Authored by Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP

We’ve all heard some variation of the phrase “a solid foundation is the key to success.” Most of the time, we’re talking about education, morals, or technical expertise. Of course, I agree with the statement when it comes to personal development, but right now I’d like to talk more literally.

A solid foundation is the key to success.

According to the World Bank, over one billion people live two kilometers from a road, 675 million people lack electricity at home, and 450 million people live outside the range of a broadband signal. That’s not a statistic from the 1990s … that’s as of June 2023. Several important studies were made throughout the 2010s about the magnitude of the gap needed to finance infrastructure, including the following:

- In 2016, McKinsey & Company estimated a global investment requirement of $3.3 trillion per year to keep pace with global GDP.

- In 2017, the World Bank estimated that emerging markets would need to invest approximately $1.7 trillion per year to support their growing economies and populations.

- In 2017, the Global Infrastructure Hub estimated that the world would need to invest $94 trillion in infrastructure to support global economic growth and development.

So, what does our report card look like as a society?

Not so great. Just last year, the Global Infrastructure Hub estimated that the annual amount of investment needed by G20 countries increased from $0.7 trillion to $3.0 trillion between 2017 and 2022. We have a lot of work to do here.

The need for infrastructure also varies substantially, as shown in this interesting tool offered by the Atlantic Council that further breaks down the need for infrastructure investment by region and indicator of access. In developed economies, the focus seems to be on improving existing structures as well as digital infrastructure, whereas many developing economies simply need transportation.

Themes and Opportunities

The COVID-19 global pandemic impacted most asset classes in the early 2020s. As governments scrambled to stimulate their economies, investments in creating or updating the “old economy” (e.g., transportation) sat alongside investments in the new one.

For example, the pandemic shifted most things online, including remote work, online education, and telehealth services. Digital infrastructure, a sector that may have been nascent before, has seemingly exploded in interest. In the Western world, this means faster internet speeds … in other countries, it means greater access to economic opportunities and social services in the developing world. According to the Gates Foundation, the number of adults with bank accounts in India more than doubled in the course of a decade after the introduction of digital infrastructure investment.

Similarly, as the economies reopened, causing goods and services to come back online, supply chains became disrupted, revealing a need for further investment and re-investment in transportation. In the United States, this was evidenced by massive infrastructure investments by the Biden administration.

Finally, the threat of climate change has increased the demand for green infrastructure and renewable energy. We’re about halfway through the 15-year period of sustainable development goals, and the progress isn’t looking great for emerging economies. In fact, the United Nations Conference on Trade and Development (UNCTAD) reported earlier this year that developing countries need roughly $4 trillion annually to meet their sustainable development goals by 2030, up from $2.5 trillion in 2015.

Growth Prospects and Fundraising Trends in Infrastructure Investments

Over the past few decades, the investments in infrastructure have shifted from government-led in the early 20th century, to public-private-partnerships (PPPs) in the 90s and early 2000s, to predominately private-sector investments today. This is highly necessary as many governments are strapped for cash, running large deficits, and/or facing polarizing political figures. Governments cannot do this alone, and the opportunity for investors could be substantial.

Investors are voting with their assets, with fundraising hitting an all-time high of $158 billion in 2022 and Preqin expects infrastructure to be the second-fastest growing private markets strategy over the next five years. The attractiveness of inflation-protected cash flows, downside protection, low correlations, and stability of the asset class is an attractive selling point for most long-dated institutional investors.

