Authored by Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP, Managing Director of Global Content Strategy

Superhero Summer is back, baby. With the reimagined blockbuster releases of Superman and the Fantastic Four, the DC vs. MCU rivalry continues. Just when you thought the momentum was coming to a stop, both franchises delivered movies that didn’t want to make me curl into a ball of existential dread (read: recent DC) or just die inside from pure cringe (read: recent MCU).

Speaking of momentum, let’s talk private credit.

In 2025, there’s $3 trillion in AUM floating around in dedicated private credit fund vehicles. What’s more interesting (beyond private credit’s growth in size over the past decade) is how the demand for the asset class has cut through some of the challenges being faced by other asset classes: a slowdown of private equity exits (leading to continuation funds and NAV lending), or the continued challenging supply/demand dynamics of the real estate market leftover from the last few years. In contrast, private credit has enjoyed a perfect combination of fundraising, double-digit yields, and greater product customization.

However, as private credit garners more attention, so do concerns about its sustainability. Increased warnings about rising defaults, aggressive deal terms, or asset-liability mismatches loom large.

So, this all begs the question: is private credit about to jump the curve in its multi-year secular rise, or are we about to enter a period of cyclical challenges?

Rather than offer easy answers, we found better clarity in four of the most telling questions we heard on the road.

Inspired by Marvel, I’ll call them the Filbeck Four, and like any good origin story, these questions reveal more than they resolve.

Question 1: Is Private Credit (Silver) Surfing Around a Bubble… or a Wormhole?

The b-word (“bubble”) starts to creep into our language any time we start witnessing investors piling into a single trade with little regard for fundamentals. In private credit’s case, the velocity of inflows and product launches has been incredible. According to Burgiss data, the number of private credit drawdown funds was less than 20 in the early 2010s but has increased to approximately 200 in the 2020s. That’s a lot of product!

