ADDITIONAL RESOURCES

Getting Started with Due Diligence

-

Our Commitment to Better Due Diligence in Alts By CAIA Association

-

ILPA Due Diligence Questionnaire (Institutional Limited Partners Association)

- AIMA Due Diligence Questionnaire (Alternative Investment Management Association)

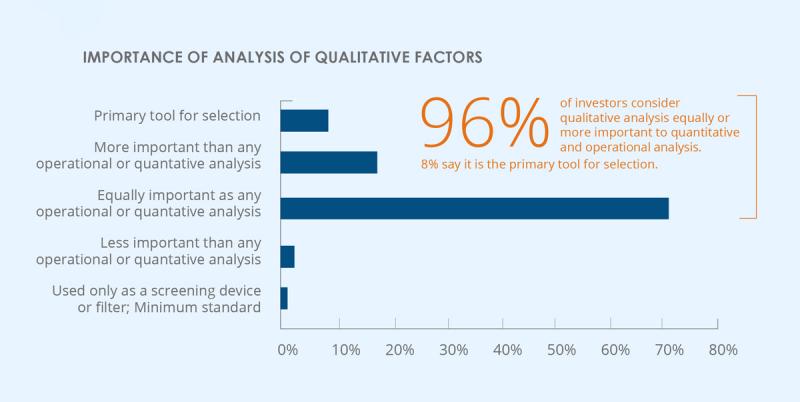

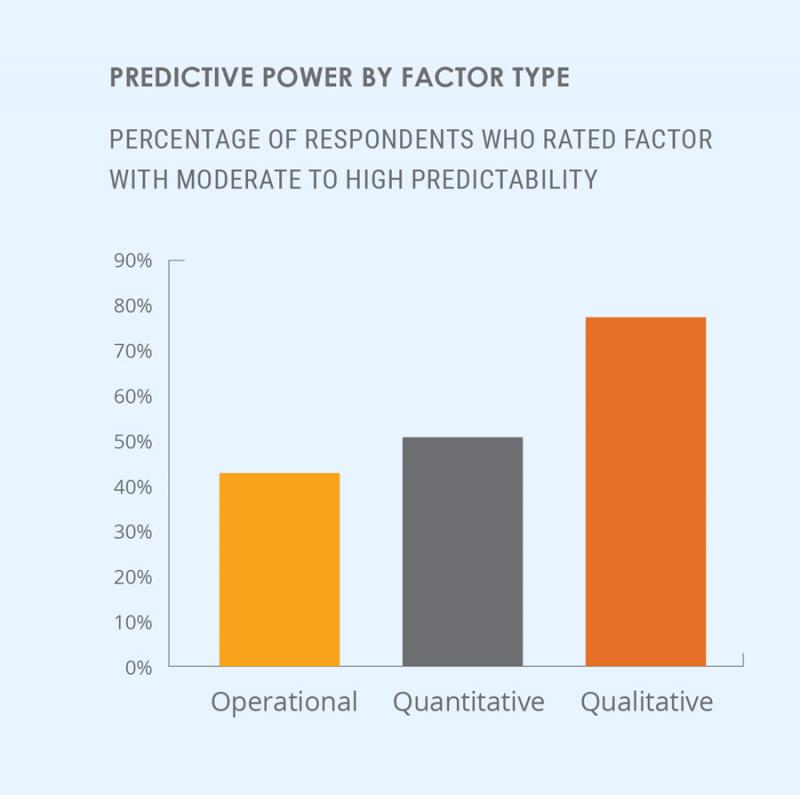

Qualitative Factors Matter

- The Art of Due Diligence: The Story Beyond the Numbers by Keith Black, PhD, CFA, CAIA, FDP and Mark S. Rzepczynski, PhD, Founding Partner and CEO, AMPHI Research and Trading

- Culture Eats Sharpe Ratios for Breakfast

- Culture, Communication, and Common Ground with Stacy Havener, Founder and CEO of Havener Capital Partners and Aaron Filbeck, CFA, CAIA, CIPM, FDP

- The Often-Forgotten Art and Science of Manager Due Diligence

- Outdated Due Diligence: The Enemy of Manager Diversity (Pacific Current Group)

- Demystifying Private Capital Due Diligence with CAIA Seattle and CAIA Minnesota

Manager Selection Considerations

- Operational Due Diligence: Some Good News for Emerging Managers by Keith Black, PhD, CFA, CAIA, FDP and Mark S. Rzepczynski, PhD, Founding Partner and CEO, AMPHI Research and Trading

- Operational Plus Commercial Due Diligence: Strengthen the Shield Against Fraud (PDF, AIAR)

- Due Diligence: Applications and Practice: Panel Discussion

Investment Strategies and Vehicles

- How Venture Capitalists Make Decisions (Harvard Business Review)

- The Evolution of Private Equity Fund Value (JAI)

- Do Private Equity Alternative Vehicles Benefit Some LPs More Than Others?

- Performance Persistence: Is It There, and Can it Be Exploited?

- Co-Investments: A Sprint or a Marathon?

- ESG Asset Owner Survey: How Are Investors Changing? (bfinance)