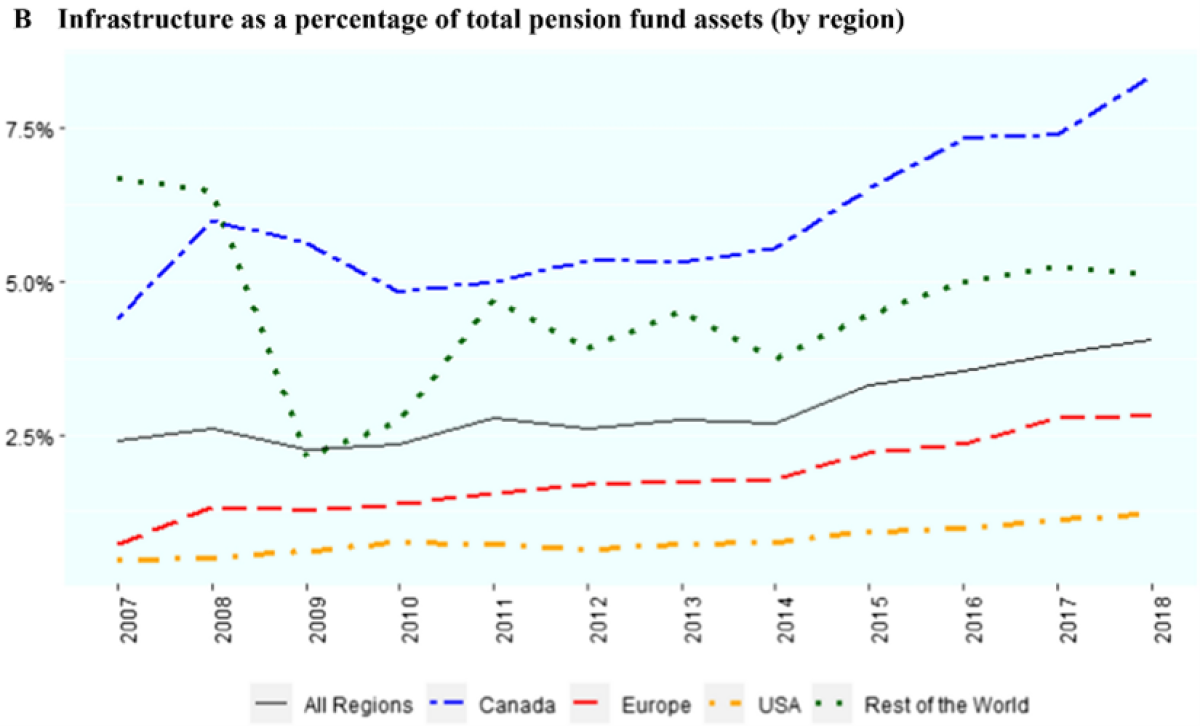

However, infrastructure allocations vary amongst asset owners and are highest in countries like Canada, Europe, and Australia. A recent academic paper by Carlo, Eicholtz, Kok, and Wijnands (2023) analyzed the average allocations to infrastructure across pension funds and found that the United States had the lowest allocations while Canada had the highest. Crazy, eh?

While infrastructure investments have gathered interest from asset owners and institutional investors for their risk and return characteristics, there are still some longer-term concerns ahead. This article summarizes some of these challenges and opportunities that investors should consider.

This article from Macquarie highlights the substantial need for energy investment in Australia in a post-coal world. Like infrastructure assets themselves, the process of building out new infrastructure is long-lived and takes time. However, if capital can be deployed properly, the desire for wind, solar, and other renewables is enormous.