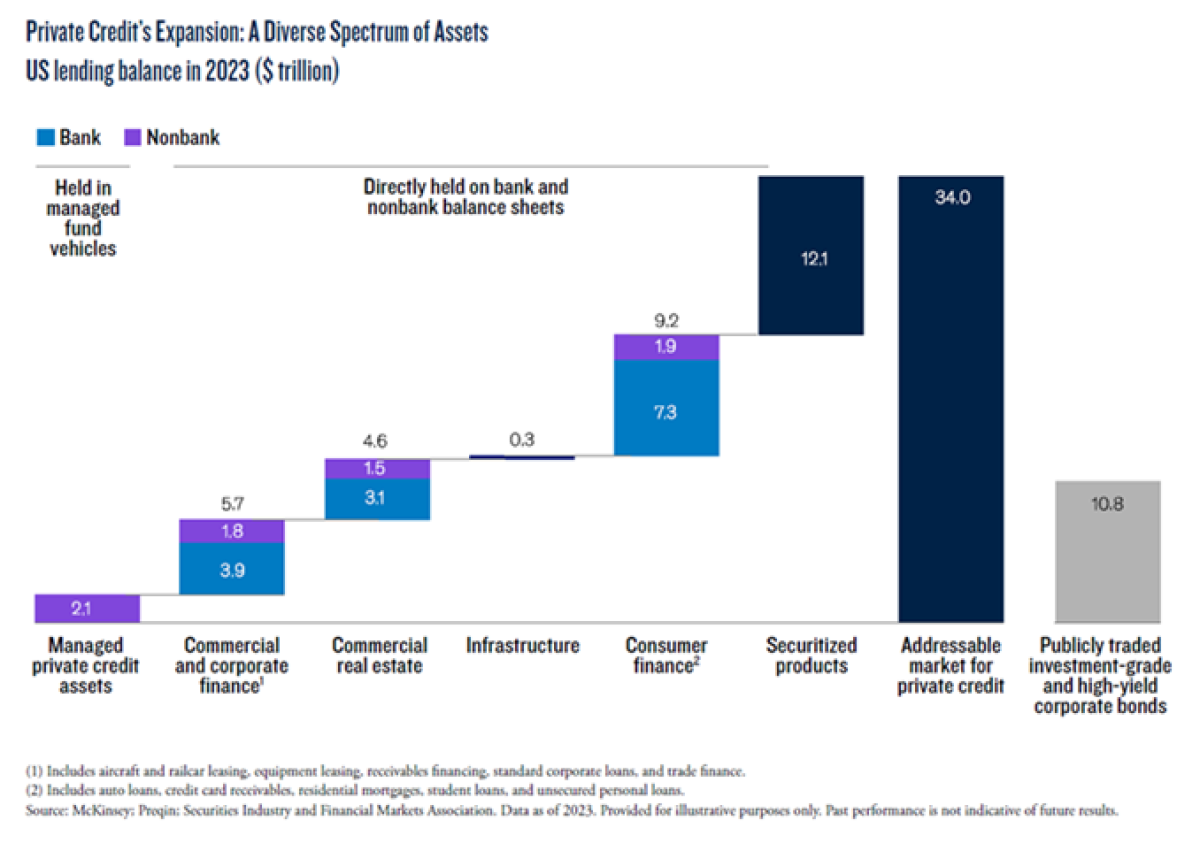

Figure 1: Private Credit’s Total Addressable Market (U.S. Only)

Source: McKinsey 2025

Like any good financial metric, we need to scale it in a broader context. Despite the number of funds, McKinsey estimates the total addressable private credit market at $30 trillion or more in the U.S. alone. While private credit has grown very quickly, a report from the Federal Reserve Bank of Boston argues that borrowers are still using private lenders as a replacement for bank lending. In other words, private credit isn’t expanding the pie, but rather dividing it up. There are still risks underlying this assumption but, at a macro level, private credit continues to be a “the banks are stepping back” story.

Question #2: Will Higher Rates Clobber Private Credit’s Value Proposition?

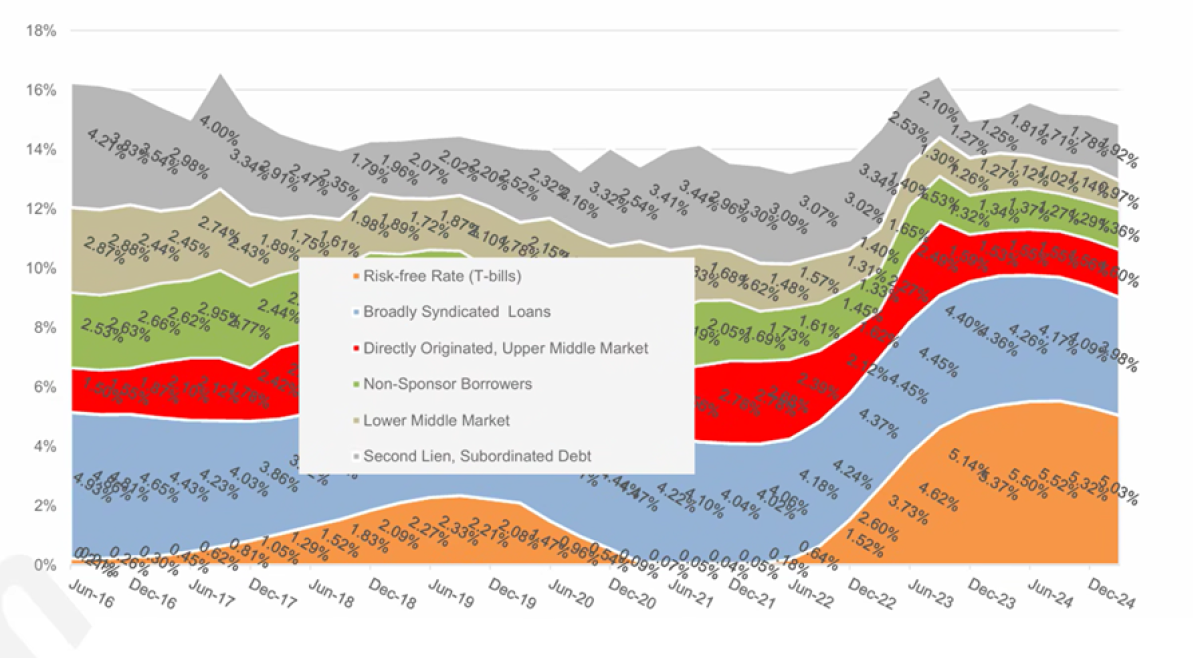

In a ZIRP world, private credit benefited from being one of the only alternative (and attractive) sources of income and had much less competition in terms of lenders. Not only was the return profile a strong argument when cash paid nothing, but you were also getting paid to take on additional credit risk. However, as you can see in Figure 2, riskier credits have seen a slight increase from rising base rates, but not by much. Basically, base rates have increased, and spreads have compressed as competition for deals continues.

