Authored by Claire Sawyer, Associate Director, Educational Programs

In a world where markets are more volatile, resources more constrained, and expectations higher than ever, the traditional investment playbook, strategic asset allocation, has served the industry well, but may be beginning to feel a bit… waterlogged.

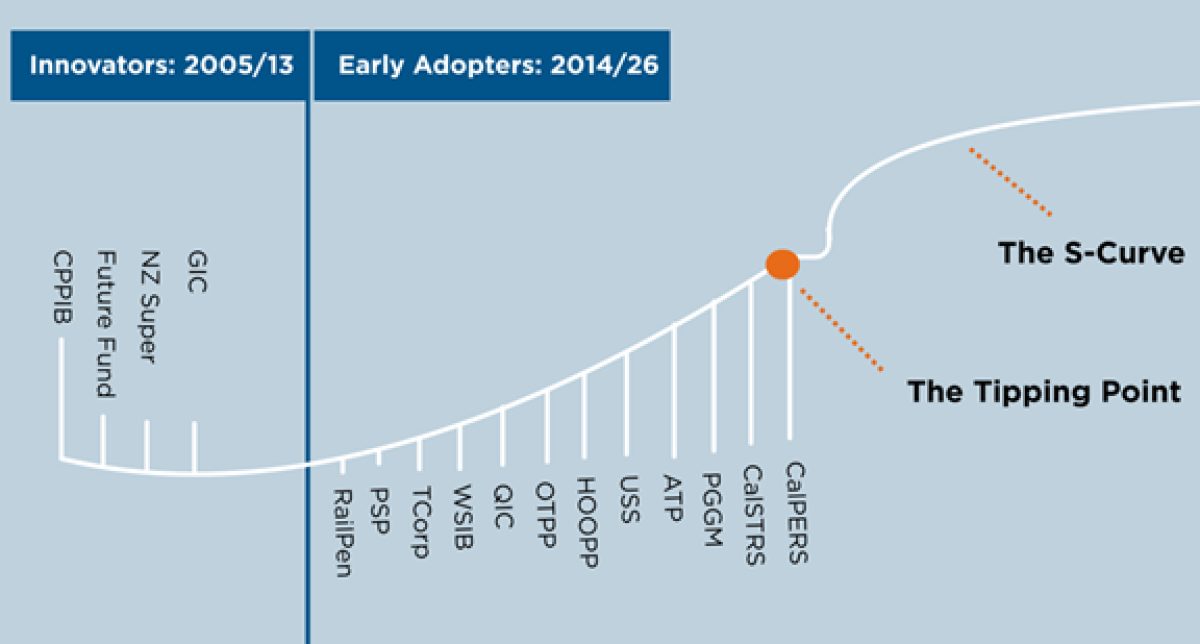

Enter the Total Portfolio Approach (TPA), a mindset that’s been adopted and evolved by a handful of asset owners for decades, but has increasingly caught the attention of others in the last few years.

Source: Thinking Ahead Institute

CAIA Association began its own exploration of TPA a few years ago, which led to our first report attempting to explain the conceptual underpinnings of this mindset. The reception to Innovation Unleashed: The Rise of Total Portfolio Approach was a pleasant surprise – fostering debate, interest, and questions around the world. A mere 18 months later, we released From Vision to Execution: How Investors Are Operationalizing the Total Portfolio Approach, which explores the hardest question of all:

How do I actually do this?

Drawing from interviews with a dozen global asset owners, we sought to offer practical lessons for those embarking on the long journey towards implementation.

Where to Begin

Every institution we spoke with emphasized that TPA is not a plug-and-play framework. It’s an evolution that starts with people and processes, and not what investment professionals tend to fixate on: the portfolio itself. While each organization’s path is unique, several consistent takeaways for us emerged:

- Start with mindset and governance. Before changing models or metrics, take time to clarify who owns which decisions. The organizations furthest along told us they began by redefining governance, revisiting investment beliefs, clarifying decision rights, and creating accountability at the right levels. As one CIO put it: “Without clarity of ownership, TPA never takes root.”

- Build cultural alignment before structural change. Most early adopters found it easier to tweak governance documents than to shift mindsets. Teams that succeeded invested time in internal storytelling: explaining why they were evolving, not just what they were changing. TPA works only when the organization collectively believes in collaboration over silos, flexibility over fixed allocations, and achieving long-term objectives over outperforming artificial benchmarks.

- Experiment, it’s going to take some time. Rather than a top-down rebuild, several asset owners started with targeted experiments in a bottom-up way – a small “opportunistic” portfolio, a single partnership, or a new investment opportunity that cut across asset classes. These pilots served as proof points to demonstrate the benefits of a goal-aligned approach and to refine decision processes before scaling.

- Reframe performance and risk. The shift to TPA requires re-educating boards and stakeholders on success metrics. Performance reporting should be mapped to total-fund objectives, not legacy benchmarks. That might mean emphasizing contribution to total-fund return, liquidity, or longevity rather than beating an index.

- Accept that TPA is ongoing. Even mature adopters describe a continual gravitational pull back toward strategic asset allocation (SAA). Our industry is built upon peer comparisons, traditional metrics, and comfort with silos. The difference is awareness and effort. As one asset owner noted, “You don’t reach TPA, you choose it every day.”

The Water We Swim In

Think of traditional SAA as the familiar water we’ve all been swimming in. It’s comfortable, structured, and benchmark-friendly. Everyone knows what’s expected of them, and those boundaries feel safe.

TPA is, for all intents and purposes, the opposite. It throws out the comfortable categories and benchmarks that we’re used to, and in certain respects, it’s a messier way of doing things. There’s no cookie-cutter rulebook to follow, and it requires some experimentation to succeed. But we’d argue that’s where much of its strength lies: traditional boundaries are blurred, and that grey area is what leaves room for exactly the kind of creativity and flexibility our industry needs.

To implement TPA requires intentionally breaking away from peers and swimming against the current, even when it’s difficult (or unpopular) to do so. If SAA is the water we swim in, implementing TPA is to be like the salmon—aware of its environment and unafraid to swim upstream, challenging as it may be.

If it sounds daunting, we get it. Reframing your entire approach to asset allocation is a big ask, and it requires a leap of faith to challenge the business-as-usual approach.

But one thing we didn’t hear from anyone? That they regretted the transition.

Whether you’re just dipping your toe in or already swimming in TPA waters, explore more resources and learn from the asset owners putting these ideas into practice at CAIA.org.