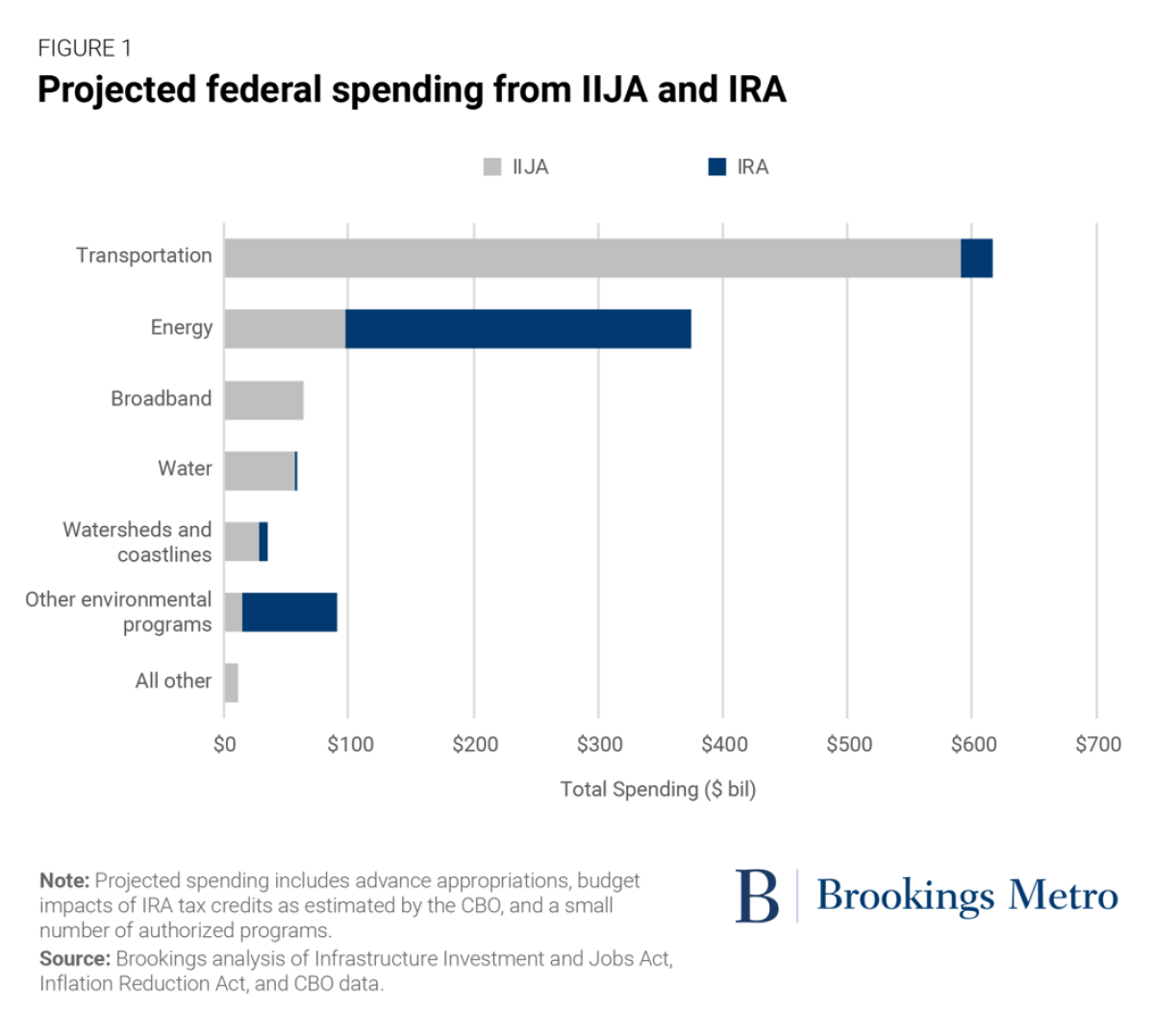

Over the next decade, the United States has pledged $1.25 trillion toward infrastructure projects, primarily transportation and renewable energy. But a lot of the money still sits on the federal balance sheet. This article provides a great summary of the main takeaways and opportunities in the U.S. infrastructure market.

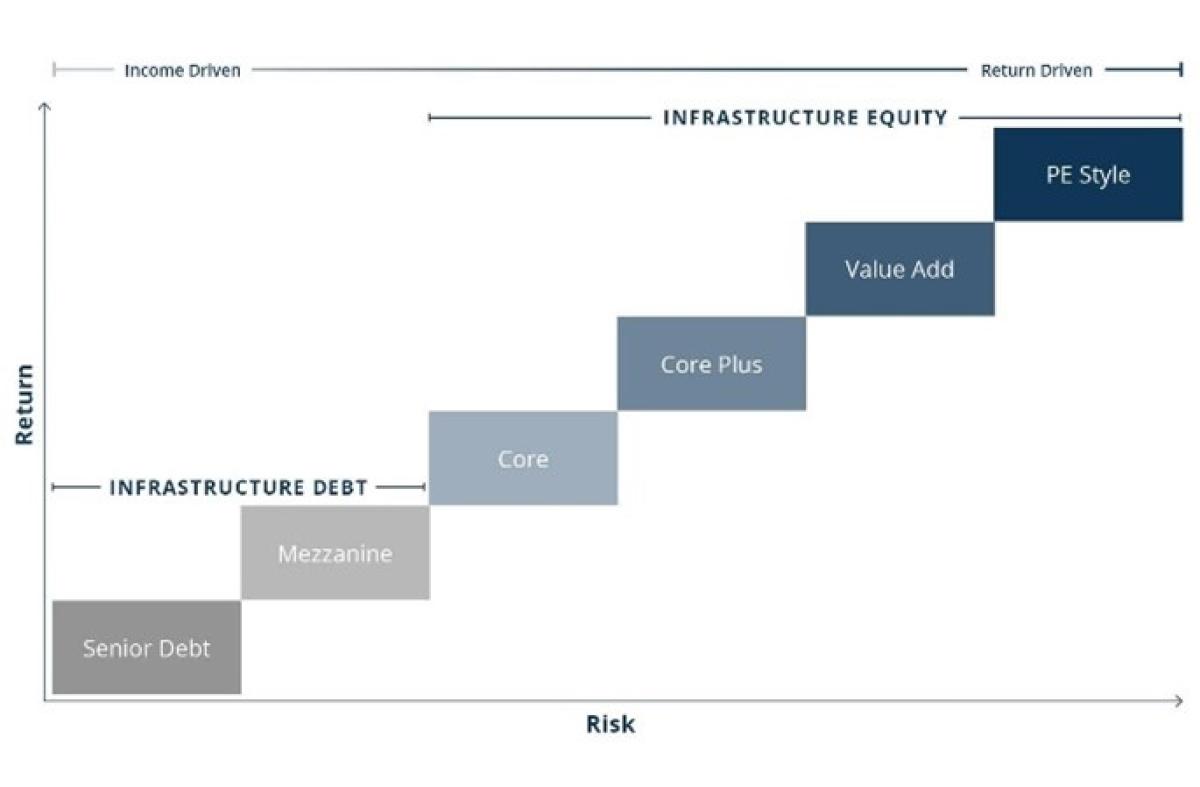

As the infrastructure universe has expanded, the risk profiles and categories of infrastructure have started to blur, and the defining characteristics of “core” infrastructure have been stretched. This whitepaper helps re-orient our definition of core infrastructure.

With such an appetite for infrastructure spending from the Biden administration, there are a few steps that can be taken to ensure underserviced communities’ benefit from incremental investment. This whitepaper from McKinsey outlines some of those steps.