Figure 2: Private Credit Yield Premiums: 2016-2024

Source: Cliffwater

The reality is private credit’s golden age began in a low-rate world. Floating-rate structures helped many funds maintain attractive yields as rates rose, but we’ve entered an environment where financing costs matter. We may not be in a bubble from an AUM perspective, but growth and competition are beginning to change the value proposition.

Question #3: If Galactus Were an Investor, Would Private Lenders Use the Baby as Bait?

Related to questions #1 and #2, a recent WSJ article described how the continual influx of capital into private credit funds (specifically direct lending) and competition for deals is outpacing high-quality opportunities and that lenders are compromising underwriting standards to win deals, further compressing spreads and introducing weaker covenants.[1]

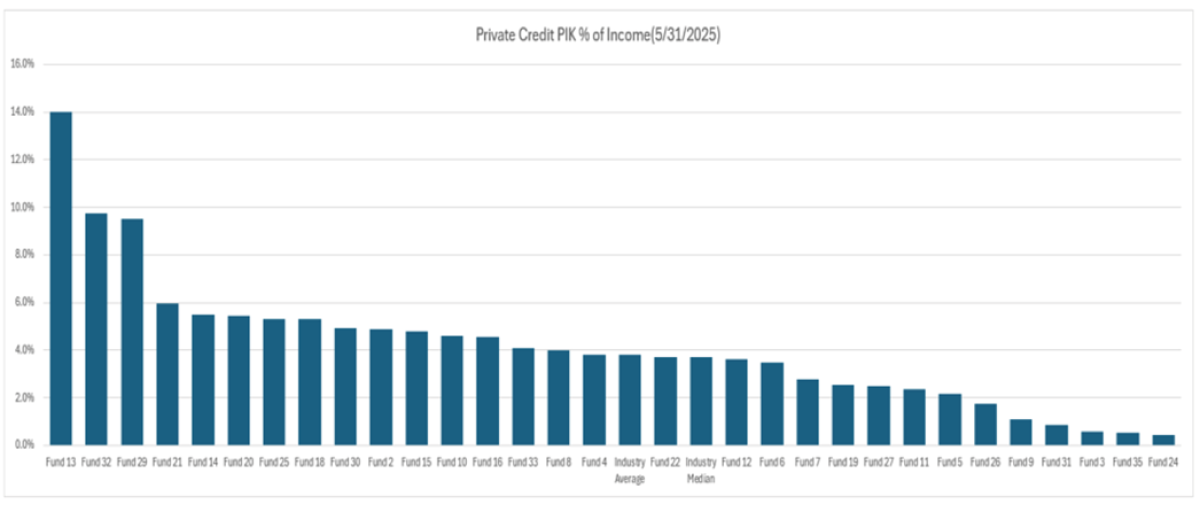

One of the ways to quantify this concern is to look at the proportion of income that’s considered PIK (payment-in-kind), which has become a more common feature of deal structures across a company’s capital structure.

At face value, PIK interest can be a useful tool for GPs to structure deals to best fit a company’s profile, especially during periods of distress (like COVID). However, as PIK toggles become more prevalent and/or built into loans from the start, there’s a risk that companies are incentivized to be liberal with how they use their cash.

Figure 3: Private Credit PIK As a Percentage of Income (Registered Funds)

Source: Sanctuary Investment Diligence and Consulting

While Churchill points out that PIK usage has seemingly normalized to around 7–8% of income, iCapital argues that when PIK nears 10% of total income, the portfolio may become stressed (this is in the context of the BDC structure, but directionally correct).[2] As shown in Figure 3, PIK as a % of income is still relatively contained in the registered evergreen fund universe, but with a wide dispersion. If we use this as a proxy, it’s important to understand 1) whether these PIK toggles were negotiated on the front end as a capital appreciation tool or 2) PIK is creeping up due to poor credit quality.

Question #4: Where Can I Feed My Hunger for Credit Outside of Direct Lending?

While the first leg of the private credit’s rise was driven by changes to Basel III and Dodd-Frank, which led to a large and competitive direct lending business throughout the 2010s, the regional banking crisis of the early 2020s (Silicon Valley Bank and Signature Bank’s failures, followed by First Republic Bank’s sale to JPMorgan) may have kickstarted the second wave of growth for non-direct lending strategies. As the middle market becomes stratified and more competitive, investors are increasingly looking to places like distressed, venture and, more recently, asset-based lending (ABL).

