based Ardian made history saying it raised $30 billion in the biggest-ever secondary fund. Jefferies reported $103 billion in global secondary volume in H1 2025 alone, up 51% year-over-year, putting the market on pace for a record-breaking $176 billion by year-end.[5]

And exits? They’re improving, but slowly. By December, U.S. private equity firms were on track to cash out more investment than in 2024, marking a second consecutive year of recovery, according to PitchBook data reported by Reuters[6]. Still, a backlog of aging assets remains significant: nearly 30% of PE-backed companies have been held for seven years or longer, and median hold periods stretched to 3.4 years in 2024[7], up from three years in 2022.

For investors, these twin dynamics— fundraising consolidation and liquidity bottlenecks— will demand a fresh playbook. Mega-funds offer operational depth and deal access, but they also amplify exposure to crowded trades and correlated outcomes. Secondaries provide an off-ramp, but diligence matters: structure, pricing discipline, and asset quality remain decisive. In a market where the exit line stretches out the door, the smartest guests are planning their moves before the music stops.

A Revolving Door of New Players

Tokenization and retailization are bringing new guests (and new rules). Back in 2021, our research on tokenization of alternative assets[8] highlights why this is more than hype: improved liquidity, faster, lower-cost transactions, greater transparency, and broadened access via fractional ownership and digital record-keeping. Bain & Company[9] estimates tokenization could unlock $400 billion of annual revenue for the alternatives ecosystem by streamlining subscriptions, automating capital calls, enabling collateralization, and opening wealth channels. On-the-ground-adoption is visible: Franklin Templeton, BlackRock, and WisdomTree have launched on-chain funds and digital record-keeping pilots; several private credit and private equity vehicles have begun tokenized offerings targeted at qualified investors.

Scale is emerging. According to Cointelegraph and other industry reports, the tokenized real-world asset expanded from roughly $10 billion in 2024[10] to over $24 billion in 2025, fueled by private credit and tokenized Treasuries– evidence that infrastructure and demand are converging. At the same time, retailization is being codified in policy structure. This opportunity comes with responsibilities. Greater access requires education, clear risk disclosure, and robust governance. Tokenized rails won’t eliminate illiquidity, valuation lag, or complexity; they repackage how ownership is recorded and transacted. For allocators the playbook is to pilot well-structured evergreen vehicles, insist on transparent liquidity mechanics (gates, intervals, secondaries links), and favor managers with proven operations and compliance. New guests are welcome- so long as we keep house rules intact.

The Party Isn’t Over—But Chez Margaux This is Not

The alternatives boom has transformed from an exclusive members-only club to your neighborhood block party (but make it APAC/EMEA/Blockchain, semi-liquid, etc. friendly)– and the momentum shows no signs of slowing.

Private credit and private equity remain headline acts, but the influx of capital, new structures, and emerging technologies is reshaping an industry that may very well still be considered “developing”. Crowding brings opportunity, but also risk. Looser underwriting, opaque strategies, and liquidity bottlenecks mean that allocators can’t afford to chase returns blindly. Tokenization and retailization promise scale and efficiency, yet they also demand stronger investor education and governance at the institutional level.

In short, the music is still going, but success in 2026 and beyond will hinge on discipline, transparency, and knowing when to step back from the noise. Dystopian author Kurt Vonnegut once said, “Dance first, think later”, but in private markets, that mindset has run its course.

And besides, taking advice from a nihilist (likely bear) is so 2025.

Resources:

- CAIA Association. “Opportunistic Credit in Multi-Asset Portfolios: A Private Credit Complement.” CAIA.org, September 15, 2025. https://caia.org/blog/2025/09/15/opportunistic-credit-multi-asset-portfolios-private-credit-complement.

- Preqin. “2025 Global Report: Private Equity.” Preqin.com, 2025. https://www.preqin.com/insights/global-reports/2025-private-equity.

- PitchBook. “Aging Buyout Portfolios Reach Decade High.” PitchBook News, 2024. https://pitchbook.com/news/articles/aging-buyout-portfolios-reach-decade-high

Fitch Ratings. (2025, March 31). U.S. Leveraged Finance and CLO Weekly. Retrieved from https://www.fitchratings.com/research/structured-finance/us-leveraged-finance-clo-weekly-31-03-2025

[1] Preqin. “2025 Global Report: Private Equity.” Preqin.com, 2025. https://www.preqin.com/insights/global-reports/2025-private-equity.

[2] With Intelligence. (2025, August). Private Credit Trends in 2025. Retrieved from https://www.withintelligence.com/insights/private-credit-trends-in-2025

[3] Fitch Ratings. (2025, March 31). U.S. Leveraged Finance and CLO Weekly. Retrieved from https://www.fitchratings.com/research/structured-finance/us-leveraged-finance-clo-weekly-31-03-2025

[4] CAIA Association. “Opportunistic Credit in Multi-Asset Portfolios: A Private Credit Complement.” CAIA.org, September 15, 2025. https://caia.org/blog/2025/09/15/opportunistic-credit-multi-asset-portf….

[5] Jefferies PCA. (2025, Jul). Global Secondary Market Review. Retrieved from https://www.jefferies.com/wp-content/uploads/sites/4/2025/08/Jefferies-Global-Secondary-Market-Review-July-2025.pdf

[6] Reuters. (2025, Dec 4). U.S. private equity exit deals set for second year of recovery, PitchBook finds. Retrieved from https://www.reuters.com/business/us-private-equity-exit-deals-set-secon…

[7] PitchBook. “Aging Buyout Portfolios Reach Decade High.” PitchBook News, 2024. https://pitchbook.com/news/articles/aging-buyout-portfolios-reach-decade-high

[9] Bain & Company. “How Tokenization Can Fuel a $400 Billion Opportunity in Distributing Alternative Investments to Individuals.” Bain.com, 2024. https://www.bain.com/insights/how-tokenization-can-fuel-a-400-billion-o…

[10] Cointelegraph. “Private Credit Powers $24B Tokenization Market, Ethereum Still Dominates: Redstone.” Cointelegraph.com, 2025. https://cointelegraph.com/news/private-credit-powers-24b-tokenization-market-ethereum-still-dominates-redstone.