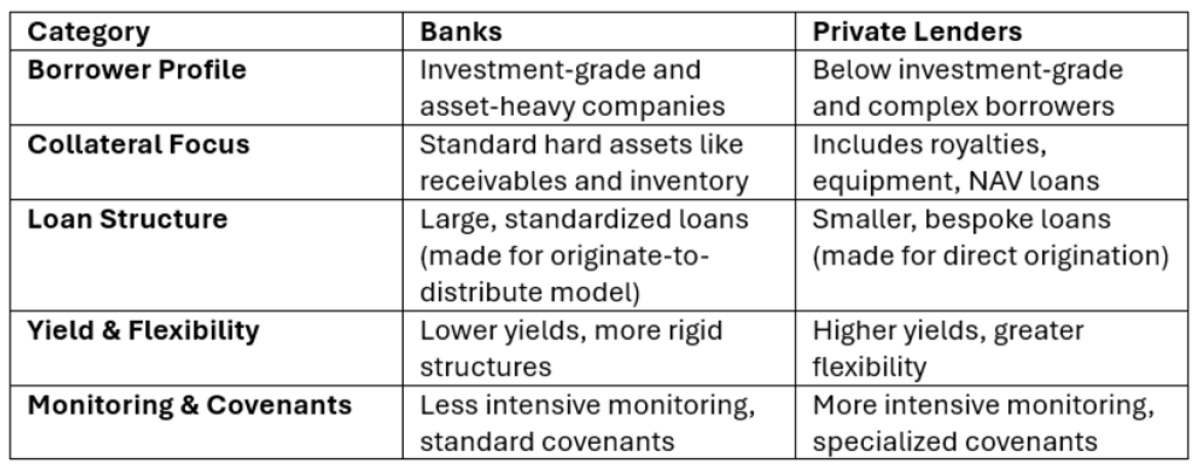

Figure 4: Asset Based Lending in Banks vs. Private Lenders

Source: CAIA Association

As I’ve written before, ABL has redefined itself and come of age in the 2020s. In the early 2000s, ABL was viewed as a distressed lender of last resort, driven by bank lending, and provided an option for companies to secure financing by collateralizing assets off the balance sheet.

Unlike banks, which typically operate under an “originate-to-distribute” model and are highly sensitive to regulatory capital requirements, private lenders tend to take a more customized and asset-focused approach to what they originate. They are naturally less constrained in terms of underwriting complexity and collateral diversity. Some of these differences are shown in Figure 4.

Like direct lending, the growth and expansion of ABL reflects both demand from borrowers for flexible capital and innovation by lenders who want to originate risk away from crowded corporate deals. But don’t be fooled by a new shiny object, the collateral matters more than anything in this space.

No Surprise: Manager Selection is More Critical, Especially to Avoid Doom

It’s tempting to view private credit as either unstoppable or unsustainable. The truth, as usual, lies somewhere in the middle. We’ve described the evolution of private credit as a secular force with cyclical challenges, and I think that thesis still holds up in many respects.

The returns are still there, but the risks are more prevalent. Underwriting terms have loosened, and lenders are getting creative in some pockets to “pretend and extend” the life of these loans. But there’s also maturity and coming-of-age stories in this asset class as more vintage years pass. Many managers are expanding beyond crowded corporate deals into other parts of the private credit ecosystem.

It's important to consider two things:

First, view private credit as a unified ecosystem across public, private, and banking markets and systems, rather than drawing hard lines between the two. Systemic risk is just as (if not more) important as credit risk, and this is an ecosystem of replacement.

Second, it’s more important than ever to partner with GPs that have a breadth of underwriting experience and can articulate and showcase their credit analysis. Understand where PIK comes into the picture and how comfortable you are with aggressive, fast, and loose lending practices.

Speaking of track records, you should view private credit performance with just as much diligence as any other strategy. As a recent Substack author wrote, “the more ‘storytelling’ and flexibility a strategy involves, the more inflated the manager-reported returns tend to be.”[3]

So, the bottom line? Like Reed Richards, we can’t solve for every variable, but private credit doesn’t seem to be headed to its Doom just yet.

More resources:

CAIA Association: Asset-Based Lending Comes of Age in the 2020s.

PGIM: The Convergence of Public and Private Credit.

[2] https://icapital.com/insights/private-credit/painting-a-pikture-the-ben…

[3] https://covenantlite.substack.com/p/covenant-lite-23-the-private-credit…